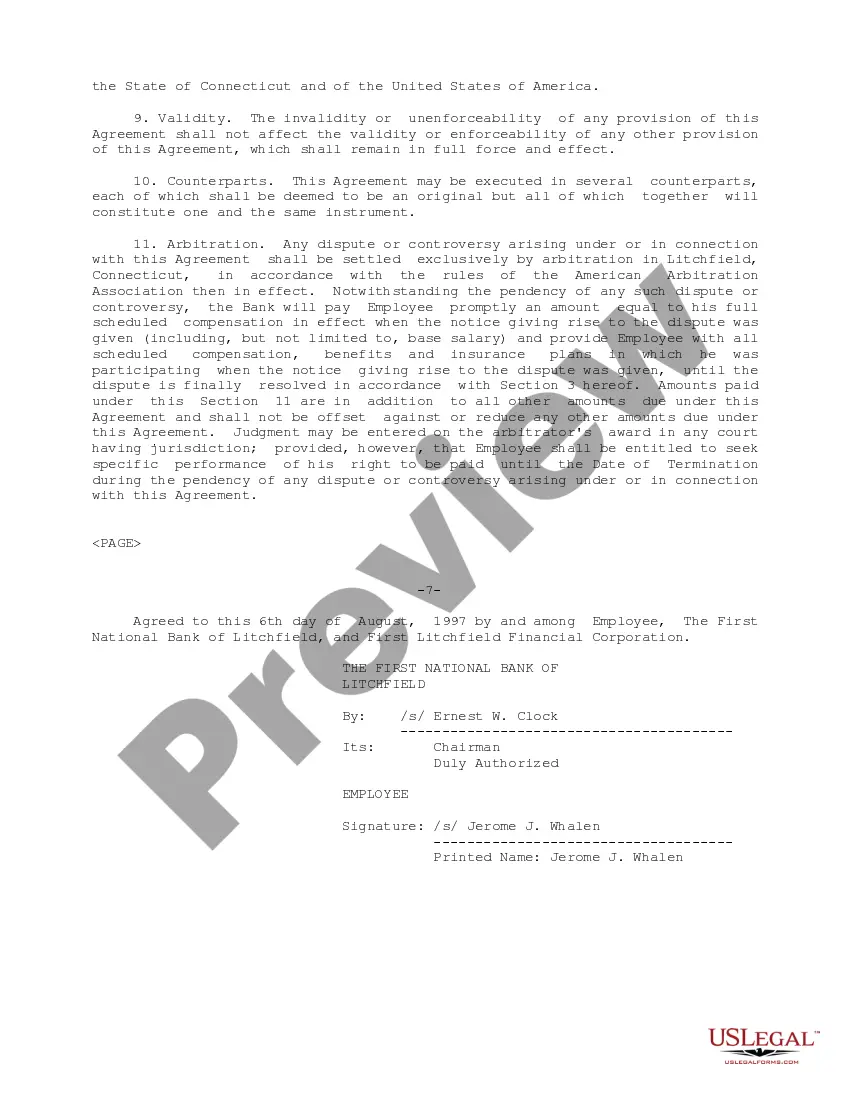

The Contra Costa California Executive Change in Control Agreement for The First National Bank of Litchfield is a comprehensive document designed to outline the terms and conditions surrounding potential executive changes in control within the bank. This agreement serves as a contractual framework to protect the rights and interests of executives, shareholders, and the bank itself in the event of a significant change in ownership or management. The agreement contains several key provisions that are important to understand. Firstly, it specifies the circumstances that constitute a change in control, such as a merger, acquisition, sale of a substantial amount of assets, or a change in a majority of the bank's board of directors. These triggers can vary depending on the specific type of agreement entered into. Additionally, the Contra Costa California Executive Change in Control Agreement for The First National Bank of Litchfield addresses executive compensation and benefits in the event of a change in control. It outlines the monetary or equity-based compensations, severance packages, stock options, and other benefits that executives are entitled to receive if their employment is terminated as a result of the change in control. These provisions are crucial in attracting and retaining top-tier executive talent, while also ensuring that their interests align with those of the bank and its shareholders. Furthermore, this agreement typically includes confidentiality and non-compete clauses. Executives are required to maintain the confidentiality of any sensitive or proprietary information about the bank during and after their employment, safeguarding trade secrets and intellectual property. Non-compete provisions restrict executives from joining or starting competing financial institutions for a specified period, protecting the bank's interests and preventing any potential conflicts of interest. Different types of Contra Costa California Executive Change in Control Agreements for The First National Bank of Litchfield may include variations based on the executive's position, seniority, and length of service. For example, there may be separate agreements for top-level executives, such as the CEO or CFO, compared to agreements for other executives within the bank. Additionally, the terms and conditions may differ depending on whether the change in control is triggered by a merger, acquisition, or other specific events. In conclusion, the Contra Costa California Executive Change in Control Agreement for The First National Bank of Litchfield is a crucial legal contract that ensures clarity, fairness, and protection for both the bank and its executives in the face of significant ownership or management changes. By creating a transparent framework, this agreement upholds the interests of all parties involved and helps maintain stability and continuity within the bank's leadership.

Contra Costa California Executive Change in Control Agreement for The First National Bank of Litchfield

Description

How to fill out Contra Costa California Executive Change In Control Agreement For The First National Bank Of Litchfield?

Creating forms, like Contra Costa Executive Change in Control Agreement for The First National Bank of Litchfield, to manage your legal affairs is a tough and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can take your legal matters into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms crafted for various scenarios and life circumstances. We make sure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Contra Costa Executive Change in Control Agreement for The First National Bank of Litchfield template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before downloading Contra Costa Executive Change in Control Agreement for The First National Bank of Litchfield:

- Make sure that your document is compliant with your state/county since the rules for creating legal paperwork may differ from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Contra Costa Executive Change in Control Agreement for The First National Bank of Litchfield isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our service and get the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is all set. You can try and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!