The Alameda California Security holders Agreement between GST Telecommunications, Inc. and Ocean Horizon, NRL is a contractual arrangement that outlines the rights, obligations, and responsibilities of the security holders involved. This agreement is vital for establishing a secure investment environment and protecting the interests of both parties involved. Keywords: Alameda California, Security holders Agreement, GST Telecommunications, Inc., Ocean Horizon, NRL. There are different types of Alameda California Security holders Agreements between GST Telecommunications, Inc. and Ocean Horizon, NRL, and they include: 1. Preferred Stock Security holders Agreement: This type of agreement pertains specifically to preferred stockholders, who possess certain privileges and claims over common stockholders. It outlines the preferences and rights associated with these stocks, including dividend payouts, liquidation preferences, and conversion rights. 2. Common Stock Security holders Agreement: This agreement focuses on common stockholders and covers their rights and responsibilities. It may include provisions regarding voting rights, information rights, and restrictions on share transfers. 3. Convertible Debt Security holders Agreement: When a security holder holds convertible debt, which has the potential to be converted into equity, a specific agreement is necessary. This agreement defines the terms, conditions, and procedures for conversion, such as conversion price, conversion period, and circumstances triggering conversion. 4. Warrant Holder Security holders Agreement: In cases where security holders possess warrants, which provide the option to purchase additional shares at a predetermined price, a warrant holder agreement is essential. It outlines the rights, obligations, and exercise conditions related to the warrants, such as expiration dates and exercise prices. 5. Subordinated Debt Security holders Agreement: If a security holder holds subordinated debt, which ranks below other debt obligations in terms of repayment priority, this agreement becomes relevant. It establishes the rights, interests, and repayment terms associated with subordinated debt. Overall, the Alameda California Security holders Agreement(s) between GST Telecommunications, Inc. and Ocean Horizon, NRL ensure transparency, accountability, and fair treatment of security holders, regardless of the type of security they hold. These agreements are crucial in maintaining a harmonious relationship between the involved entities and protecting their respective interests.

Alameda California Securityholders Agreement between GST Telecommunications, Inc. and Ocean Horizon, SRL

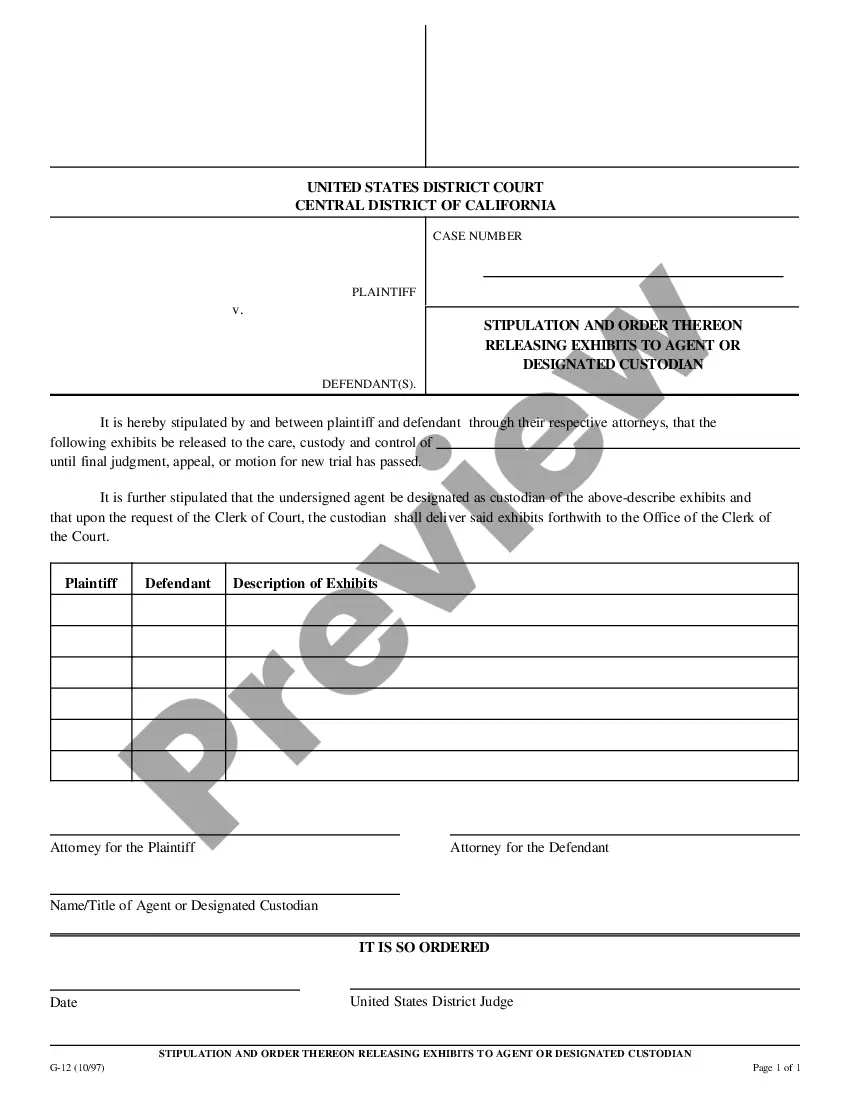

Description

How to fill out Alameda California Securityholders Agreement Between GST Telecommunications, Inc. And Ocean Horizon, SRL?

Creating legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from scratch, including Alameda Securityholders Agreement between GST Telecommunications, Inc. and Ocean Horizon, SRL, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different categories varying from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find information materials and tutorials on the website to make any activities associated with paperwork execution straightforward.

Here's how you can purchase and download Alameda Securityholders Agreement between GST Telecommunications, Inc. and Ocean Horizon, SRL.

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state regulations can impact the legality of some records.

- Check the similar document templates or start the search over to locate the right document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment method, and purchase Alameda Securityholders Agreement between GST Telecommunications, Inc. and Ocean Horizon, SRL.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Alameda Securityholders Agreement between GST Telecommunications, Inc. and Ocean Horizon, SRL, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional completely. If you have to cope with an extremely difficult case, we recommend getting a lawyer to examine your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Become one of them today and purchase your state-specific documents effortlessly!