Contra Costa California Underwriting Agreement is a legal document that establishes the terms and conditions for the issuance and sale of shares of common stock between Tel axis Communications Corp. and Credit Suisse First Boston Corp., a prominent investment banking firm. This agreement outlines the roles, responsibilities, and obligations of both parties involved in the underwriting process. It serves to protect the interests of both Tel axis Communications Corp. and Credit Suisse First Boston Corp. The Contra Costa California Underwriting Agreement includes key provisions such as the number of shares to be issued and their pricing, the underwriters' commitment to purchase the shares, the underwriting fee, the timeline for the sale and issuance, and any potential conditions or representations made by Tel axis Communications Corp. This type of agreement is crucial for Tel axis Communications Corp. as it allows the company to raise capital by offering its common stock to the public. Credit Suisse First Boston Corp., acting as the underwriter, plays a vital role in facilitating the issuance and sale of the shares by purchasing them from Tel axis Communications Corp. and reselling them to investors. Different types of Contra Costa California Underwriting Agreements may exist based on various factors such as the size of the offering, whether it is a firm commitment or the best efforts' agreement, and the overall market conditions. Some commonly used types include: 1. Firm Commitment Underwriting Agreement: This is the most typical type of underwriting agreement where the underwriter commits to purchasing the entire offering of shares from Tel axis Communications Corp., even if it means absorbing any unsold shares. 2. The Best Efforts Underwriting Agreement: In this type of agreement, the underwriter does not guarantee the sale of all the shares offered by Tel axis Communications Corp. Instead, they make their best efforts to sell as many shares as possible, but any unsold shares remain with Tel axis Communications Corp. 3. Standby Underwriting Agreement: This type of agreement is often used in rights offerings. The underwriter commits to purchasing any shares not subscribed to by existing shareholders during the subscription period. It is important for both Tel axis Communications Corp. and Credit Suisse First Boston Corp. to negotiate the terms of the Contra Costa California Underwriting Agreement carefully, taking into consideration market conditions, investor demand, and regulatory requirements. This agreement provides legal protection and ensures a smooth and transparent process for the issuance and sale of Tel axis Communications Corp.'s common stock.

Contra Costa California Underwriting Agreement between Telaxis Communications Corp. and Credit Suisse First Boston Corp. regarding issuance and sale of shares of common stock

Description

How to fill out Contra Costa California Underwriting Agreement Between Telaxis Communications Corp. And Credit Suisse First Boston Corp. Regarding Issuance And Sale Of Shares Of Common Stock?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Contra Costa Underwriting Agreement between Telaxis Communications Corp. and Credit Suisse First Boston Corp. regarding issuance and sale of shares of common stock, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different categories ranging from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find information materials and guides on the website to make any activities related to document execution straightforward.

Here's how to purchase and download Contra Costa Underwriting Agreement between Telaxis Communications Corp. and Credit Suisse First Boston Corp. regarding issuance and sale of shares of common stock.

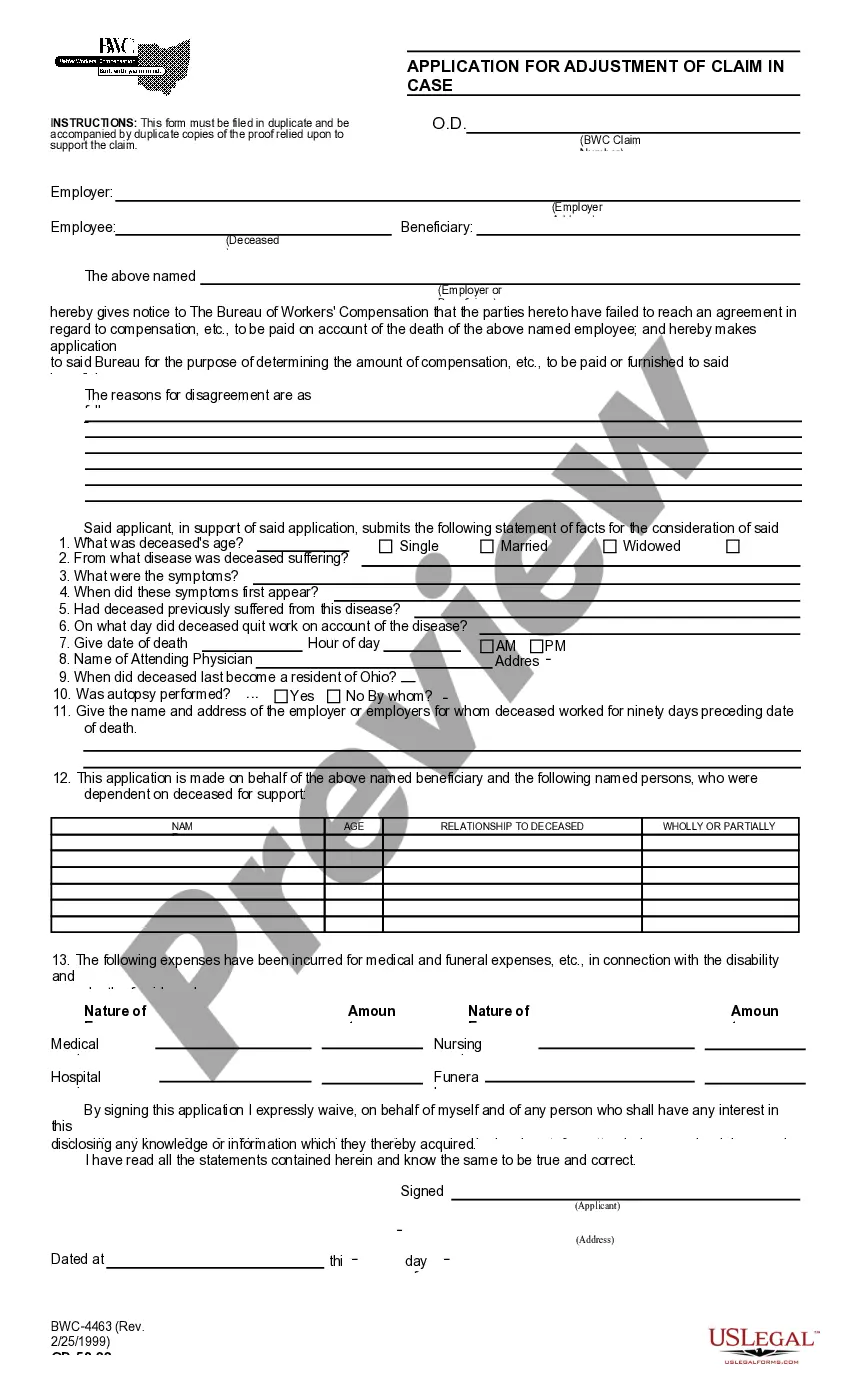

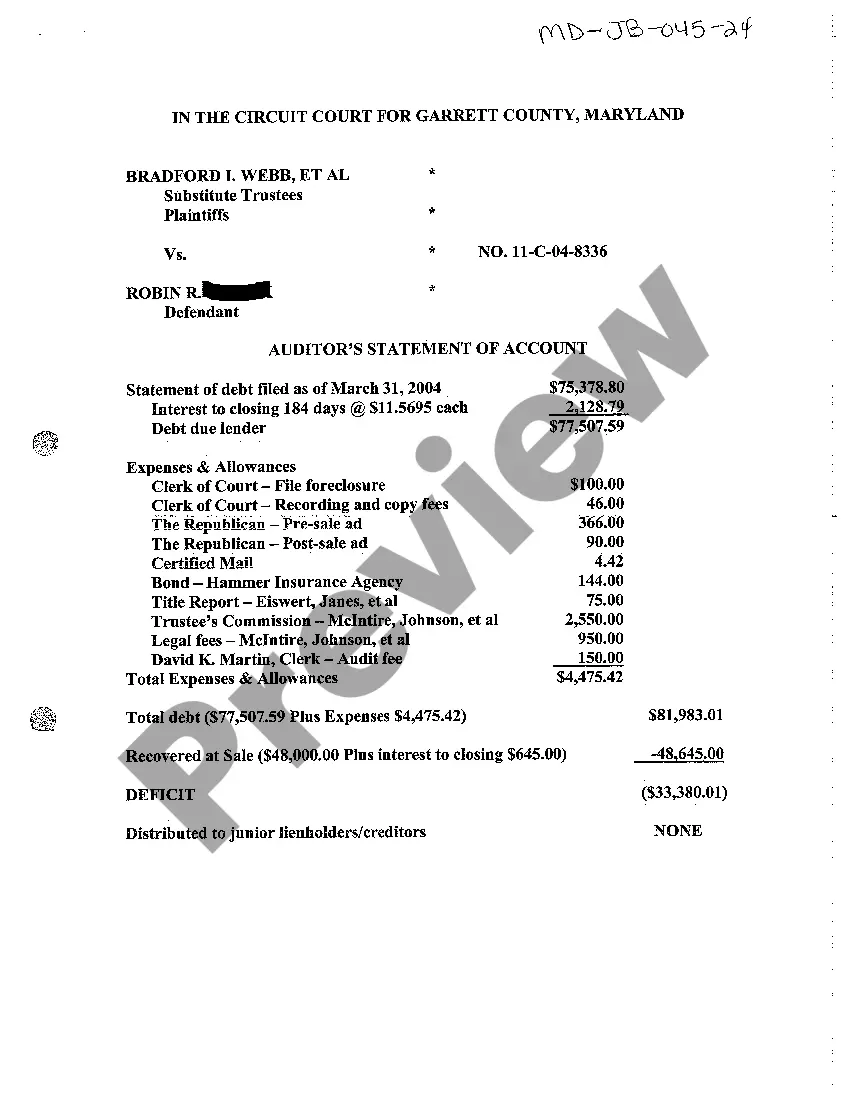

- Take a look at the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can impact the legality of some documents.

- Examine the related document templates or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and purchase Contra Costa Underwriting Agreement between Telaxis Communications Corp. and Credit Suisse First Boston Corp. regarding issuance and sale of shares of common stock.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Contra Costa Underwriting Agreement between Telaxis Communications Corp. and Credit Suisse First Boston Corp. regarding issuance and sale of shares of common stock, log in to your account, and download it. Of course, our website can’t take the place of an attorney completely. If you need to cope with an exceptionally complicated case, we advise using the services of a lawyer to examine your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and get your state-compliant documents effortlessly!