The Dallas Texas Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., and multiple banks and financial institutions is a significant financial document that outlines the terms and conditions of a credit agreement between the parties involved. This legal document serves as a mutual agreement for the extension of credit and outlines the obligations, rights, and responsibilities of the borrower and the lenders. The credit agreement is a crucial component for businesses like SBA Communications, Corp. and SBA Telecommunications, Inc. that require substantial financial resources to support their operations, expansions, and investments. These agreements are typically essential for companies to secure the necessary working capital or funds for various purposes, including capital expenditures, debt refinancing, and day-to-day operations. The Dallas Texas Second Amended and Restated Credit Agreement is unique to the particular circumstances and needs of the parties involved. However, there can be different types or variations of such agreements, tailored to the specific requirements of the participants. These variations may include: 1. Revolving Credit Agreement: This type of credit agreement provides businesses with access to a specific credit limit, allowing them to borrow funds as needed. The borrowed amount can be repaid and borrowed again, making it a flexible financing option for recurring capital needs. 2. Term Loan Agreement: A term loan agreement provides a borrower with a lump sum loan, typically repaid over an agreed-upon term and with a fixed interest rate. This type of agreement is commonly used for long-term investments or acquisitions. 3. Syndicated Credit Agreement: In some cases, a credit agreement involves multiple banks and financial institutions acting as lenders. Such agreements are known as syndicated credit agreements, where each lender provides a portion of the total credit facility. This allows borrowers to access larger amounts than a single lender might provide and diversify risk for the participating lenders. 4. Secured Credit Agreement: A secured credit agreement involves the borrower providing collateral, such as assets or property, as a form of security to the lenders. If the borrower fails to fulfill their repayment obligations, the lenders have the right to seize and sell the collateral to recover their funds. These are just a few examples of the possible types of credit agreements that may exist within the Dallas Texas Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., and multiple banks and financial institutions. Each agreement is unique and represents a specific financial arrangement designed to meet the needs and goals of the parties involved.

Dallas Texas Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions

Description

How to fill out Dallas Texas Second Amended And Restated Credit Agreement Among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks And Financial Institutions?

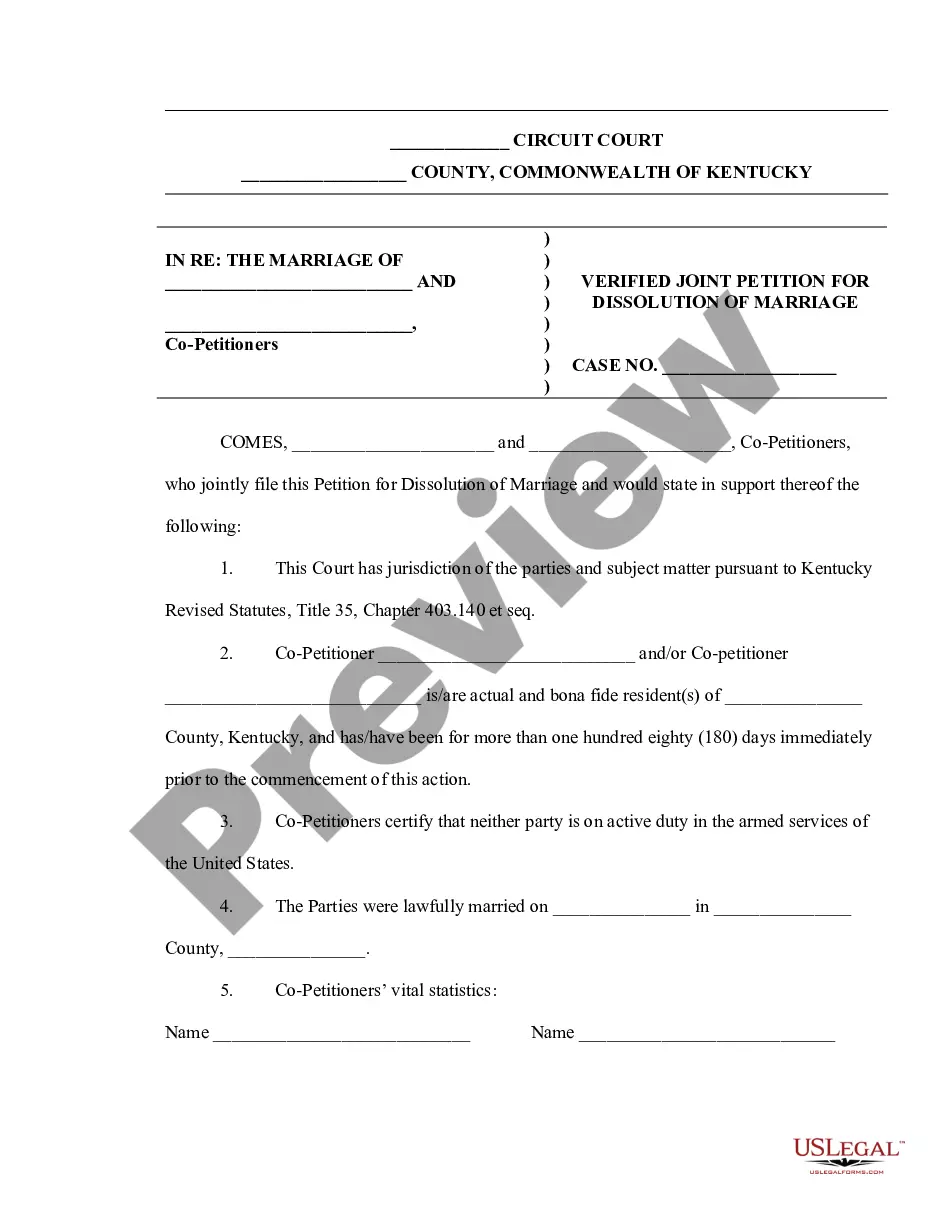

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Dallas Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find detailed resources and tutorials on the website to make any activities related to document execution simple.

Here's how to find and download Dallas Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions.

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the validity of some documents.

- Examine the related forms or start the search over to find the correct document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment method, and buy Dallas Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Dallas Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions, log in to your account, and download it. Of course, our website can’t take the place of a legal professional entirely. If you have to cope with an exceptionally difficult case, we advise getting a lawyer to examine your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Join them today and get your state-specific documents with ease!

Form popularity

Interesting Questions

More info

(3) We are in advanced negotiations with a number of banks regarding providing them with loans to underwrite and provide short-term financing on the debt of Citizens Financial Group to finance new construction of the First Texas Center and support the ongoing operations of the Arena. (4) On August 3, 2018, Citizens Financial closed a 2.6 million private placement of unsecured senior secured notes against Citizens' existing stock and the existing debt of Citizens Financial Group. (5) Because of our recent purchase of Citizens Facing Foreclosures LLC, we also have purchased approximately 3.8 million of non-recourse obligations under the original indenture. (6) As of December 31, 2016, we had approximately 17,600 of indebtedness of related entities. For the twelve-month period ended December 31, 2016, the principal amount of the outstanding indebtedness was 24 million. In addition, we are subject to various tax withholding due from related entities. (7) We received a 4.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.