Title: Understanding the Harris Texas Registration Rights Agreement: Agreement between VIA Net. Works, Inc. and Certain Stockholders Introduction: The Harris Texas Registration Rights Agreement is a crucial document that outlines the terms and conditions applicable to the registration of securities held by certain stockholders of VIA Net. Works, Inc. This agreement ensures that the stockholders have the right to register their shares or other equity interests in accordance with applicable securities laws. In this comprehensive description, we will dive into the details of this agreement, its significance, and understand the different types it may include. 1. Definition and Purpose of the Harris Texas Registration Rights Agreement: The Harris Texas Registration Rights Agreement is a legally binding contract between VIA Net. Works, Inc., a company issuing securities, and specific stockholders which grants them certain rights related to the registration of their securities. This agreement primarily aims to protect the stockholders' interest in ensuring their ability to sell or transfer their securities and obtain the benefits of a public market. 2. Understanding the Rights Provided: Under the Harris Texas Registration Rights Agreement, stockholders typically secure the following rights: a. Demand Registration Rights: Demand registration allows stockholders to request VIA Net. Works, Inc. to register their securities with the appropriate regulatory authorities. This right is triggered when the stockholder submits a written demand request, and the agreement outlines the process, timelines, and associated costs. b. Piggyback Registration Rights: Piggyback registration provides stockholders the option to include their securities in any registration undertaken by VIA Net. Works, Inc. for its own offerings or for other stockholders. This right assures that stockholders have the opportunity to sell securities alongside the company's offerings. 3. Types of Harris Texas Registration Rights Agreement: Depending on the specific circumstances and negotiations, the Harris Texas Registration Rights Agreement can include additional provisions to address the parties' unique requirements. Common variations of this agreement may involve: a. S-3 Shelf Registration Rights: This type of agreement allows stockholders to take advantage of the SEC's S-3 registration statement, which offers an expedited and cost-effective process for offering securities to the public. b. Lock-Up Provisions: Lock-up provisions may restrict the stockholders from selling or transferring their securities for a specified period after an initial public offering (IPO) or another predetermined event. These provisions ensure stability and prevent excessive volatility in the market. c. Registration Expenses: The agreement may outline the allocation of registration expenses incurred during the registration process, such as filing fees, legal expenses, and underwriting discounts. Conclusion: The Harris Texas Registration Rights Agreement acts as a crucial instrument to protect the rights of certain stockholders of VIA Net. Works, Inc. By granting them the ability to register their securities under specific conditions, this agreement facilitates liquidity, enhances marketability, and ensures fair treatment for stockholders. Understanding the various types and provisions of this agreement is pivotal for all parties involved in the process of securities registration.

Harris Texas Registration Rights Agreement Agreement between VIA Net.Works, Inc. and certain stockholders

Description

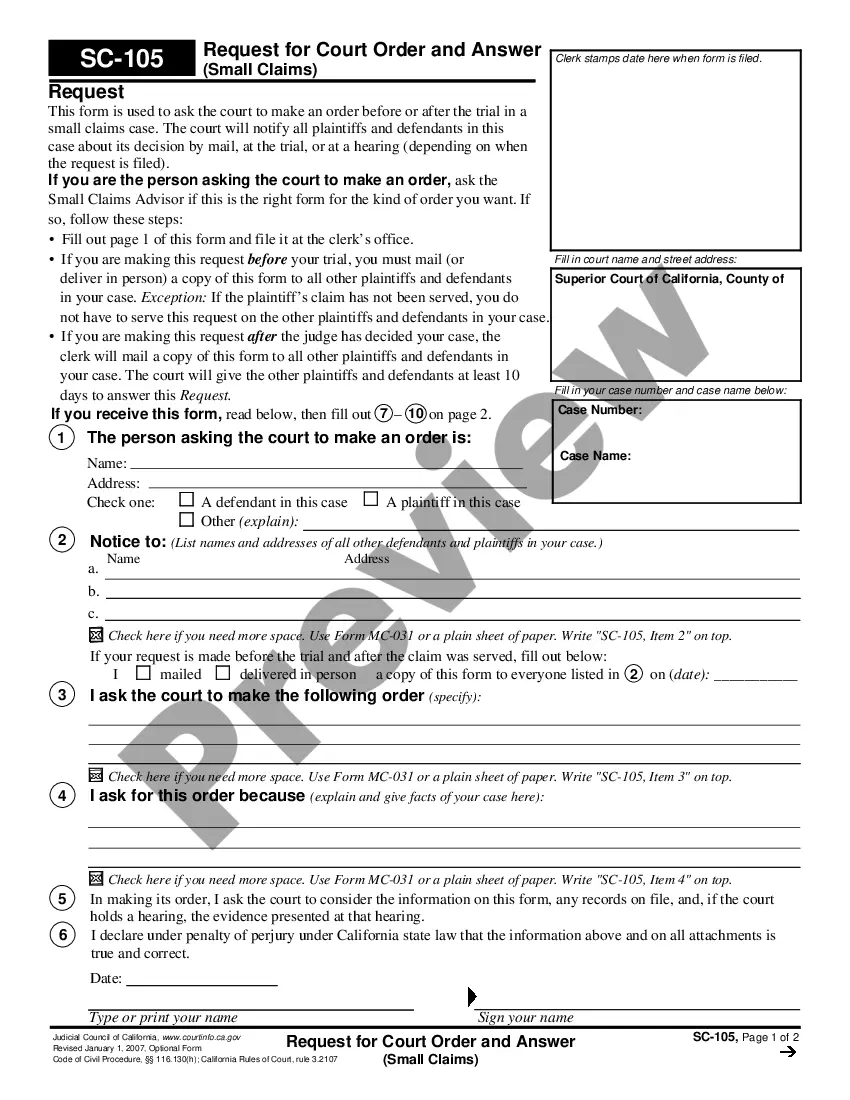

How to fill out Harris Texas Registration Rights Agreement Agreement Between VIA Net.Works, Inc. And Certain Stockholders?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Harris Registration Rights Agreement Agreement between VIA Net.Works, Inc. and certain stockholders, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various types ranging from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find information resources and guides on the website to make any activities related to document completion simple.

Here's how to find and download Harris Registration Rights Agreement Agreement between VIA Net.Works, Inc. and certain stockholders.

- Go over the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the validity of some documents.

- Check the similar document templates or start the search over to locate the right document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment gateway, and purchase Harris Registration Rights Agreement Agreement between VIA Net.Works, Inc. and certain stockholders.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Harris Registration Rights Agreement Agreement between VIA Net.Works, Inc. and certain stockholders, log in to your account, and download it. Of course, our platform can’t replace a lawyer completely. If you have to cope with an extremely difficult situation, we recommend using the services of a lawyer to examine your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-specific documents with ease!