Title: Understanding Travis Texas Registration Rights Agreements: Agreement between VIA Net. Works, Inc. and Certain Stockholders Introduction: In the corporate landscape, registration rights agreements play a vital role in safeguarding the interests of stockholders during the issuance of securities. This article aims to provide a detailed description of the Travis Texas Registration Rights Agreement specifically signed between VIA Net. Works, Inc. and certain stockholders. We will explore the purpose, key components, and potential variations of this agreement, shedding light on its significance in the business world. 1. Definition and Purpose of Travis Texas Registration Rights Agreement: The Travis Texas Registration Rights Agreement is a legal contract between VIA Net. Works, Inc. (the Company) and a specified group of stockholders. This agreement grants the stockholders certain rights and privileges related to the registration of securities with the U.S. Securities and Exchange Commission (SEC) or other regulatory bodies. The primary objective is to provide stockholders with the ability to register and sell their shares freely, ensuring liquidity and fair market value. 2. Key Components of the Agreement: a) Demand Registration Rights: Stockholders are granted the right to request the Company to register their shares with the SEC for public sale, subject to certain requirements and limitations. b) Piggyback Registration Rights: These rights enable stockholders to include their shares in the Company's registration statement if the Company plans to sell its securities to the public. c) S-3 Registration Rights: If the Company is eligible to use Form S-3, certain stockholders may have the right to participate in such offerings, subject to specified conditions. d) Shelf Registration Rights: This provision allows stockholders to have their shares registered on a shelf registration statement, granting them the flexibility to sell their shares at their discretion within specific timeframes. e) Expenses and Indemnification: The agreement outlines the responsibilities of each party regarding the payment of registration expenses, including legal and accounting fees, and the indemnification of stockholders against potential liabilities. 3. Variations of Travis Texas Registration Rights Agreement: a) Series-Based Agreement: In instances where a company has issued multiple series of securities, separate registration rights agreements may exist for each series, outlining specific terms and conditions relevant to that particular series. b) Investor-Specific Agreement: Certain stockholders may negotiate unique terms based on their individual investment criteria, offering tailored registration rights tailored to their needs and preferences. c) Termination Clause: The agreement may include provisions specifying circumstances under which the registration rights agreement can be terminated, such as upon the completion of a public offering or the expiration of a specified period. Conclusion: The Travis Texas Registration Rights Agreement is a crucial legal document for both VIA Net. Works, Inc. and certain stockholders. By conferring specific rights related to the registration of securities, this agreement ensures stockholders can participate in public offerings, gain liquidity, and exercise control over their investments. Understanding the key components and potential variations of this agreement is essential for both parties to navigate the complexities of the capital market effectively.

Travis Texas Registration Rights Agreement Agreement between VIA Net.Works, Inc. and certain stockholders

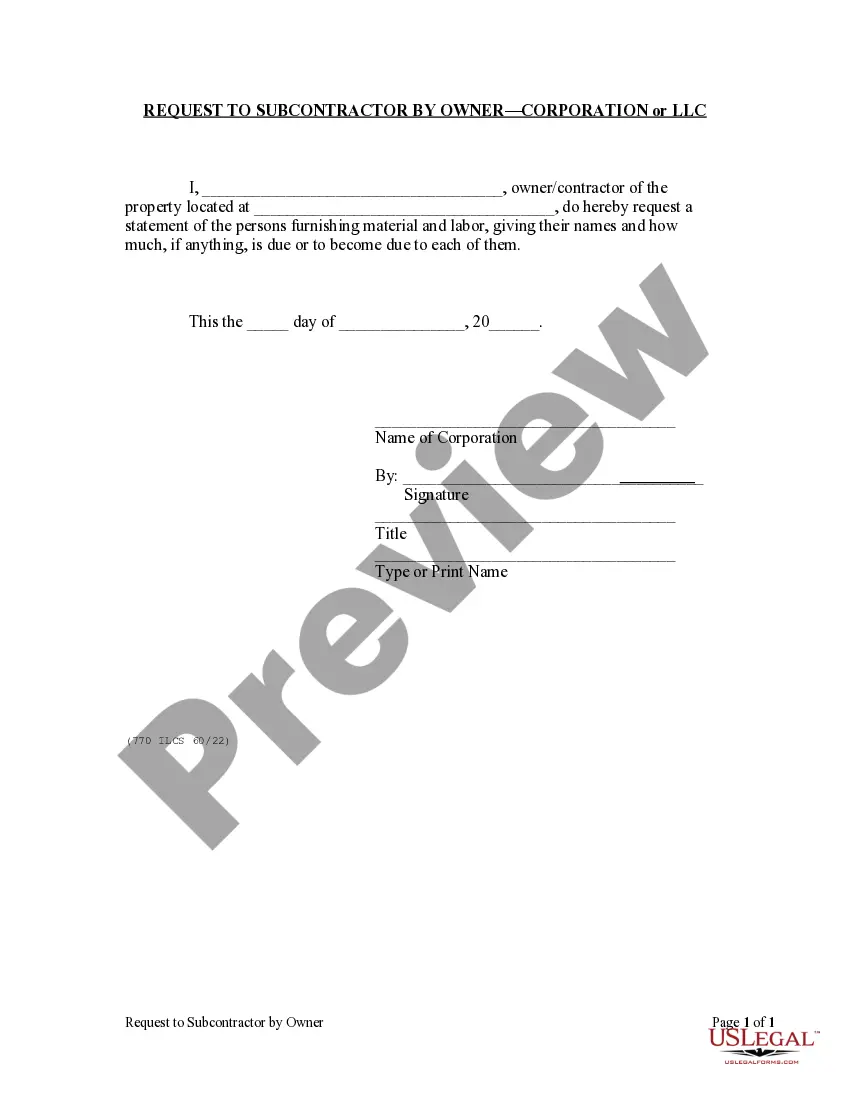

Description

How to fill out Travis Texas Registration Rights Agreement Agreement Between VIA Net.Works, Inc. And Certain Stockholders?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Travis Registration Rights Agreement Agreement between VIA Net.Works, Inc. and certain stockholders suiting all regional requirements can be exhausting, and ordering it from a professional attorney is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. In addition to the Travis Registration Rights Agreement Agreement between VIA Net.Works, Inc. and certain stockholders, here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Travis Registration Rights Agreement Agreement between VIA Net.Works, Inc. and certain stockholders:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Travis Registration Rights Agreement Agreement between VIA Net.Works, Inc. and certain stockholders.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!