Tarrant Texas Stock Transfer Agreement is a legally binding contract between EMC Corp., Eagle Merger Corp., and the shareholders involved in the stock transfer process. This agreement outlines the terms, conditions, and responsibilities associated with the sale or transfer of stock shares. It serves as a crucial document to ensure a smooth and transparent transaction between the involved parties. The specific details of a Tarrant Texas Stock Transfer Agreement may vary depending on the unique circumstances of each transaction. However, it typically includes the following key elements: 1. Parties Involved: The agreement clearly identifies the participating parties, namely EMC Corp., Eagle Merger Corp., and the shareholders looking to transfer their stock shares. This establishes the legal framework necessary to proceed with the stock transfer process. 2. Transfer of Stock Shares: The agreement specifies the number of shares being transferred and the method of transfer, ensuring accurate record-keeping and preventing any discrepancies during the transaction. 3. Purchase Price: The agreement outlines the agreed-upon purchase price for the stock shares being transferred. This can be a fixed price or based on certain valuation methods, such as market value or book value, depending on the negotiation between the parties involved. 4. Payment Terms: The agreement includes provisions regarding the payment terms, such as the agreed-upon payment schedule and the acceptable methods of payment for the stock shares. This ensures clarity and eliminates any confusion regarding the financial aspects of the transaction. 5. Representations and Warranties: Both parties involved in the stock transfer provide certain representations and warranties to ensure that they have the legal capacity to undertake the agreement. These may include confirming ownership of the stock shares, asserting that there are no encumbrances or third-party claims on the shares, and other relevant assurances. 6. Conditions Precedent: The agreement may specify certain conditions that must be met before the stock transfer can be completed. This could include obtaining necessary regulatory approvals, securing any necessary consents, or other specific requirements that need to be fulfilled. 7. Governing Law and Jurisdiction: The agreement includes provisions stating which jurisdiction's laws will govern the agreement and any potential disputes. This helps establish the legal framework for resolving any disagreements that may arise during or after the stock transfer process. It is important to note that the specific types of Tarrant Texas Stock Transfer Agreements between EMC Corp., Eagle Merger Corp., and shareholders may vary depending on the specific transaction being entered into. For instance, there might be different agreements for a direct stock purchase, stock options, or stock transfers related to mergers and acquisitions. Each agreement is customized to address the unique needs and circumstances of the parties involved. In summary, a Tarrant Texas Stock Transfer Agreement is a comprehensive document that governs the transfer of stock shares between EMC Corp., Eagle Merger Corp., and shareholders. It ensures transparency, protects the rights of all parties involved, and serves as a legal record of the transaction.

Tarrant Texas Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders

Description

How to fill out Tarrant Texas Stock Transfer Agreement Between EMC Corp., Eagle Merger Corp., And Shareholders?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from scratch, including Tarrant Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different types varying from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information resources and guides on the website to make any tasks associated with document execution straightforward.

Here's how to purchase and download Tarrant Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders.

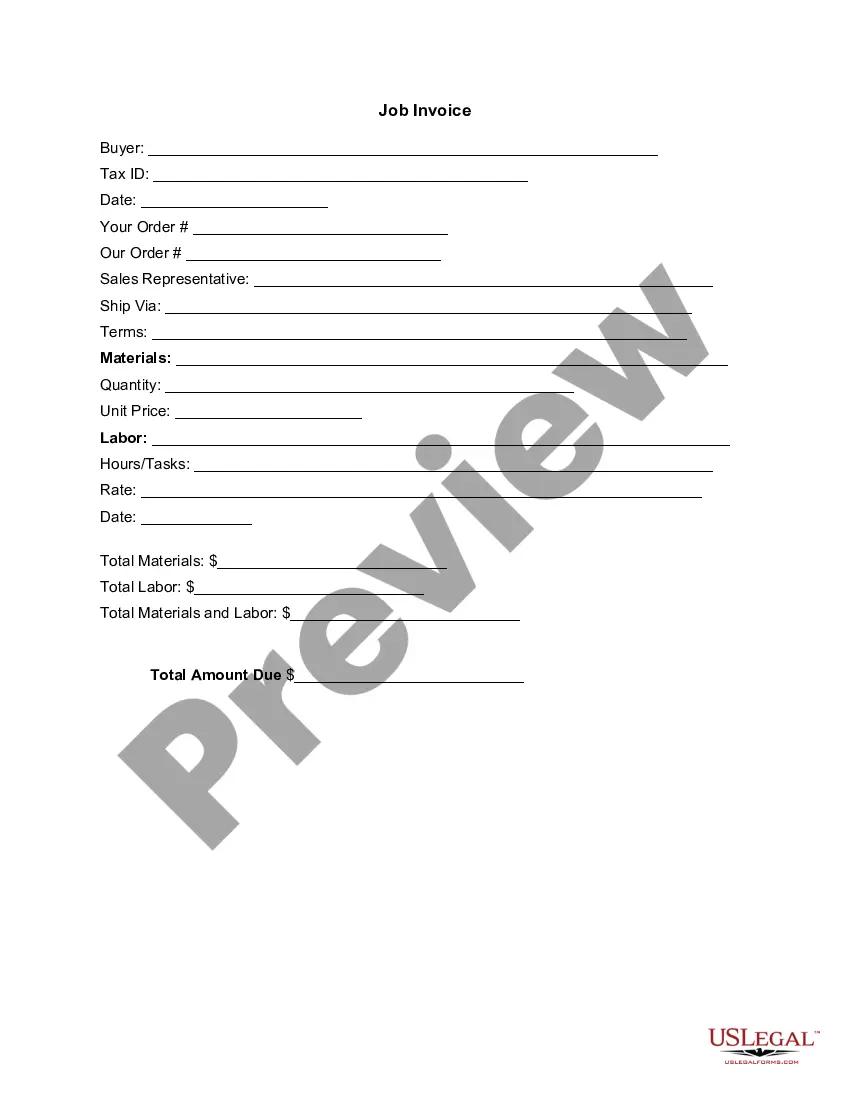

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some documents.

- Examine the similar document templates or start the search over to locate the appropriate file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Tarrant Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Tarrant Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer completely. If you need to deal with an exceptionally difficult case, we recommend getting a lawyer to review your document before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and purchase your state-compliant paperwork effortlessly!