Cuyahoga Ohio Distribution Agreement is a contractual arrangement between a fund and a distributor that governs the continuous offering of the fund's shares to investors. This agreement outlines the terms and conditions under which the distributor is authorized to sell and distribute the fund's shares, ensuring compliance with applicable regulations and providing a framework for a mutually beneficial relationship between the parties involved. Keywords: 1. Distribution Agreement: Also referred to as a distribution contract, this legally binding document outlines the rights, obligations, and responsibilities of the fund and the distributor regarding the ongoing sale and distribution of the fund's shares. 2. Continuous offering: The distribution agreement pertains to the continuous offering of the fund's shares, ensuring that the distributor can consistently market and sell the shares to potential investors. It sets guidelines on how the shares should be offered, redeemed, and marketed on an ongoing basis. 3. Fund's shares: The agreement focuses on the distribution of the fund's shares, which represent ownership in the investment fund. These shares can be bought and sold by investors, and the distribution agreement specifies the terms under which these transactions occur. 4. Compliance: The Cuyahoga Ohio Distribution Agreement ensures compliance with applicable laws, rules, and regulations governing the offering of the fund's shares. It ensures that all marketing materials, sales practices, and distribution activities comply with securities laws and regulations, providing protection for both investors and the fund. Types of Cuyahoga Ohio Distribution Agreement regarding the continuous offering of the Fund's shares: 1. Principal-Agent Agreement: In this type of distribution agreement, the fund acts as the principal, appointing a distributor as its agent to sell and distribute the shares. The distributor takes on the responsibility of marketing and selling the fund's shares on behalf of the fund. 2. Sub-distribution Agreement: In certain cases, a distributor may enter into a sub-distribution agreement with other intermediaries to further expand the reach of the fund's shares. This agreement allows the distributor to appoint sub-distributors who will also sell and market the fund's shares to investors. 3. Wrap Fee Program Agreement: This type of distribution agreement is specific to wrap fee programs where the investor pays a single fee to cover investment management, advisory services, and distribution costs. The agreement outlines how the distribution fees are calculated and distributed among the parties involved, including the fund, distributor, and investment advisor. While these are some common types of distribution agreements, it is important to note that specific terms and provisions may vary depending on the unique circumstances and requirements of the Cuyahoga Ohio jurisdiction and the parties involved.

Cuyahoga Ohio Distribution Agreement regarding the continuous offering of the Fund's shares

Description

How to fill out Cuyahoga Ohio Distribution Agreement Regarding The Continuous Offering Of The Fund's Shares?

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Cuyahoga Distribution Agreement regarding the continuous offering of the Fund's shares, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Cuyahoga Distribution Agreement regarding the continuous offering of the Fund's shares from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Cuyahoga Distribution Agreement regarding the continuous offering of the Fund's shares:

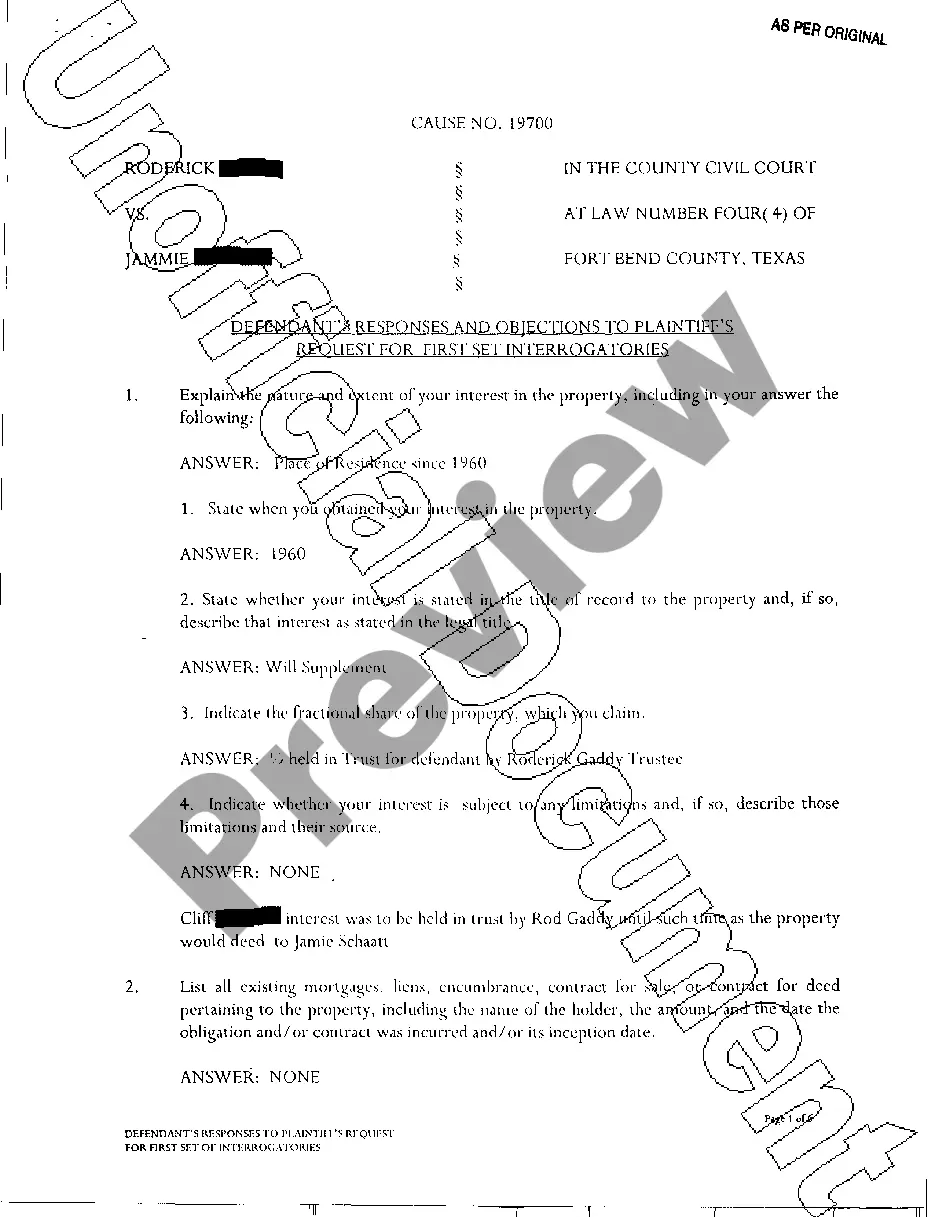

- Analyze the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!