The Nassau New York Agreement and Irrevocable Proxy is a legal agreement that outlines the terms and conditions for the transfer of shares or voting rights in a company. It serves as a tool to ensure the smooth transition of ownership and decision-making power. In this agreement, the term "Nassau New York" refers to the specific jurisdiction where the agreement is being made. It signifies that the laws and regulations of Nassau County, New York, will govern the agreement. An Irrevocable Proxy is a key component of this agreement, which grants the proxy holder the authority to vote on behalf of the share owner. Unlike a regular proxy, an irrevocable proxy is not subject to revocation, meaning it cannot be canceled or terminated by the share owner once granted. This proxy is typically used in situations where a party wants to ensure a specific outcome, maintain control, or protect their interests even if circumstances change. Different types of Nassau New York Agreement and Irrevocable Proxy may include: 1. Share Purchase Agreement with Irrevocable Proxy: This type of agreement combines the purchase of shares with the granting of an irrevocable proxy. It allows the purchaser to acquire shares and secure the necessary voting rights to make important decisions for the company. 2. Shareholder Voting Agreement with Irrevocable Proxy: This agreement is entered into by multiple shareholders to establish shared decision-making and control. The irrevocable proxy grants a designated party the right to vote on behalf of the shareholders, ensuring that the agreed-upon actions are taken. 3. Irrevocable Proxy for Corporate Takeovers: In the context of a hostile takeover attempt, some shareholders might grant an irrevocable proxy to a party or group to ensure the desired outcome, such as blocking the takeover or approving a specific acquisition proposal. This type of agreement can be critical in corporate governance battles. 4. Share Restriction Agreement with Irrevocable Proxy: Share restriction agreements may impose certain restrictions on shares, such as transferability or voting rights. By combining an irrevocable proxy with such an agreement, a party can maintain control or regulate decisions even if shareholders try to circumvent the restrictions. In conclusion, the Nassau New York Agreement and Irrevocable Proxy is a legally-binding contract used in various scenarios related to the transfer of shares or voting rights in a company. It provides stability, protects interests, and ensures that decisions are made in line with the agreement's terms.

Nassau New York Agreement and Irrevocable Proxy

Description

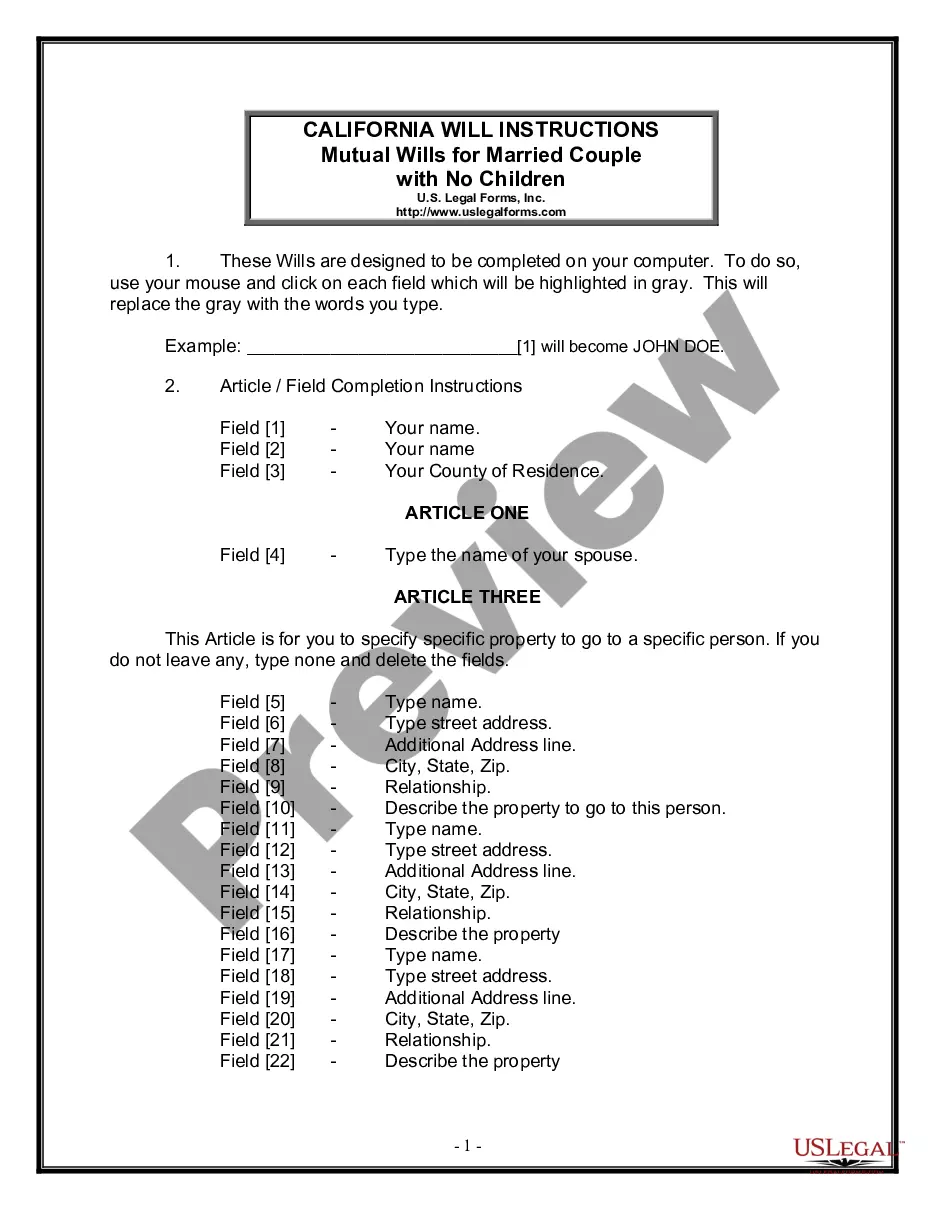

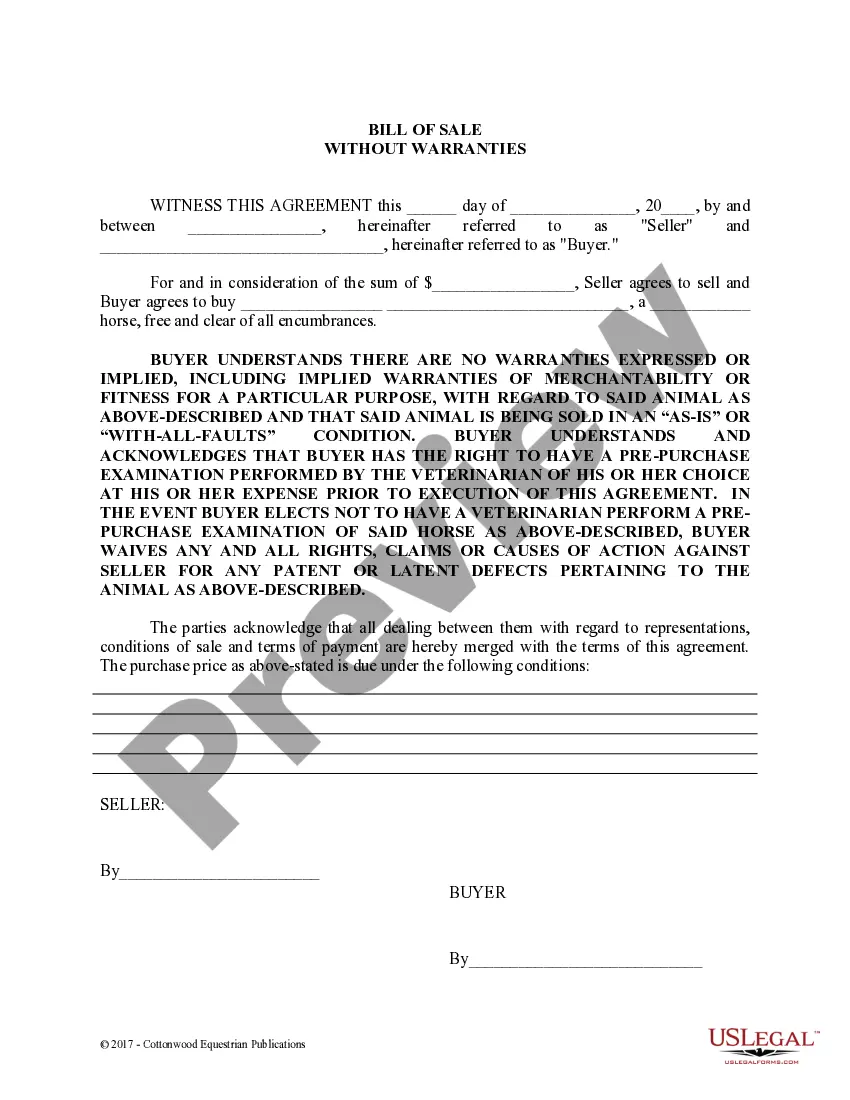

How to fill out Nassau New York Agreement And Irrevocable Proxy?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Nassau Agreement and Irrevocable Proxy, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different types ranging from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find detailed materials and tutorials on the website to make any activities associated with document execution simple.

Here's how you can purchase and download Nassau Agreement and Irrevocable Proxy.

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Examine the related document templates or start the search over to find the right document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment gateway, and buy Nassau Agreement and Irrevocable Proxy.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Nassau Agreement and Irrevocable Proxy, log in to your account, and download it. Of course, our platform can’t replace a lawyer completely. If you have to deal with an extremely complicated case, we recommend using the services of a lawyer to check your document before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Become one of them today and purchase your state-specific paperwork with ease!