Salt Lake Utah Class C Distribution Plan and Agreement is a contractual arrangement between Putnam Mutual Funds Corp and Putnam High Yield Trust II, outlining the distribution framework for the Class C shares of the mutual funds. This agreement is crucial in determining the sales, distribution channels, compensation, and other related aspects for the distribution of these investment products. The Salt Lake Utah Class C Distribution Plan and Agreement reflect Putnam Mutual Funds Corp's commitment to expanding the availability of Class C shares for investors in the Salt Lake Utah region. This distribution plan allows individual and institutional investors to access a specific class of shares that offer distinct features compared to other share classes, such as Class A and Class B shares. The agreement provides a comprehensive framework for the distribution of Salt Lake Utah Class C shares, including the identification of authorized distribution partners, sales practices, charges, fees, and commissions associated with the sale of these shares. It also outlines the specific terms and conditions under which Putnam Mutual Funds Corp and Putnam High Yield Trust II will cooperate to facilitate the distribution process. The Salt Lake Utah Class C Distribution Plan and Agreement may include provisions related to marketing efforts, training and education materials for distribution partners, compliance requirements, reporting obligations, and ongoing communication channels to ensure transparency and efficiency throughout the distribution process. Furthermore, it is important to note that there may be different types or variations of the Salt Lake Utah Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II. While the specific names of these variations might not be explicitly mentioned, they could include customized agreements tailored to the needs of specific distribution partners or individual investors in Salt Lake Utah. Overall, the Salt Lake Utah Class C Distribution Plan and Agreement represents a vital document that governs the distribution of Class C shares of mutual funds in the region. It ensures that investors have access to a specific class of shares and that the distribution process adheres to regulatory standards and aligns with the objectives of both Putnam Mutual Funds Corp and Putnam High Yield Trust II.

Salt Lake Utah Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II

Description

How to fill out Salt Lake Utah Class C Distribution Plan And Agreement Between Putnam Mutual Funds Corp And Putnam High Yield Trust II?

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Salt Lake Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Salt Lake Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Salt Lake Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II:

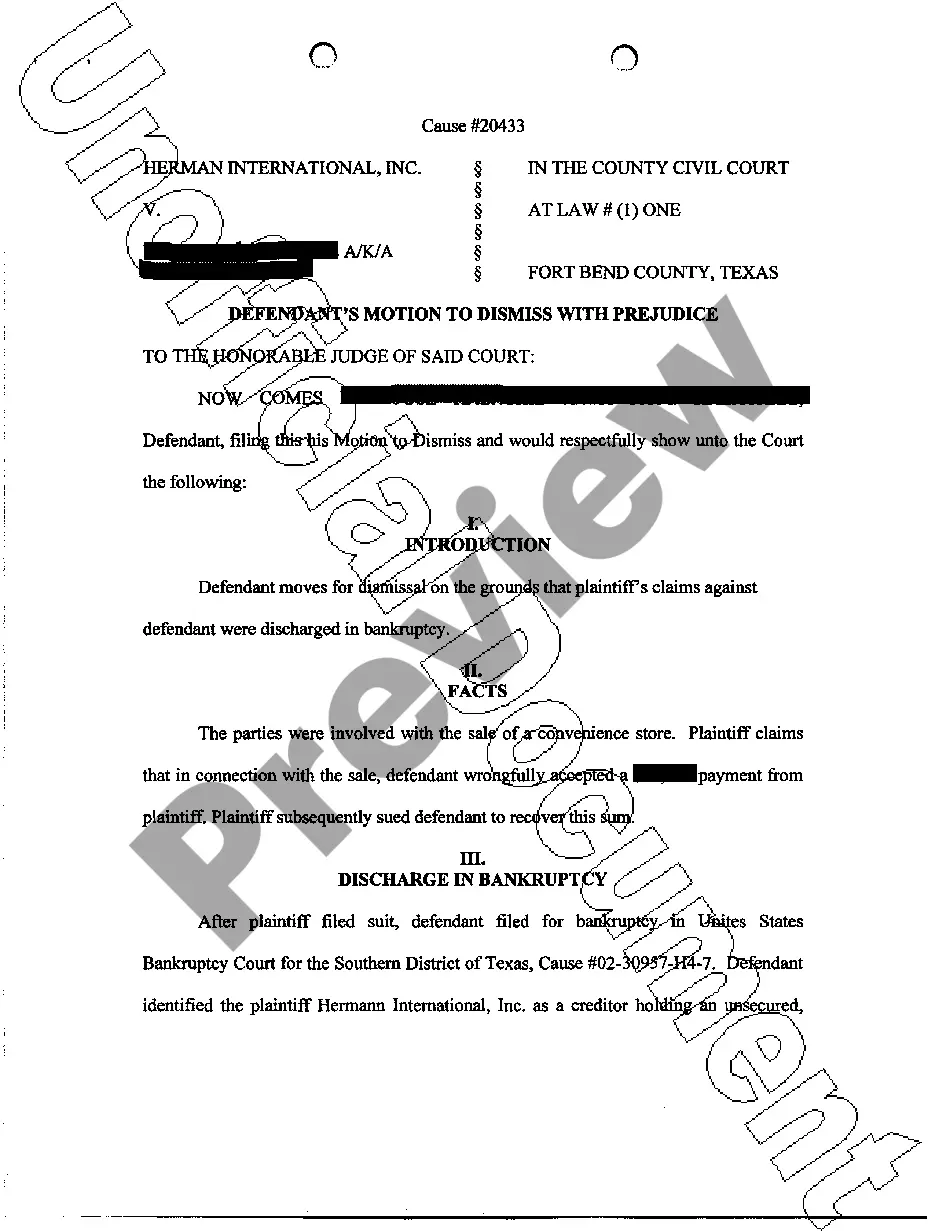

- Examine the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Putnam Investments managed assets worth $188 billion as of the end of November 2020, with $91 billion allocated to more than 100 mutual funds. The company operates in North America, Europe and Asia through offices in Boston, London, Sydney, Frankfurt, Singapore and Tokyo.

Putnam Investments today announced that it is being acquired by Great-West Lifeco Inc., a subsidiary of Power Financial Corp. in Montreal, for $3.9 billion.

Putnam Investment has more than 100 mutual funds and 60 institutional strategies across a range of asset classes and investment styles.

Putnam Investments today announced that it is being acquired by Great-West Lifeco Inc., a subsidiary of Power Financial Corp. in Montreal, for $3.9 billion.

It is currently owned by the Power Financial Corporation.

Putnam is a subsidiary of Great-West Lifeco Inc. and a member of the Power Financial Corporation group of companies.

It is a subsidiary of Great-West Lifeco and as of June 2017 managed $183 billion in assets across 80 mutual funds, 100 institutional clients, and 5 million shareholders and participants. It is currently owned by the Power Financial Corporation.

Under the terms of the Agreement and Plan of Reorganization, the assets and liabilities of Growth and Income Fund will be transferred to Equity Income Fund in return for shares of Equity Income Fund (the Merger Shares) with equal total net asset value as of the valuation date.