The Maricopa Arizona Distribution Agreement outlines the terms and conditions for the continuous offering of a Fund's shares in Maricopa, Arizona. It encompasses the comprehensive guidelines and procedures that govern the relationship between the fund manager and the distributor, ensuring a seamless process for the distribution and sale of shares to investors in the Maricopa area. The agreement is specifically designed to provide clarity and define the roles and responsibilities of both parties involved in this continuous offering. It includes provisions related to the distribution territory, sales targets, marketing strategies, fees and commissions, and any additional obligations that need to be fulfilled. Keywords: Maricopa, Arizona, distribution agreement, continuous offering, Fund's shares, terms and conditions, fund manager, distributor, sales targets, marketing strategies, fees, commissions, obligations. Different types of Maricopa Arizona Distribution Agreements regarding the continuous offering of the Fund's shares may include: 1. Exclusive Distribution Agreement: This type of agreement grants exclusive rights to a single distributor in Maricopa, Arizona, prohibiting the fund manager from appointing any other distributors for the continuous offering of the Fund's shares within the specified territory. 2. Non-Exclusive Distribution Agreement: This agreement allows multiple distributors to sell the Fund's shares in Maricopa, Arizona. The fund manager has the freedom to appoint multiple distributors to maximize the reach and accessibility of the shares to potential investors. 3. Limited Distribution Agreement: This type of agreement limits the distribution of the Fund's shares to a specific target audience or a particular distribution network in Maricopa, Arizona. This can be beneficial when the fund manager wants to focus on reaching a particular demographic or penetrate a specific market segment. 4. General Distribution Agreement: A general distribution agreement is a broad and comprehensive agreement that covers all aspects of the continuous offering of the Fund's shares in Maricopa, Arizona. It encompasses all the essential terms, conditions, and requirements necessary for the distribution process, without any specific limitations or restrictions. These agreements may have variations based on the negotiation between the fund manager and the distributor, and the specific needs and objectives of the Fund in Maricopa, Arizona.

Maricopa Arizona Distribution Agreement regarding the continuous offering of the Fund's shares

Description

How to fill out Maricopa Arizona Distribution Agreement Regarding The Continuous Offering Of The Fund's Shares?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Maricopa Distribution Agreement regarding the continuous offering of the Fund's shares, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Maricopa Distribution Agreement regarding the continuous offering of the Fund's shares from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Maricopa Distribution Agreement regarding the continuous offering of the Fund's shares:

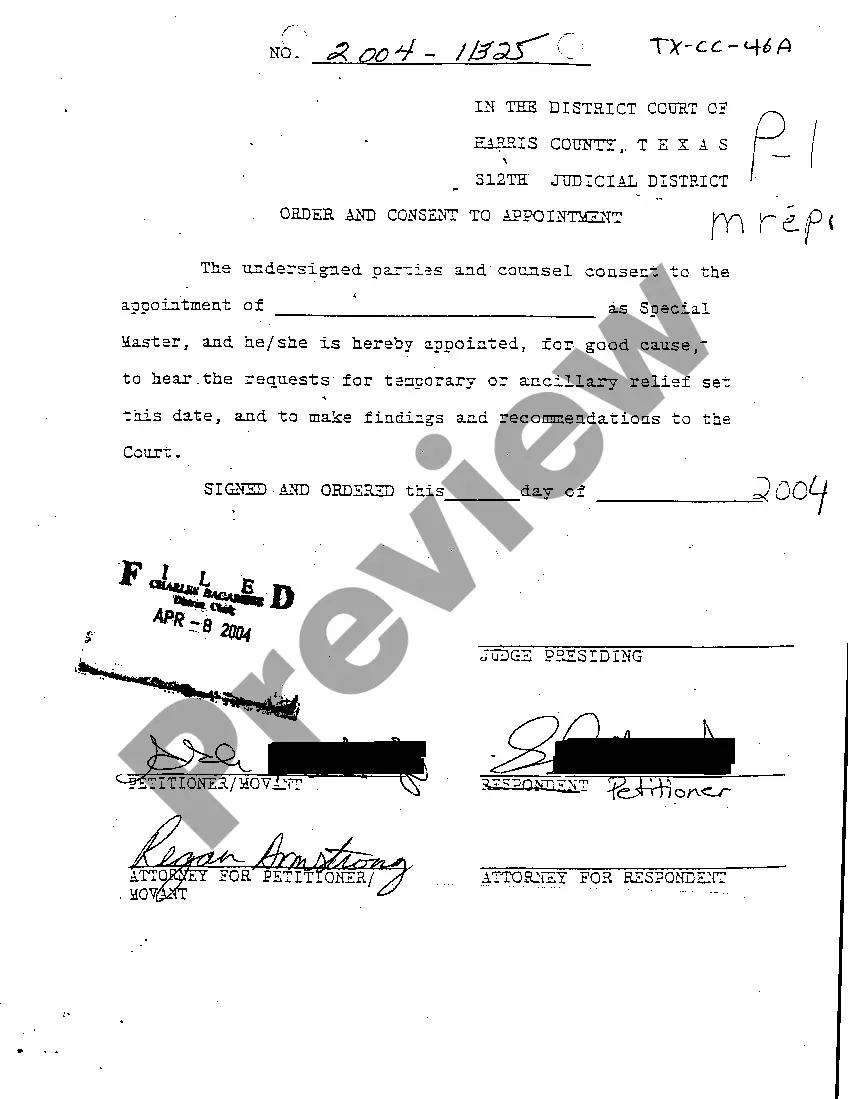

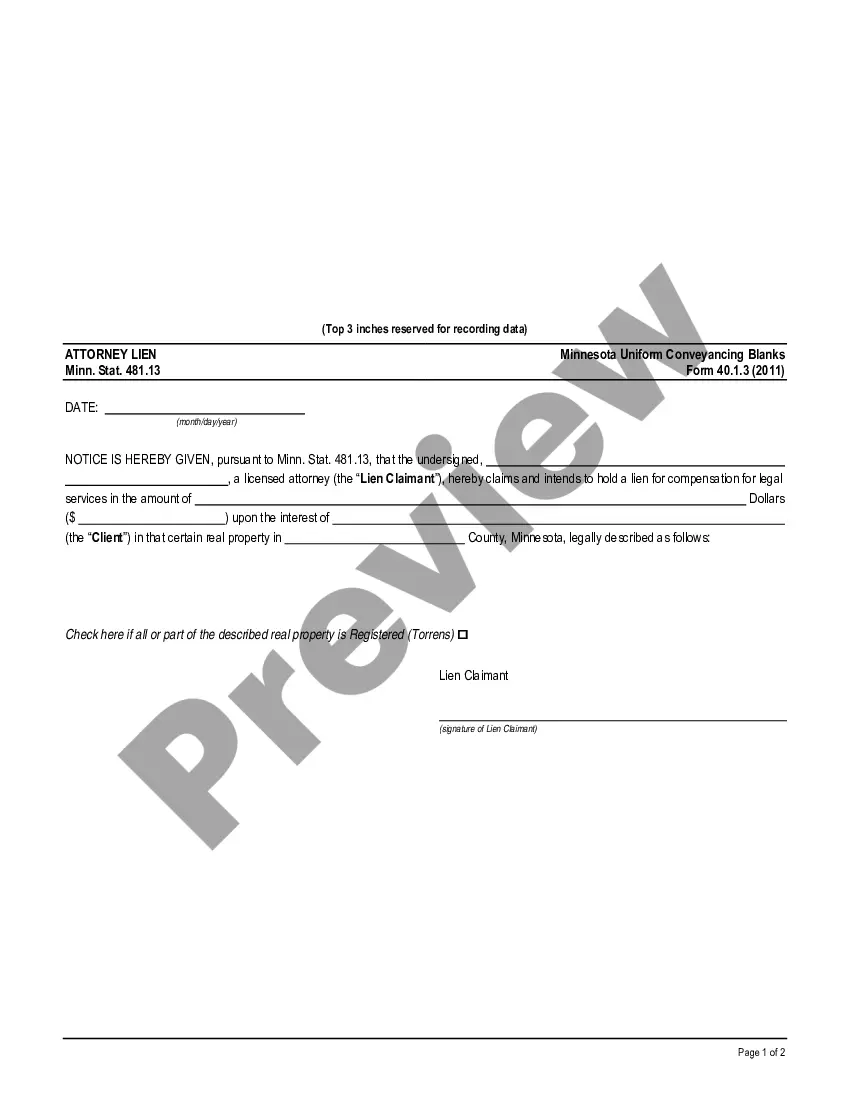

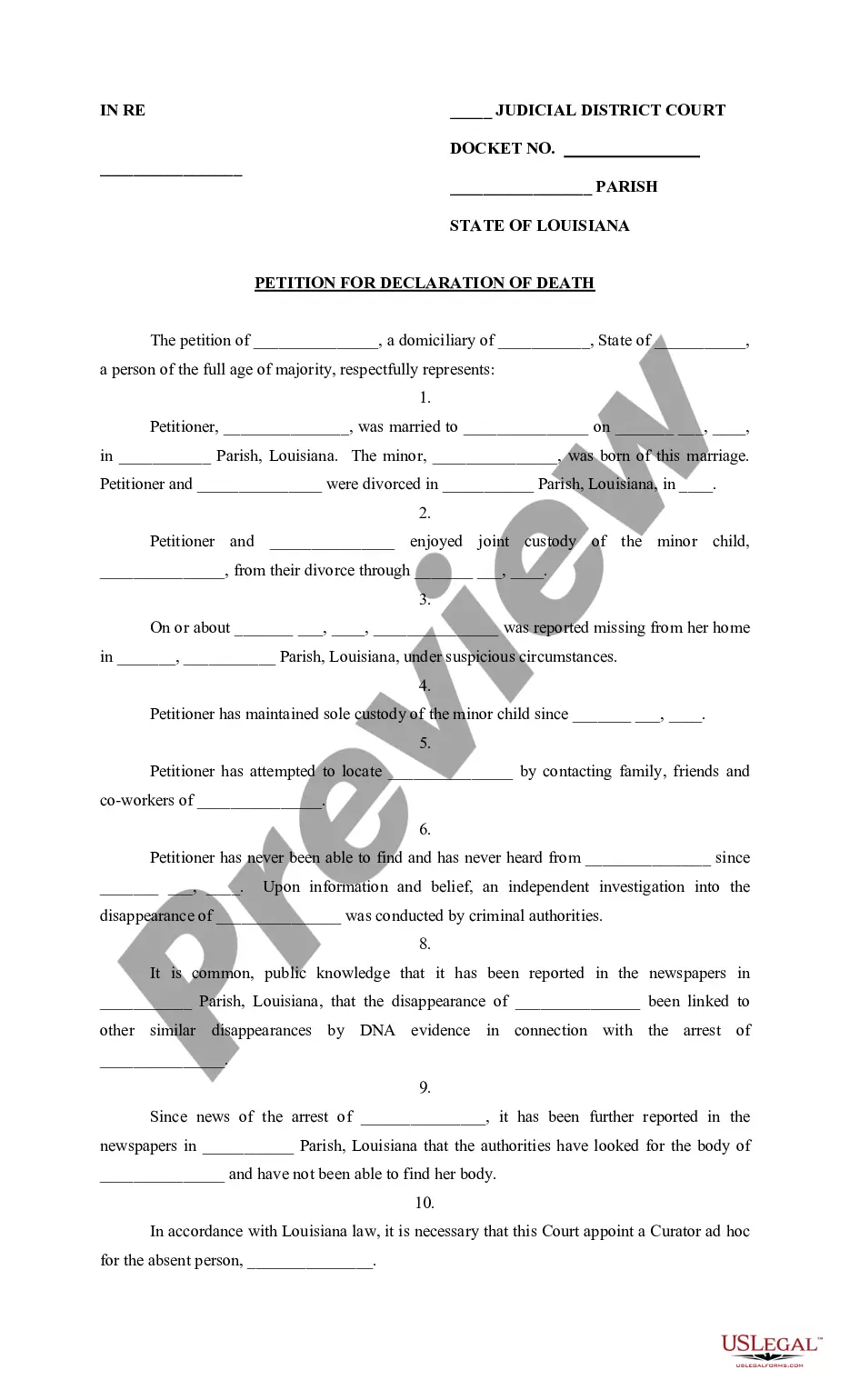

- Take a look at the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

A distribution deal (also known as distribution contract or distribution agreement) is a legal agreement between one party and another, to handle distribution of a product. There are various forms of distribution deals. There are exclusive and non-exclusive distribution agreements.

An equity distribution agreement is a contract typically used by a company that offers another party the ability to distribute shares through what's known as an at-the-market (or ATM) offering program.

A distribution agreement is one under which a supplier or manufacturer of goods agrees that an independent third party will market and sell the goods. The distributor buys the goods on their own account and trades under their own name.

Businesses must use distribution agreements to facilitate clear guidelines among the parties while providing a legal record of the formalized agreement. The following business types may need distribution agreements: Type 1. Wholesalers.

While brand-related intellectual property is typically held by the supplier, a thorough distribution agreement will always include an intellectual property clause that will give the distributor the legal right to use the supplier's intellectual property, including brand names and trademarks, for purposes of its sales

Distribution agreements give a distributor the right and duty to sell and market the supplier's products. It's a win-win situation for both the supplier and the distributor: for a fee or a commission, the distributor markets the product so the supplier doesn't have to worry how to get its products into the right hands.

A distribution agreement is what allows a distributor the rights to sell and market a supplier's products. Distribution agreements between suppliers and distributors can vary greatly based on the needs and goals of each specific distributor-supplier partnership.

A distribution agreement (Distribution Agreement) is a form of commercial contract where one party, the distributor (Distributor) is granted the right to distribute goods or services of another supplier (Supplier) to clients or customers usually in a distinct territory.

Six Rules for Negotiating a Better Distribution Agreement Balance. Balance in a distribution agreement ensures that neither party holds unfair power over the other.Due Diligence.Annual Termination and Semiautomatic Renewal.Comparison with Proven Industry Agreements.Four Eyes versus Two Eyes.Cause and Convenience.