Nassau, New York is a vibrant county located on Long Island, just east of New York City. Known for its picturesque landscapes, rich history, and diverse communities, Nassau offers residents and visitors a unique blend of urban amenities and suburban charm. One of the critical aspects of the real estate market in Nassau, New York, is mortgage finance. Mortgage loan purchase agreements play a vital role in facilitating the movement of capital and the growth of the housing market. Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC are prominent players in this market, and their Sample Mortgage Loan Purchase Agreement outlines the terms and conditions of their collaborative efforts. The Nassau New York Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC serves as a comprehensive guideline for the acquisition of mortgage loans. This agreement establishes a framework for the transfer of mortgage assets from the originating lenders to Credit Suisse, enabling them to bundle and sell these loans as mortgage-backed securities in the secondary market. Keywords: Nassau, New York, mortgage loan purchase agreement, Credit Suisse First Boston Mortgage Securities Corp., Credit Suisse First Boston Mortgage Capital, LLC, Long Island, real estate market, urban amenities, suburban charm, capital movement, housing market, terms and conditions, collaborative efforts, mortgage assets, originating lenders, transfer, mortgage-backed securities, secondary market, financial agreement. Different types of Nassau New York Sample Mortgage Loan Purchase Agreements between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC can include variations specific to loan types, terms, or targeted borrower demographics. Such variations may result in different agreements tailored to meet the unique needs of specific mortgage loan portfolios. These agreements can include purchase agreement terms for residential mortgages, commercial mortgages, adjustable-rate mortgages, fixed-rate mortgages, government-backed mortgages (such as FHA or VA loans), and jumbo mortgages, among others. Each type of mortgage loan purchase agreement will cater to the specific requirements and regulations associated with the respective loan type, ensuring compliance and efficiency in the mortgage finance process.

Nassau New York Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC

Description

How to fill out Nassau New York Sample Mortgage Loan Purchase Agreement Between Credit Suisse First Boston Mortgage Securities Corp. And Credit Suisse First Boston Mortgage Capital, LLC?

How much time does it normally take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, locating a Nassau Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC suiting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. In addition to the Nassau Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can pick the document in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Nassau Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC:

- Examine the content of the page you’re on.

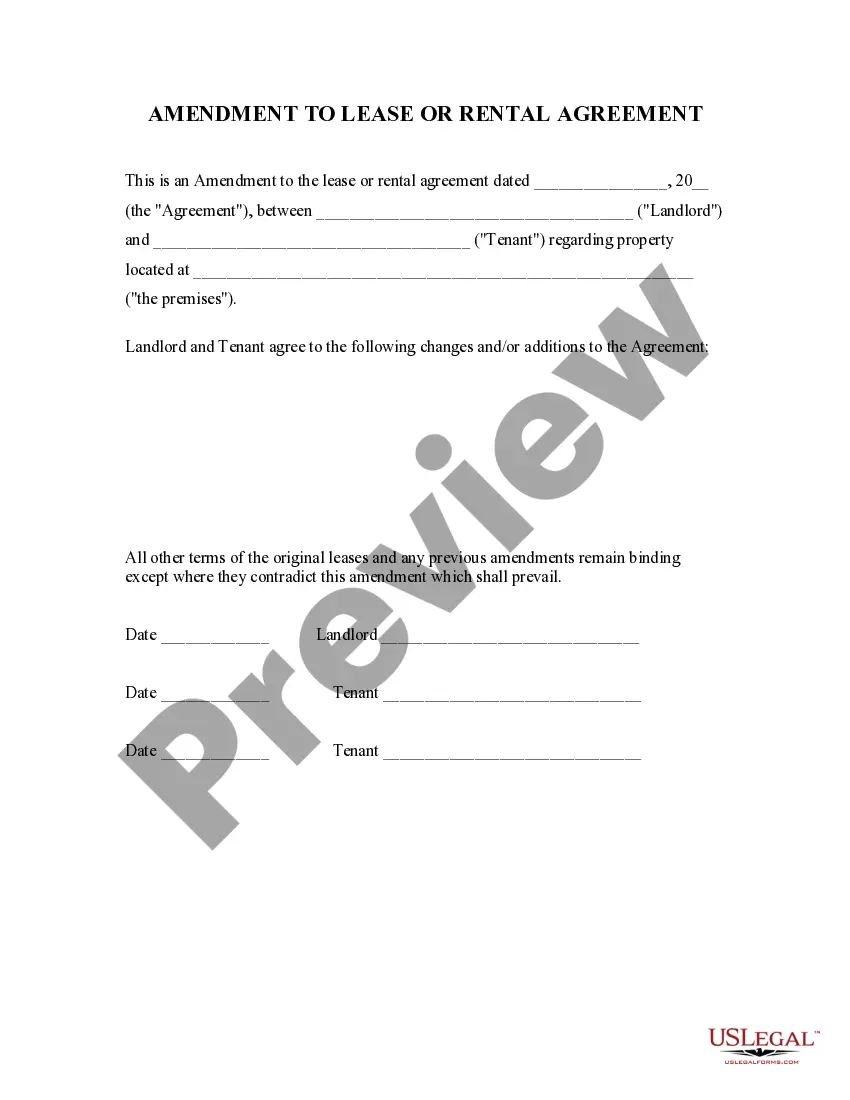

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Nassau Sample Mortgage Loan Purchase Agreement between Credit Suisse First Boston Mortgage Securities Corp. and Credit Suisse First Boston Mortgage Capital, LLC.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!