Franklin Ohio Underwriting Agreement between Telaxis Communications Corp. and Credit Suisse First Boston Corp. regarding issuance and sale of shares of common stock

Description

How to fill out Franklin Ohio Underwriting Agreement Between Telaxis Communications Corp. And Credit Suisse First Boston Corp. Regarding Issuance And Sale Of Shares Of Common Stock?

Preparing documents for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to draft Franklin Underwriting Agreement between Telaxis Communications Corp. and Credit Suisse First Boston Corp. regarding issuance and sale of shares of common stock without professional assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Franklin Underwriting Agreement between Telaxis Communications Corp. and Credit Suisse First Boston Corp. regarding issuance and sale of shares of common stock by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Franklin Underwriting Agreement between Telaxis Communications Corp. and Credit Suisse First Boston Corp. regarding issuance and sale of shares of common stock:

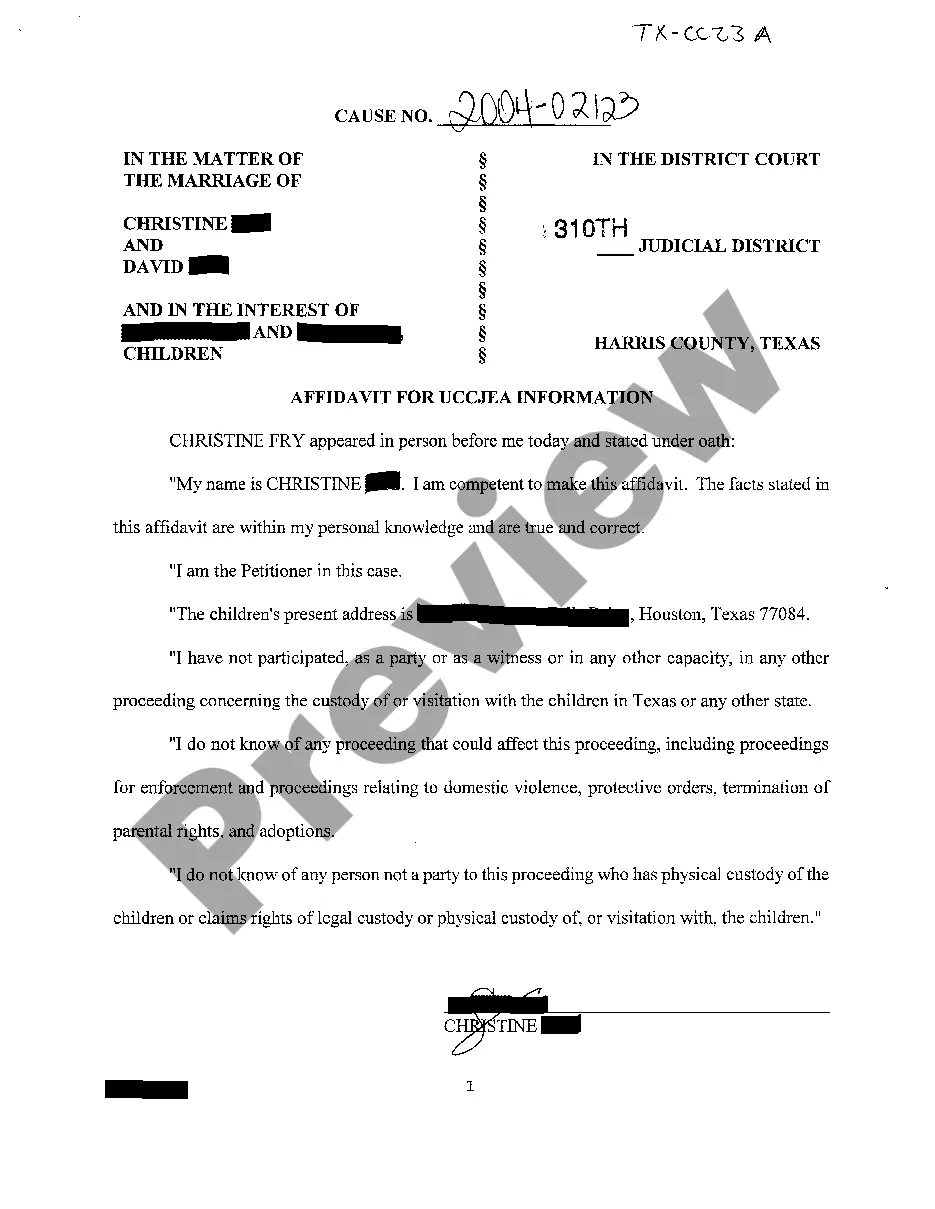

- Examine the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To find the one that fits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any use case with just a few clicks!

Form popularity

FAQ

An underwriter is any party that evaluates and assumes another party's risk for a fee, which often takes the form of a commission, premium, spread, or interest. Agents and brokers represent both consumers and insurance companies, while underwriters work for insurance companies.

The underwriting agreement contains an agreement by the underwriter(s) to purchase the offered securities from the issuer or other seller and to resell them to the public, the underwriting discount, representations and warranties of the parties, certain covenants, expense allocation and indemnification provisions.

An underwriter is any party that evaluates and assumes another party's risk for a fee, which often takes the form of a commission, premium, spread, or interest. Agents and brokers represent both consumers and insurance companies, while underwriters work for insurance companies.

An underwriting agreement takes place between a syndicate of investment bankers who form an underwriting group and the issuing corporation of a new securities issue. The agreement ensures everyone involved understands their responsibility in the process.

However, as per Rule 3 of the SEBI Rules, 1993 no person can act as underwriter unless he holds a certificate granted by the SEBI under the Securities and Exchange Board of India (Underwriters) Regulations, 1993.

Ans: Company enters into an underwriting agreement with the underwriters.

Company enters into an underwriting agreement with the shareholders.

Which of the following clearly define the Syndicate Underwriting? It is underwriting in which, two or more agencies or underwriters jointly underwrite an issue of. It is one in which an underwriter gets a part of the issue further underwritten by another agency.

The underwriting agreement contains the details of the transaction, including the underwriting group's commitment to purchase the new securities issue, the agreed-upon price, the initial resale price, and the settlement date. A best-efforts underwriting agreement is mainly used in the sales of high-risk securities.

(c) Yes. The company can enter into an Underwriting Agreement with underwriters by paying them a commission.