Wayne Michigan Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit is a legal document that outlines the terms and conditions under which financial institutions provide a post-petition loan and security agreement to a borrower in Wayne, Michigan. This agreement allows the borrower to access funds from a revolving line of credit, which can be used for various purposes such as working capital, debt refinancing, or business expansion. The post-petition loan provided in Wayne, Michigan is specifically designed to assist borrowers who have filed for bankruptcy or are in the process of undergoing Chapter 11 reorganization. This loan helps the borrower to address immediate financial needs and continue their operations during the restructuring process. In this agreement, various financial institutions come together, forming a lending syndicate, and collectively provide the revolving line of credit to the borrower. The loan is typically secured by the borrower's assets, which means that in case of default, the lenders have the right to claim and sell the pledged collateral to recover their outstanding debt. The Wayne Michigan Post-Petition Loan and Security Agreement may have different types or variations, based on specific provisions and borrower requirements. Some of the variations that can be encountered include: 1. Secured Revolving Line of Credit: This type of agreement requires the borrower to pledge specific assets as collateral against the loan, providing additional security for the lenders. 2. Unsecured Revolving Line of Credit: In this arrangement, there is no specific collateral required, and the borrower's creditworthiness plays a primary role in determining loan eligibility and terms. 3. Floating Interest Rate Revolving Line of Credit: This agreement allows the interest rate to fluctuate based on prevailing market rates, ensuring that the borrower benefits from lower rates during periods of economic stability. 4. Fixed Interest Rate Revolving Line of Credit: This type of loan agreement provides the borrower with a fixed interest rate for the duration of the loan, providing stability and predictability in interest expenses. 5. Convertible Revolving Line of Credit: This variation allows the borrower to convert a certain portion of the loan into equity shares or other financial instruments, providing flexibility in managing the borrower's capital structure. In conclusion, the Wayne Michigan Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit is a crucial document that enables borrowers undergoing bankruptcy or Chapter 11 reorganization to access funds and support business operations during a financially challenging period. The specific terms and types of agreements may vary depending on the borrower's requirements and the lending institutions involved.

Wayne Michigan Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit

Description

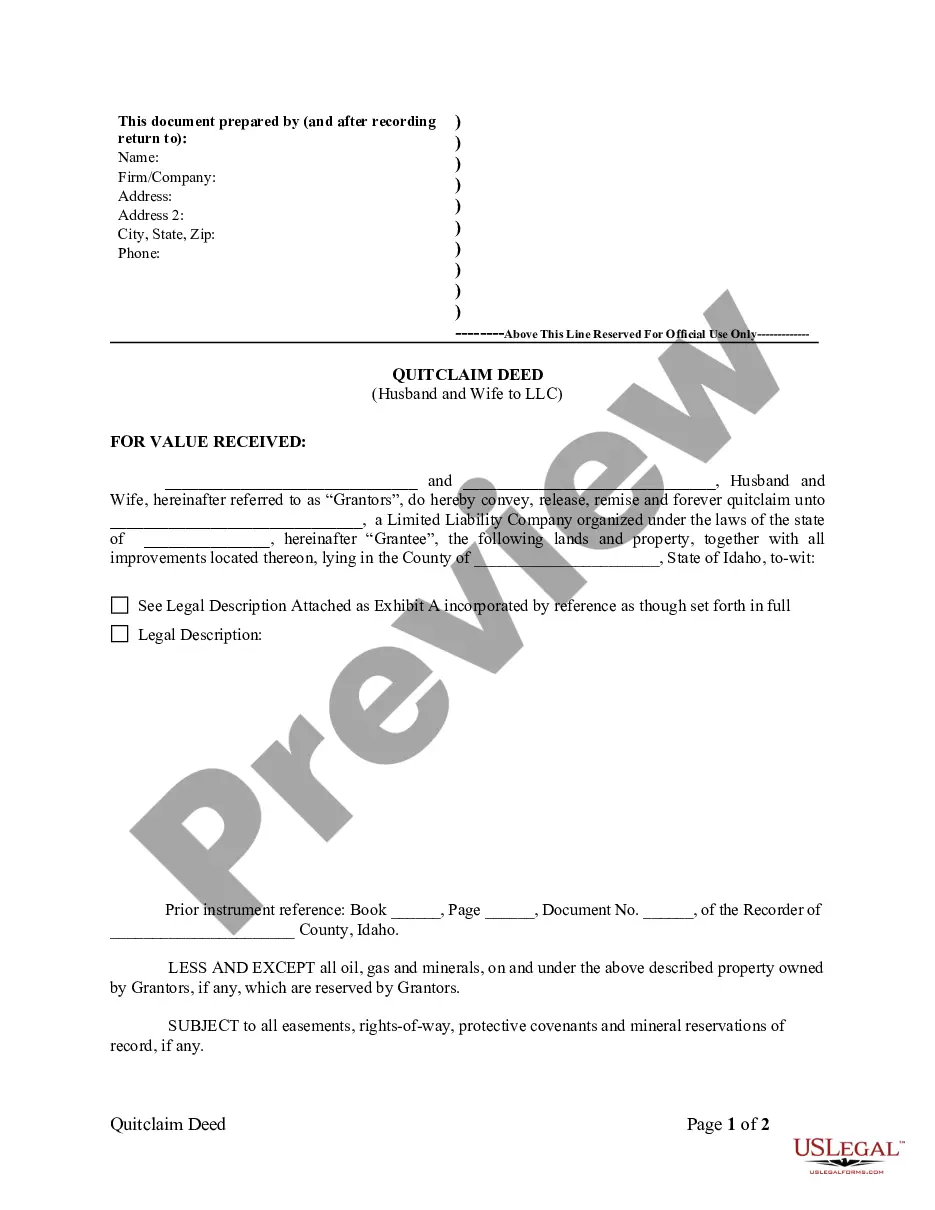

How to fill out Wayne Michigan Post-Petition Loan And Security Agreement Between Various Financial Institutions Regarding Revolving Line Of Credit?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a legal professional to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Wayne Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario collected all in one place. Therefore, if you need the current version of the Wayne Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Wayne Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Wayne Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Other remedies that lenders can consider if an event of default exists under a loan agreement are: Refusing to make further loans or issue additional letters of credit. Accelerating the borrower's loan repayment obligations. Requiring the borrower to cash collateralize undrawn and unexpired letters of credit.

Revolving credit is an agreement that permits an account holder to borrow money repeatedly up to a set dollar limit while repaying a portion of the current balance due in regular payments. Each payment, minus the interest and fees charged, replenishes the amount available to the account holder.

To maintain a good credit score, it's important to have both installment loans and revolving credit, but revolving credit tends to matter more than the other. Installment loans (student loans, mortgages and car loans) show that you can pay back borrowed money consistently over time.

Revolving credit lines offer borrowers the option to draw funds up to a limit, repay and redraw them as they see fit. In term loans, borrowers usually make a single draw of funds and commit to pay a fixed amount periodically.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

A security agreement is a legal document that provides a lender a security interest in property or an asset that is promised as collateral. It gives the legal claim to the collateral to the creditor in case of a default by the borrower.

Examples of revolving credit include credit cards, personal lines of credit and home equity lines of credit (HELOCs).

A general security agreement creates a security interest in all present and future assets of the borrower. This means the lender would have access to all assets your business owns now and any future assets your business purchases as collateral for the loan issued.

Key Takeaways Personal loans offer borrowed funds in one initial lump sum with relatively lower interest rates; they must be repaid over a finite period of time. Credit cards are a type of revolving credit that give a borrower access to funds as long as the account remains in good standing.