The Hennepin Minnesota Sub-Advisory Agreement is a legally binding contract between Prudential Investments Fund Management, LLC (IFM) and The Prudential Investment Corporation (PIC). This agreement outlines the terms and conditions under which IFM provides investment advisory services to PIC. Under this agreement, IFM acts as the sub-adviser to PIC, offering expertise and guidance in managing investment strategies and portfolios. IFM assists PIC in making informed investment decisions, conducting research, and monitoring the performance of investments on behalf of PIC. The agreement ensures that IFM provides services in accordance with industry standards, laws, and regulations. It establishes the scope of services, fees, and responsibilities of both parties involved. Areas of focus may include asset allocation, risk management, investment research, and reporting. The Hennepin Minnesota Sub-Advisory Agreement may have variations or different types tailored to specific investment objectives, strategies, or asset classes. Some potential types include: 1. Equity Sub-Advisory Agreement: This type of agreement specifically focuses on managing equity investments on behalf of PIC. IFM provides advice on equity selection, portfolio construction, and performance monitoring. 2. Fixed Income Sub-Advisory Agreement: This agreement pertains to the management of fixed income assets. IFM assists in developing fixed income investment strategies, identifying suitable fixed income securities, and monitoring their performance. 3. Multi-Asset Sub-Advisory Agreement: This type of agreement encompasses a broader spectrum of investments, including both equities and fixed income. IFM advises on asset allocation, risk management, and the overall investment strategy, incorporating multiple asset classes within portfolios. 4. Alternative Investment Sub-Advisory Agreement: This agreement focuses on alternative investments such as hedge funds, private equity, or real estate. IFM provides insight into these non-traditional investments, offering advice on due diligence, risk assessment, and portfolio construction within the alternative asset realm. These various types of sub-advisory agreements allow IFM and PIC to tailor their relationship and services provided based on the specific investment needs and objectives of PIC. It is worth noting that the information provided is for illustrative purposes only and the actual terms and types of the agreement may vary based on the specific arrangement between IFM and PIC. It is advisable to consult the agreement documents or legal professionals for accurate details and specific variations.

Hennepin Minnesota Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services

Description

How to fill out Hennepin Minnesota Sub-Advisory Agreement Between Prudential Investments Fund Management, LLC And The Prudential Investment Corp. Regarding Provision Of Investment Advisory Services?

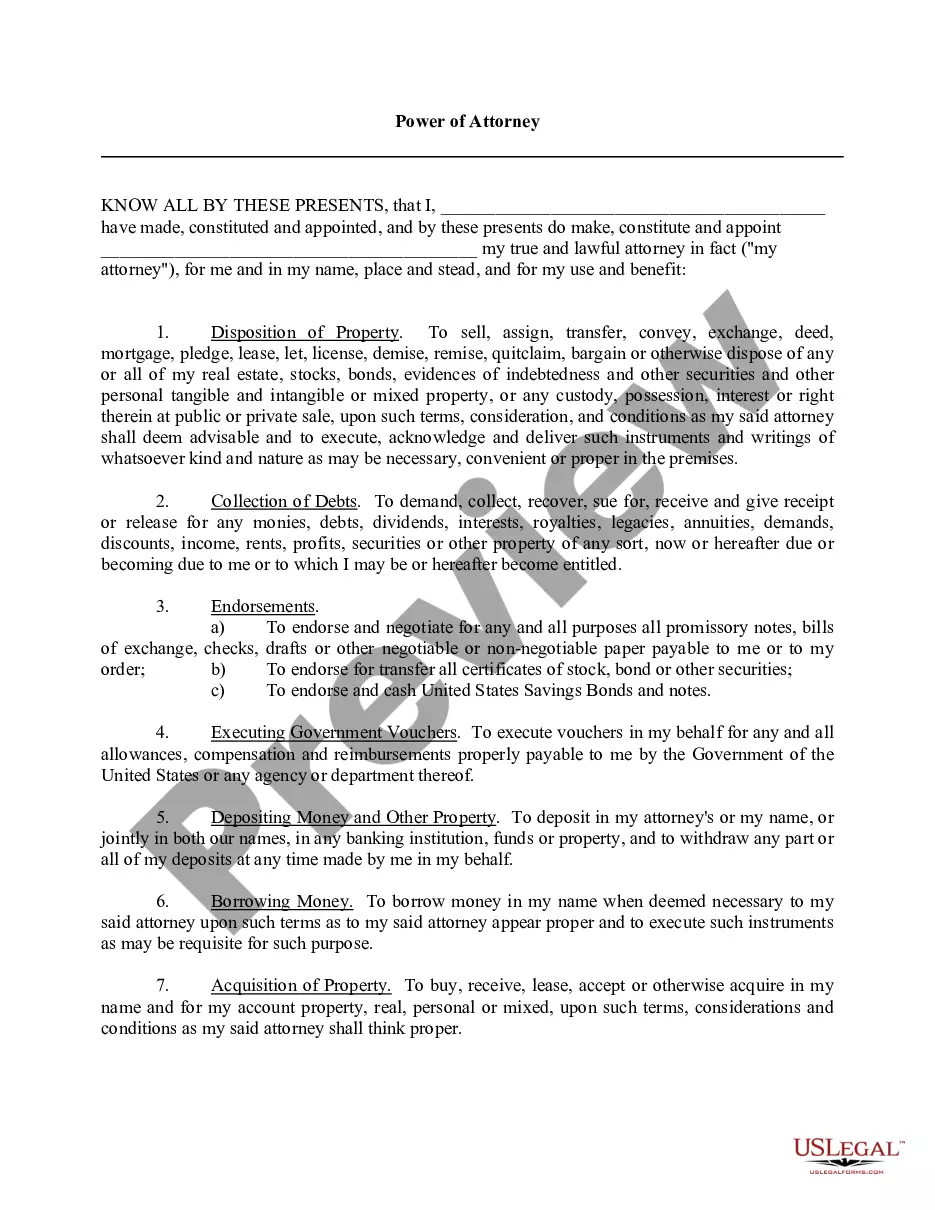

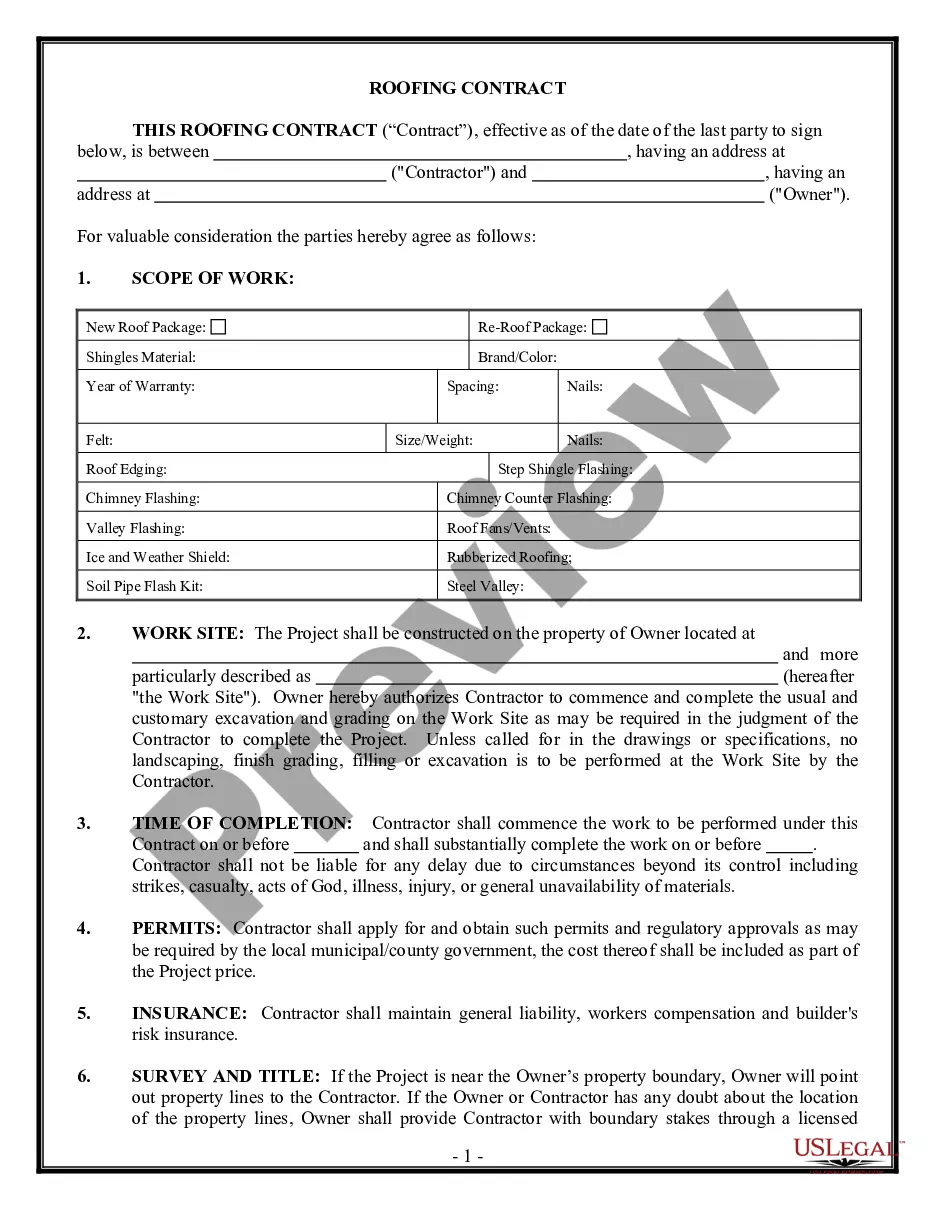

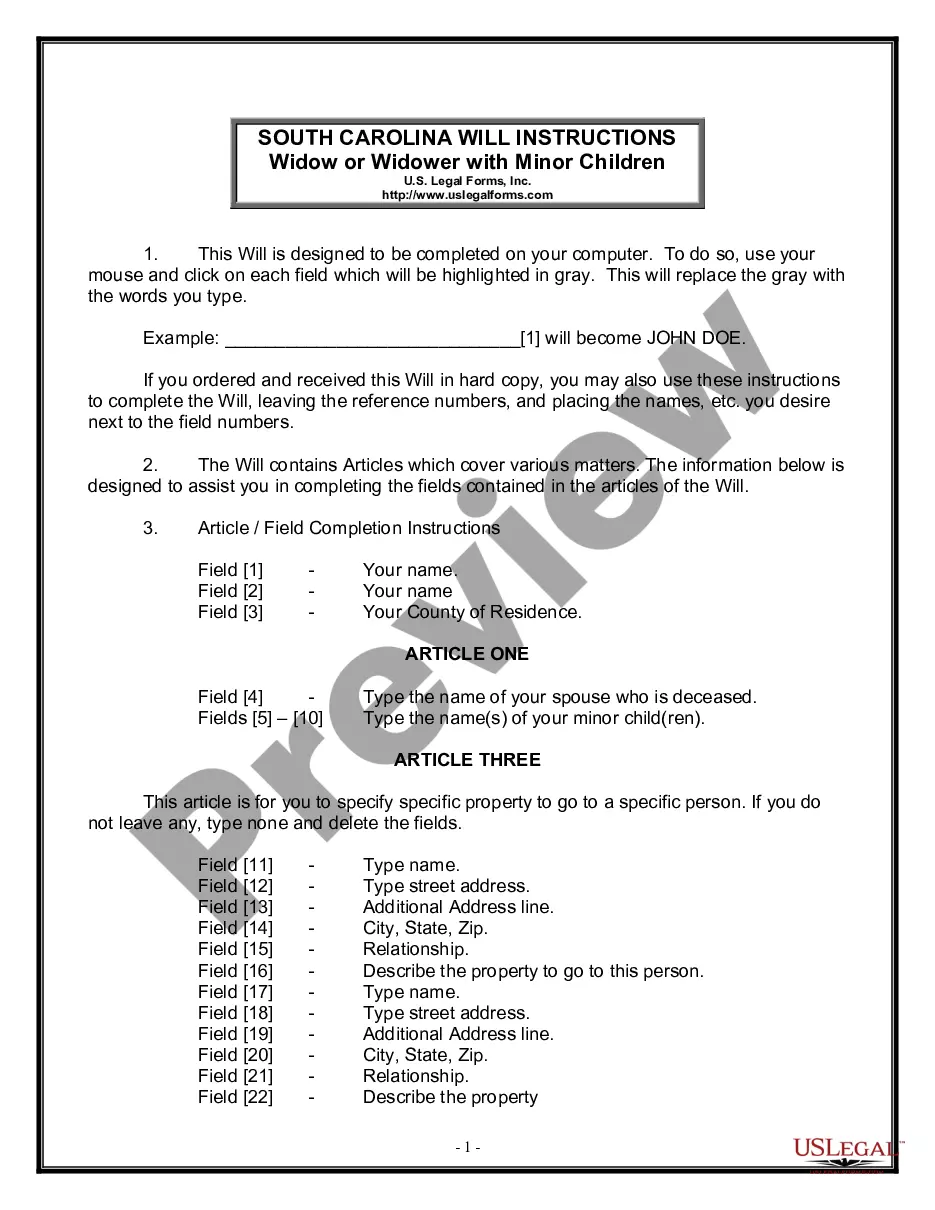

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Hennepin Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different types ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find detailed resources and guides on the website to make any activities associated with paperwork execution straightforward.

Here's how you can locate and download Hennepin Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services.

- Take a look at the document's preview and description (if available) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can affect the legality of some documents.

- Examine the related forms or start the search over to locate the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and purchase Hennepin Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Hennepin Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services, log in to your account, and download it. Needless to say, our website can’t replace a lawyer completely. If you have to deal with an exceptionally complicated case, we recommend using the services of a lawyer to review your form before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-compliant documents effortlessly!

Form popularity

FAQ

Reported a loss, on an adjusted operating income basis, of $111 million in the current quarter, compared to a loss of $132 million in the year-ago quarter. This lower loss reflects more favorable underwriting results in both group life and disability, partially offset by higher expenses.

GREENWOOD VILLAGE, Colo. April 4, 2022Empower today announced it has completed the previously announced acquisition of Prudential Financial, Inc.'s full-service retirement business.

Commissions & Fees Link by Prudential charges you a hefty 0.79% wrap fee on the first $100,000 in assets for the classic investment portfolio, paid quarterly, dropping to 0.69% up to $500,000. A 0.20% fee is charged for the cash-heavy emergency portfolio.

PGIM, Inc. (PGIM), formerly Prudential Investment Management, is the asset management arm of American life insurance company Prudential Financial.

The company was founded in Hatton Garden in London in May 1848 as The Prudential, Investment, Loan, and Assurance Association and in September 1848 changed its name to The Prudential Mutual Assurance, Investment, and Loan Association, to provide loans to professional and working people.

Prudential's Fundamentals Remain Robust Prudential recently reported results for the fourth quarter of what turned out to be a great 2021 for the company. Prudential's PGIM, U.S. Businesses, and International Businesses segments each generated double-digit adjusted operating income growth over 2020.

In aggregate, Prudential Financial currently has a Value Score of A, putting it into the top 20% of all stocks we cover from this look. This makes Prudential Financial a solid choice for value investors, and some of its other key metrics make this pretty clear too.

Investment advisory programs and services, including PruUMA, are offered through Pruco, a registered investment adviser, doing business as Prudential Financial Planning Services.

TrustedChoice.com's Final Review We award Prudential Financial Insurance Company a final rating of 4.6 out of 5 stars. The insurance company has been around for over 140 years, which is notable within the insurance industry. Prudential Financial has received high ratings through A.M. Best.

Life Insurance and Annuities are issued by The Prudential Insurance Company of America, Pruco Life Insurance Company (in New York, by Pruco Life Insurance Company of New Jersey), located in Newark, NJ (main office).