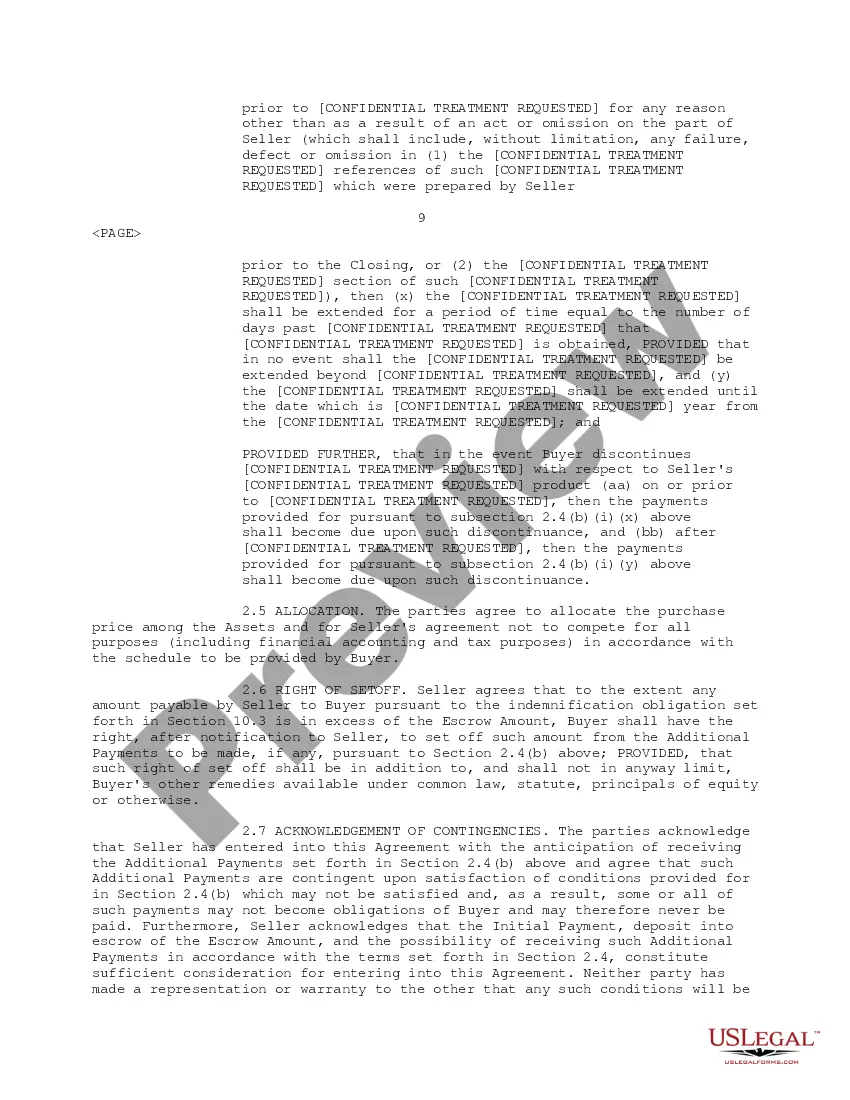

Maricopa, Arizona, Sample Asset Purchase Agreement between Orthogonal Pharmaceutical, Inc. and Cygnus, Inc. is a legally binding document outlining the terms and conditions of the sale and purchase of assets between the two companies. Below is a detailed description of this agreement. The Maricopa, Arizona, Sample Asset Purchase Agreement is a comprehensive contract executed between Orthogonal Pharmaceutical, Inc. (referred to as the "Buyer") and Cygnus, Inc. (referred to as the "Seller"). The agreement governs the purchase and sale of specific assets belonging to Cygnus, Inc. The purpose of this agreement is to outline the transfer of assets from Cygnus, Inc. to Orthogonal Pharmaceutical, Inc. in exchange for a specified purchase price. The assets involved may include intellectual property rights, licenses, patents, trademarks, physical properties, equipment, inventory, customer records, and any other assets specifically identified in the agreement. The agreement begins by providing a background of both parties involved, stating their respective names, addresses, and legal identities. It also lists the authority of the parties to enter into this agreement. The purchase price is a substantial component of the agreement. It details the agreed-upon purchase price, payment terms, and any additional payments, such as earn-outs or contingent payments, which may be subject to certain conditions. The agreement includes a comprehensive description of the assets being acquired. This description should be specific and identify each asset involved in the transaction. It may provide item descriptions, quantities, conditions, locations, and any other relevant information regarding the assets. In addition to the assets, the agreement covers the assumption of liabilities associated with the purchased assets. These liabilities include but are not limited to debts, contracts, warranties, claims, and any pending legal matters directly related to the acquired assets. The timeline for the transfer of assets is an essential aspect of the agreement. It includes the effective date of the agreement, the anticipated closing date, and any actions required to complete the transfer of assets. The agreement also addresses representations and warranties made by both parties. These representations ensure that the assets being sold are owned by the seller, free of any encumbrances or disputes, and in compliance with all applicable laws and regulations. It also includes representations regarding the buyer's ability to fulfil their obligations under the agreement. The agreement concludes with miscellaneous provisions, including governing law, dispute resolution mechanisms, confidentiality clauses, and the entire agreement clause, which states that the written agreement supersedes any prior understandings or agreements between the parties. Overall, the Maricopa, Arizona, Sample Asset Purchase Agreement between Orthogonal Pharmaceutical, Inc. and Cygnus, Inc. provides a framework for a successful and legally binding transfer of assets. It encompasses all the necessary details and provisions to protect the interests of both parties involved in the transaction.

Maricopa Arizona Sample Asset Purchase Agreement between Orth-McNeil Pharmaceutical, Inc. and Cygnus, Inc. regarding the sale and purchase of assets of company - Sample

Description

How to fill out Maricopa Arizona Sample Asset Purchase Agreement Between Orth-McNeil Pharmaceutical, Inc. And Cygnus, Inc. Regarding The Sale And Purchase Of Assets Of Company - Sample?

Do you need to quickly create a legally-binding Maricopa Sample Asset Purchase Agreement between Orth-McNeil Pharmaceutical, Inc. and Cygnus, Inc. regarding the sale and purchase of assets of company - Sample or maybe any other document to manage your own or corporate affairs? You can go with two options: contact a professional to draft a legal paper for you or create it completely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant document templates, including Maricopa Sample Asset Purchase Agreement between Orth-McNeil Pharmaceutical, Inc. and Cygnus, Inc. regarding the sale and purchase of assets of company - Sample and form packages. We offer templates for an array of use cases: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the needed template without extra troubles.

- First and foremost, double-check if the Maricopa Sample Asset Purchase Agreement between Orth-McNeil Pharmaceutical, Inc. and Cygnus, Inc. regarding the sale and purchase of assets of company - Sample is tailored to your state's or county's laws.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the search again if the template isn’t what you were looking for by utilizing the search box in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Maricopa Sample Asset Purchase Agreement between Orth-McNeil Pharmaceutical, Inc. and Cygnus, Inc. regarding the sale and purchase of assets of company - Sample template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Additionally, the paperwork we provide are updated by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!