Maricopa, Arizona, is a thriving city that serves as the county seat of Pinal County. Located in the southern part of the state, Maricopa offers its residents and visitors a high quality of life with a range of amenities and a close-knit community atmosphere. When it comes to financial institutions in Maricopa, several options provide a revolving line of credit through the Maricopa Arizona Post-Petition Loan and Security Agreement. This agreement encompasses different types of loans and security agreements offered by these institutions to support individuals and businesses in managing their finances effectively. One type of Maricopa Arizona Post-Petition Loan and Security Agreement, provided by various financial institutions, is the revolving line of credit based on personal assets. This loan allows individuals to utilize their personal assets, such as property or investments, as collateral to secure a credit line which can be withdrawn and repaid multiple times within a set timeframe. Another type of Maricopa Arizona Post-Petition Loan and Security Agreement is geared towards businesses. Financial institutions extend revolving lines of credit to businesses of all sizes, allowing them to access funds as needed to cover operating expenses, manage cash flow, or invest in growth opportunities. These credit lines can be secured against business assets or through other means agreed upon between the financial institution and the borrowing business. Furthermore, some financial institutions may offer specialized versions of the Maricopa Arizona Post-Petition Loan and Security Agreement. These tailored agreements may provide additional features or benefits focused on specific industries or sectors, such as agriculture, manufacturing, or healthcare. By tailoring the loan terms to specific needs and requirements, businesses can benefit from financial support tailored to their unique circumstances. Overall, the Maricopa Arizona Post-Petition Loan and Security Agreement offered by various financial institutions serves as a crucial financial tool for individuals and businesses in Maricopa. By providing access to revolving lines of credit, these agreements empower borrowers to manage their financial obligations effectively, seize opportunities, and navigate economic challenges with confidence.

Maricopa Arizona Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit

Description

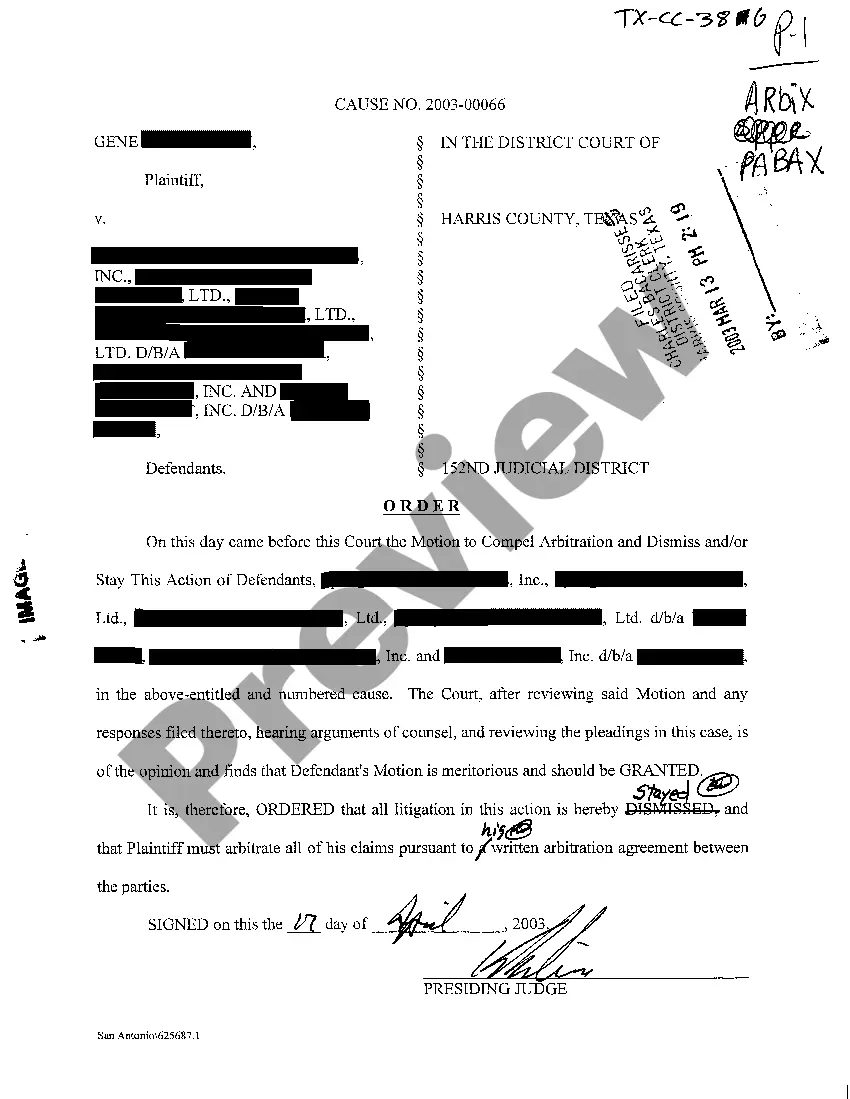

How to fill out Maricopa Arizona Post-Petition Loan And Security Agreement Between Various Financial Institutions Regarding Revolving Line Of Credit?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal documentation that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business objective utilized in your county, including the Maricopa Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit.

Locating samples on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Maricopa Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Maricopa Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit:

- Make sure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Maricopa Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

A revolving line of credit agreement is a legal agreement between a borrower and a lender. The borrower can continue to borrow money up to a predetermined limit while paying back the money on an agreed schedule. A typical example of a revolving line of credit is a personal credit card.

Term loans provide the stability of fixed repayments and a predetermined repayment schedule. Fixed and variable interest rates are available for both types of loans. Term loans are better suited for long-term fixed asset investments, while revolving loans are better suited for short-term working capital needs.

Revolving credit lines offer borrowers the option to draw funds up to a limit, repay and redraw them as they see fit. In term loans, borrowers usually make a single draw of funds and commit to pay a fixed amount periodically.

How is a line of credit different from a credit card? The primary difference is that a line of credit lets you borrow money against a revolving credit line (rather than the lump sum you'd get with a loan), while a credit card allows you to make purchases that you then pay back.

A revolving line of credit is a dynamic financial product, as you pay the credit down, you may be offered more credit to spend, especially if you make regular, consistent payments on a revolving credit account. A line of credit is a one-time financial arrangement or a static product.

A revolving line of credit allows the credit line to remain open regardless of when you spend or pay off your debt, while a non-revolving line of credit can't be used again after it's paid off. The pool of available credit does not replenish after payments are made.

Revolving credit is an agreement that permits an account holder to borrow money repeatedly up to a set dollar limit while repaying a portion of the current balance due in regular payments. Each payment, minus the interest and fees charged, replenishes the amount available to the account holder.

A revolving line of credit refers to a type of loan offered by a financial institution. Borrowers pay the debt as they would any other. However, with a revolving line of credit, as soon as the debt is repaid, the user can borrow up to her credit limit again without going through another loan approval process.

To maintain a good credit score, it's important to have both installment loans and revolving credit, but revolving credit tends to matter more than the other. Installment loans (student loans, mortgages and car loans) show that you can pay back borrowed money consistently over time.

Key Takeaways. A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.