Oakland Michigan Reinsurance Agreement is a contractual agreement between Blue Cross Blue Shield of Missouri (BCBS) and Healthy Alliance Life Insurance Co. (HALF) in the state of Michigan. This agreement aims to provide reinsurance coverage for specific health insurance policies offered by HALF in Oakland County, Michigan. As one of the largest health insurance providers in the region, BCBS extends its expertise and financial support through this reinsurance agreement to HALF. The purpose is to mitigate and manage the financial risks associated with providing health insurance coverage to individuals and groups residing in Oakland County. The Oakland Michigan Reinsurance Agreement includes various provisions and terms that outline the rights and responsibilities of both BCBS and HALF. Some important aspects covered in this agreement may involve: 1. Coverage Scope: This agreement identifies the specific health insurance policies offered by HALF in Oakland County that are eligible for reinsurance coverage through BCBS. It may highlight policy types, such as individual plans, family plans, or group plans, among others. 2. Reinsurance Premiums: The agreement stipulates the premium rates that HALF will pay to BCBS for availing reinsurance coverage. Premium calculations may consider factors such as the insured individuals' age, medical history, coverage level, and the associated risks. 3. Risk Sharing: The agreement elucidates the sharing of risks between BCBS and HALF. It may define the deductible amount or limits, beyond which BCBS will reimburse HALF for eligible claims. The risk sharing percentages or ratios may also be included. 4. Claims Settlement: This agreement explains the process by which HALF will submit reinsurance claims to BCBS for reimbursement. It may outline the required documentation, timeframes, and any dispute resolution mechanisms in case of claim rejections or disagreements. 5. Financial Regulations: Compliance with state and federal regulations, including those related to reinsurance, solvency, and financial reporting, may be addressed in the agreement. It aims to ensure that both parties conform to the applicable laws and guidelines. While there may not be variations in Oakland Michigan Reinsurance Agreements between BCBS and HALF in terms of different types, updates or amendments to the agreement may occur periodically to adapt to changing regulatory environments or emerging market needs. Overall, the Oakland Michigan Reinsurance Agreement between BCBS and HALF serves as a crucial framework for risk management and financial protection, enabling HALF to provide quality health insurance coverage in Oakland County, while having the support and backing of BCBS's reinsurance expertise and resources.

Oakland Michigan Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co.

Description

How to fill out Oakland Michigan Reinsurance Agreement Between Blue Cross Blue Shield Of Missouri And Healthy Alliance Life Insurance Co.?

Drafting papers for the business or personal needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft Oakland Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. without professional assistance.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Oakland Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Oakland Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co.:

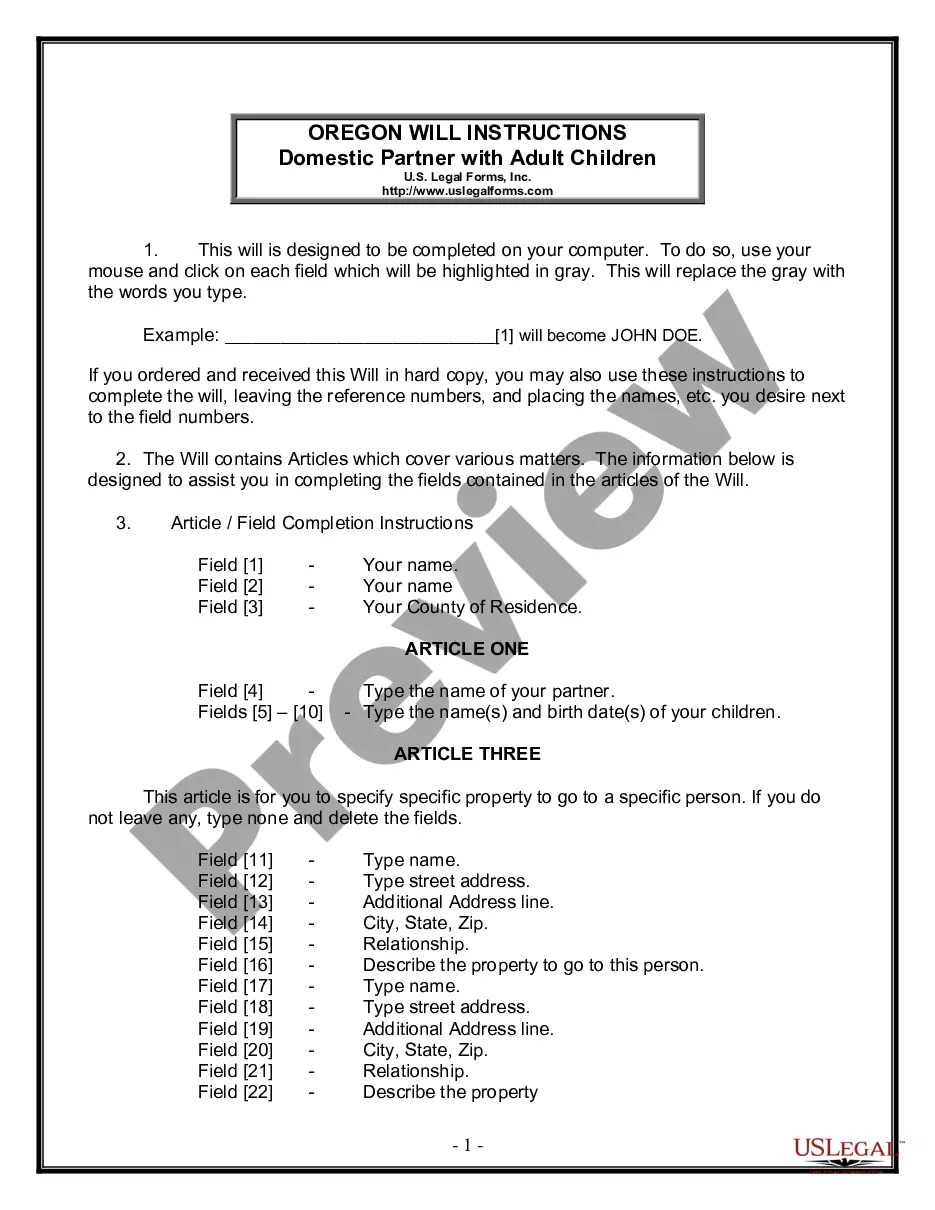

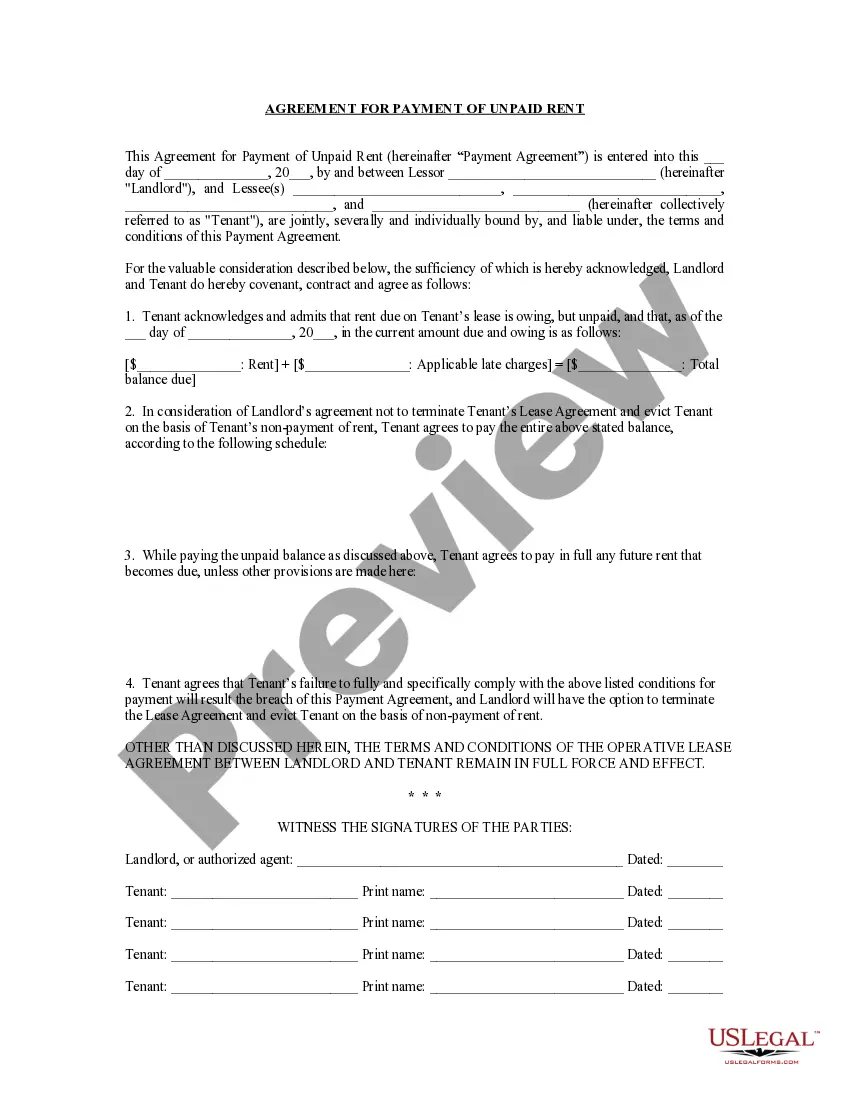

- Examine the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that suits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a few clicks!