Contra Costa, California, is a county located in the San Francisco Bay Area with a population of over a million residents. Contra Costa serves as a vibrant business hub, offering various investment opportunities, including mutual funds and trusts. One notable example is the Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II. This agreement outlines the terms and conditions associated with the distribution of Class C shares offered by the Putnam Mutual Funds Corp. These shares are part of the Putnam High Yield Trust II, which provides investors with an opportunity to invest in a diversified portfolio of high-yield bonds. The Contra Costa California Class C Distribution Plan and Agreement aim to establish guidelines for the mutual funds' operations, investor eligibility, distribution fees, and overall fund management. The agreement delineates the responsibilities of Putnam Mutual Funds Corp as the fund's manager and the obligations of the investors. The Class C Distribution Plan offers investors the option to pay a sales commission upon purchasing or redeeming shares. These commissions help cover expenses associated with marketing and distributing the mutual fund. By choosing the Class C shares, investors may enjoy the flexibility of shorter holding periods without any front-end sales charges. Under this agreement, Putnam High Yield Trust II seeks to maximize returns for investors while effectively managing risks associated with high-yield bonds. The fund aims to provide regular income by investing in bonds issued by corporations, government entities, and other issuers that demonstrate potential for higher yields. It is important to note that while the Contra Costa California Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II serve as a specific example, there may be variations in such plans and agreements offered by other financial institutions. These variations may cater to different investor needs, offering various fee structures, redemption options, and investment strategies. In conclusion, the Contra Costa California Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II present an investment opportunity for individuals seeking to invest in high-yield bonds. This agreement outlines the terms and conditions associated with investing in Class C shares, providing investors with flexibility and potential returns while adhering to the fund's overall objectives.

Contra Costa California Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II

Description

How to fill out Contra Costa California Class C Distribution Plan And Agreement Between Putnam Mutual Funds Corp And Putnam High Yield Trust II?

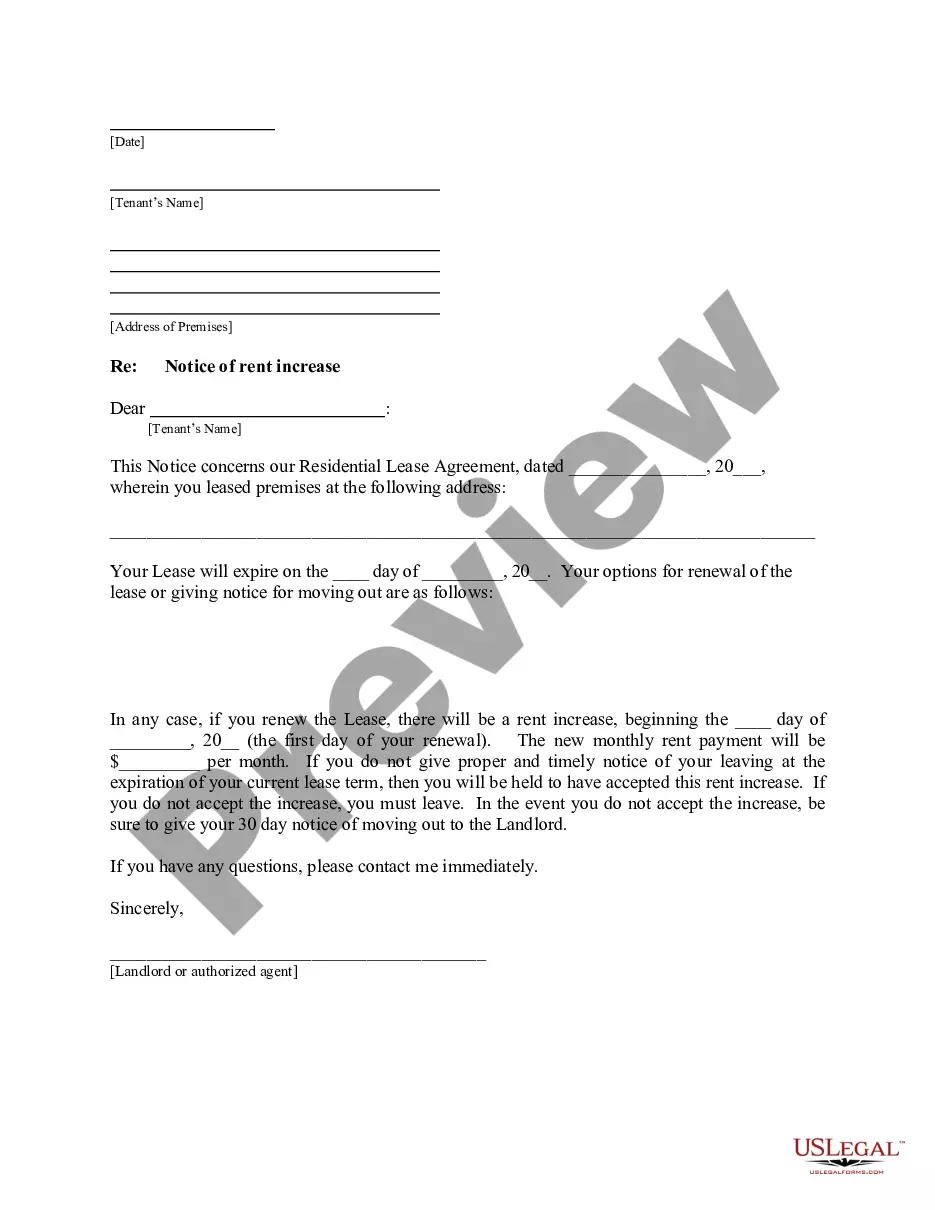

Do you need to quickly create a legally-binding Contra Costa Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II or probably any other form to handle your own or business affairs? You can go with two options: contact a professional to write a valid document for you or create it entirely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive professionally written legal documents without having to pay sky-high fees for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-compliant form templates, including Contra Costa Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed template without extra troubles.

- First and foremost, double-check if the Contra Costa Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II is tailored to your state's or county's laws.

- If the form has a desciption, make sure to verify what it's intended for.

- Start the searching process over if the document isn’t what you were looking for by using the search box in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Contra Costa Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the templates we provide are updated by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!