Dallas, Texas Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II The Dallas, Texas Class C Distribution Plan and Agreement are integral components of the collaboration between Putnam Mutual Funds Corp and Putnam High Yield Trust II. These documents outline the distribution strategy and objectives of their mutual funds in the Dallas, Texas market. The Class C Distribution Plan encompasses a set of guidelines and procedures devised to ensure effective distribution of the mutual funds in Dallas, Texas. It focuses on enhancing accessibility and increasing market penetration for the mutual fund products offered by Putnam Mutual Funds Corp and Putnam High Yield Trust II. The plan takes into account various factors such as investor demographics, market trends, competitive analysis, and regulatory guidelines to develop a comprehensive, tailored distribution strategy. The agreement acts as a legally binding contract between Putnam Mutual Funds Corp and Putnam High Yield Trust II, establishing the terms and conditions of their collaboration and the ongoing responsibilities of each party. It outlines the roles and obligations of both entities, ensuring a smooth functioning of the distribution plan in Dallas, Texas. Additionally, it addresses key aspects such as compensation, termination provisions, intellectual property rights, and confidentiality. Variations of the Dallas, Texas Class C Distribution Plan and Agreement may exist based on specific considerations, market conditions, or fund types. These variations could include subcategories such as Class C Distribution Plan for Equity Funds, Class C Distribution Plan for Fixed Income Funds, Class C Distribution Plan for Balanced Funds, or Class C Distribution Plan for Specialty Funds. Each type may have its unique objectives, strategies, and implementation approaches within the Dallas, Texas market. In summary, the Dallas, Texas Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II serve as fundamental frameworks for effective mutual fund distribution in Dallas, Texas. They combine strategic planning, regulatory compliance, and contractual obligations to achieve success in reaching investors and optimizing market share.

Dallas Texas Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II

Description

How to fill out Dallas Texas Class C Distribution Plan And Agreement Between Putnam Mutual Funds Corp And Putnam High Yield Trust II?

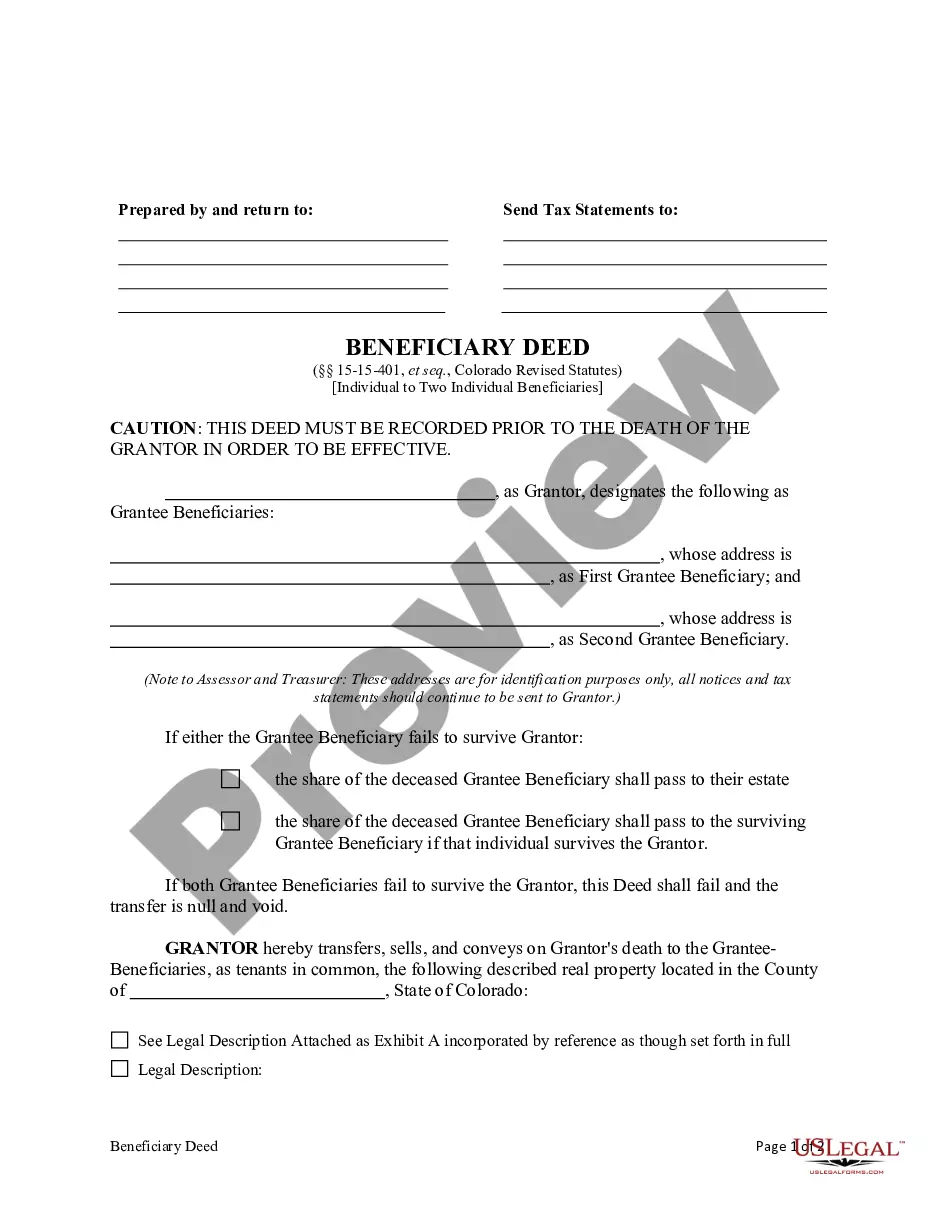

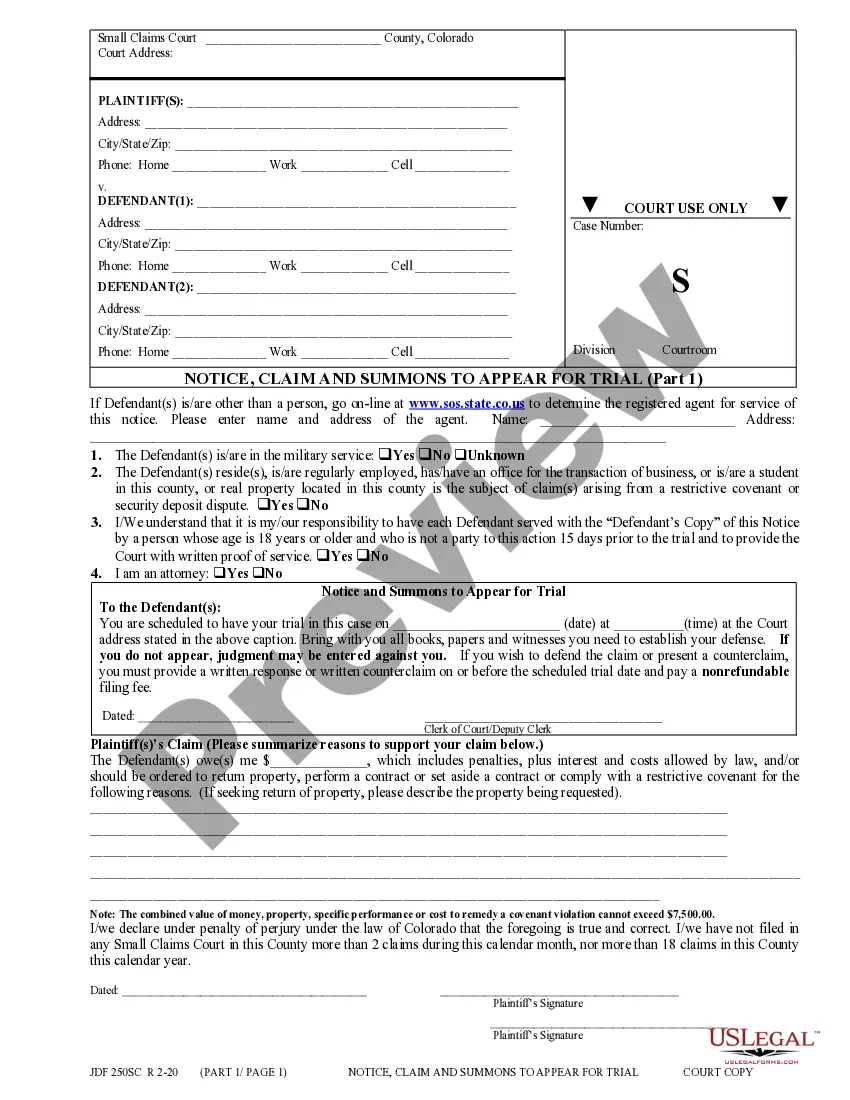

Do you need to quickly create a legally-binding Dallas Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II or maybe any other form to take control of your own or corporate matters? You can go with two options: contact a professional to write a valid document for you or create it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you receive professionally written legal paperwork without paying unreasonable prices for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-compliant form templates, including Dallas Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- To start with, carefully verify if the Dallas Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II is adapted to your state's or county's laws.

- In case the form has a desciption, make sure to verify what it's suitable for.

- Start the search over if the template isn’t what you were looking for by utilizing the search bar in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Dallas Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. In addition, the templates we provide are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!