The Maricopa Arizona Voting Trust and Divestiture Agreement is a legally binding contract made between parties involved in a voting trust or divestiture arrangement in Maricopa, Arizona. This agreement outlines the terms and conditions under which the trust or divestiture will operate and govern the transfer of voting rights or assets. The main purpose of a voting trust agreement is to consolidate the voting power of multiple shareholders or stakeholders into a single trustee. This arrangement allows for efficient decision-making and can ensure the preservation of a company's long-term vision. The voting trust agreement specifies the trustee's responsibilities, the composition of the trust, and the duration of the agreement. On the other hand, a divestiture agreement refers to a contractual arrangement where a company sells off or transfers a portion of its assets, business divisions, or subsidiaries to another entity. This agreement aims to streamline operations, raise capital, or comply with regulatory requirements. The divestiture agreement will delineate the assets or business units being divested, the terms of the transfer, and any associated obligations or liabilities. In Maricopa, Arizona, there may be varying types of voting trust and divestiture agreements depending on the specific circumstances and industries involved. For instance, one may come across: 1. Corporate Voting Trust Agreement: This type of agreement is typically employed when a corporation wishes to consolidate voting rights into a trust to enhance decision-making and corporate governance. 2. Real Estate Trust Agreement: In the real estate sector, a voting trust agreement may be used to concentrate voting power among trustees when managing certain properties or developments. 3. Mergers and Acquisitions Divestiture Agreement: This form of agreement arises when a company disposes of assets, business divisions, or subsidiaries as part of a merger or acquisition deal, outlining the terms under which the transfer will occur. 4. Regulatory Divestiture Agreement: When regulatory bodies require companies to divest assets or operations to promote competition and prevent monopolies, a regulatory divestiture agreement is used. Remember, the specific terms and conditions of a Maricopa Arizona Voting Trust and Divestiture Agreement may vary greatly depending on the parties involved, the industry sector, and the objectives behind the trust or divestiture. It is crucial to consult legal professionals familiar with local laws and regulations when drafting or entering into such agreements.

Maricopa Arizona Voting Trust and Divestiture Agreement

Description

How to fill out Maricopa Arizona Voting Trust And Divestiture Agreement?

Whether you plan to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you must prepare certain documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Maricopa Voting Trust and Divestiture Agreement is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few additional steps to get the Maricopa Voting Trust and Divestiture Agreement. Adhere to the guide below:

- Make certain the sample meets your personal needs and state law requirements.

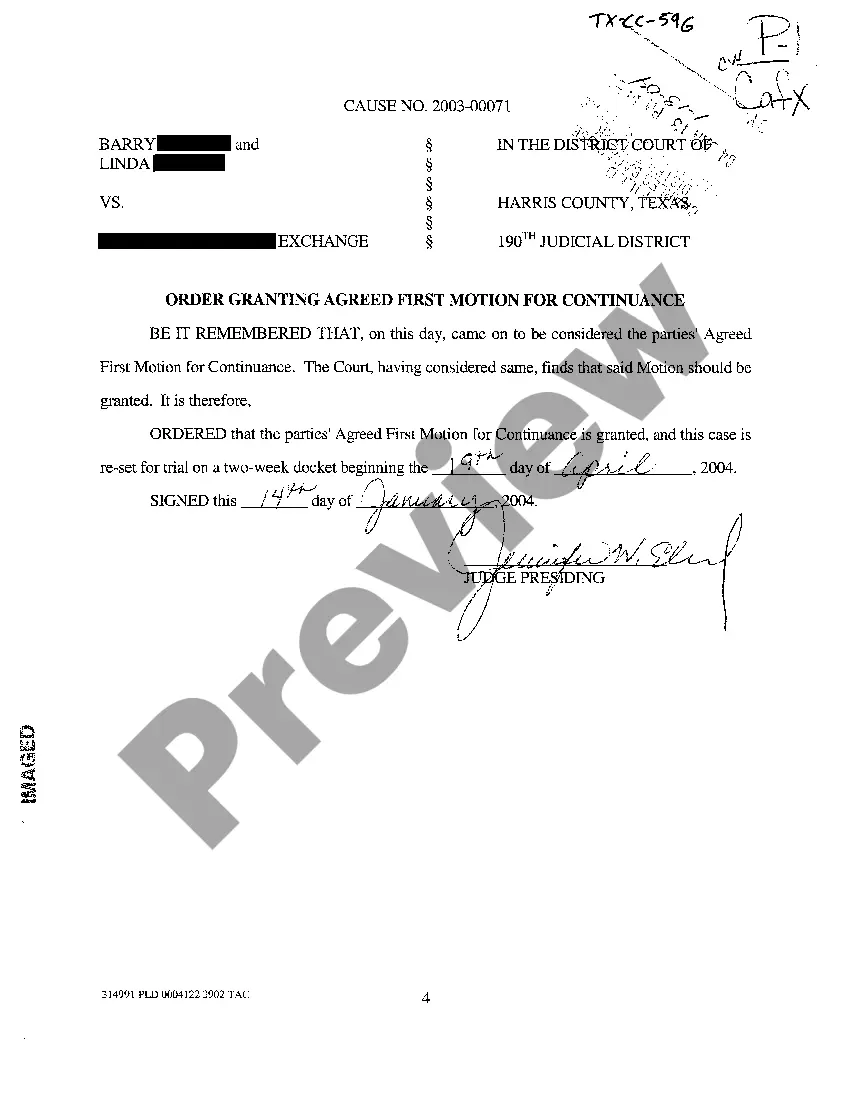

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the sample when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Voting Trust and Divestiture Agreement in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!