San Diego California Stock Option Agreement of VIA Internet, Inc. is a legal document outlining the terms and conditions between VIA Internet, Inc. and an employee or investor regarding stock options. This agreement enables individuals to purchase or receive shares of stock in VIA Internet, Inc. at a predetermined price within a specified timeframe. The San Diego California Stock Option Agreement outlines various essential aspects, including the grant date, the number of shares to be offered, exercise price, vesting schedule, expiration date, and any specific terms or conditions. This agreement clearly specifies the rights and obligations of both parties involved. Types of San Diego California Stock Option Agreement of VIA Internet, Inc. may include Incentive Stock Options (SOS) and Non-Qualified Stock Options (Nests). SOS are typically granted to employees and have favorable tax treatment, while Nests are usually granted to consultants, advisors, or non-employee directors. The key aspects covered in the San Diego California Stock Option Agreement are as follows: 1. Grant Date: The date when the stock options are granted to the individual. 2. Number of Shares: The quantity of stock options being offered. 3. Exercise Price: The predetermined price at which the individual can purchase the shares. 4. Vesting Schedule: The timeline or criteria over which the individual becomes eligible to exercise the options. 5. Expiration Date: The date by which the individual must exercise the options before they expire. 6. Cliff Vesting: A specific vesting schedule where a certain percentage of options become exercisable after completing a specified period. 7. Accelerated Vesting: Circumstances under which the vesting period may be accelerated, typically due to a change of control or acquisition. 8. Termination of Employment: The effect on options in case of termination of employment, whether vested or invested. 9. Stock Option Exercise: The procedures, requirements, and timeline for the individual to exercise their stock options. 10. Tax Consequences: A section that outlines the tax treatment associated with exercising the options and subsequent sale of shares. The San Diego California Stock Option Agreement of VIA Internet, Inc. is a crucial document that protects the interests of both VIA Internet, Inc. and the individual receiving the stock options. It ensures transparency, compliance with regulations, and clearly defines the rights and responsibilities related to stock ownership within the company.

San Diego California Stock Option Agreement of VIA Internet, Inc.

Description

How to fill out San Diego California Stock Option Agreement Of VIA Internet, Inc.?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, locating a San Diego Stock Option Agreement of VIA Internet, Inc. suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. Apart from the San Diego Stock Option Agreement of VIA Internet, Inc., here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can get the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your San Diego Stock Option Agreement of VIA Internet, Inc.:

- Examine the content of the page you’re on.

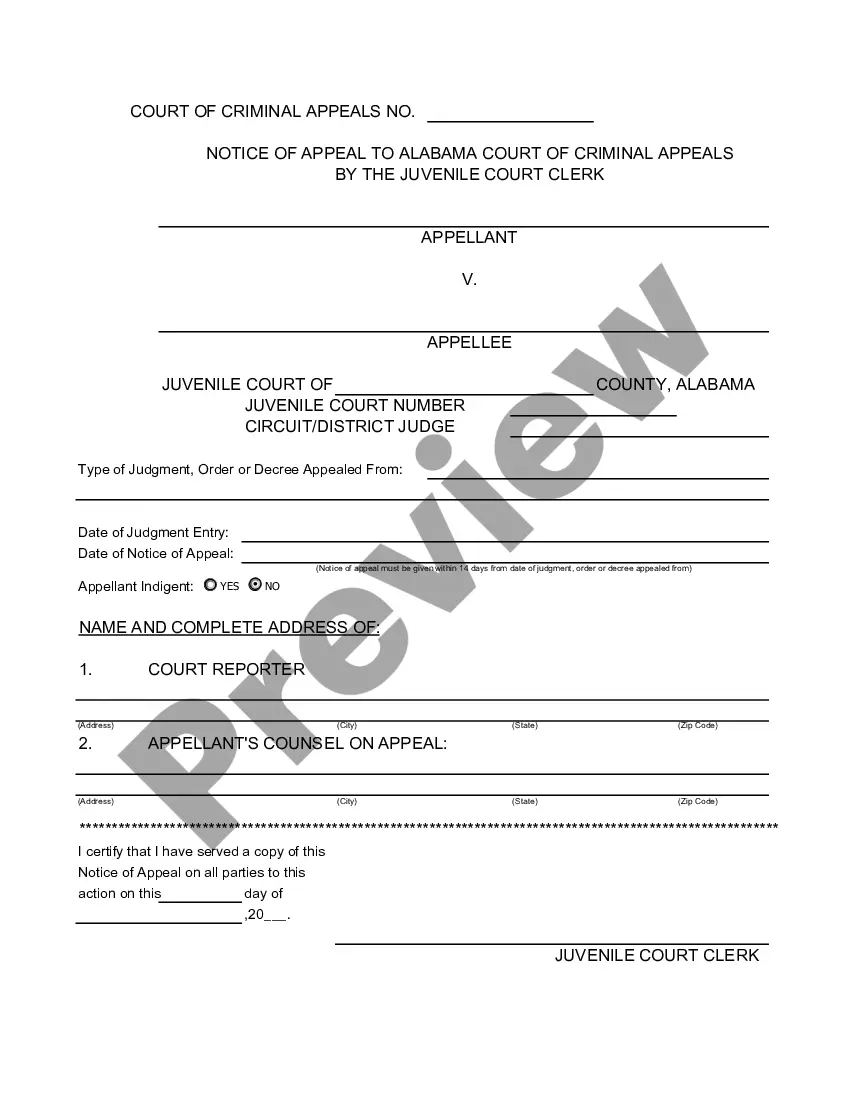

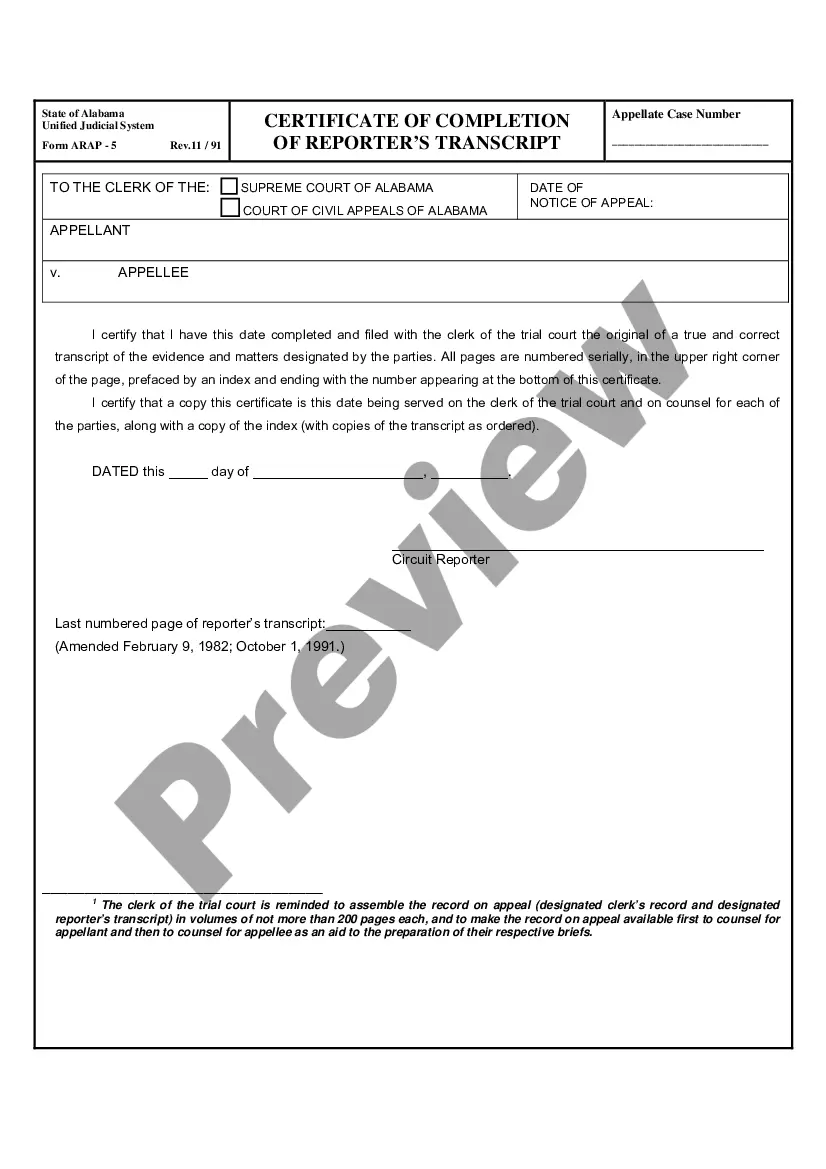

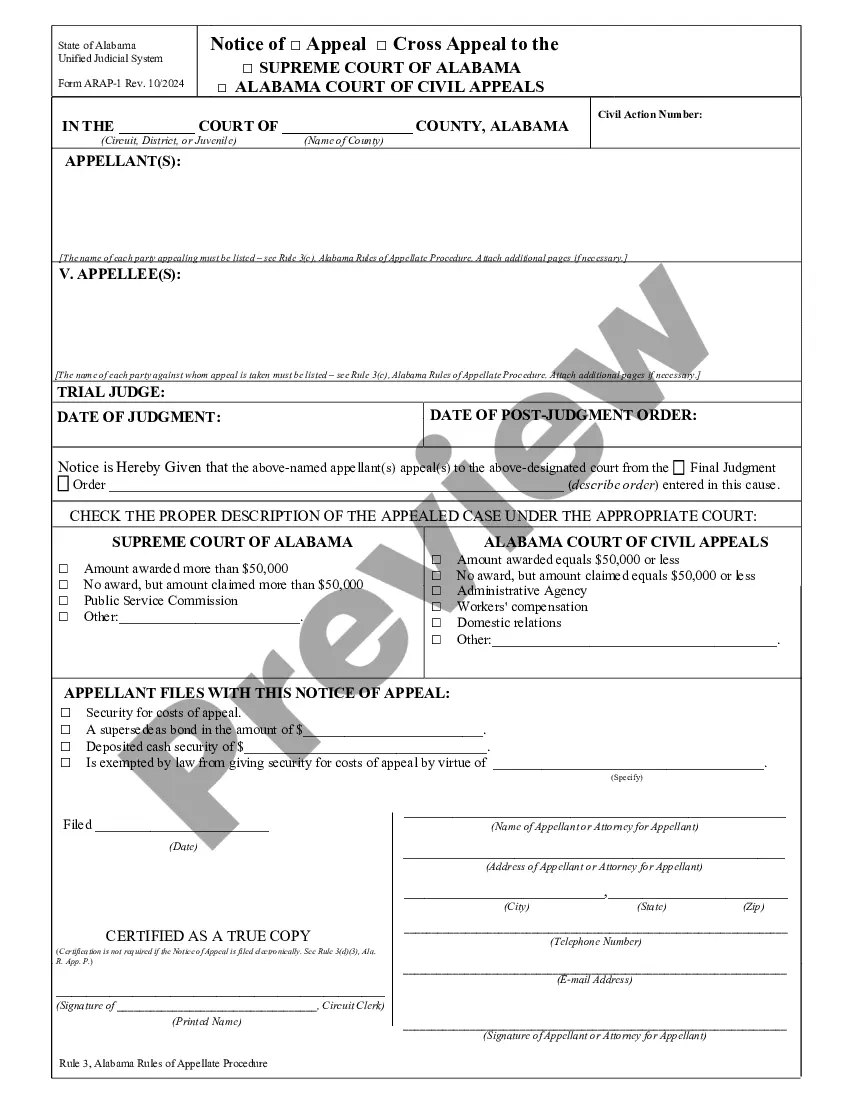

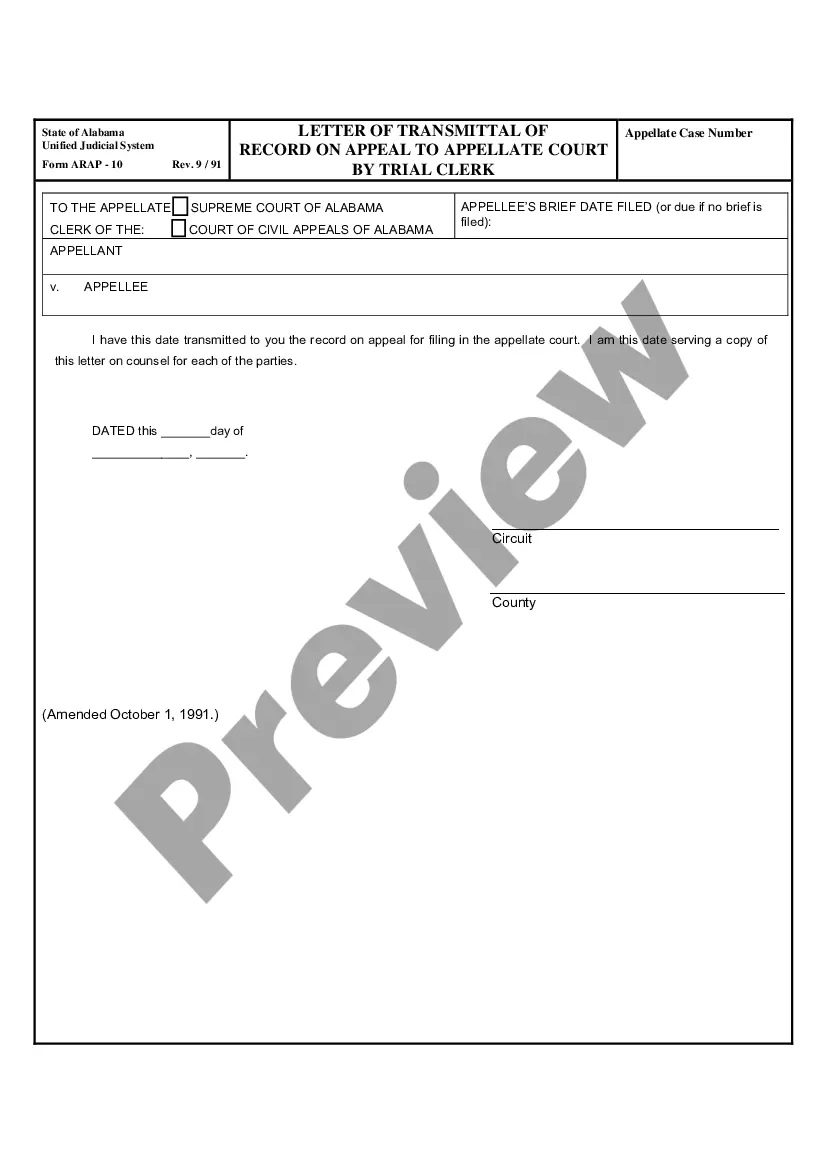

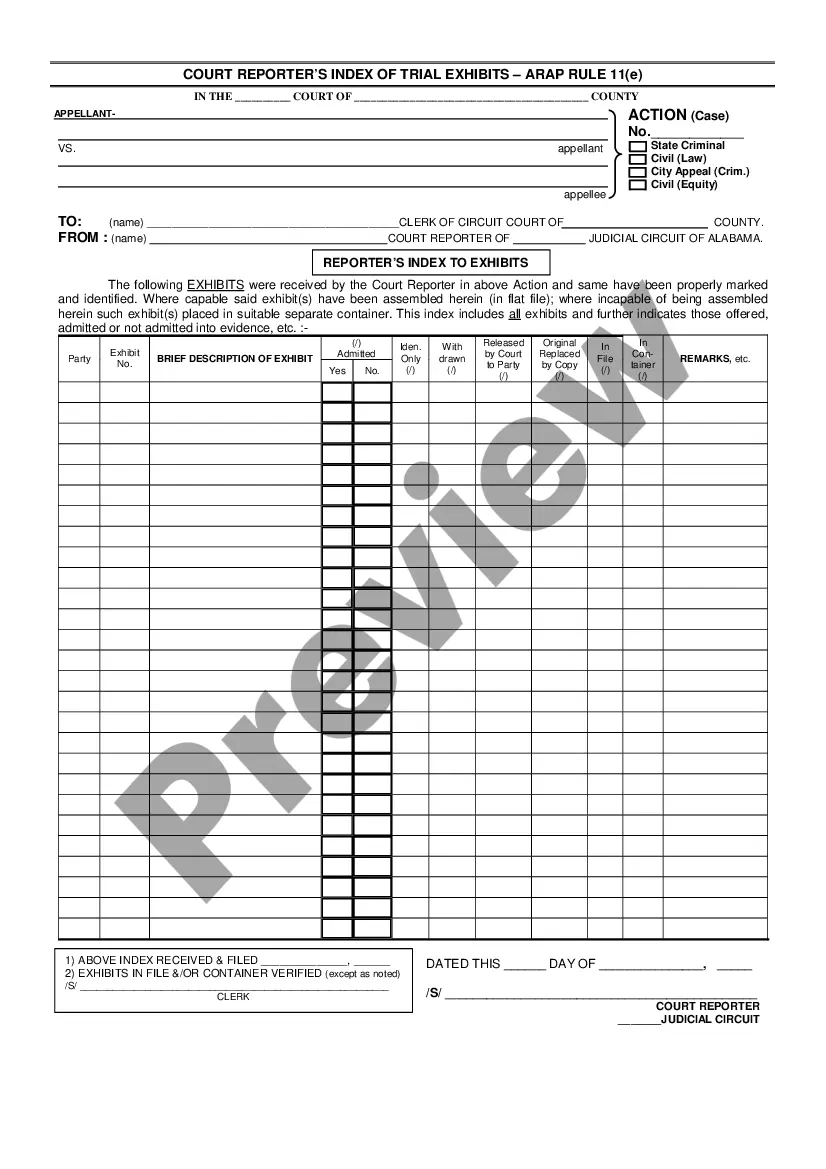

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the San Diego Stock Option Agreement of VIA Internet, Inc..

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!