Riverside California Insurance Agreement is a legal contract between an insurance company and an individual or business entity residing in Riverside, California. This agreement ensures that the insured party receives financial protection and compensation in case of covered losses or damages as per the terms and conditions outlined within the agreement. The primary purpose of a Riverside California Insurance Agreement is to transfer the risk of potential financial loss from the insured party to the insurance company. In return for regular premium payments, the insurer agrees to provide coverage for specified risks, such as property damage, liability claims, personal injuries, or medical expenses. The agreement defines the scope of coverage, policy limits, deductibles, and exclusions, establishing the terms and conditions under which the insurance company will provide compensation. There are various types of Riverside California Insurance Agreements, each catering to different needs and areas of coverage within the Riverside community. Some notable types of insurance agreements in Riverside include: 1. Home Insurance Agreement: This type of agreement provides coverage for homeowners, protecting their property against risks such as fire, theft, vandalism, or natural disasters. It often includes liability coverage for injuries occurring on the property. 2. Auto Insurance Agreement: Auto insurance agreements are mandatory in California and provide coverage for drivers and their vehicles. These agreements typically include liability coverage for bodily injury and property damage, as well as coverage for collision, comprehensive damages, uninsured or under insured motorists, and medical expenses. 3. Business Insurance Agreement: Designed for businesses operating in Riverside, California, this type of agreement offers coverage for various risks associated with commercial operations. It may include property insurance, general liability coverage, business interruption coverage, workers' compensation, and professional liability coverage, among others. 4. Health Insurance Agreement: Health insurance agreements provide coverage for medical expenses, including doctor visits, hospitalization, prescription drugs, and preventive care. These agreements are essential for individuals and families residing in Riverside, ensuring access to healthcare services. 5. Life Insurance Agreement: Life insurance agreements provide financial protection to beneficiaries in case of the insured's death. They offer peace of mind by ensuring that loved ones are taken care of in terms of financial obligations, funeral expenses, and debt settlement. 6. Umbrella Insurance Agreement: This agreement provides supplementary liability coverage that extends beyond the limits of primary insurance policies, such as auto or home insurance. It offers additional protection against catastrophic events or lawsuits. It's important for individuals or businesses in Riverside, California, to carefully review and understand the terms and conditions of their insurance agreements to ensure they have appropriate coverage for their specific needs. Consulting with insurance experts or legal professionals can help ensure that the insurance agreement aligns with their requirements and provides adequate protection.

Riverside California Insurance Agreement

Description

How to fill out Riverside California Insurance Agreement?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from the ground up, including Riverside Insurance Agreement, with a service like US Legal Forms.

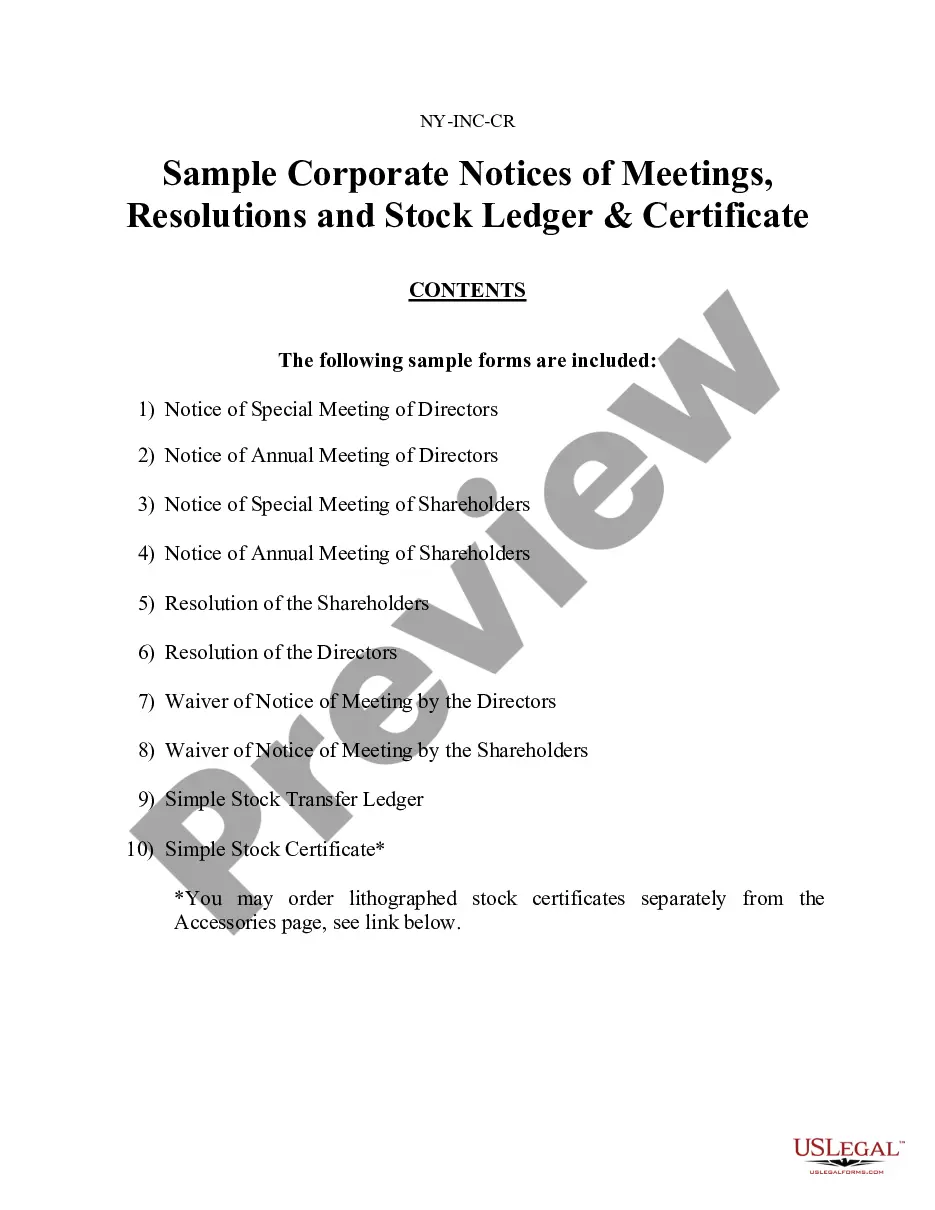

US Legal Forms has over 85,000 templates to choose from in various categories ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less challenging. You can also find information materials and guides on the website to make any tasks associated with document completion straightforward.

Here's how you can find and download Riverside Insurance Agreement.

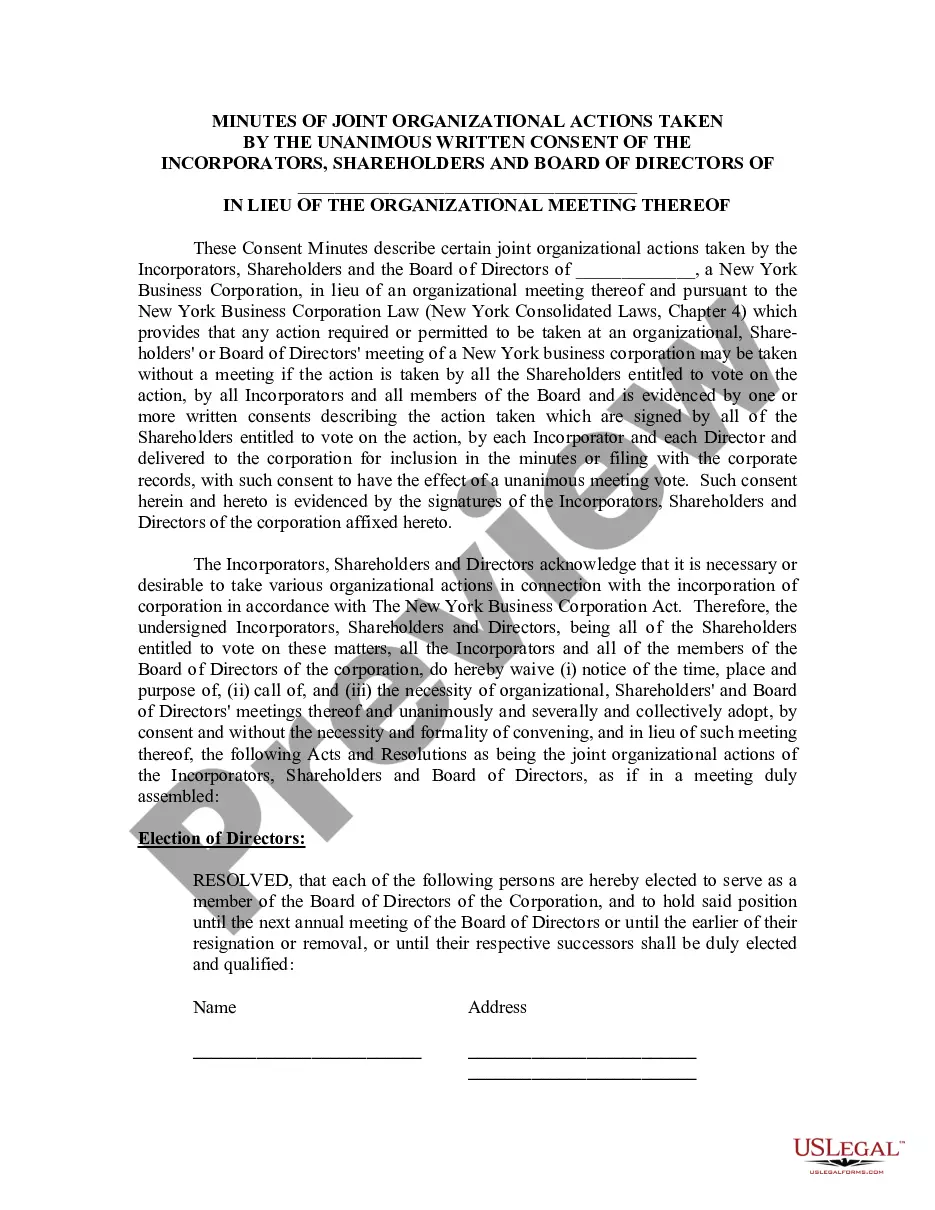

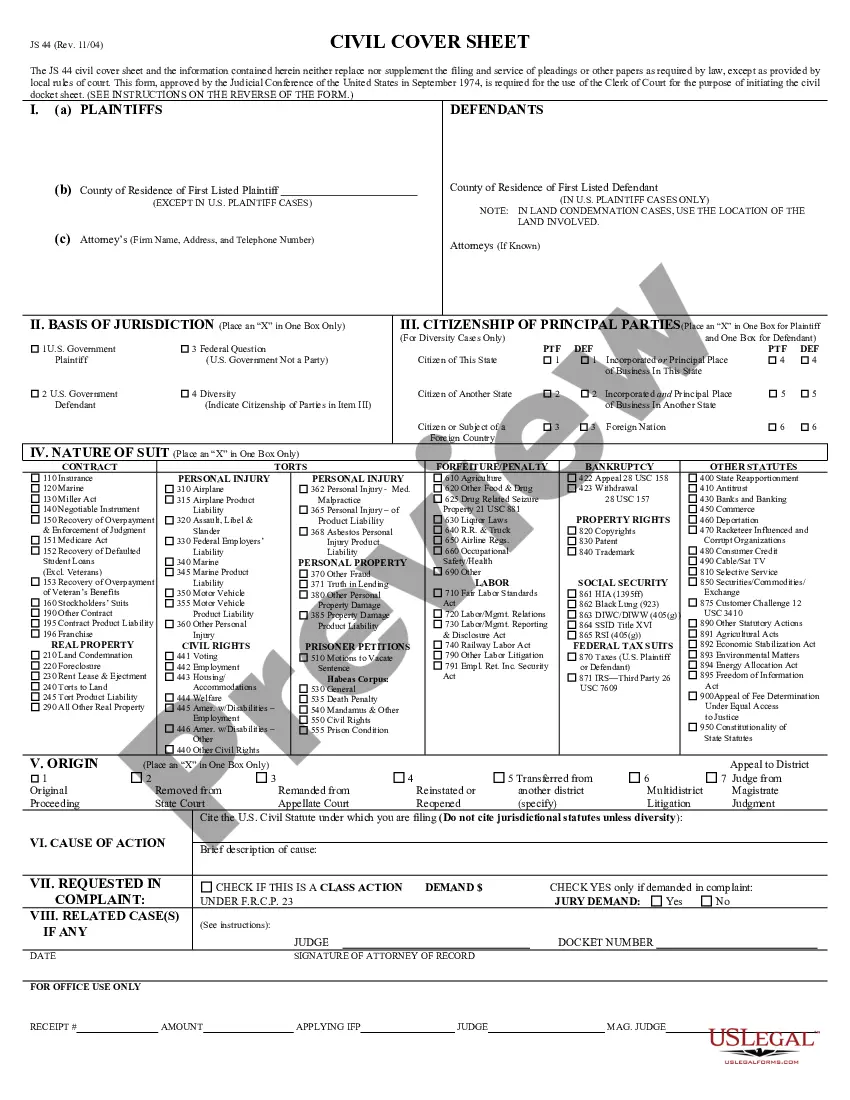

- Take a look at the document's preview and description (if available) to get a general information on what you’ll get after getting the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the validity of some documents.

- Check the related forms or start the search over to find the right file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment method, and buy Riverside Insurance Agreement.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Riverside Insurance Agreement, log in to your account, and download it. Of course, our website can’t replace a lawyer completely. If you have to cope with an exceptionally difficult situation, we recommend using the services of an attorney to check your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and get your state-compliant paperwork effortlessly!