Riverside, California Plan of Merger and Reorganization by Digital Insight Corp., Black Transitory Corp., and front, Inc.: A Comprehensive Overview The Riverside, California Plan of Merger and Reorganization represents a significant strategic move involving key players in the tech industry. Digital Insight Corp., Black Transitory Corp., and front, Inc. have come together to execute a seamless integration, aiming to leverage their combined expertise, resources, and market presence. This plan encompasses several types of mergers and reorganization strategies, showcasing the ambitions of these companies to create a stronger, more diversified entity. Let's delve into the different dimensions of this landmark deal. 1. Horizontal Merger: The Plan of Merger and Reorganization involves a horizontal merger, which implies the integration of companies operating in the same industry. In this case, Digital Insight Corp., Black Transitory Corp., and front, Inc. are pooling their resources to expand their reach, achieve economies of scale, and increase market share. 2. Vertical Merger: Alongside the horizontal merger, the plan may also encompass a vertical merger, wherein companies at different stages of the supply chain merge to create a unified entity. This strategic move allows the involved companies to solidify their position in the market and enhance efficiency by streamlining operations. 3. Market Diversification: The Riverside Plan of Merger and Reorganization aims to leverage the diverse product portfolios and customer bases of the merging entities. By harnessing their respective expertise, the merged entity can explore new market segments, mitigate risks, and expand its range of offerings, ultimately enhancing competitiveness. 4. Synergies and Cost Savings: Mergers often promise cost synergies and savings through economies of scale and shared resources. The Riverside Plan of Merger and Reorganization intends to capitalize on these synergies, leading to improved operational efficiency, reduced costs, and maximized profits for all involved companies. 5. Technological Advancements: Digital Insight Corp., Black Transitory Corp., and front, Inc. are renowned for their technological prowess. The plan seeks to combine their technological advances and capabilities, opening up new opportunities for innovation, research and development, and breakthrough solutions in the digital and fintech sectors. 6. Human Resources Integration: Merging organizations also need to address the integration of human resources. The plan may include provisions to effectively combine the workforce of Digital Insight Corp., Black Transitory Corp., and front, Inc., ensuring a smooth transition while preserving the talent and expertise necessary for continued success. This Plan of Merger and Reorganization sets the stage for a transformative partnership, fostering growth, innovation, and value creation in the digital and fintech industries. Through different types of mergers, market diversification, and synergistic collaborations, Digital Insight Corp., Black Transitory Corp., and front, Inc. aim to solidify their market positions and deliver enhanced products and services to their customers. Keywords: Riverside California, Plan of Merger, Reorganization, Digital Insight Corp., Black Transitory Corp., front, horizontal merger, vertical merger, market diversification, synergies, cost savings, economies of scale, technological advancements, human resources integration, fintech.

Riverside California Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc.

Description

How to fill out Riverside California Plan Of Merger And Reorganization By And Among Digital Insight Corp., Black Transitory Corp. And NFront, Inc.?

Preparing papers for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to generate Riverside Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc. without expert assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Riverside Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc. by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Riverside Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc.:

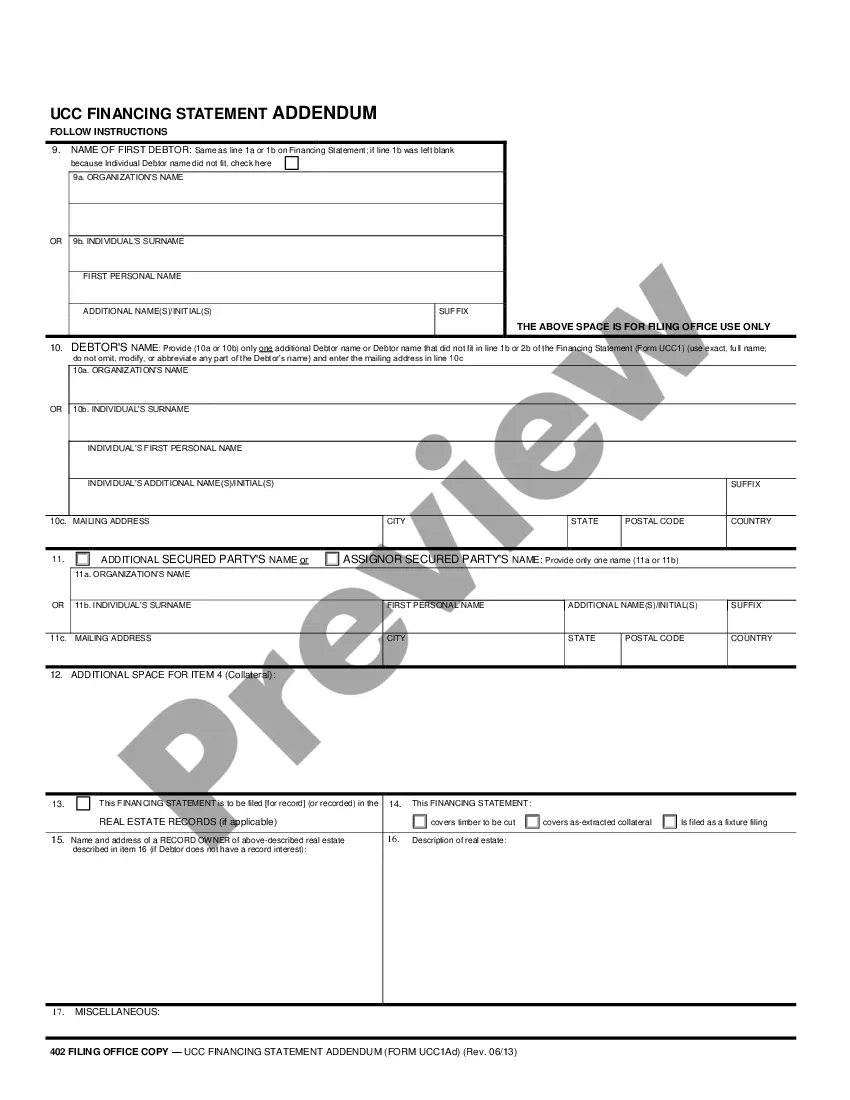

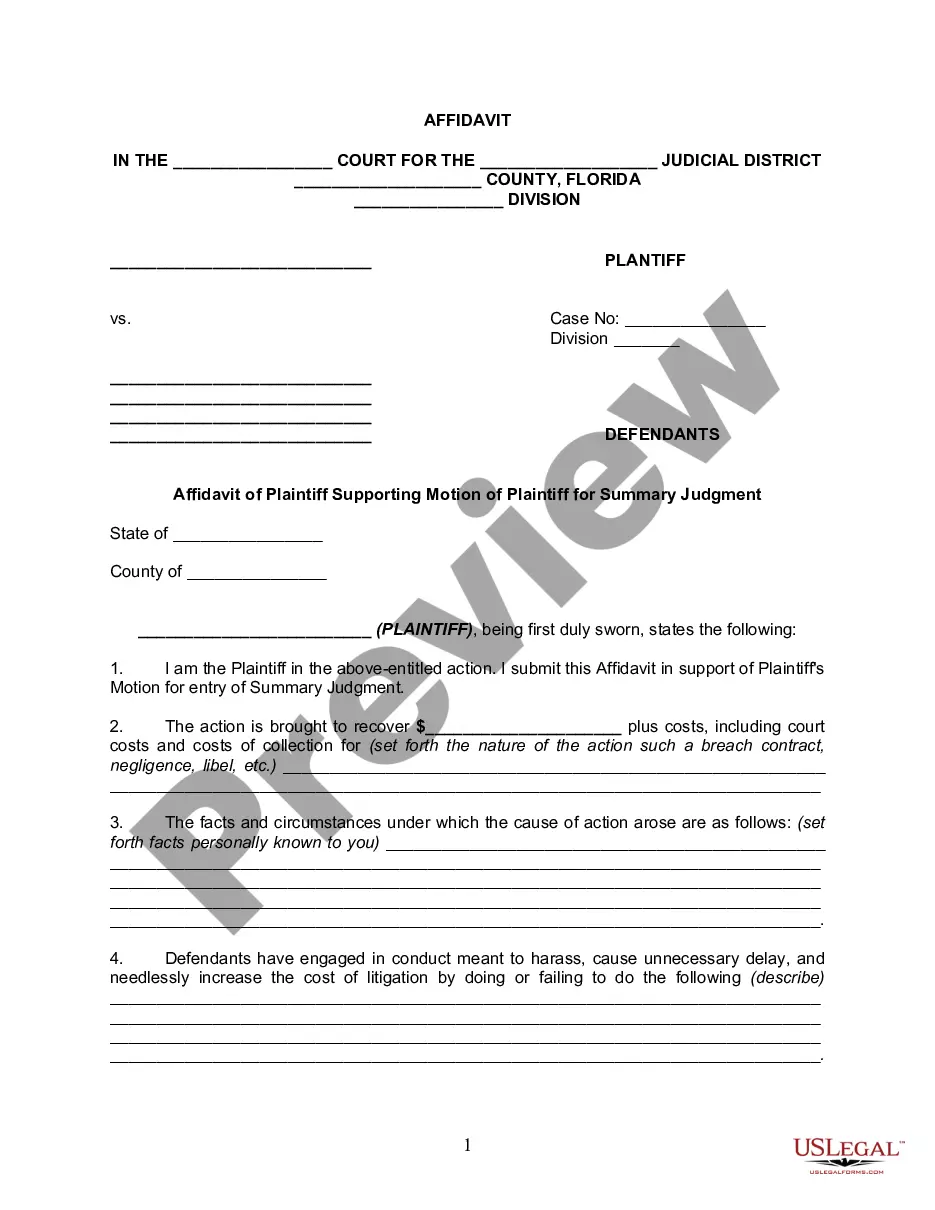

- Look through the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any use case with just a few clicks!

Form popularity

FAQ

A merger agreement definition is a legal contract governing the combination of two companies into a single business entity. 1.

As in most aspects of business, communication is a vital key to ensuring your merger or acquisition goes smoothly and is the right move for both companies. You need to have completely open and direct lines of communication with the key players from the company with which you want to merge.

The key terms include: The Buyer and Seller, Price (per share, or lump sum for private companies), and Type of Transaction.Treatment of Outstanding Shares, Options, and RSUs and Other Dilutive Securities.Representations and Warranties.Covenants.Solicitation (?No Shop? vs.Financing.Termination Fee (or ?Break-Up Fee?)

Also known as articles of merger. A certificate evidencing the merger of two or more entities into one entity.

Common Sections in Agreements Of Merger THE MERGER. DISSENTING SHARES; PAYMENT FOR SHARES; OPTIONS. REPRESENTATIONS AND WARRANTIES. REPRESENTATIONS AND. COVENANTS. CONDITIONS TO CONSUMMATION OF THE MERGER. TERMINATION; AMENDMENT; WAIVER. MISCELLANEOUS.

A certificate of merger, also known as an articles of merger, is a document that provides evidence of the merger between two or more entities into one entity.

After that, I'll also very briefly introduce you to several other common mergers and acquisitions (M&A) transaction documents, including: Confidentiality Agreements. Letters of Intent. Exclusivity Agreements. Disclosure Schedules. HSR Filings. Third Party Consents. Legal Opinions. Stock Certificates.

7. A statement that the Agreement of Merger will be provided to any stockholder of any constituent corporation or any partner of any constituent limited partnerships. Execution Block - The document must be signed by an Authorized Officer of the surviving Delaware corporation.

A merger agreement (or ?definitive merger agreement?) is the legal contract that is drawn up and signed by both parties when two companies merge. Its terms and conditions can be quite detailed, and it usually spells out several parameters regarding staffing actions to be implemented.

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).