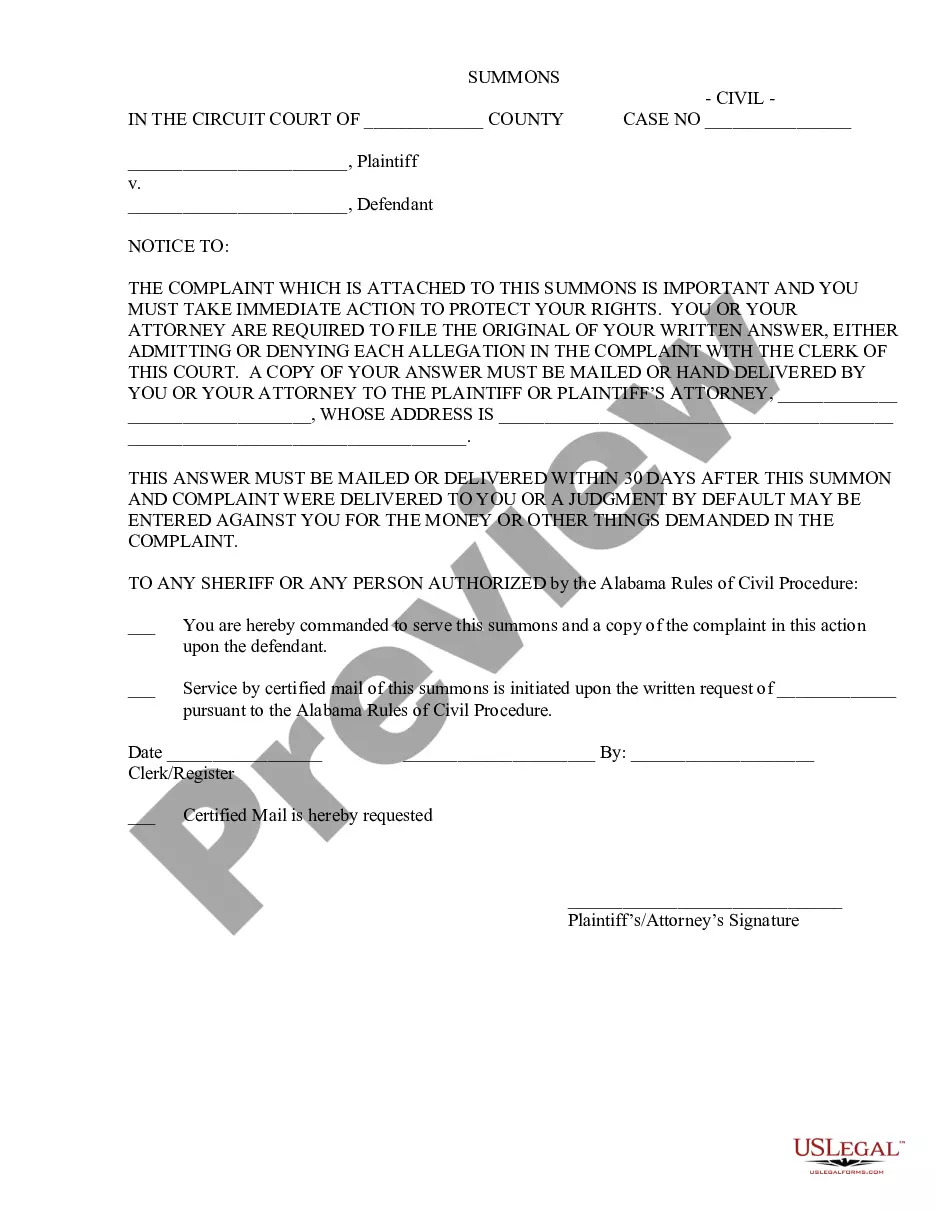

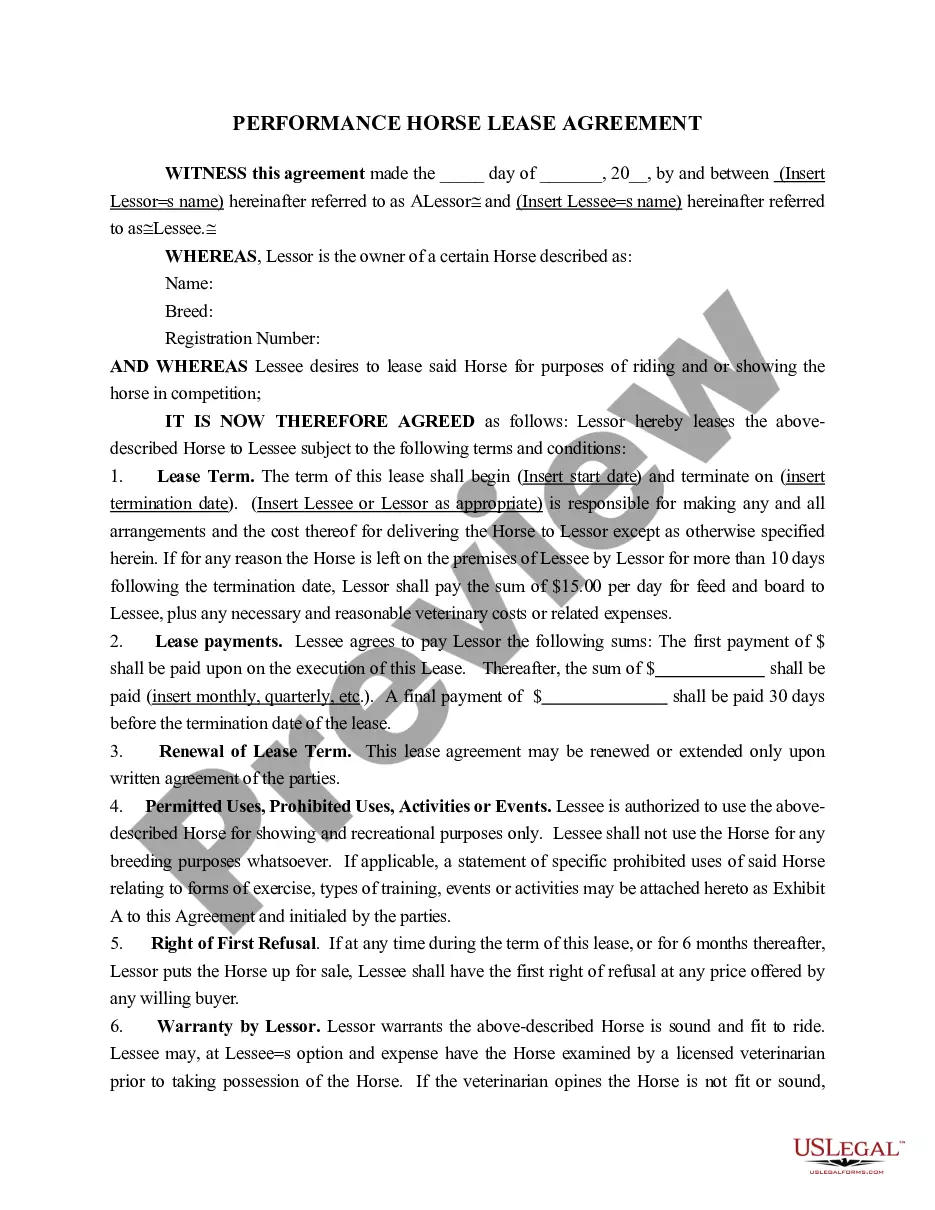

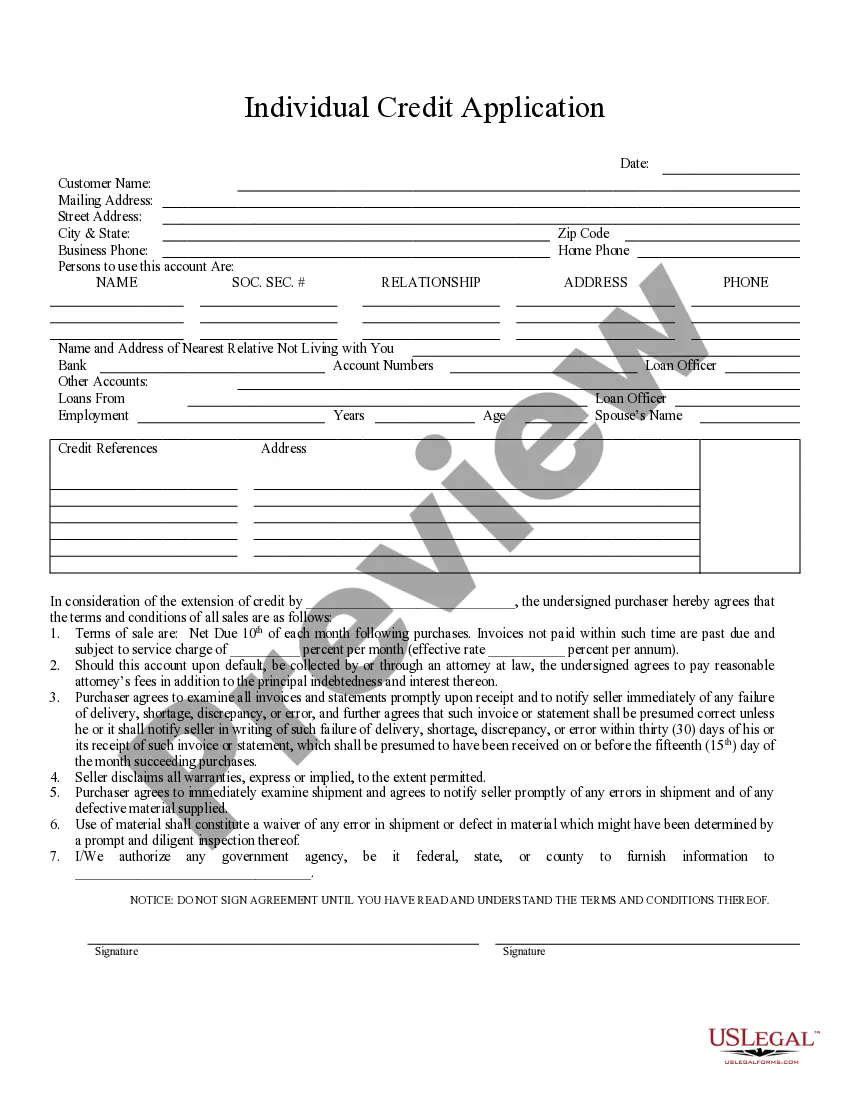

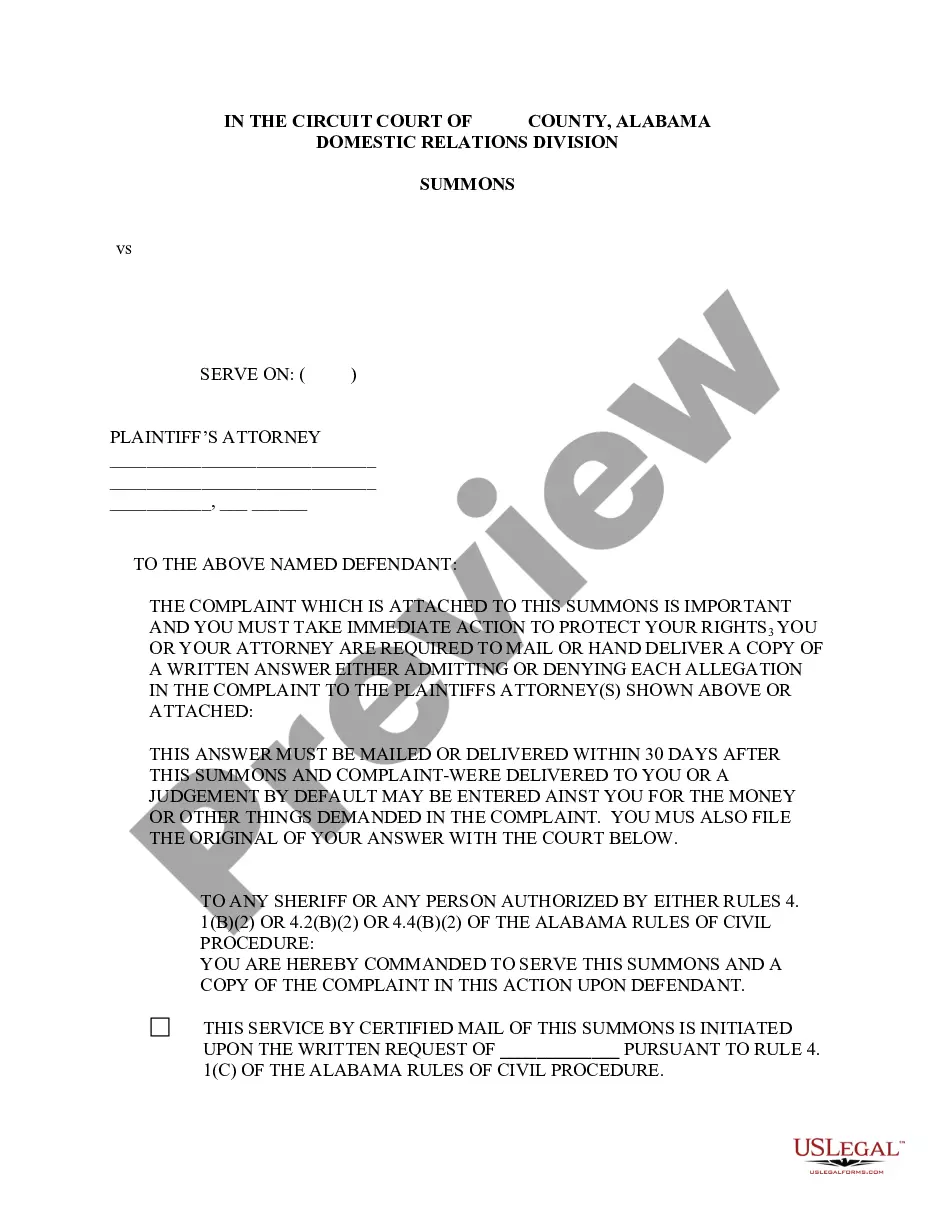

San Diego, California Stock Agreement between Greg Manning Auctions, Inc., et al. A San Diego Stock Agreement refers to a legally binding contract between Greg Manning Auctions, Inc. (GMA) and other parties involved, commonly known as et al., based in San Diego, California. This agreement outlines the terms and conditions regarding the issuance, purchase, and transfer of stocks or shares within the company. It is an essential document that governs the relationship between the participating parties. The agreement typically includes relevant information such as the parties involved, their roles and responsibilities, the purpose of the agreement, and the terms of the stock issuance. It outlines the number of shares to be issued, their class, par value, and the consideration required for their purchase. It may also include details about any restrictions on the transferability of shares, including rights of first refusal, tag-along, or drag-along provisions. Moreover, a San Diego Stock Agreement specifies how dividends or other distributions are to be handled among shareholders. It may outline the voting rights attached to each class of shares and the procedures for conducting shareholder meetings. Additionally, the agreement might include provisions to protect minority shareholders and ensure fair treatment in decision-making processes. There may be various types of Stock Agreements between Greg Manning Auctions, Inc., et al., depending on the specific context or purpose. Some common types include: 1. Founders' Stock Agreement: This type of agreement is specifically tailored for founding members of a company, defining the issuance and ownership of initial shares and the conditions under which they may be purchased or transferred. 2. Employee Stock Option Agreement: This agreement pertains to the stock options granted to employees, allowing them to purchase company stocks at a predetermined price within a specified period. It outlines the terms and conditions related to exercising the options and any restrictions on transferring or selling the acquired shares. 3. Share Purchase Agreement: Typically used when a party intends to purchase existing shares from another shareholder or group of shareholders. It outlines the terms of the purchase, including the purchase price, payment terms, and representations and warranties made by the selling shareholders. In conclusion, a San Diego Stock Agreement between Greg Manning Auctions, Inc., et al. is a legally binding contract that governs the issuance, purchase, and transfer of stocks within the company. It outlines the rights and obligations of the parties involved, ensuring transparency and clarity in the ownership and management of shares.

San Diego California Stock Agreement between Greg Manning Auctions, Inc., et al

Description

How to fill out San Diego California Stock Agreement Between Greg Manning Auctions, Inc., Et Al?

How much time does it typically take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, locating a San Diego Stock Agreement between Greg Manning Auctions, Inc., et al suiting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Aside from the San Diego Stock Agreement between Greg Manning Auctions, Inc., et al, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Specialists verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your San Diego Stock Agreement between Greg Manning Auctions, Inc., et al:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Diego Stock Agreement between Greg Manning Auctions, Inc., et al.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!