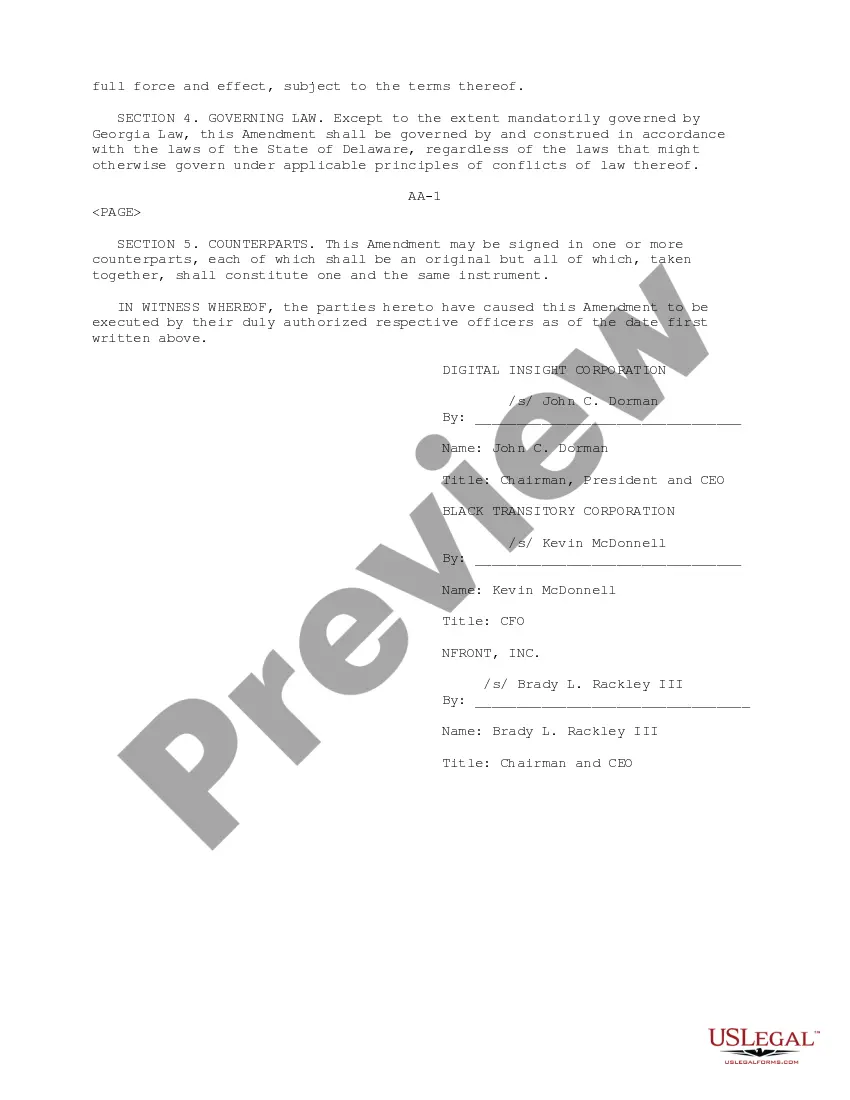

San Diego California Amendment No. 1 to Plan of Merger and Reorganization is a legally binding document that outlines the modifications and revisions made to the original merger agreement between Digital Insight Corp, Black Transitory Corp, and front, Inc. This amendment serves to update and refine the terms and conditions initially proposed in the Plan of Merger and Reorganization. The purpose of this amendment is to enhance collaboration, clarify certain provisions, and address any issues or concerns that have emerged since the initial agreement was drafted. By including specific keywords, we can classify different types of amendments: 1. Materiality Amendment: This type of amendment focuses on changes that are considered significant and could potentially impact the overall structure and objectives of the merger. It typically involves altering financial terms, organizational structure, or intellectual property rights. 2. Procedural Amendment: A procedural amendment pertains to modifications made to the process or procedures involved in the merger or reorganization. It may involve changes in the timeline, voting requirements, or approval procedures for the shareholders of the involved companies. 3. Governance Amendment: Governance amendments deal with alterations in the governance structure and decision-making processes of the merged entities. This includes changes to the composition of the board of directors, their powers, or the establishment of new committees. 4. Regulatory Amendment: Regulatory amendments are made to ensure compliance with applicable laws, regulations, or guidelines from governmental or regulatory authorities. This could involve modifying provisions related to data protection, antitrust concerns, or any other legal requirements. 5. Financial Amendment: Financial amendments focus primarily on revising the financial terms of the merger agreement. This may include adjustments to the purchase price, payment terms, or allocation of assets and liabilities. 6. Scope Amendment: A scope amendment addresses any adjustments required to refine the scope of the merger or reorganization. This could involve excluding or including certain assets, subsidiaries, or business lines not initially covered in the original agreement. Through San Diego California Amendment No. 1 to Plan of Merger and Reorganization, Digital Insight Corp, Black Transitory Corp, and front, Inc. aim to ensure that the merger remains aligned with their strategic objectives while accounting for any changes or challenges that have arisen since the initial agreement was made.

San Diego California Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc.

Description

How to fill out San Diego California Amendment No. 1 To Plan Of Merger And Reorganization By And Among Digital Insight Corp, Black Transitory Corp And NFront, Inc.?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the San Diego Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc., it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the latest version of the San Diego Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc., you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Diego Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc.:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your San Diego Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc. and download it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!