The Nassau New York Second Amended and Restated Credit Agreement is a legal document that outlines the terms and conditions of a credit agreement among SBA Communications, Corp., SBA Telecommunications, Inc., and several banks and financial institutions. This agreement is designed to provide a framework for borrowing, lending, and other financial transactions between the parties involved. Keywords: Nassau New York, Second Amended and Restated Credit Agreement, SBA Communications, Corp., SBA Telecommunications, Inc., banks, financial institutions, borrowing, lending, financial transactions. Different Types of Nassau New York Second Amended and Restated Credit Agreements among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks, and Financial Institutions: 1. Term Loan Agreement: This type of credit agreement provides a specified amount of funds that are disbursed to the borrower, to be repaid over a specific period with regular installments. 2. Revolving Credit Facility: A revolving credit agreement allows the borrower to withdraw funds up to a predetermined limit at any given time. The borrower can make multiple draws and repayments within the set credit limit, providing flexibility for ongoing financial needs. 3. Letter of Credit Facility: This type of credit agreement allows the borrower to obtain letters of credit, which act as a guarantee of payment to third-party suppliers or vendors. The borrower can draw upon the letter of credit to fulfill financial obligations. 4. Term Loan and Revolving Credit Facility: In some cases, credit agreements may combine both term loans and revolving credit facilities, providing the borrower with options for both long-term funding and ongoing working capital needs. 5. Syndicated Credit Agreement: A syndicated credit agreement involves multiple banks or financial institutions collectively lending to the borrower. It spreads the risk among the participating lenders and allows for larger borrowing capacity than individual lenders might provide. It is essential to note that the specific terms and provisions of these credit agreements can vary depending on the unique financial needs and circumstances of the parties involved. Therefore, the actual terms and conditions will be defined within the Nassau New York Second Amended and Restated Credit Agreement document itself.

Nassau New York Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions

Description

How to fill out Nassau New York Second Amended And Restated Credit Agreement Among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks And Financial Institutions?

Whether you plan to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Nassau Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to get the Nassau Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions. Adhere to the instructions below:

- Make certain the sample fulfills your personal needs and state law regulations.

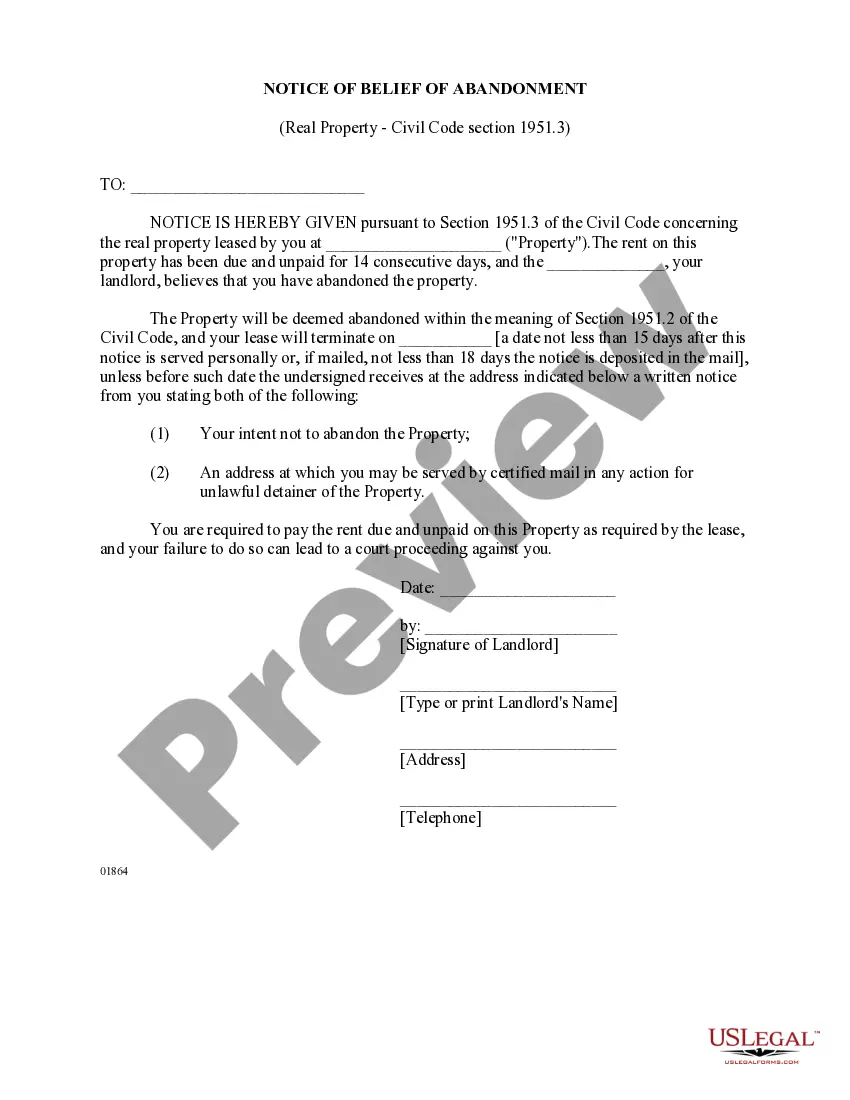

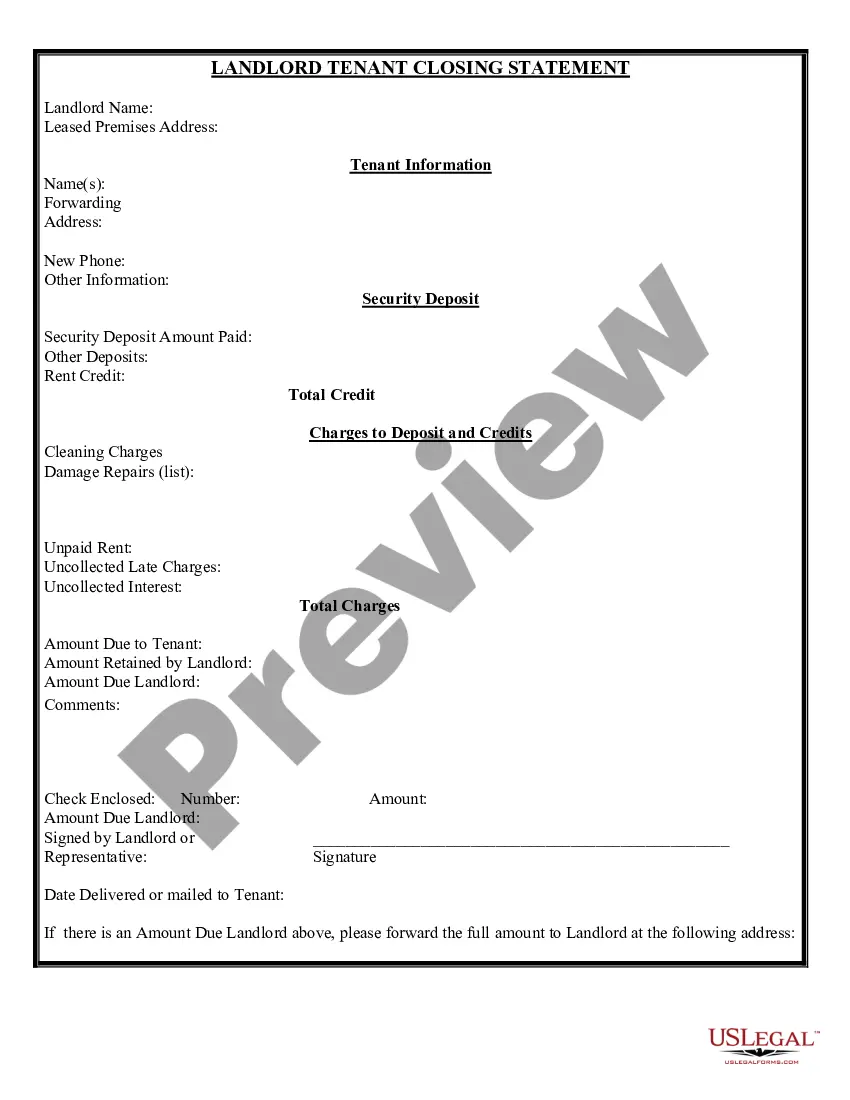

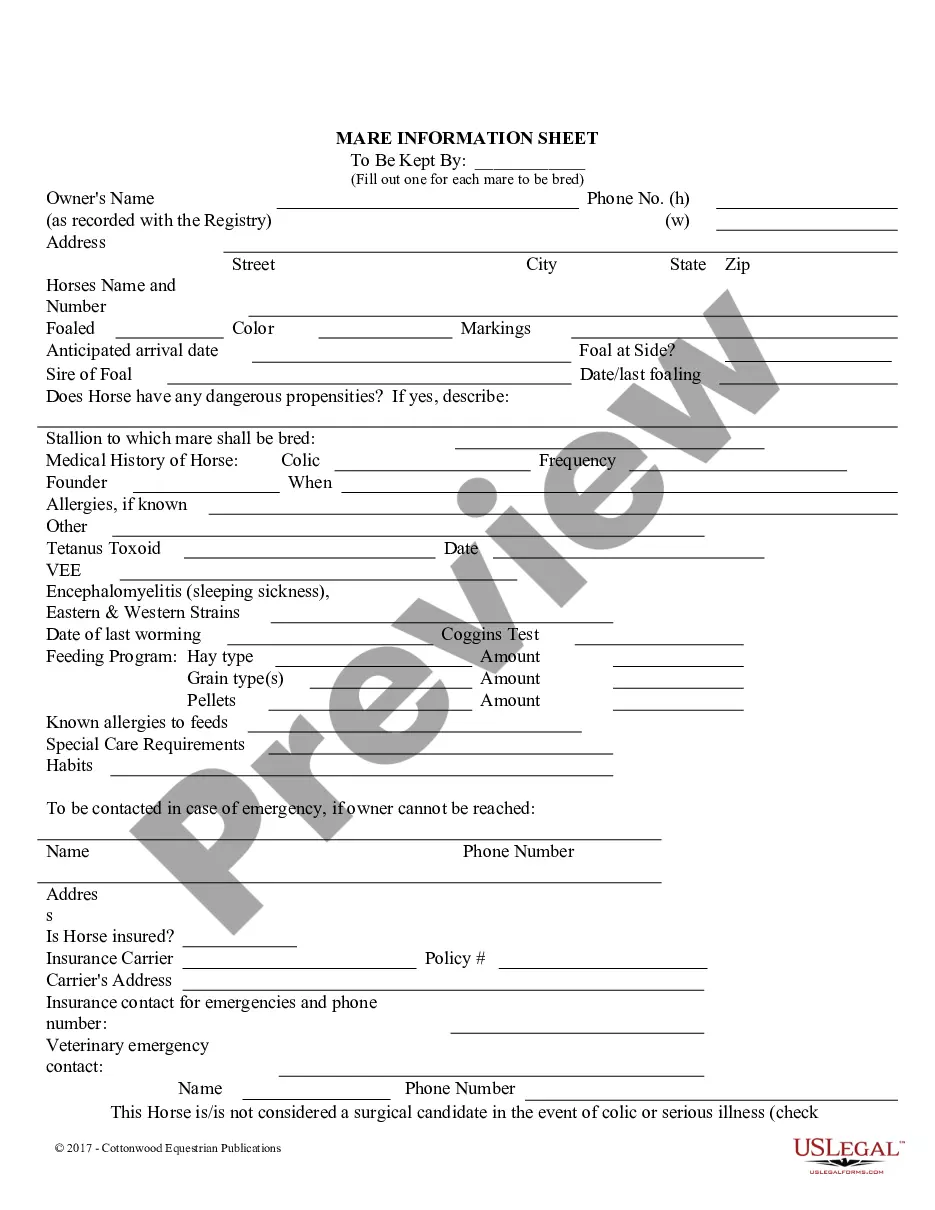

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Second Amended and Restated Credit Agreement among SBA Communications, Corp., SBA Telecommunications, Inc., Several Banks and Financial Institutions in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!