Title: Understanding the Maricopa Arizona Stock Tender Agreement: EMC Corp., Eagle Merger Corp., Computer Concepts Corp., et al. Introduction: The Maricopa Arizona Stock Tender Agreement is a legally binding contract that outlines the terms and conditions for the acquisition or merger of EMC Corp., Eagle Merger Corp., Computer Concepts Corp., and other parties involved. This agreement aims to protect the interests of both the acquiring and target companies, ensuring a smooth transition and efficient completion of the transaction. 1. Key Elements of the Maricopa Arizona Stock Tender Agreement: The Maricopa Arizona Stock Tender Agreement typically includes the following key elements: a. Price and Payment Terms: The agreement will specify the price per share that the acquiring company will pay to the target company's shareholders. It outlines the payment terms, whether it is a cash transaction, stock exchange, or a combination of both. b. Tender Offer: The agreement may include a tender offer by the acquiring company to purchase a certain number of shares from the target company's shareholders. This offer typically includes a timeframe within which the shareholders can decide to accept or decline the tender offer. c. Merger or Acquisition Process: The agreement will outline the steps and procedures involved in the merger or acquisition process, including regulatory approvals, shareholder meetings, and closing requirements. d. Representations and Warranties: Both parties will provide representations and warranties to assure each other about the accuracy of the information provided, financial statements, and compliance with laws and regulations. e. Confidentiality and Non-Disclosure: The agreement may contain confidentiality provisions to protect sensitive information and trade secrets of both parties involved. f. Termination and Breach: The agreement will define the circumstances under which the agreement can be terminated and the penalties for any material breach. 2. Different Types of Maricopa Arizona Stock Tender Agreements: While the Maricopa Arizona Stock Tender Agreement between EMC Corp., Eagle Merger Corp., Computer Concepts Corp., et al., may differ based on specific provisions, there are a few common types of agreements: a. Hostile Takeover Tender Offer: In cases where the target company does not willingly agree to a merger or acquisition, the acquiring company might launch a hostile takeover tender offer to purchase the target company's shares directly from its shareholders. b. Friendly Takeover Tender Offer: In contrast to a hostile takeover, a friendly takeover tender offer occurs when the target company agrees to be acquired or merged with the acquiring company. The agreement is established collaboratively, with both parties working together to define the terms and conditions. c. Issuer Tender Offer: This type of agreement is initiated by the company whose shares are to be acquired. The company offers to repurchase its own outstanding shares from its shareholders. Conclusion: The Maricopa Arizona Stock Tender Agreement plays a vital role in shaping the acquisition or merger of companies, ensuring the protection of various stakeholders' interests. By clearly defining the terms, conditions, and procedures, this agreement establishes a framework for a successful and legally compliant transaction between EMC Corp., Eagle Merger Corp., Computer Concepts Corp., et al.

Maricopa Arizona Stock Tender Agreement between EMC Corp., Eagle Merger Corp., Computer Concepts Corp., et al.

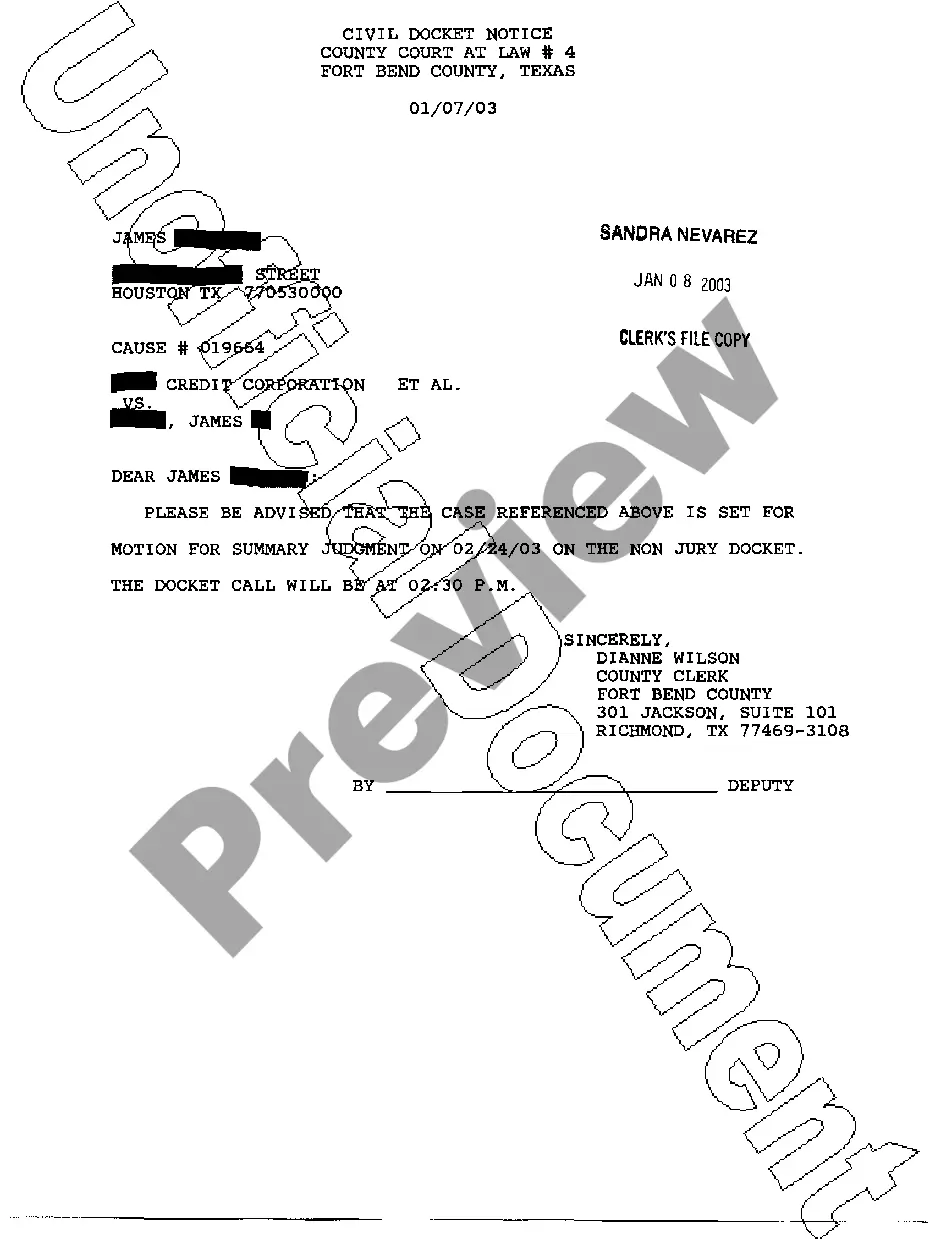

Description

How to fill out Maricopa Arizona Stock Tender Agreement Between EMC Corp., Eagle Merger Corp., Computer Concepts Corp., Et Al.?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Maricopa Stock Tender Agreement between EMC Corp., Eagle Merger Corp., Computer Concepts Corp., et al., it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Therefore, if you need the current version of the Maricopa Stock Tender Agreement between EMC Corp., Eagle Merger Corp., Computer Concepts Corp., et al., you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Stock Tender Agreement between EMC Corp., Eagle Merger Corp., Computer Concepts Corp., et al.:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Maricopa Stock Tender Agreement between EMC Corp., Eagle Merger Corp., Computer Concepts Corp., et al. and download it.

When done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!