Allegheny, Pennsylvania is a county located in the southwestern region of the state. It is known for its rich history, diverse culture, and natural beauty. Home to numerous cities and towns, Allegheny is a bustling area with a strong economy and vibrant community. One relevant document pertaining to mortgage loan purchase agreements in Allegheny, Pennsylvania is the Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC. This agreement outlines the terms and conditions under which the mortgage loans will be purchased by the mortgage securities corporation from the mortgage capital company. The key elements of such a Sample Mortgage Loan Purchase Agreement include loan details, purchase price, representations and warranties, conditions precedent to closing, covenants, indemnification provisions, dispute resolution, and other relevant clauses. This agreement ensures a legally binding framework for the transfer of mortgage loans in a secure and transparent manner. While there may not be different types of Allegheny Pennsylvania Sample Mortgage Loan Purchase Agreements specifically between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC, it is possible that variations of this agreement may exist based on specific loan types, terms, and conditions. To facilitate a successful transaction, the parties involved may consider including specific provisions addressing adjustable-rate mortgages (ARM's), fixed-rate mortgages, government-insured loans, or other specialized loan products. These different loan types could require tailored agreements to account for their unique features, such as interest rate adjustments, term lengths, and eligibility criteria. Additionally, based on the nature of the mortgage loan portfolio being purchased, the parties may need to address specific requirements related to residential or commercial properties, investment properties, foreclosure properties, or other specialized assets. It is crucial for both parties to consult legal professionals and ensure that the Sample Mortgage Loan Purchase Agreement complies with Pennsylvania state laws and regulations as well as any federal guidelines governing mortgage loan transactions. Overall, the Sample Mortgage Loan Purchase Agreement plays a significant role in facilitating the smooth transfer of mortgage loans, providing a clear understanding of the terms and obligations for both the buyer and the seller.

Allegheny Pennsylvania Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC

Description

How to fill out Allegheny Pennsylvania Sample Mortgage Loan Purchase Agreement Between Credit Suisse First Boston Mortgage Securities Corp. And Credit Suisse First Boston Mortgage Capital, LLC?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Allegheny Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Allegheny Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Allegheny Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC:

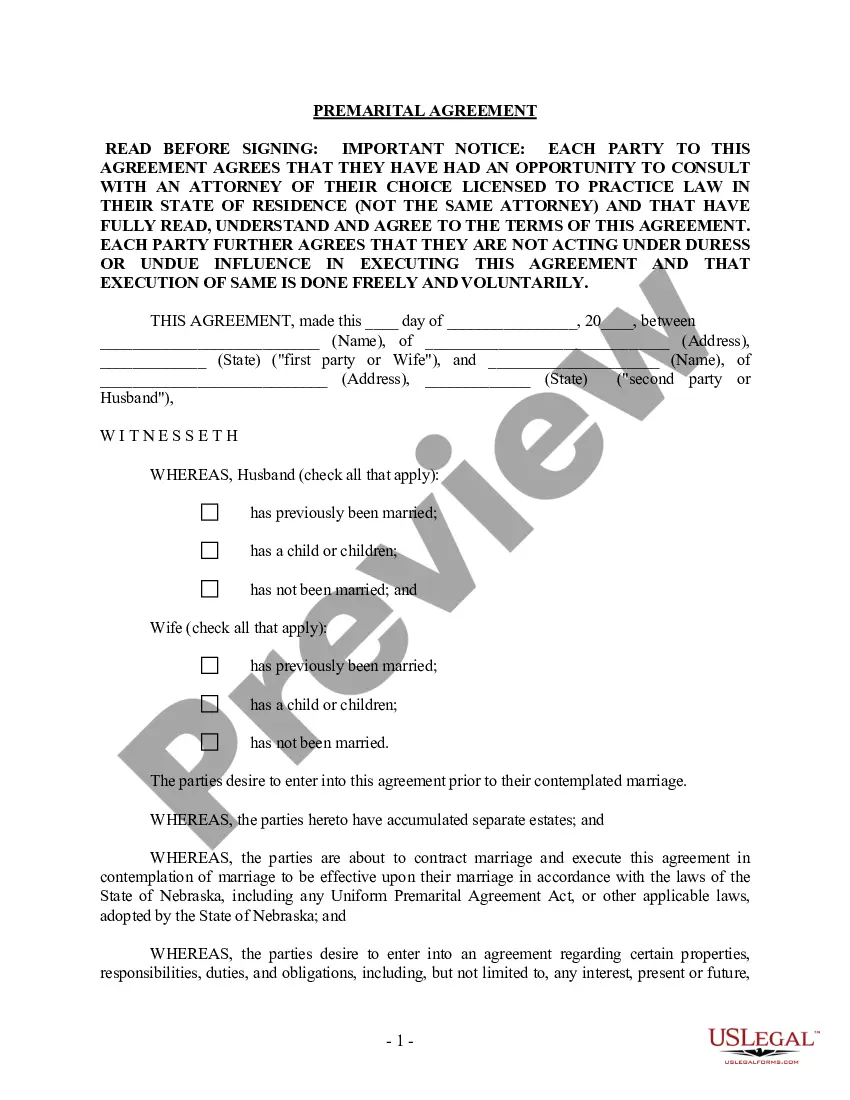

- Examine the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Capital One Announces Sale of Approximately $17 billion of Mortgages to DLJ Mortgage Capital, Inc., a subsidiary of Credit Suisse AG Capital One Financial Corp.

A loan purchase agreement is an agreement between a lender and borrower that states how a secured financial asset, such as real estate or equipment, will be purchased. The buyer of this type of security agrees to buy the asset at some point for an agreed-upon price.

Ask for a plan.Review the borrower's finances and help them set up a budget that includes your monthly repayment. Make sure they understand this is a loan, not a gift. Set terms that both sides agree can be enforced ? and enforce them! Keep your distance.Get it down on paper.

Common items in personal loan agreements. The name, address, and contact information of the borrower. The name, address, and contact information of the lender. A plan for loan payment, such as a monthly payment plan with start dates and due dates. The maturity date or the date that the final payment is due on the loan.

However, the do-it-yourself approach is perfectly acceptable and just as legally enforceable. Once you have both agreed on the terms, you may want to have the personal loan contract notarized or ask a third party to act as a witness during the signing.

In a real estate agreement, the mortgagor is the borrower of a mortgage loan and the mortgagee is the lender. The mortgagor makes regular payments on the loan and agrees to a lien on the mortgaged property as collateral for the mortgagee.

A Mortgage Agreement is a contract between a borrower (called the mortgagor) and the lender (called the mortgagee) where a lien is created on the property in order to secure repayment of the loan.

Capital One Shopping used to be called Wikibuy. Wikibuy was acquired by Capital One in 2018 and to align more closely with our parent company, we changed our name to Capital One Shopping in 2020.

How to Write a Mortgage Deed Step 1 ? Fill In Effective Date.Step 2 ? Enter Borrower and Lender Details.Step 3 ? Write Loan Information.Step 4 ? Fill In Property Details.Step 5 ? Identify Assigned Rents.Step 6 ? Enter Acceleration Upon Default.Step 7 ? Choose Power of Sale Option.

PROVIDENCE, R.I. --(BUSINESS WIRE)-- Citizens Financial Group, Inc. (NYSE: CFG or ?Citizens?) today announced the closing of its previously announced acquisition of 80 East Coast branches and the national online deposit business from HSBC Bank U.S.A. , N.A. (?HSBC?), effective February 18.