Cook Illinois Class C Distribution Plan and Agreement is a legal document that outlines the terms and conditions between Putnam Mutual Funds Corp and Putnam High Yield Trust II for the distribution of Class C shares of Cook Illinois. This plan and agreement enable investors to understand the process, fees, and responsibilities associated with investing in Cook Illinois Class C shares. The Cook Illinois Class C Distribution Plan and Agreement ensure transparency and provide clarity regarding the distribution of Class C shares. It serves as a guideline for both Putnam Mutual Funds Corp and Putnam High Yield Trust II to follow while executing the distribution process. Key aspects covered in this agreement include the initial purchase of Class C shares, subsequent purchases, redemption or sale of shares, fees and expenses associated with the distribution, and any other terms and conditions relevant to Cook Illinois Class C shares. Some different types of Cook Illinois Class C Distribution Plan and Agreements between Putnam Mutual Funds Corp and Putnam High Yield Trust II may include variations in fees, expenses, or structures. For example, there might be a specific plan for retail investors, another plan for institutional investors, and a third plan catering to retirement accounts or pension funds. Investors should carefully review the Cook Illinois Class C Distribution Plan and Agreement to gain a detailed understanding of the investment terms, such as load charges, redemption fees, short-term trading fees, and ongoing expense ratios. By encompassing all essential aspects, this agreement ensures compliance with regulatory standards and protects the interests of both parties involved. In conclusion, the Cook Illinois Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II describes the framework for the distribution of Class C shares and establishes the rights and responsibilities of all parties involved. It is crucial for investors to thoroughly review the agreement to make informed investment decisions and to comply with the requirements laid out in the plan.

Cook Illinois Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II

Description

How to fill out Cook Illinois Class C Distribution Plan And Agreement Between Putnam Mutual Funds Corp And Putnam High Yield Trust II?

Dealing with legal forms is a must in today's world. However, you don't always need to seek professional help to create some of them from the ground up, including Cook Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various types varying from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching experience less challenging. You can also find detailed resources and tutorials on the website to make any tasks associated with paperwork completion straightforward.

Here's how you can purchase and download Cook Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II.

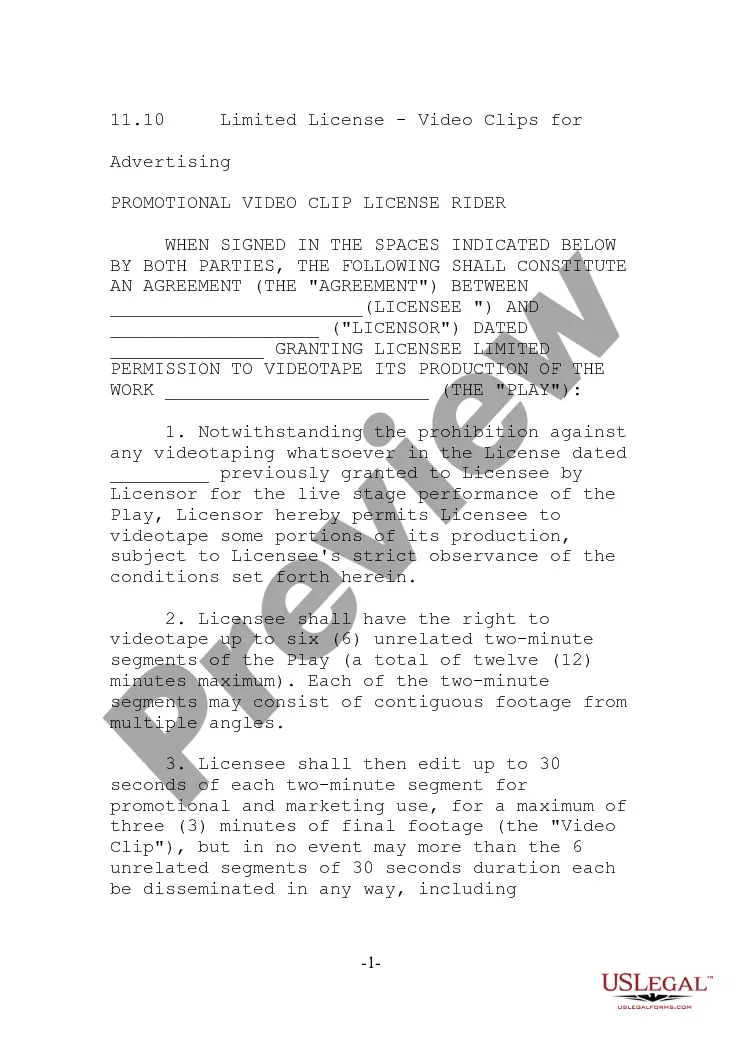

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can affect the validity of some documents.

- Examine the related document templates or start the search over to locate the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Cook Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Cook Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you need to deal with an extremely difficult case, we recommend getting an attorney to review your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-compliant documents effortlessly!