The Riverside California Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. is a comprehensive agreement that outlines the terms and conditions under which the two organizations collaborate to provide reinsurance services in the Riverside County, California region. This agreement plays a crucial role in managing risk and ensuring the financial stability of both parties involved. Under this agreement, Blue Cross Blue Shield of Missouri acts as the ceding insurer, while Healthy Alliance Life Insurance Co. acts as the reinsurer. The purpose of this reinsurance agreement is to transfer a portion of the insurance risk from Blue Cross Blue Shield of Missouri to Healthy Alliance Life Insurance Co., in exchange for specific premiums. This reinsurance agreement applies to various types of insurance policies offered by Blue Cross Blue Shield of Missouri in the Riverside County area. It encompasses health insurance policies, including individual and group health plans, as well as dental and vision coverage options. Moreover, it may extend to additional insurance offerings, such as life and disability insurance policies. The Riverside California Reinsurance Agreement outlines the specific terms related to the reinsured portfolios, premium calculation methodologies, and the process for claims handling. It also addresses the overall relationship between the two entities, including provisions for data sharing, confidentiality, and compliance with regulatory requirements. Different types of Riverside California Reinsurance Agreements between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. may include proportional reinsurance, non-proportional reinsurance, or facultative reinsurance. Proportional reinsurance entails sharing a specific percentage of the risk and premium with the reinsurer. This type of agreement is commonly used in cases where Blue Cross Blue Shield of Missouri seeks to mitigate a portion of its insurance exposure while maintaining a significant share of the risk and premium. Non-proportional reinsurance, on the other hand, involves the reinsurer covering losses beyond a predetermined threshold. Blue Cross Blue Shield of Missouri retains the remaining portion of the risk and premium. This agreement structure provides financial protection against catastrophic events or unusually high claims. Facultative reinsurance refers to a case-by-case arrangement in which the reinsurer evaluates and decides whether to accept each individual risk presented by Blue Cross Blue Shield of Missouri. This type of agreement provides flexibility for both parties, enabling them to negotiate terms and premiums based on the specific characteristics of each policy. In conclusion, the Riverside California Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. is a crucial collaborative framework that enables risk management and financial stability for both organizations. Its provisions apply to various types of insurance policies offered by Blue Cross Blue Shield of Missouri, and it may involve proportional, non-proportional, or facultative reinsurance, depending on the nature of the risk at hand.

Riverside California Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co.

Description

How to fill out Riverside California Reinsurance Agreement Between Blue Cross Blue Shield Of Missouri And Healthy Alliance Life Insurance Co.?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Riverside Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co., you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Riverside Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Riverside Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co.:

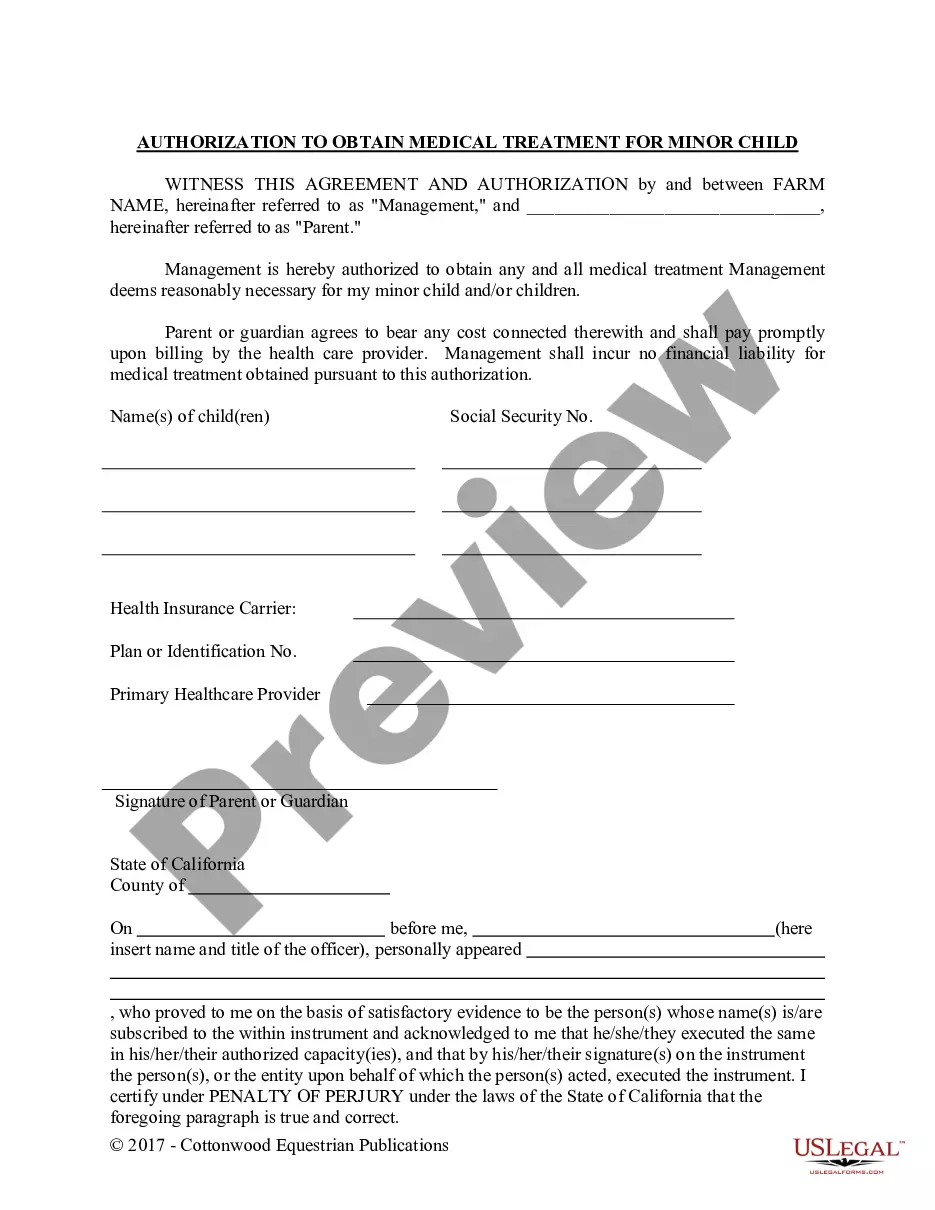

- Analyze the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!