The Wayne Michigan Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC is an important legal document that outlines the terms and conditions of the agreement between the two parties. This agreement establishes the parameters for the management of the fund portfolio by Prudential Investments Fund Management, LLC on behalf of Prudential Tax-Managed Growth Fund. Keywords: Wayne Michigan, management agreement, Prudential Tax-Managed Growth Fund, Prudential Investments Fund Management, LLC, legal document, terms and conditions, fund portfolio, management. The Wayne Michigan Management Agreement serves as a guiding document for the relationship between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC. It delineates the responsibilities and obligations of both parties, ensuring transparency and accountability in the management of the fund. Some key provisions typically found in the Wayne Michigan Management Agreement include: 1. Objective and Investment Guidelines: The agreement defines the investment objectives, policies, and restrictions for the fund portfolio. This section outlines the desired investment returns, risk tolerance, and any specific investment strategies to be employed. 2. Portfolio Management Services: The agreement details the specific services to be provided by Prudential Investments Fund Management, LLC. This covers portfolio management, research, analysis, and recommendations for investment decisions. 3. Compensation and Fees: The management agreement specifies the compensation structure of Prudential Investments Fund Management, LLC. This typically includes a base management fee tied to the value of the assets under management and may also contain performance-based incentives. 4. Reporting and Auditing: The agreement outlines the reporting requirements, including regular performance reports, portfolio holdings disclosure, and compliance reports. It may also cover provisions for audits and inspections by regulatory bodies or third-party auditors. 5. Termination and Amendments: The management agreement includes provisions for termination, allowing either party to end the agreement under certain circumstances. Additionally, it outlines the process for making amendments to the agreement, including any necessary shareholder approvals. It is important to note that variations of the Wayne Michigan Management Agreement may exist, depending on specific circumstances or requirements. These variations might include different investment objectives, risk profiles, or investment strategies tailored to meet the unique needs of clients or specific funds offered by Prudential Investments Fund Management, LLC. Overall, the Wayne Michigan Management Agreement acts as a legally binding document that provides a framework for collaboration between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC. It ensures that both parties are aligned in their investment objectives and establishes clear expectations for the management of the fund portfolio.

Wayne Michigan Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC

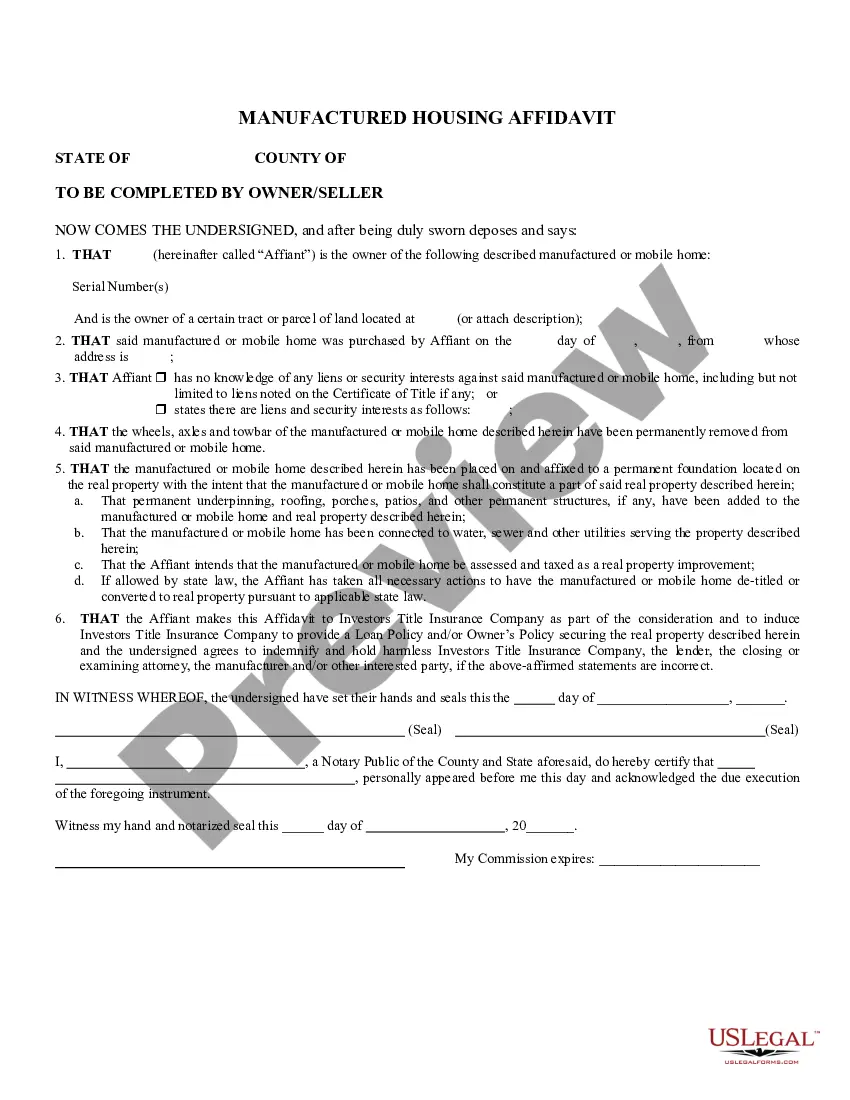

Description

How to fill out Wayne Michigan Management Agreement Between Prudential Tax-Managed Growth Fund And Prudential Investments Fund Management, LLC?

Whether you plan to start your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business case. All files are grouped by state and area of use, so picking a copy like Wayne Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Wayne Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC. Follow the instructions below:

- Make sure the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Wayne Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!