The Bexar Texas Executive Change in Control Agreement for The First National Bank of Litchfield is a legal document designed to outline the terms and conditions associated with executive changes in control within the organization. This agreement aims to protect the interests of the bank and its executives in the event of a change in ownership or leadership. Under this agreement, keywords such as "Bexar Texas," "Executive Change in Control Agreement," "The First National Bank of Litchfield," and "terms and conditions" are applicable. Other relevant keywords include "executive protection," "ownership transfer," "leadership changes," and "interest safeguarding." The Bexar Texas Executive Change in Control Agreement for The First National Bank of Litchfield may have different types or variations depending on the specific circumstances and provisions established by the organization. Some potential variations may include: 1. Standard Bexar Texas Executive Change in Control Agreement: This type of agreement outlines the general provisions and conditions that apply to executive changes in control within The First National Bank of Litchfield. 2. Enhanced Bexar Texas Executive Change in Control Agreement: This version includes additional benefits and protections for executives, such as severance packages, stock options, and extended healthcare coverage. 3. Restricted Bexar Texas Executive Change in Control Agreement: In certain situations, the agreement may have limitations and restrictions on executive benefits or compensation to ensure a smooth transition during a change in control. 4. Tailored Bexar Texas Executive Change in Control Agreement: This type of agreement is customized to meet the unique needs and requirements of specific executives within The First National Bank of Litchfield. It may include individualized provisions based on the executive's role, tenure, or performance. In conclusion, the Bexar Texas Executive Change in Control Agreement for The First National Bank of Litchfield is a comprehensive legal document that safeguards the interests of both the bank and its executives during changes in ownership or leadership. It ensures a fair and transparent process while outlining the terms, conditions, and potential benefits associated with such changes.

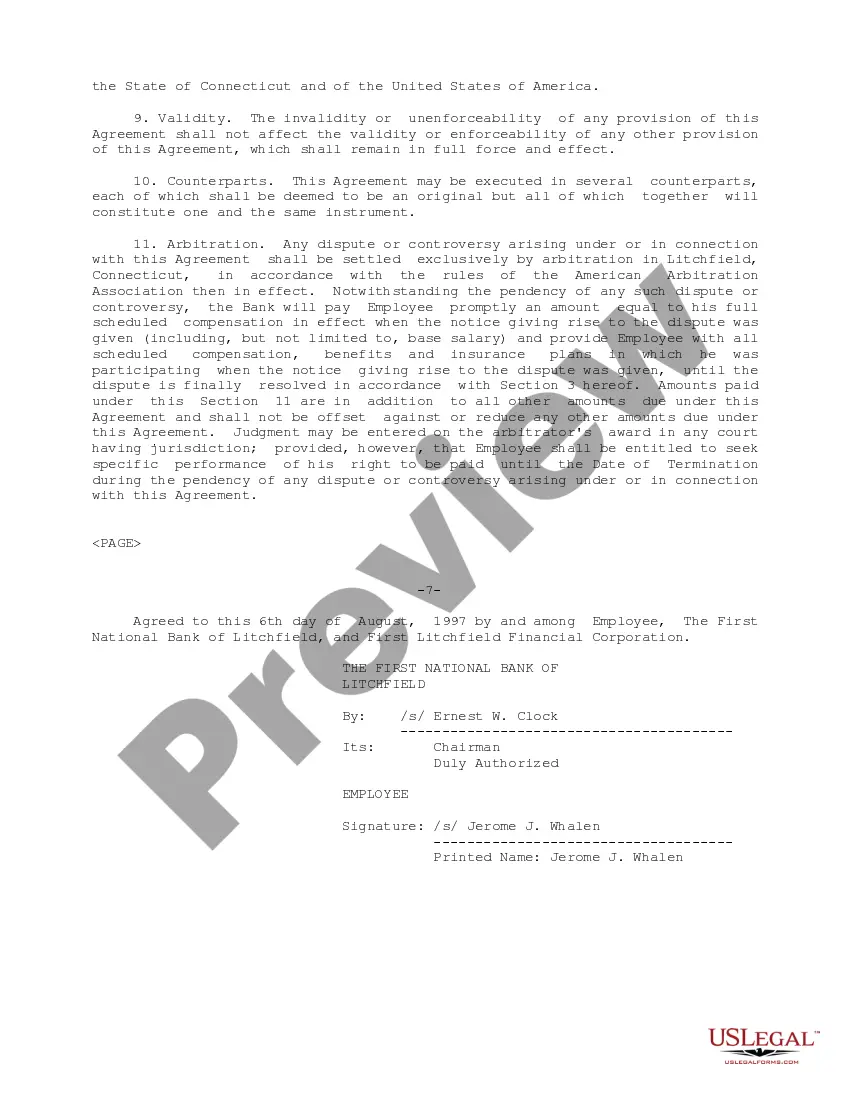

Bexar Texas Executive Change in Control Agreement for The First National Bank of Litchfield

Description

How to fill out Bexar Texas Executive Change In Control Agreement For The First National Bank Of Litchfield?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a lawyer to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Bexar Executive Change in Control Agreement for The First National Bank of Litchfield, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Therefore, if you need the latest version of the Bexar Executive Change in Control Agreement for The First National Bank of Litchfield, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Bexar Executive Change in Control Agreement for The First National Bank of Litchfield:

- Look through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Bexar Executive Change in Control Agreement for The First National Bank of Litchfield and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!