A Cuyahoga Ohio Post-Petition Loan and Security Agreement between Various Financial Institutions regarding a revolving line of credit is a legal document that governs the terms and conditions of a loan provided to an entity based in Cuyahoga County, Ohio, after it has filed for bankruptcy under Chapter 11. The primary purpose of this agreement is to provide post-petition financing to the debtor, allowing it to continue its operations during the bankruptcy proceedings. This loan is typically secured by the debtor's assets, such as accounts receivable, inventory, property, or equipment, which serve as collateral to protect the financial institutions involved in case of default. Keywords associated with this agreement may include: Cuyahoga Ohio, Post-Petition, Loan and Security Agreement, Various Financial Institutions, revolving line of credit, Chapter 11, bankruptcy, financing, debtor, collateral, assets, accounts receivable, inventory, property, equipment. There may be different types of Cuyahoga Ohio Post-Petition Loan and Security Agreements based on the specific terms and conditions agreed upon by the debtor and the financial institutions involved. These can include: 1. Secured Revolving Line of Credit Agreement: This type of agreement involves a revolving line of credit that is secured by specific collateral, ensuring the financial institutions have a claim to the assets identified in case of default. 2. Unsecured Revolving Line of Credit Agreement: In this case, the line of credit is not backed by any collateral, meaning that the financial institutions rely solely on the debtor's ability to repay the loan. 3. Term Revolving Line of Credit Agreement: This type of agreement establishes a fixed term (e.g., one year) during which the debtor can access the line of credit. The debtor can borrow, repay, and re-borrow within the predetermined timeframe. 4. Floating Rate Revolving Line of Credit Agreement: This agreement includes an interest rate that adjusts periodically based on a specific financial index, such as the prime rate, ensuring that the rate aligns with market conditions. These are just a few examples of the potential variations in Cuyahoga Ohio Post-Petition Loan and Security Agreements regarding revolving lines of credit. It is essential for both parties involved to clearly define the terms, conditions, and objectives of the loan to ensure a smooth and mutually beneficial arrangement.

Cuyahoga Ohio Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit

Description

How to fill out Cuyahoga Ohio Post-Petition Loan And Security Agreement Between Various Financial Institutions Regarding Revolving Line Of Credit?

How much time does it normally take you to create a legal document? Given that every state has its laws and regulations for every life scenario, locating a Cuyahoga Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit suiting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. Apart from the Cuyahoga Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can pick the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Cuyahoga Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit:

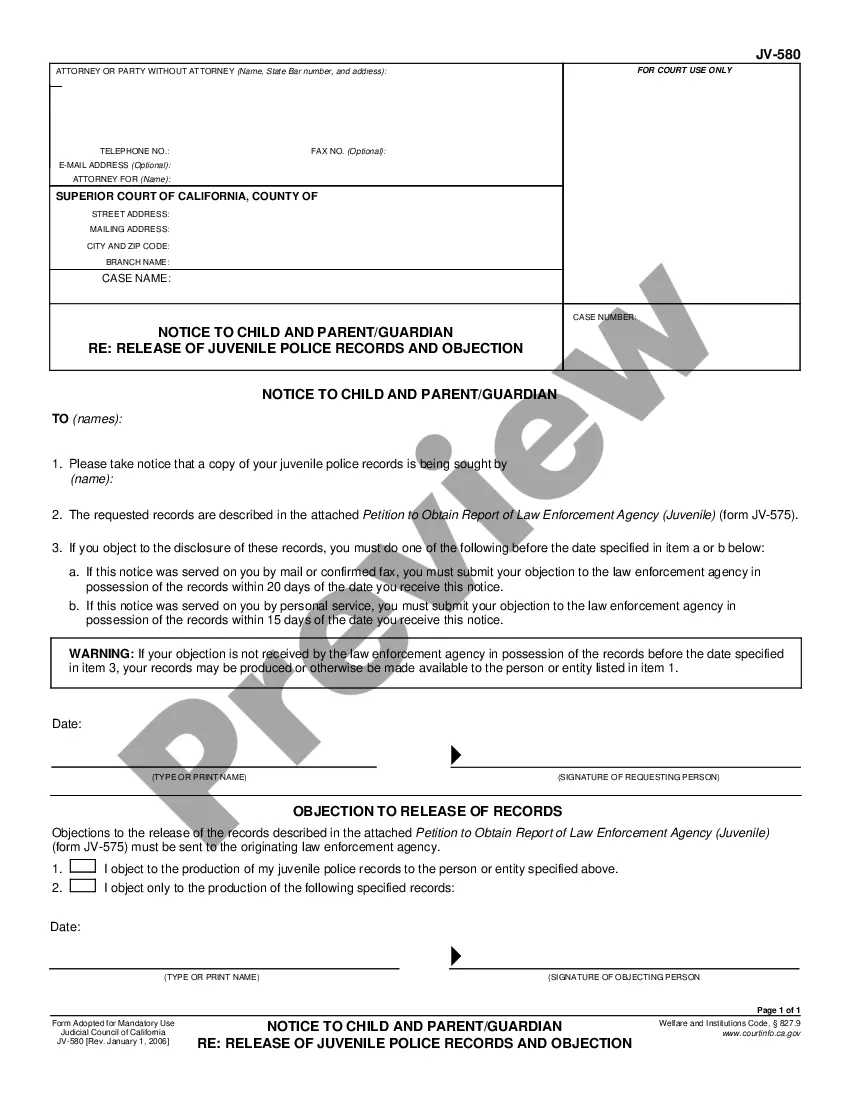

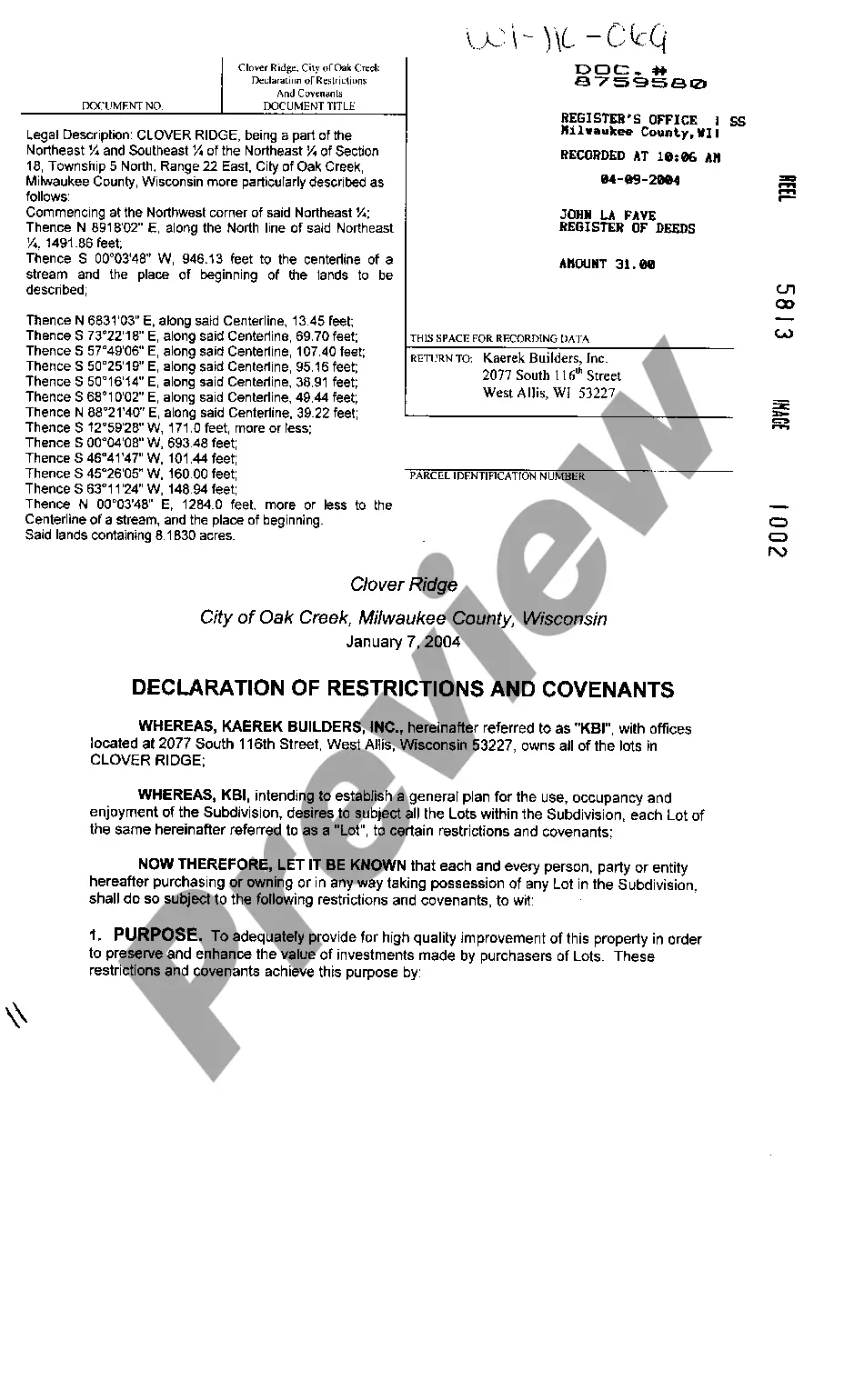

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Cuyahoga Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!