Nassau New York Employee Retirement Agreement is a legal contract that outlines the terms and conditions of retirement for employees in the Nassau County, New York region. This agreement is specific to employees employed within Nassau County and governs their retirement benefits, options, and entitlements upon reaching the retirement age. This retirement agreement is designed to provide a comprehensive framework for employees in Nassau County, ensuring a smooth transition from active employment to retirement. It includes several key provisions that protect the rights and interests of both the employer and the retiring employee. The primary purpose of the Nassau New York Employee Retirement Agreement is to detail the retirement benefits available to eligible employees. These benefits often include a pension plan, health insurance coverage, life insurance policies, and other post-retirement benefits. The agreement specifies the eligibility criteria for these benefits, such as the required years of service, age requirements, and other relevant factors. One prominent type of Nassau New York Employee Retirement Agreement is the Defined Benefit Plan. Under this type of agreement, retirees receive a predetermined amount of retirement income based on factors like salary history, years of service, and age at retirement. Another common type is the Defined Contribution Plan, wherein employees and employers contribute to an individual retirement account or similar investment vehicle to accumulate retirement savings. The agreement also covers the process and procedures for filing retirement applications, computation of retirement benefits, and the timing of benefit payments. It outlines the rights and responsibilities of both retirees and their former employer, ensuring a fair and transparent retirement process. Furthermore, the Nassau New York Employee Retirement Agreement may address additional provisions such as retirement counseling services, cost-of-living adjustments, survivor benefits, and provisions for disability retirement. To ensure compliance with relevant laws and regulations, the agreement may refer to specific retirement statutes, such as the New York State and Local Retirement System (YEARS) laws or the Employee Retirement Income Security Act (ERICA). In summary, the Nassau New York Employee Retirement Agreement is a crucial document that establishes the retirement benefits and procedures available to employees in Nassau County, New York. It safeguards the retiree's financial security and provides a clear understanding of their entitlements upon leaving active employment. Different types of retirement agreements may be available, including Defined Benefit Plans and Defined Contribution Plans, each tailored to meet the diverse needs of employees in the region.

Nassau New York Employee Retirement Agreement

Description

How to fill out Nassau New York Employee Retirement Agreement?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Nassau Employee Retirement Agreement, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Nassau Employee Retirement Agreement from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Nassau Employee Retirement Agreement:

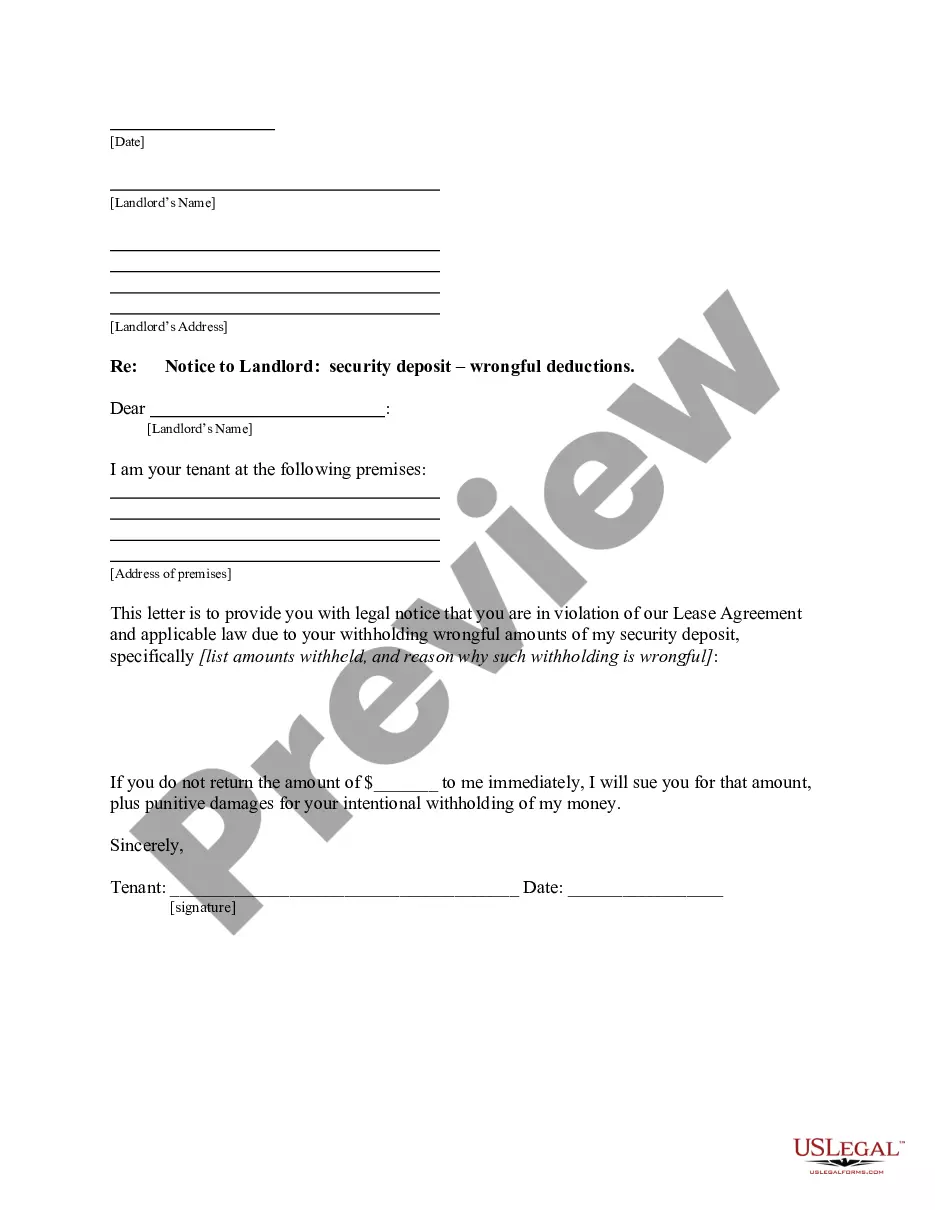

- Take a look at the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!