The Allegheny Pennsylvania Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC is a legally binding contract that outlines the terms and conditions governing the management of investment funds. This agreement is crucial in ensuring a harmonious relationship between the two entities involved, and it establishes clear guidelines for fund management, decision-making, and profit sharing. Prudential Tax-Managed Growth Fund is an investment fund managed by Prudential Investments Fund Management, LLC. This fund focuses on tax-efficient investments while promoting long-term growth. Prudential Investments Fund Management, LLC is a well-known investment management company that specializes in managing a diverse range of funds. The Allegheny Pennsylvania Management Agreement includes various key elements, such as the fund objectives, investment strategy, fee structure, performance benchmarks, and reporting requirements. The agreement ensures that both parties are aligned in their goals and expectations. Specific deliverables, milestones, and review periods may also be outlined in the agreement. Additionally, the Allegheny Pennsylvania Management Agreement may have different types or variants based on factors such as the timeframe, fund size, or investment focus. For example, there could be separate agreements for different fund classes within the Prudential Tax-Managed Growth Fund, such as Class A, Class B, or institutional shares. Each class may have its own set of terms and conditions tailored to its specific needs and requirements. The management agreement also addresses key legal and regulatory aspects, including compliance with applicable securities laws, fiduciary responsibilities, and provisions for dispute resolution. Both parties must adhere to these regulations to ensure the fund's integrity, transparency, and compliance. In summary, the Allegheny Pennsylvania Management Agreement is a comprehensive document that governs the relationship between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC. It establishes the framework for effective fund management, outlines performance expectations, and ensures legal and regulatory compliance.

Allegheny Pennsylvania Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC

Description

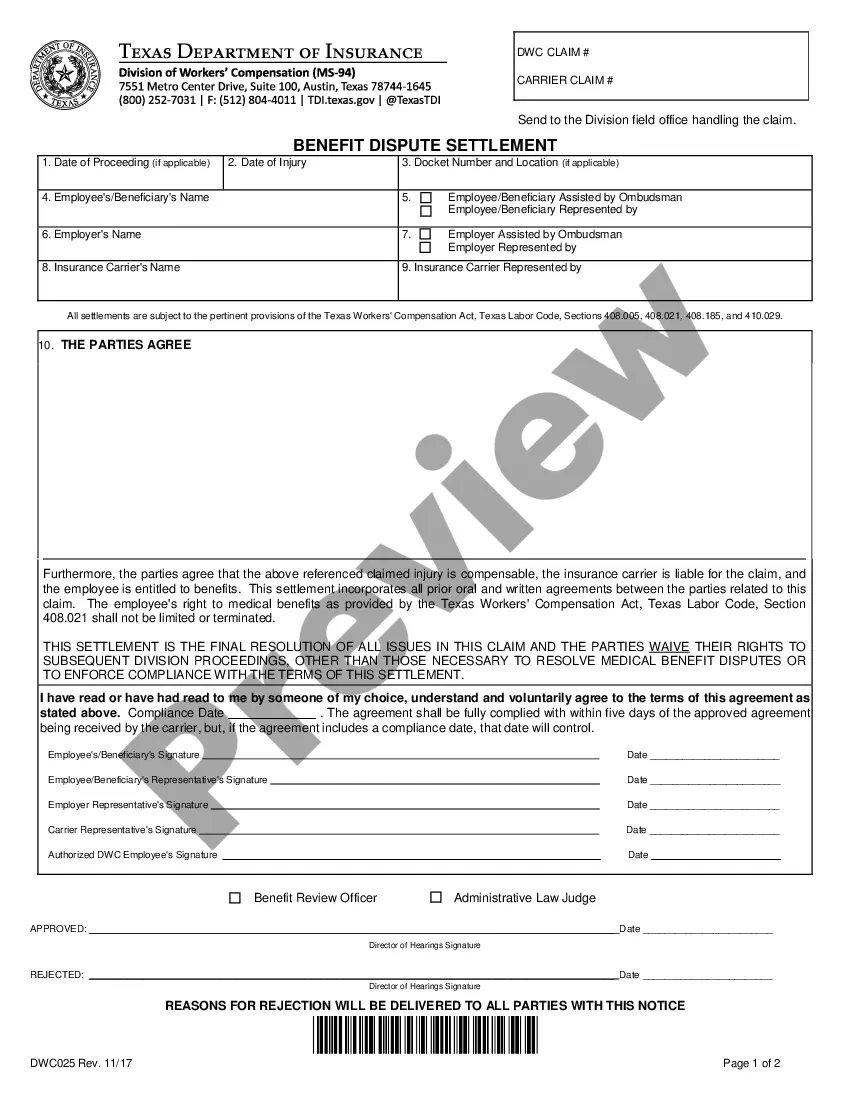

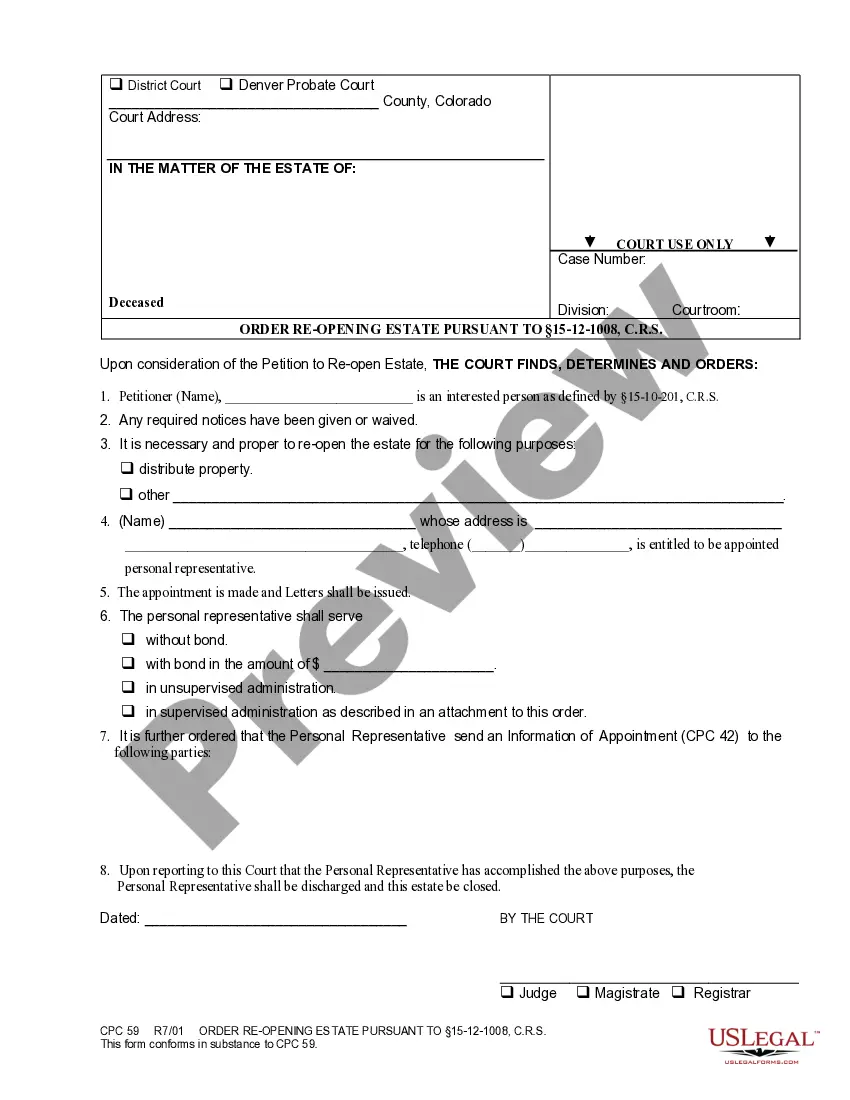

How to fill out Allegheny Pennsylvania Management Agreement Between Prudential Tax-Managed Growth Fund And Prudential Investments Fund Management, LLC?

Drafting papers for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Allegheny Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC without expert help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Allegheny Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Allegheny Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC:

- Examine the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that fits your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any use case with just a couple of clicks!

Form popularity

FAQ

The Best Prudential Funds Over 5-years, this funds' performance was equally impressive with cumulative growth of 57.56% ranking among the best in its sector.

1feff Prudential Financial is known mainly for its insurance products but also has a large division that manages mutual funds and other investments. Prudential Group Investment Management, or PGIM, offers over 75 funds with AUM of over $1.3 trillion.

PGIM, Inc. (PGIM), formerly Prudential Investment Management, is the asset management arm of American life insurance company Prudential Financial.

In aggregate, Prudential Financial currently has a Value Score of A, putting it into the top 20% of all stocks we cover from this look. This makes Prudential Financial a solid choice for value investors, and some of its other key metrics make this pretty clear too.

Prudential has evolved from a mutual insurance company (owned by its policyholders) to a joint stock company (as it was prior to 1915). It is now traded on the New York Stock Exchange under the symbol PRU. The Prudential Stock was issued and started trading on the New York Stock Exchange on December 13, 2001.

PruFund suffered a dramatic fall from grace, but parent company M&G has plans to catch up with the strategy's rivals. With more than £50bn in assets under management, the PruFund range has long been a dominant force in adviser investing.

In aggregate, Prudential Financial currently has a Value Score of A, putting it into the top 20% of all stocks we cover from this look. This makes Prudential Financial a solid choice for value investors, and some of its other key metrics make this pretty clear too.

Reported a loss, on an adjusted operating income basis, of $111 million in the current quarter, compared to a loss of $132 million in the year-ago quarter. This lower loss reflects more favorable underwriting results in both group life and disability, partially offset by higher expenses.

Commissions & Fees Link by Prudential charges you a hefty 0.79% wrap fee on the first $100,000 in assets for the classic investment portfolio, paid quarterly, dropping to 0.69% up to $500,000. A 0.20% fee is charged for the cash-heavy emergency portfolio.

TrustedChoice.com's Final Review We award Prudential Financial Insurance Company a final rating of 4.6 out of 5 stars. The insurance company has been around for over 140 years, which is notable within the insurance industry. Prudential Financial has received high ratings through A.M. Best.