The Nassau New York Executive Change in Control Agreement for The First National Bank of Litchfield is a legal document that outlines the terms and conditions for executive compensation and benefits in the event of a change in control of the bank. This agreement is designed to protect the interests of the bank's executives while ensuring a smooth transition of power. Keywords: Nassau New York, Executive Change in Control Agreement, The First National Bank of Litchfield, executive compensation, benefits, change in control, legal document, power transition, interests, smooth transition. Different types of Nassau New York Executive Change in Control Agreement for The First National Bank of Litchfield may include: 1. Executive Change in Control Agreement for CEO: This specific agreement caters to the Chief Executive Officer of The First National Bank of Litchfield. It outlines the compensation, benefits, and terms applicable to the CEO in the event of a change in control. 2. Executive Change in Control Agreement for CFO: This type of agreement focuses on the Chief Financial Officer of the bank. It delineates the compensation and benefits that the CFO is entitled to in case of a change in control scenario. 3. Executive Change in Control Agreement for Senior Executives: This agreement encompasses all senior executives of The First National Bank of Litchfield, excluding the CEO and CFO. It establishes the terms and conditions applicable to these key executives during a change in control situation. 4. Executive Change in Control Agreement for General Counsel: For the bank's General Counsel, this agreement specifies the compensation, benefits, and other provisions relevant to their role during a change in control of The First National Bank of Litchfield. 5. Executive Change in Control Agreement for Board Members: This type of agreement pertains to the members of the bank's board of directors. It outlines the consequences of a change in control on their remuneration, benefits, and roles within the organization. It's important to note that the actual names and types of agreements may vary depending on the bank's specific organizational structure and executive roles.

Nassau New York Executive Change in Control Agreement for The First National Bank of Litchfield

Description

How to fill out Nassau New York Executive Change In Control Agreement For The First National Bank Of Litchfield?

Preparing paperwork for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Nassau Executive Change in Control Agreement for The First National Bank of Litchfield without professional help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Nassau Executive Change in Control Agreement for The First National Bank of Litchfield on your own, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Nassau Executive Change in Control Agreement for The First National Bank of Litchfield:

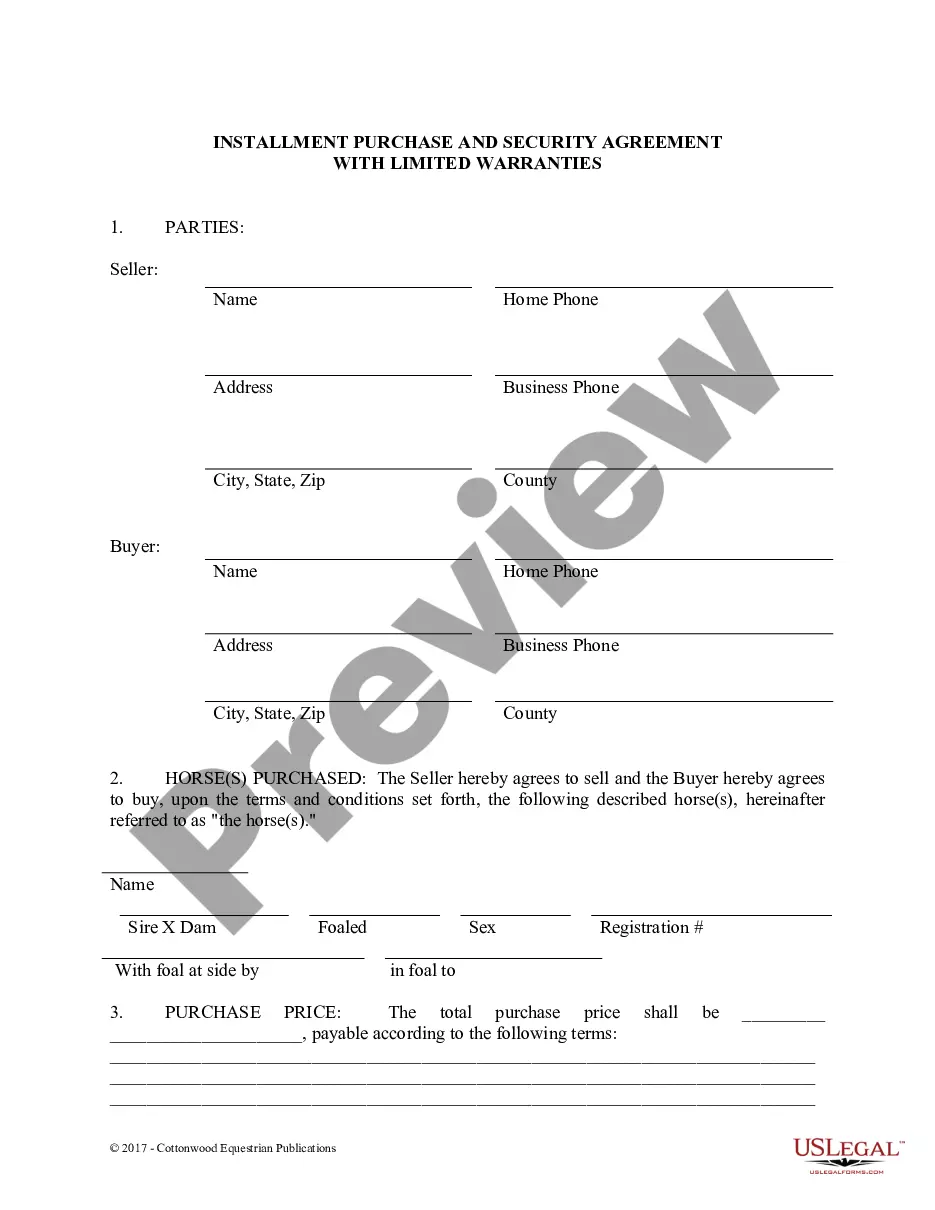

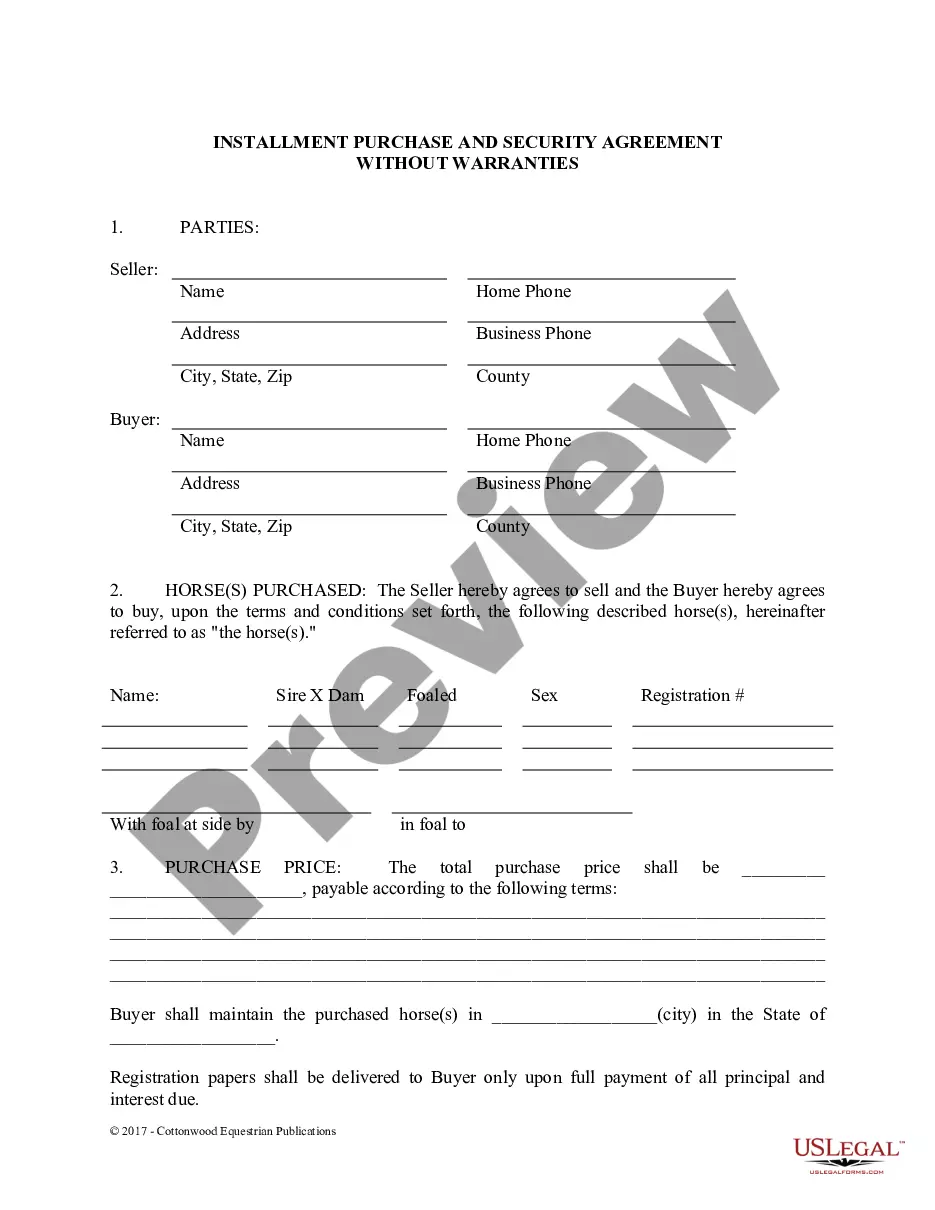

- Look through the page you've opened and check if it has the sample you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any situation with just a few clicks!