Tarrant Texas Class C Distribution Plan and Agreement The Tarrant Texas Class C Distribution Plan and Agreement is a legal document that outlines the terms and conditions of the distribution plan for Putnam Mutual Funds Corp and Putnam High Yield Trust II in the Tarrant Texas region. This plan is specifically designed for Class C shares, which are a type of mutual fund shares that typically carry a level load, or a sales charge, that is deducted annually. The agreement defines the roles and responsibilities of both Putnam Mutual Funds Corp and Putnam High Yield Trust II in distributing Class C shares in Tarrant Texas. It ensures transparency and clarity in the distribution process, protecting the interests of both the fund company and the investors. Under this distribution plan and agreement, Putnam Mutual Funds Corp and Putnam High Yield Trust II commit to offering Class C shares to investors in Tarrant Texas and ensuring they receive accurate and up-to-date information about the fund. The agreement also outlines the marketing and promotional activities that will be undertaken to promote the Class C shares to potential investors in the region. One possible variant of the Tarrant Texas Class C Distribution Plan and Agreement could be a "Fixed-Load Class C Distribution Plan." This plan would specify a fixed sales charge, which remains the same throughout the investor's holding period. Another possible variant could be a "Deferred-Load Class C Distribution Plan." In this plan, the sales charge is deferred until the investor sells the shares, subject to a contingent deferred sales charge (CDs) schedule. It is important to note that the terms and specifics of these variants may differ, and investors should carefully review the details of each plan before making any investment decisions. In summary, the Tarrant Texas Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II is a comprehensive document that governs the distribution of Class C shares in the Tarrant Texas region. It ensures that both the fund company and investors are protected, and serves as a valuable resource for understanding the terms and conditions of investing in these mutual funds.

Tarrant Texas Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II

Description

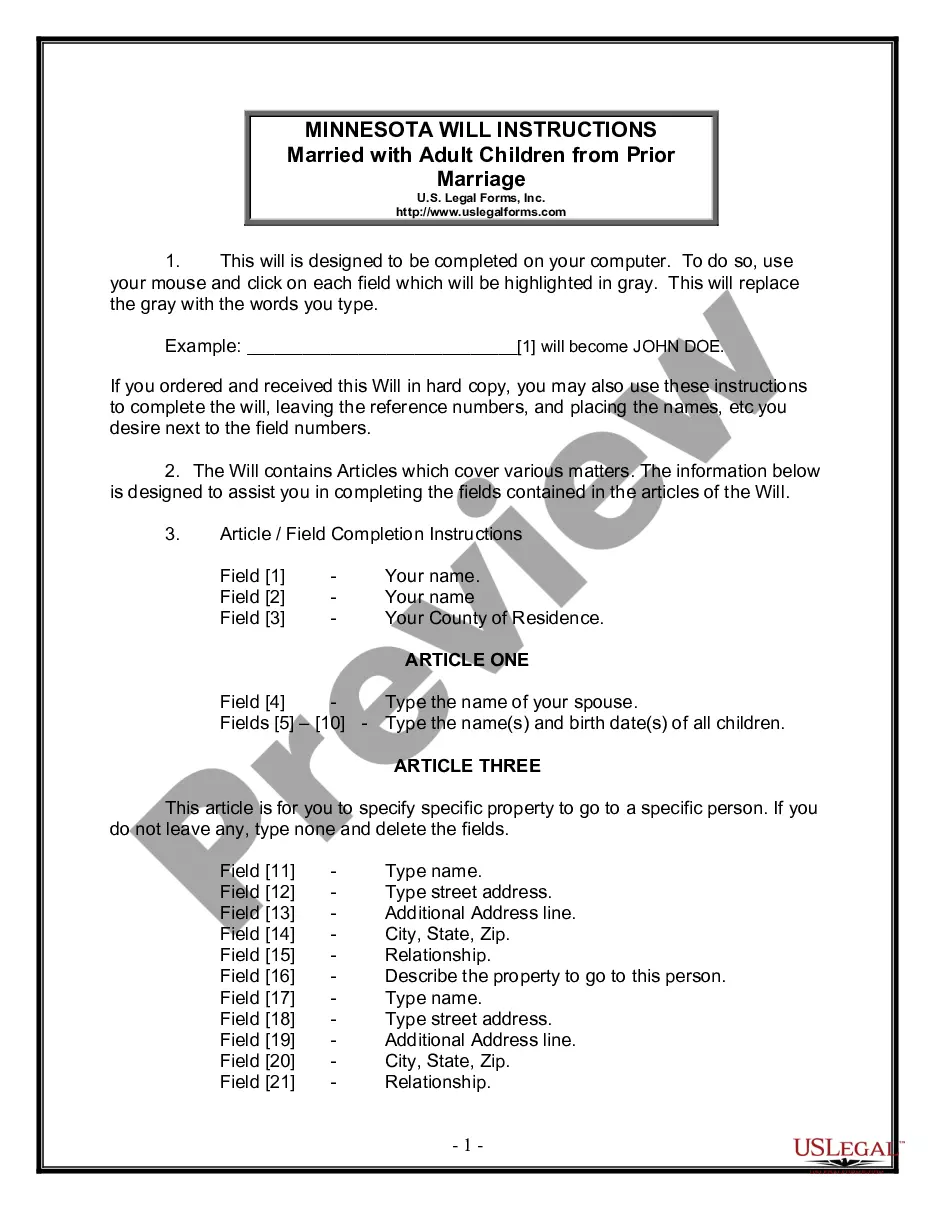

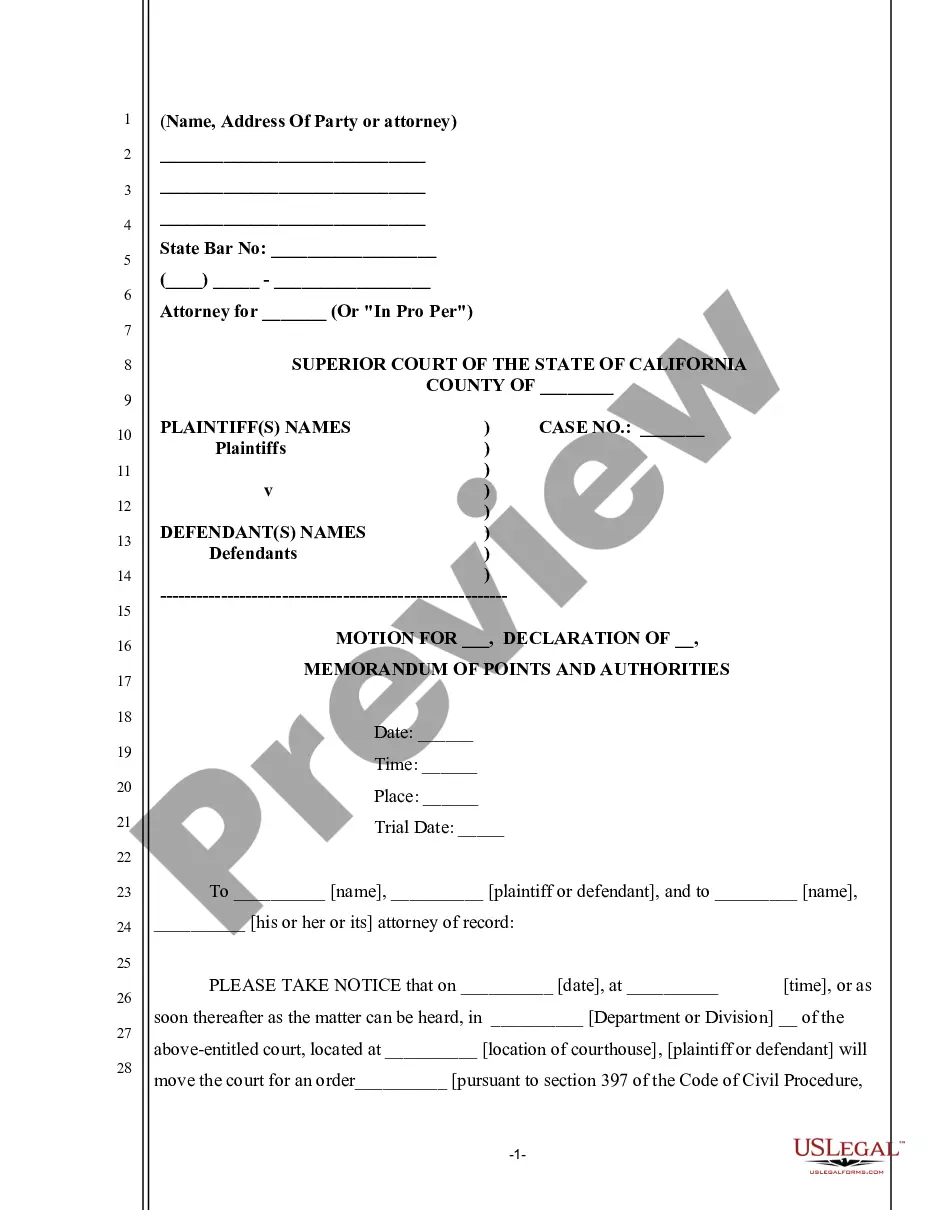

How to fill out Tarrant Texas Class C Distribution Plan And Agreement Between Putnam Mutual Funds Corp And Putnam High Yield Trust II?

Drafting documents for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to generate Tarrant Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II without professional help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Tarrant Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Tarrant Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II:

- Examine the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any scenario with just a few clicks!

Form popularity

FAQ

Overall, Putnam Investments is one of the top mutual fund companies in the world.

Putnam Investments today announced that it is being acquired by Great-West Lifeco Inc., a subsidiary of Power Financial Corp. in Montreal, for $3.9 billion.

23 Putnam funds have earned 4- or 5-star Overall Morningstar Ratings2122 as of 5/31/22.

Why are mutual funds the only investment option Dave recommends? Well, Dave likes mutual funds because they spread your investment across many companies, and that helps you avoid the risks that come with investing in single stocks and other trendy investments (we're looking at you, Dogecoin).

It is now one of the most-renowned financial investment companies in the world. Putnam had assets worth $192 billion under its management as of the end of March 2022, of which mutual fund assets comprised $92 billion and institutional assets of $100 billion.

Putnam Investments managed assets worth $188 billion as of the end of November 2020, with $91 billion allocated to more than 100 mutual funds. The company operates in North America, Europe and Asia through offices in Boston, London, Sydney, Frankfurt, Singapore and Tokyo.

It is a subsidiary of Great-West Lifeco and as of June 2017 managed $183 billion in assets across 80 mutual funds, 100 institutional clients, and 5 million shareholders and participants. It is currently owned by the Power Financial Corporation.

It is currently owned by the Power Financial Corporation.