Title: The San Antonio Texas Executive Change in Control Agreement for The First National Bank of Litchfield: A Comprehensive Overview Keywords: San Antonio Texas, Executive Change in Control Agreement, The First National Bank of Litchfield, Types Introduction: The San Antonio Texas Executive Change in Control Agreement for The First National Bank of Litchfield is a crucial document that outlines the terms and provisions governing executive employment and benefits in case of a change in the bank's ownership or control. This agreement safeguards the interests of key executives and ensures a smooth transition during such times. In this article, we will delve into the details and explore the different types of executive change in control agreements applicable to The First National Bank of Litchfield. 1. Definition and Purpose: The San Antonio Texas Executive Change in Control Agreement for The First National Bank of Litchfield is a legally binding contract between the bank and its executives. The agreement serves to protect the rights and benefits of these key employees during ownership or control transitions. It provides financial security and incentives to executives while ensuring their retention and loyalty during uncertain times. 2. Main Provisions: The executive change in control agreement typically covers a range of provisions, including but not limited to: — Change in Control Triggers: The agreement describes specific events that can be classified as a change in control, such as mergers, acquisitions, or significant ownership changes. — Severance Compensation: Executives are entitled to receive severance payments and benefits if their employment is terminated due to a change in control. The agreement defines the compensation structure, which may include severance pay, bonuses, stock options, and accelerated vesting of equity awards. — Continuation of Benefits: The agreement may stipulate the continuation of health insurance, pension plans, retirement benefits, and other employee perks for a certain period following the change in control. — Non-Compete and Non-Solicitation: Executives may be subject to non-compete and non-solicitation clauses, which restrict their ability to engage in competing activities or recruit employees from the bank after their departure. — Change in Responsibilities: In case of a change in control, the agreement may outline any changes to the executive's roles, responsibilities, and reporting structures within the organization. Types of San Antonio Texas Executive Change in Control Agreements for The First National Bank of Litchfield: 1. Full Vesting Agreement: This type of agreement ensures that executives receive accelerated vesting of all their equity-based compensation upon a change in control, providing immediate access to their financial benefits. 2. Enhanced Severance Agreement: Executives covered by this agreement are entitled to receive enhanced severance packages, which may include extended notice periods, increased severance payments, additional benefits, and extensive executive-level protection clauses. 3. Retention Bonus Agreement: This agreement motivates executives to stay with the bank during a change in control by offering retention bonuses or additional financial incentives tied to their continued employment post-transition. Conclusion: The San Antonio Texas Executive Change in Control Agreement for The First National Bank of Litchfield is a critical instrument that ensures the smooth and fair treatment of executives during ownership or control changes. By offering financial security, benefits continuation, and other provisions, this agreement aims to protect executive rights, retain top talent, and foster a stable transition for the bank.

San Antonio Texas Executive Change in Control Agreement for The First National Bank of Litchfield

Description

How to fill out San Antonio Texas Executive Change In Control Agreement For The First National Bank Of Litchfield?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the San Antonio Executive Change in Control Agreement for The First National Bank of Litchfield, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the San Antonio Executive Change in Control Agreement for The First National Bank of Litchfield from the My Forms tab.

For new users, it's necessary to make several more steps to get the San Antonio Executive Change in Control Agreement for The First National Bank of Litchfield:

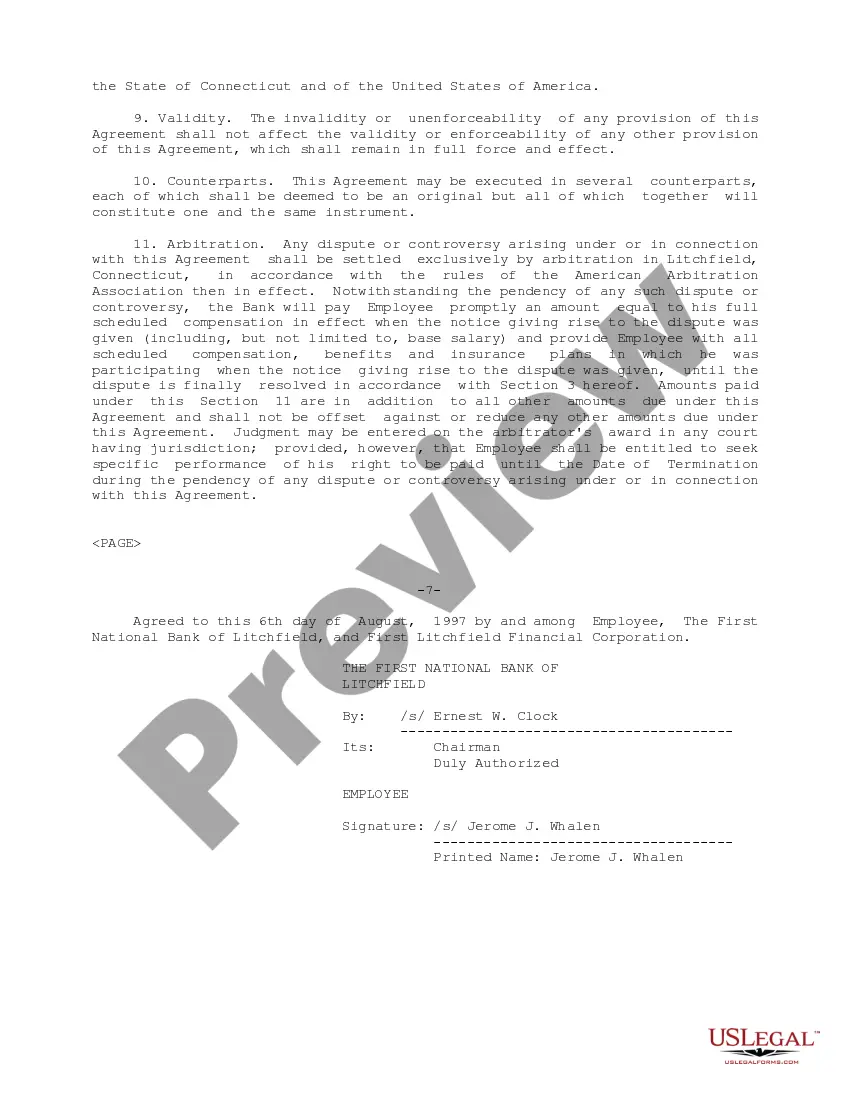

- Take a look at the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!