Nassau New York Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp, and front, Inc. has significant implications for the parties involved. This amendment serves as a supplementary agreement, modifying the original Plan of Merger and Reorganization, enhancing its efficiency and addressing specific aspects related to the merger. Key Keywords: Nassau New York Amendment, Plan of Merger and Reorganization, Digital Insight Corp, Black Transitory Corp, front Inc, supplementary agreement, modification, efficiency, merger. The Nassau New York Amendment No. 1 introduces various enhancements and adjustments to the initial merger plan, ensuring a smooth transition for all the companies involved. This amendment acknowledges the evolving nature of business operations and market dynamics, necessitating a revision to accommodate changing circumstances and optimize outcomes. Several types of Nassau New York Amendment No. 1 to Plan of Merger and Reorganization by Digital Insight Corp, Black Transitory Corp, and front, Inc. can be identified based on their focus areas: 1. Financial Adjustments: This type of amendment primarily addresses financial matters, such as revised valuation methodologies, revised consideration for the merger, or changes in the distribution of stock or cash components. 2. Legal and Regulatory Compliance: Amendments falling under this category focus on legal and regulatory aspects, ensuring that the merger complies with Nassau New York's specific legal requirements and any other relevant regulations. 3. Governance and Management: Certain amendments may pertain to the governance structure and management procedures of the merged entity. These adjustments may include alterations to board compositions, executive positions, or the framework for decision-making. 4. Employee Benefits and Integration: In cases where a merger involves a significant workforce, specific amendments may address employee benefits, compensation plans, integration strategies, and the harmonization of HR policies to ensure a smooth transition for employees. 5. Intellectual Property and Technology Integration: In situations where the merging entities possess valuable intellectual property or technology assets, amendments may focus on the protection, integration, or licensing of such assets, ensuring a seamless consolidation of resources. It is crucial for Digital Insight Corp, Black Transitory Corp, and front, Inc. to carefully review and assess the implications of Nassau New York Amendment No. 1 to Plan of Merger and Reorganization. Legal counsel and experts in financial and regulatory matters should be involved to ensure compliance and maximize the benefits of the merger for all parties involved.

Nassau New York Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc.

Description

How to fill out Nassau New York Amendment No. 1 To Plan Of Merger And Reorganization By And Among Digital Insight Corp, Black Transitory Corp And NFront, Inc.?

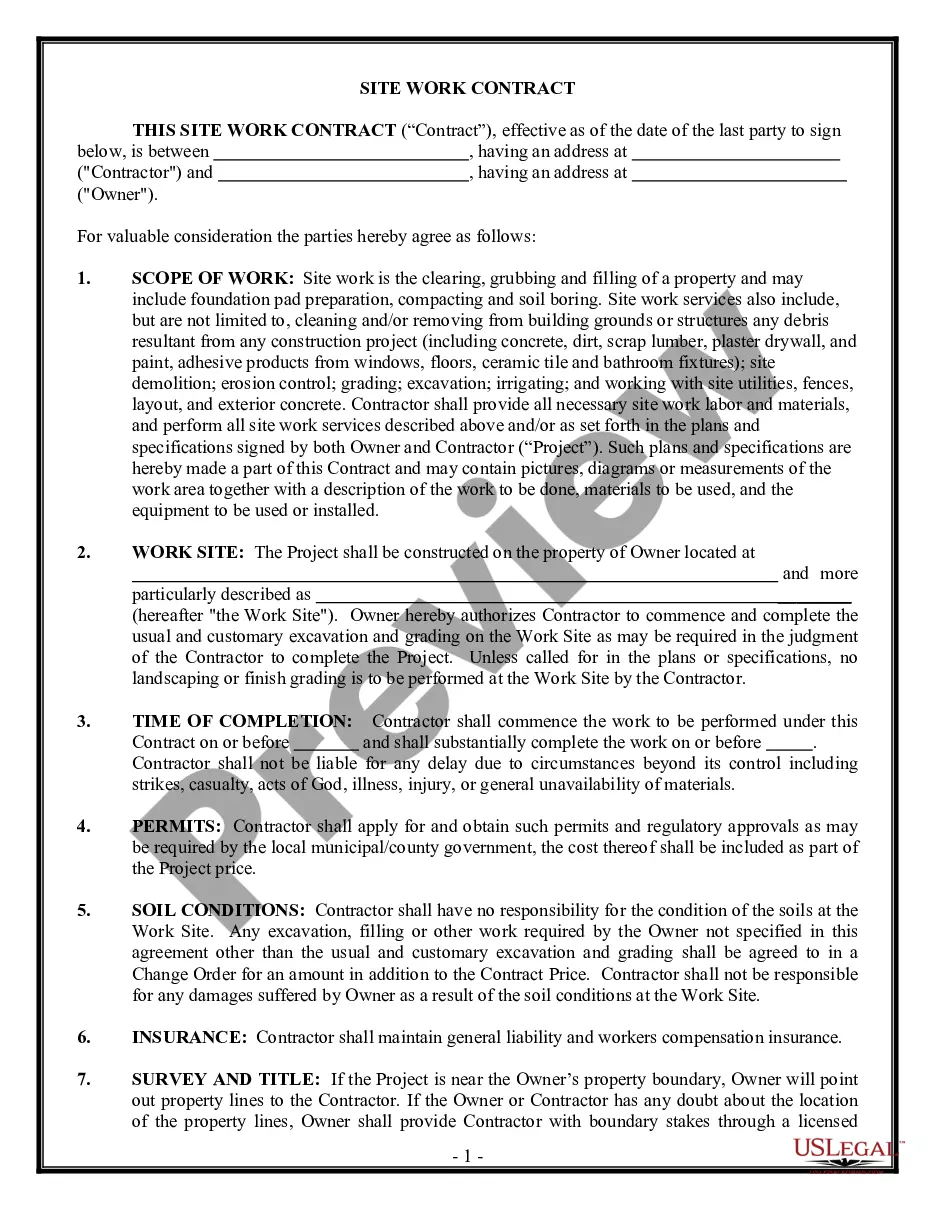

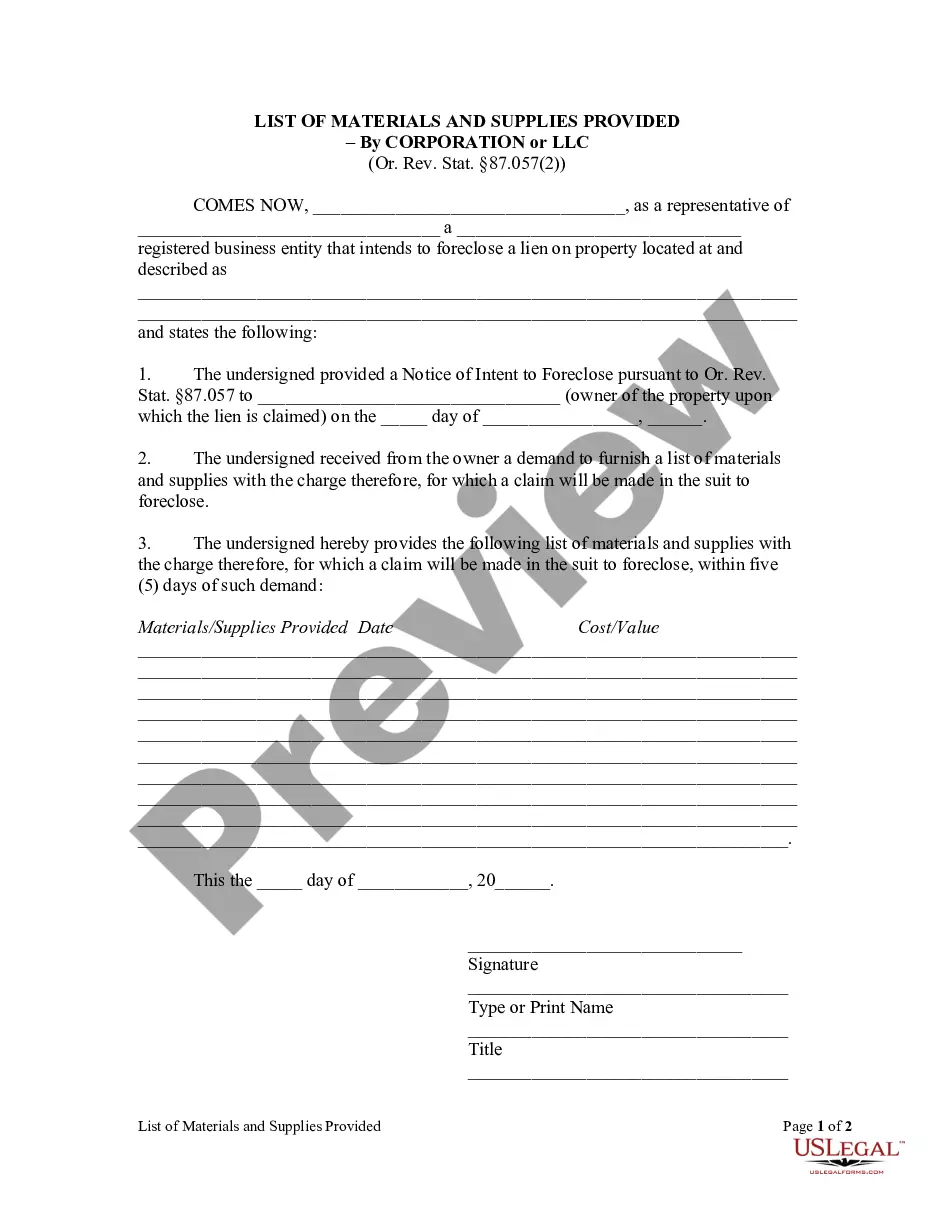

Draftwing documents, like Nassau Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc., to take care of your legal affairs is a tough and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task not really affordable. However, you can consider your legal issues into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms intended for various scenarios and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Nassau Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc. form. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before getting Nassau Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc.:

- Make sure that your form is specific to your state/county since the regulations for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Nassau Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc. isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to start utilizing our service and get the form.

- Everything looks good on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your form is good to go. You can try and download it.

It’s an easy task to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!