The Cuyahoga Ohio Management Agreement is a legally binding contract that outlines the partnership between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC. This agreement governs the management and operation of investment funds within the Cuyahoga County in Ohio. Prudential Tax-Managed Growth Fund, as the primary entity in this agreement, entrusts Prudential Investments Fund Management, LLC with the responsibility of managing and overseeing the investment strategies, fund performance, and related operations. Under this agreement, Prudential Investments Fund Management, LLC assumes various duties and responsibilities, including but not limited to: 1. Investment Management: Prudential Investments Fund Management, LLC undertakes the day-to-day management of the investment portfolio within Cuyahoga Ohio. They analyze market trends, identify investment opportunities, and execute investment decisions in line with the agreed-upon investment objectives and guidelines. 2. Fund Performance Monitoring: Prudential Investments Fund Management, LLC regularly monitors the performance of the investment fund, taking into consideration relevant benchmarks and objectives. They assess the fund's performance against established parameters to ensure alignment with investor expectations. 3. Risk Management: The agreement highlights the importance of risk management within Cuyahoga Ohio. Prudential Investments Fund Management, LLC employs various risk assessment techniques and implements risk mitigation strategies to safeguard investors' capital and optimize returns. 4. Compliance and Regulatory Oversight: Prudential Investments Fund Management, LLC is responsible for ensuring compliance with all applicable laws, regulations, and guidelines. They work diligently to maintain transparency, integrity, and regulatory adherence throughout the management process. 5. Reporting and Communication: The agreement specifies the frequency and format of reporting and communication between the parties involved. Prudential Investments Fund Management, LLC provides regular updates on fund performance, investment allocations, and any other relevant information to Prudential Tax-Managed Growth Fund and its investors. It is important to note that the Cuyahoga Ohio Management Agreement may not have different types specific to Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC. However, there might be variations in the terms and conditions of the agreement based on customized needs or specific investment strategies. These variations are typically negotiated and included as addendums to the main agreement to accommodate any unique requirements or circumstances. Keywords: Cuyahoga Ohio Management Agreement, Prudential Tax-Managed Growth Fund, Prudential Investments Fund Management, LLC, investment portfolio, investment management, fund performance, risk management, compliance, regulatory oversight, reporting, communication.

Cuyahoga Ohio Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC

Description

How to fill out Cuyahoga Ohio Management Agreement Between Prudential Tax-Managed Growth Fund And Prudential Investments Fund Management, LLC?

Preparing papers for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft Cuyahoga Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC without professional help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Cuyahoga Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC by yourself, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Cuyahoga Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC:

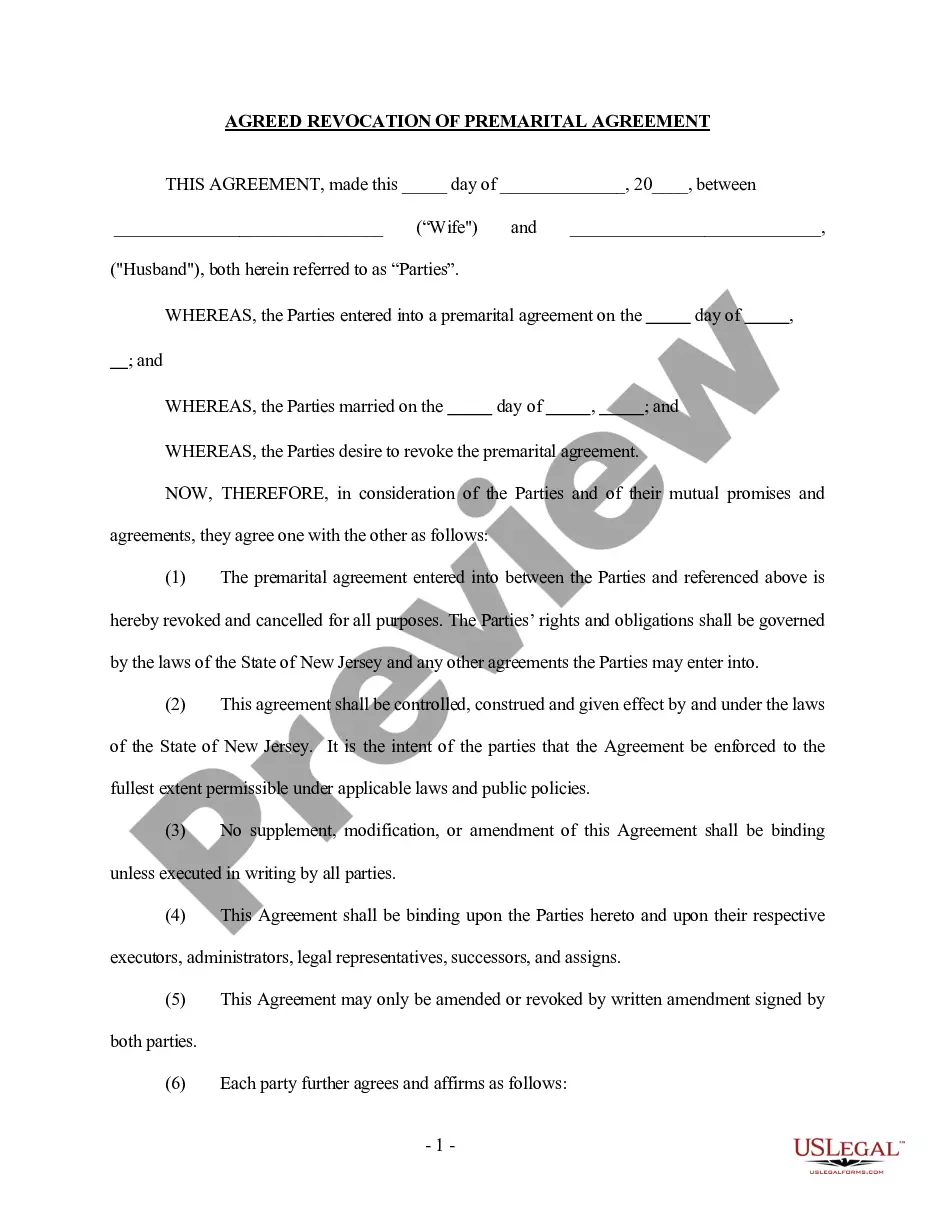

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any situation with just a few clicks!