A Dallas Texas Employee Retirement Agreement is a legally binding contract that outlines the terms and conditions under which an employee will retire from their employment in Dallas, Texas. This agreement serves as a mutual understanding between the employer and the employee and ensures a smooth transition into retirement. The Dallas Texas Employee Retirement Agreement typically includes several important components such as the appointed retirement date, the employee's job title or position, and the specific retirement benefits they are entitled to receive. It also covers the criteria for eligibility for retirement, such as age, years of service, or a combination of both. In addition to the basic provisions, a Dallas Texas Employee Retirement Agreement may also include details on the employee's pension plan or retirement savings accounts. This can encompass the contributions made by both the employer and the employee, as well as details on any vesting schedules or eligibility requirements for accessing the funds. Different types of Dallas Texas Employee Retirement Agreements may exist depending on the specific circumstances. For instance: 1. Early Retirement Agreement: This type of agreement allows employees to retire before reaching the normal retirement age defined by the company's retirement plan. It may provide added benefits or incentives to encourage early retirement. 2. Deferred Retirement Agreement: Sometimes, an employee may opt to defer their retirement date beyond the company's normal retirement age. This type of agreement specifies the timeline and conditions for this deferral. 3. Voluntary Retirement Agreement: This agreement is entered into willingly by both the employer and the employee, without any coercion. It typically offers favorable terms and benefits to the employee, encouraging them to retire voluntarily. 4. Involuntary Retirement Agreement: This type of agreement may occur when an employer initiates the retirement of an employee due to various reasons, such as downsizing, restructuring, or performance-related issues. It outlines the terms and conditions under which the employee's retirement will take place. To ensure the enforceability of a Dallas Texas Employee Retirement Agreement, it is crucial that legal counsels review and draft the contract. The agreement should comply with federal and state laws, as well as any specific regulations related to retirement benefits in Dallas, Texas.

Dallas Texas Employee Retirement Agreement

Description

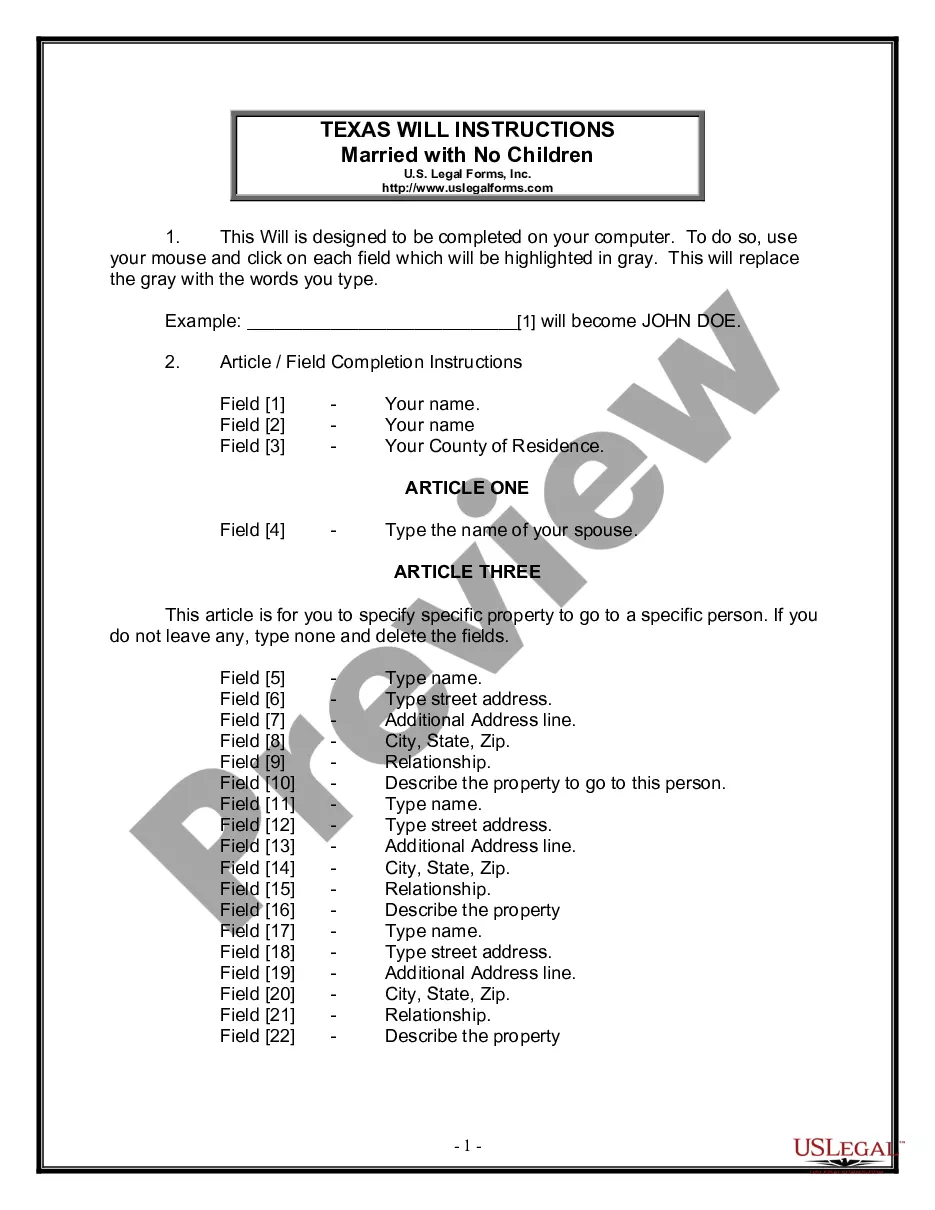

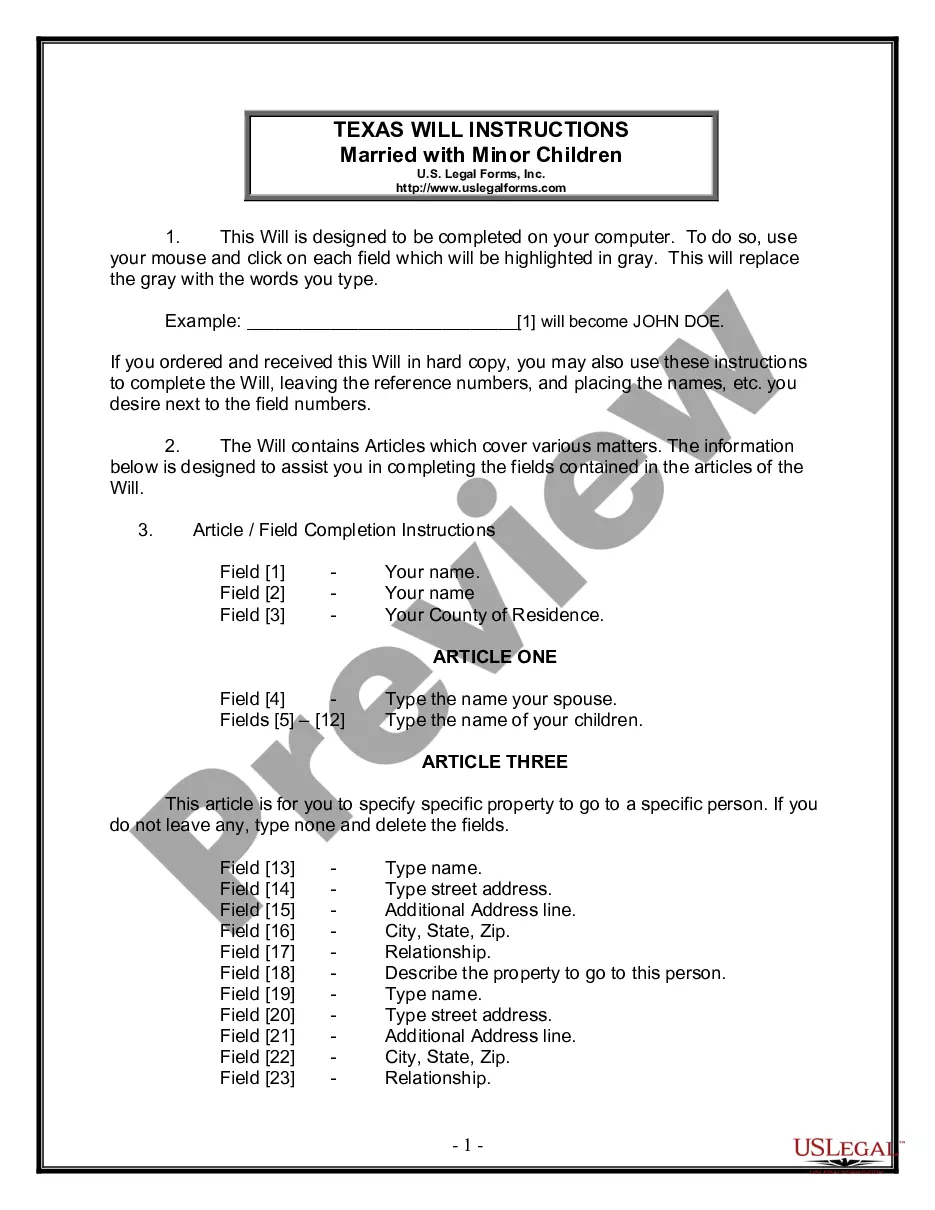

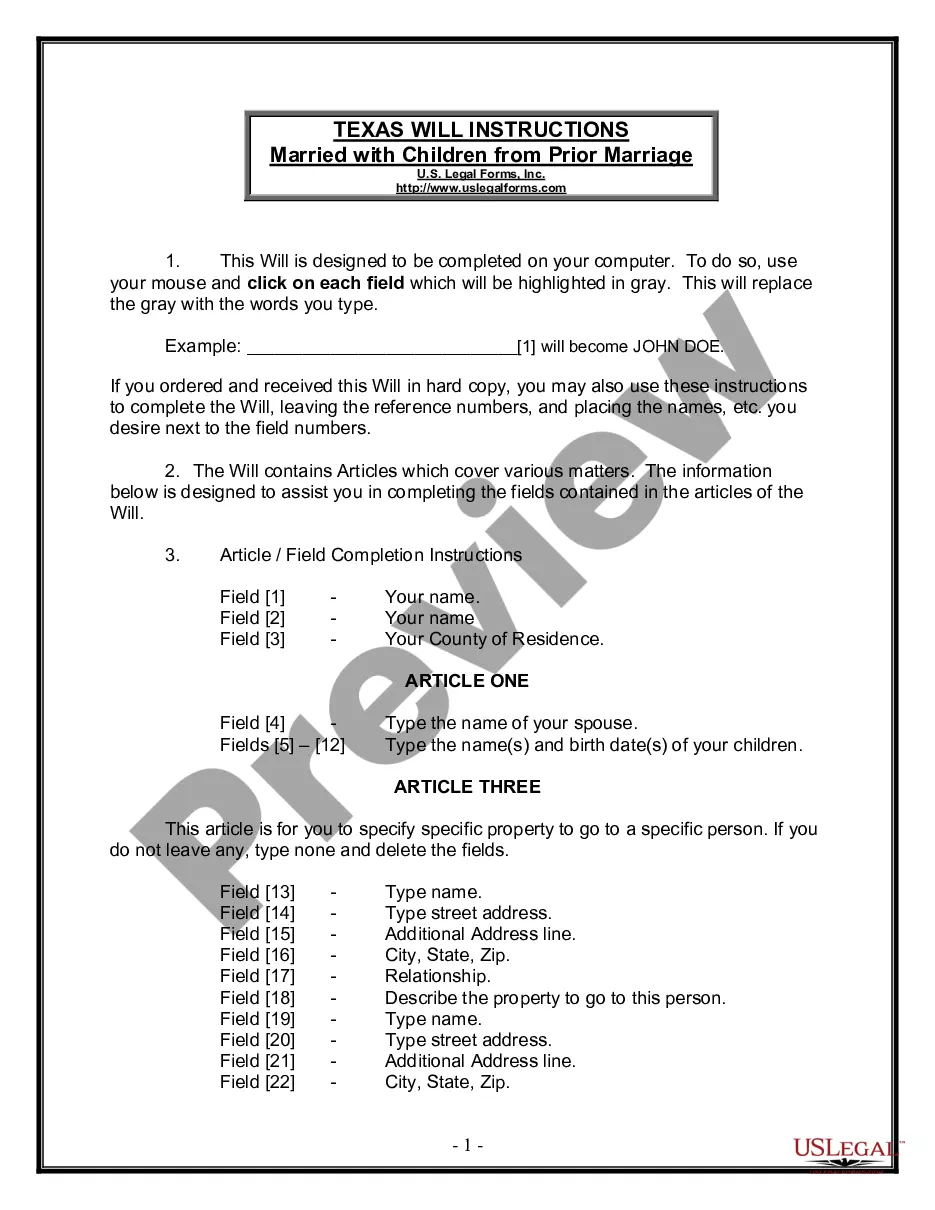

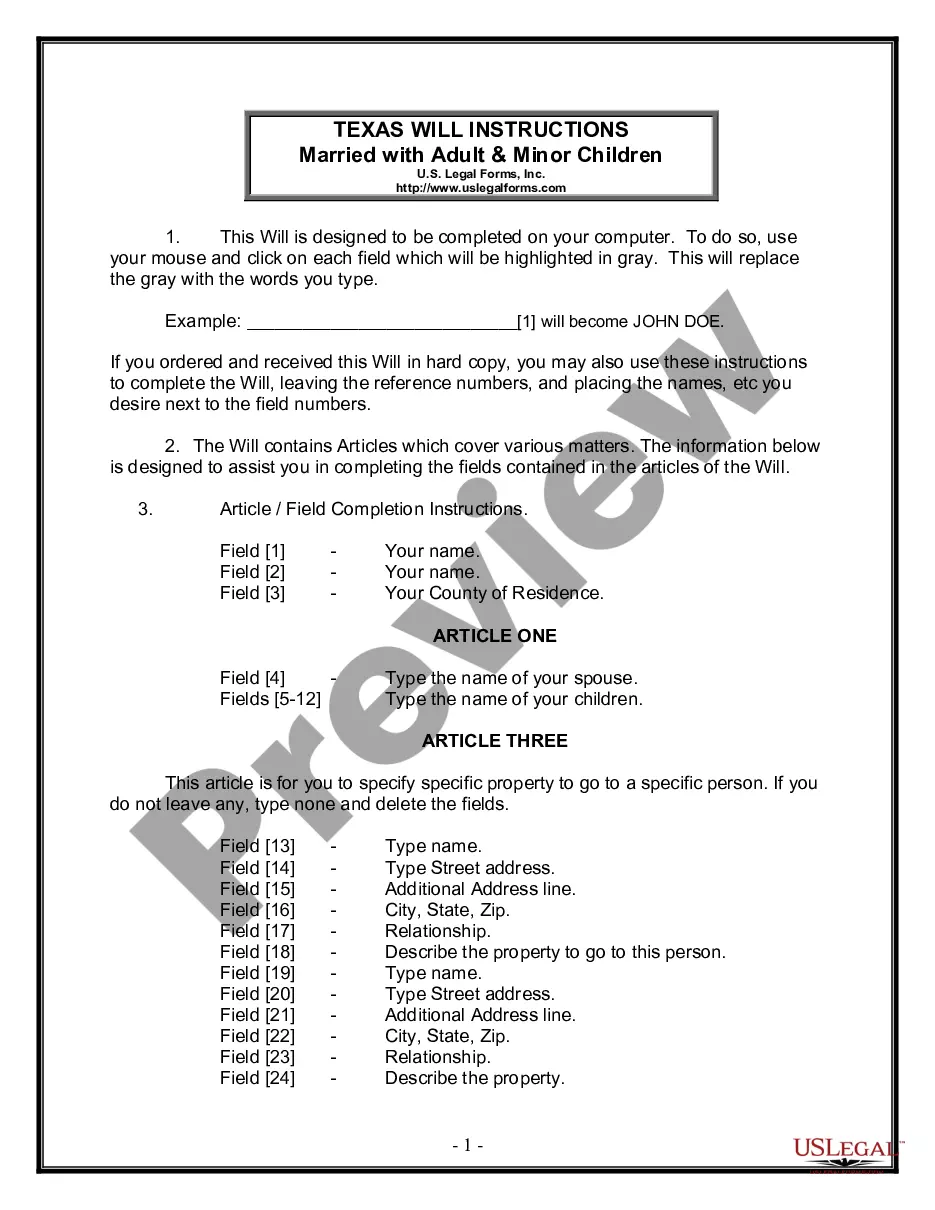

How to fill out Dallas Texas Employee Retirement Agreement?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Dallas Employee Retirement Agreement, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Dallas Employee Retirement Agreement from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Dallas Employee Retirement Agreement:

- Take a look at the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

If you leave Federal service before you meet the age and service requirements for an immediate retirement benefit, you may be eligible for deferred retirement benefits. To be eligible, you must have at least 5 years of creditable civilian service and be age 62.

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

If you meet the Rule of 80 and have at least 10 years of service credit, you will be eligible at retirement for a monthly retirement payment, health insurance, and optional benefits. If you do not meet the Rule of 80 but have 10 years of service credit, you will be eligible to retire at age 60.

A 2010 study by the federal General Accounting Office found that the Social Security participation rate among Texas public employees stood at 47 percent. Participation varies by county and public agency. In some school districts, such as San Antonio and Port Arthur, all education employees pay in to Social Security.

City employees do not participate in the Federal Social Security System. Effective October 1, 2020, the contribution rate for employees is 13.32% and the City's contribution is 22.68%.

ERF was established by ordinance in November 1943 and became effective in January 1944 after ratification by the voters of the City of Dallas. ERF is a single-employer defined benefit pension plan sponsored by the City of Dallas (the City), and it provides retirement, disability, and death benefits to its members.

Unlike most employer-sponsored pensions in the private sector, CSRS annuities were not intended to supplement Social Security benefits. Yet, most Federal workers who earn a CSRS annuity also receive Social Security benefits at some time.

Retirement for Active Employees The State of Texas retirement plan is mandatory for most state agency employees and provides a lifetime annuity when they retire.

You must have at least 10 years of eligible service credit to be eligible for retiree insurance benefits. If you began work before September 1, 2001, at least three of those years must have been with a state agency in the Texas Employees Group Benefits Program (GBP).

Workers covered by a Section 218 agreement automatically have both Social Security and Medicare. State and local government employees who are covered by Social Security and Medicare pay into these programs and have the same rights as workers in the private sector.