Wayne Michigan Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp, and front, Inc. Introduction: The Wayne Michigan Amendment No. 1 to Plan of Merger and Reorganization encompasses the legal agreement between Digital Insight Corp, Black Transitory Corp, and front, Inc. This amendment outlines the modifications made to the original plan, aiming to ensure a seamless merger and reorganization process. The amendment brings various changes, enhancing the efficiency and effectiveness of the overall merger strategy. Keywords: Wayne Michigan, Amendment No. 1, Plan of Merger and Reorganization, Digital Insight Corp, Black Transitory Corp, front, Inc. 1. Types of Amendments: 1.1 Financial Restructuring Amendment: The Wayne Michigan Amendment No. 1 includes a financial restructuring amendment to the Plan of Merger and Reorganization. This section focuses on the financial aspects of the merger, such as the reallocation of capital, revised valuation, acquisition of assets, and updated financial projections. 1.2 Operational Integration Amendment: The Operational Integration Amendment within the Wayne Michigan Amendment No. 1 encompasses the steps to integrate the operations of Digital Insight Corp, Black Transitory Corp, and front, Inc. This section outlines the proposed synergy, consolidation of departments, revised operational strategies, and the streamlining of processes. 1.3 Corporate Governance Amendment: The Corporate Governance Amendment within the Wayne Michigan Amendment No. 1 addresses the modifications in the organizational structure and governing policies. It emphasizes the formation of a new board of directors, updates to shareholder rights, changes in voting procedures, and the establishment of committees to oversee various aspects of the merged entity. 1.4 Legal Compliance Amendment: The Wayne Michigan Amendment No. 1 also includes a Legal Compliance Amendment, ensuring that the merger and reorganization comply with relevant laws, regulations, and contractual obligations. This section covers intellectual property rights, labor laws, data privacy, environmental regulations, and any other legal considerations applicable to the entities involved. 1.5 Human Resources Amendment: The Human Resources Amendment, a crucial component of the Wayne Michigan Amendment No. 1, focuses on the integration of the workforce. This section covers employee retention plans, restructuring of roles and responsibilities, benefits and compensation harmonization, and the establishment of an inclusive and equitable company culture. Conclusion: The Wayne Michigan Amendment No. 1 to Plan of Merger and Reorganization serves as a vital document in facilitating the smooth consolidation of Digital Insight Corp, Black Transitory Corp, and front, Inc. It encompasses amendments pertaining to financial restructuring, operational integration, corporate governance, legal compliance, and human resources. This comprehensive approach ensures a cohesive and successful merger, enabling the newly merged entity to thrive in the market.

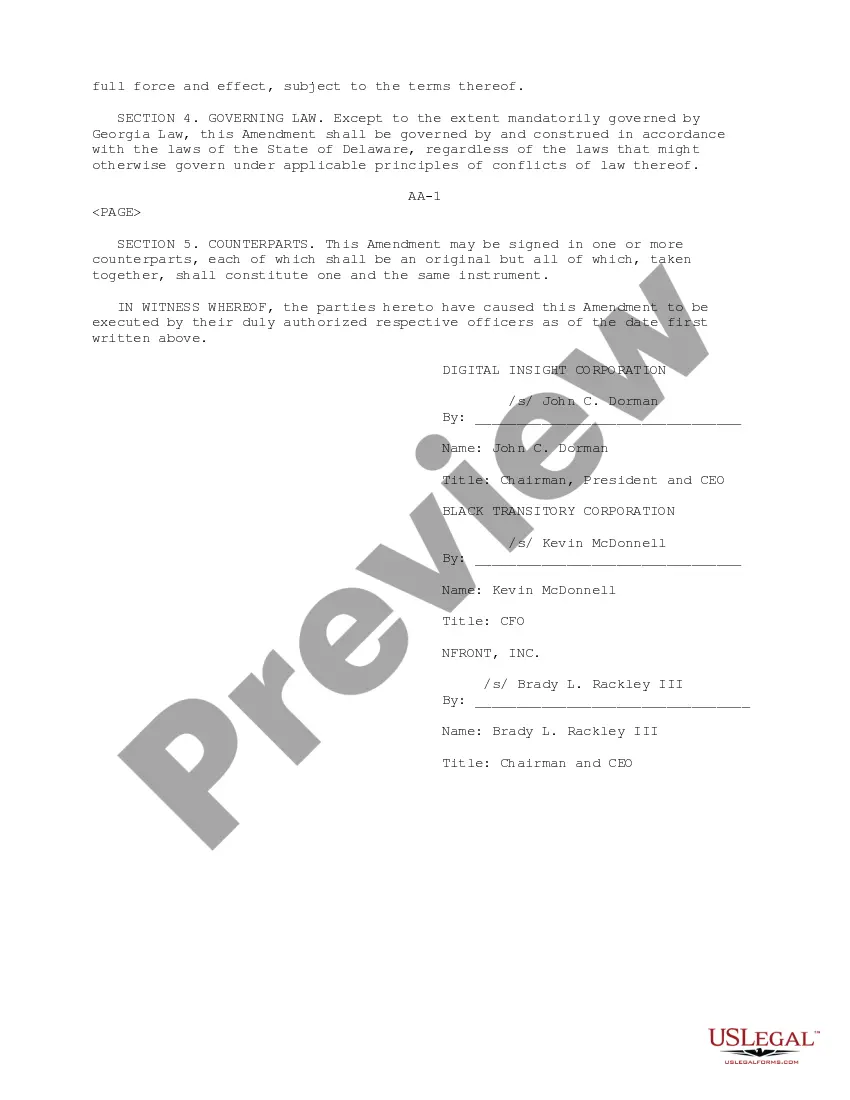

Wayne Michigan Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc.

Description

How to fill out Wayne Michigan Amendment No. 1 To Plan Of Merger And Reorganization By And Among Digital Insight Corp, Black Transitory Corp And NFront, Inc.?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Wayne Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc., it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Consequently, if you need the recent version of the Wayne Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc., you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Wayne Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc.:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your Wayne Amendment No. 1 to Plan of Merger and Reorganization by and among Digital Insight Corp, Black Transitory Corp and nFront, Inc. and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!