The Maricopa Arizona Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders is a legally binding document that outlines the terms and conditions associated with the transfer of stock ownership in Maricopa, Arizona. This agreement serves as a crucial tool for corporations involved in mergers and acquisitions, ensuring a smooth transition of ownership and facilitating the consolidation of assets. Key Terms: 1. Transfer of Ownership: The agreement outlines the process by which the shares of stock owned by the shareholders of EMC Corp. are transferred to Eagle Merger Corp. This includes the necessary paperwork, legal requirements, and timelines involved in the stock transfer. 2. Consideration and Payment: The agreement defines the consideration offered by Eagle Merger Corp. to EMC Corp. shareholders in exchange for their stock. This can include cash payments, stock options, debt, or any other agreed-upon form of consideration. 3. Rights and Obligations of Parties: The stock transfer agreement specifies the rights and obligations of both EMC Corp., Eagle Merger Corp., and the shareholders involved. This may include provisions related to voting rights, dividend entitlements, information sharing, and confidentiality. 4. Representations and Warranties: The agreement contains representations and warranties made by both parties regarding the stock transfer. This ensures that both parties provide accurate and truthful information regarding their ownership, assets, liabilities, and any encumbrances associated with the stock. 5. Indemnification: This section outlines the indemnification provisions agreed upon by the parties, protecting their interests in case of any misrepresentation, breach of warranties, or legal claims arising from the stock transfer. 6. Governing Law and Jurisdiction: The Stock Transfer Agreement specifies the jurisdiction and governing laws under which any disputes or legal actions relating to the agreement will be carried out. Types of Stock Transfer Agreements: 1. Cash Stock Transfer Agreement: This agreement entails the transfer of stock ownership in exchange for a cash consideration offered by Eagle Merger Corp. 2. Stock-For-Stock Transfer Agreement: In this type of agreement, the stock of EMC Corp. shareholders is exchanged for the shares of Eagle Merger Corp. This form of consideration allows shareholders to become owners in the merged entity. 3. Cash and Stock Transfer Agreement: This agreement involves a combination of cash and stock consideration given by Eagle Merger Corp. to EMC Corp. shareholders. The agreement sets out the ratio or formula used to determine the allocation of cash and stock. 4. Escrow Stock Transfer Agreement: In certain cases, a portion of the consideration is held in escrow for a specified period to protect against any potential future claims related to the stock transfer. By executing the Maricopa Arizona Stock Transfer Agreement, EMC Corp., Eagle Merger Corp., and the shareholders safeguard their rights, interests, and responsibilities throughout the stock transfer process. This legal document ensures transparency, clarity, and fairness in the exchange of ownership, aiming to facilitate a seamless transition and foster a successful merger or acquisition.

Maricopa Arizona Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders

Description

How to fill out Maricopa Arizona Stock Transfer Agreement Between EMC Corp., Eagle Merger Corp., And Shareholders?

Drafting papers for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft Maricopa Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders without expert assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Maricopa Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders on your own, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Maricopa Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders:

- Examine the page you've opened and verify if it has the sample you require.

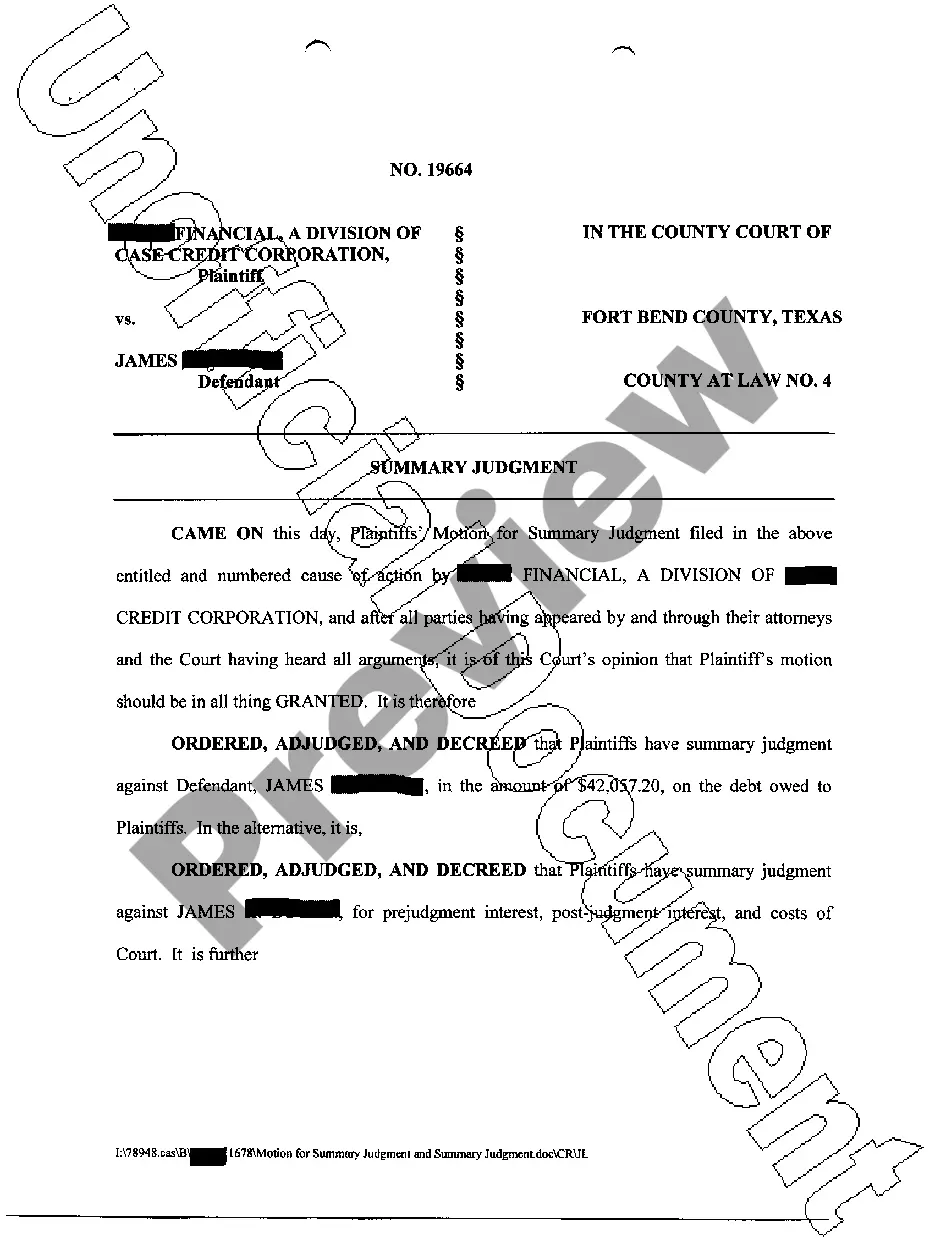

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any situation with just a couple of clicks!