Montgomery Maryland Post-Petition Loan and Security Agreement A Montgomery Maryland Post-Petition Loan and Security Agreement between Various Financial Institutions is a legally binding contract that establishes a revolving line of credit for borrowers who have filed for bankruptcy under Chapter 11. This agreement outlines the terms and conditions under which the financial institutions provide funds to the borrower, in exchange for a security interest in the borrower's assets. The purpose of this agreement is to provide the borrower with an ongoing source of financing during the post-petition period. It allows the borrower to access funds as needed within the agreed credit limit, providing the necessary liquidity to support the ongoing operations of the business during the bankruptcy process. The agreement encompasses several key components, including: 1. Revolving Line of Credit: The agreement establishes a revolving line of credit, which allows the borrower to access funds up to a certain limit. The borrower can borrow, repay, and re-borrow within this limit without the need for further approval, providing flexibility and access to funds as required. 2. Loan Terms and Conditions: The agreement defines the various terms and conditions related to the loan facility. This includes the interest rate charged on the outstanding balance, repayment terms, any fees or charges applicable, and any covenants or financial reporting requirements that the borrower must adhere to. 3. Security Interest: In exchange for the loan, the financial institutions obtain a security interest in the borrower's assets. This provides them with a lien on the assets, ensuring that they have priority in recovering their funds in case of default. The specific assets included as collateral may vary based on the agreement. 4. Default and Remedies: The agreement outlines the events that constitute a default under the loan facility, such as non-payment of interest or principal, breach of covenants, or bankruptcy termination. It also specifies the remedies available to the financial institutions in case of default, including accelerated repayment, foreclosure on assets, or taking legal action. Different types of Montgomery Maryland Post-Petition Loan and Security Agreements between Various Financial Institutions may exist, depending on the specific requirements and circumstances of the borrower and financial institutions involved. These variations may include differences in loan terms, such as interest rates, repayment periods, or credit limits. Additionally, the collateral provided as security may differ based on the nature of the borrower's assets and the financial institutions' risk assessment. In summary, the Montgomery Maryland Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving lines of credit provide crucial financing solutions for businesses undergoing bankruptcy. These agreements ensure a steady source of funds to support their operations and facilitate a smoother bankruptcy process.

Montgomery Maryland Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit

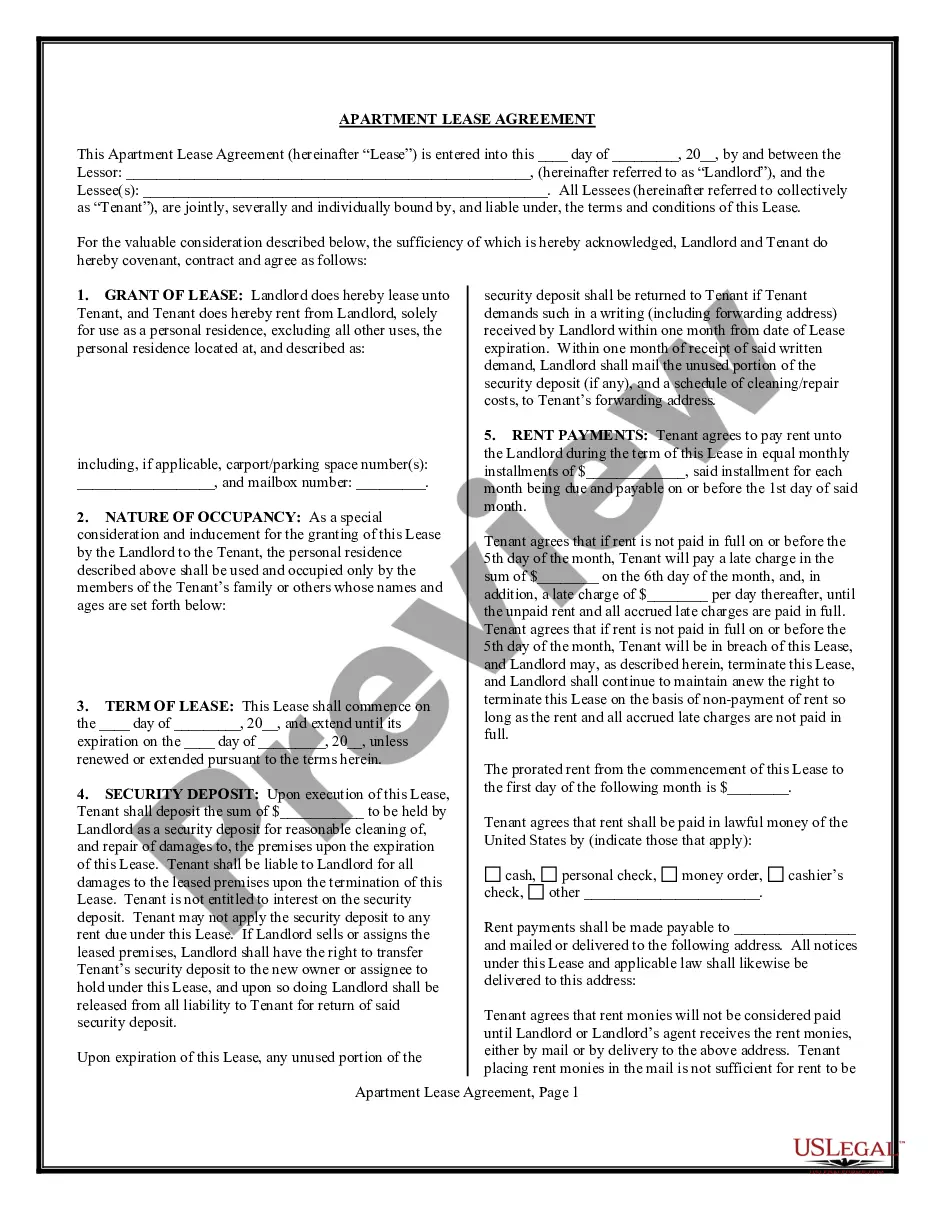

Description

How to fill out Montgomery Maryland Post-Petition Loan And Security Agreement Between Various Financial Institutions Regarding Revolving Line Of Credit?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Montgomery Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Montgomery Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Montgomery Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit:

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Revolving credit is an agreement that permits an account holder to borrow money repeatedly up to a set dollar limit while repaying a portion of the current balance due in regular payments. Each payment, minus the interest and fees charged, replenishes the amount available to the account holder.

Some of the most burdensome credit agreements are asset based-lending (ABL) credit agreements. The heart and soul of ABL lending is the collateral; thus, ABL credit agreements often provide for intense lender monitoring and supervision because the borrowing base is tied to eligible assets.

The term collateral refers to an asset that a lender accepts as security for a loan. Collateral may take the form of real estate or other kinds of assets, depending on the purpose of the loan. The collateral acts as a form of protection for the lender.

Examples of revolving credit include credit cards, personal lines of credit and home equity lines of credit (HELOCs).

Key Takeaways Personal loans offer borrowed funds in one initial lump sum with relatively lower interest rates; they must be repaid over a finite period of time. Credit cards are a type of revolving credit that give a borrower access to funds as long as the account remains in good standing.

Revolving credit is an agreement that permits an account holder to borrow money repeatedly up to a set dollar limit while repaying a portion of the current balance due in regular payments. Each payment, minus the interest and fees charged, replenishes the amount available to the account holder.

A revolving loan is considered a flexible financing tool due to its repayment and re-borrowing accommodations. It is not considered a term loan because, during an allotted period of time, the facility allows the borrower to repay the loan or take it out again.

Revolving credit lines offer borrowers the option to draw funds up to a limit, repay and redraw them as they see fit. In term loans, borrowers usually make a single draw of funds and commit to pay a fixed amount periodically.

To maintain a good credit score, it's important to have both installment loans and revolving credit, but revolving credit tends to matter more than the other. Installment loans (student loans, mortgages and car loans) show that you can pay back borrowed money consistently over time.