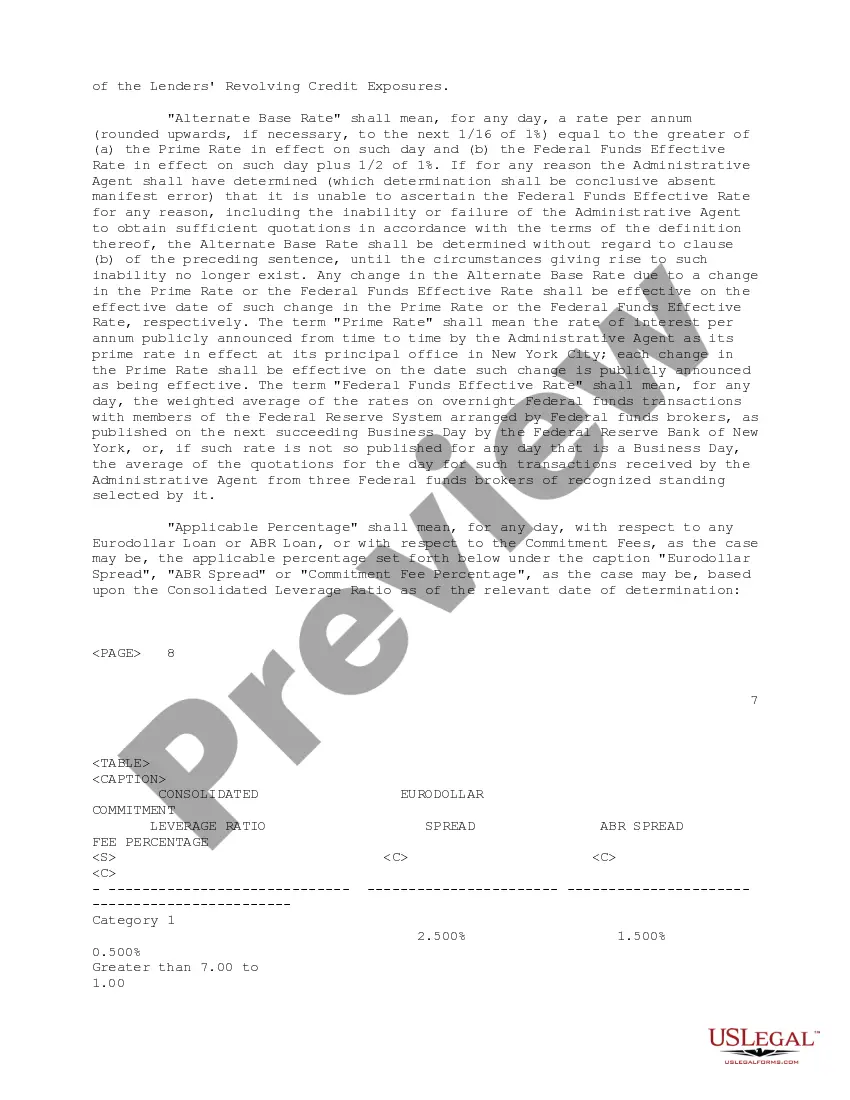

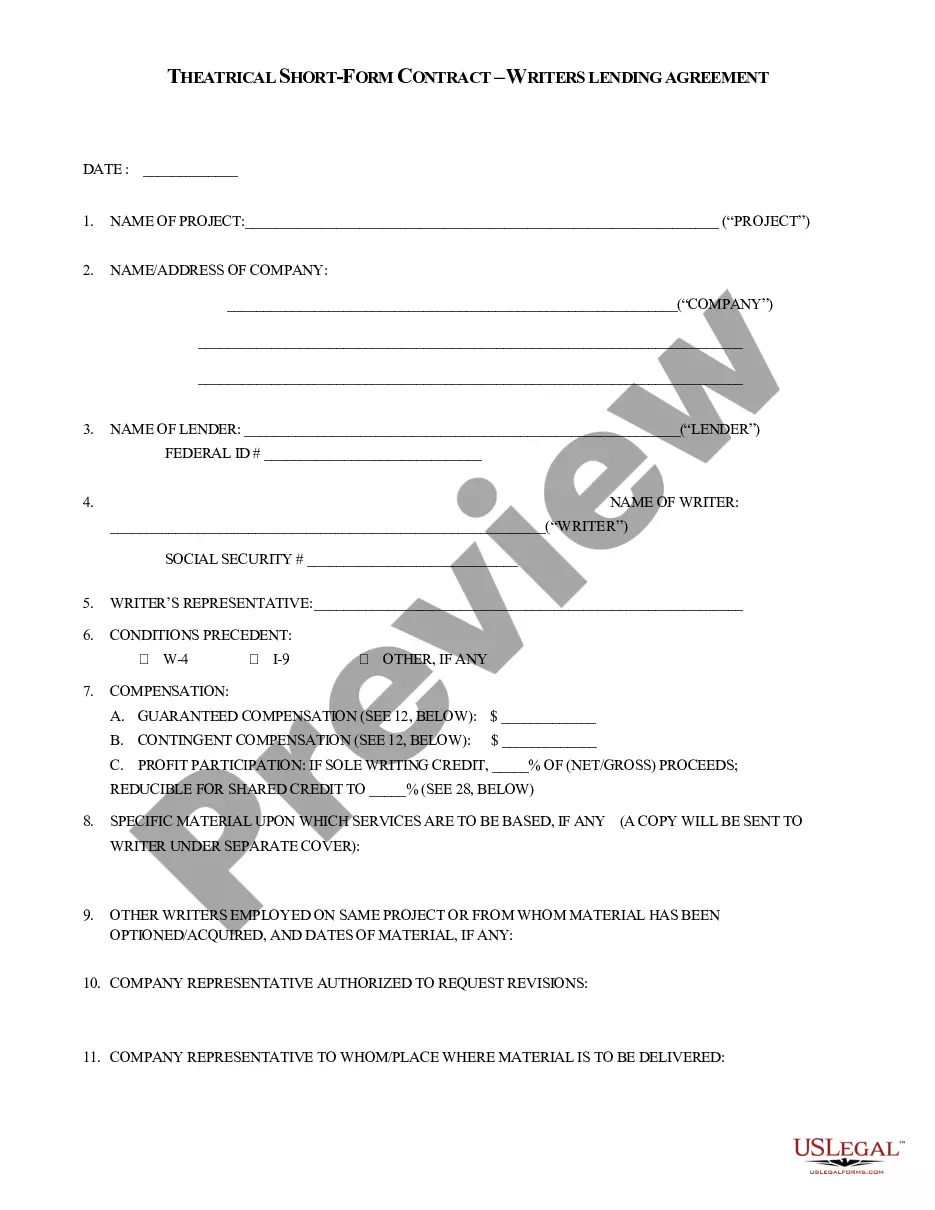

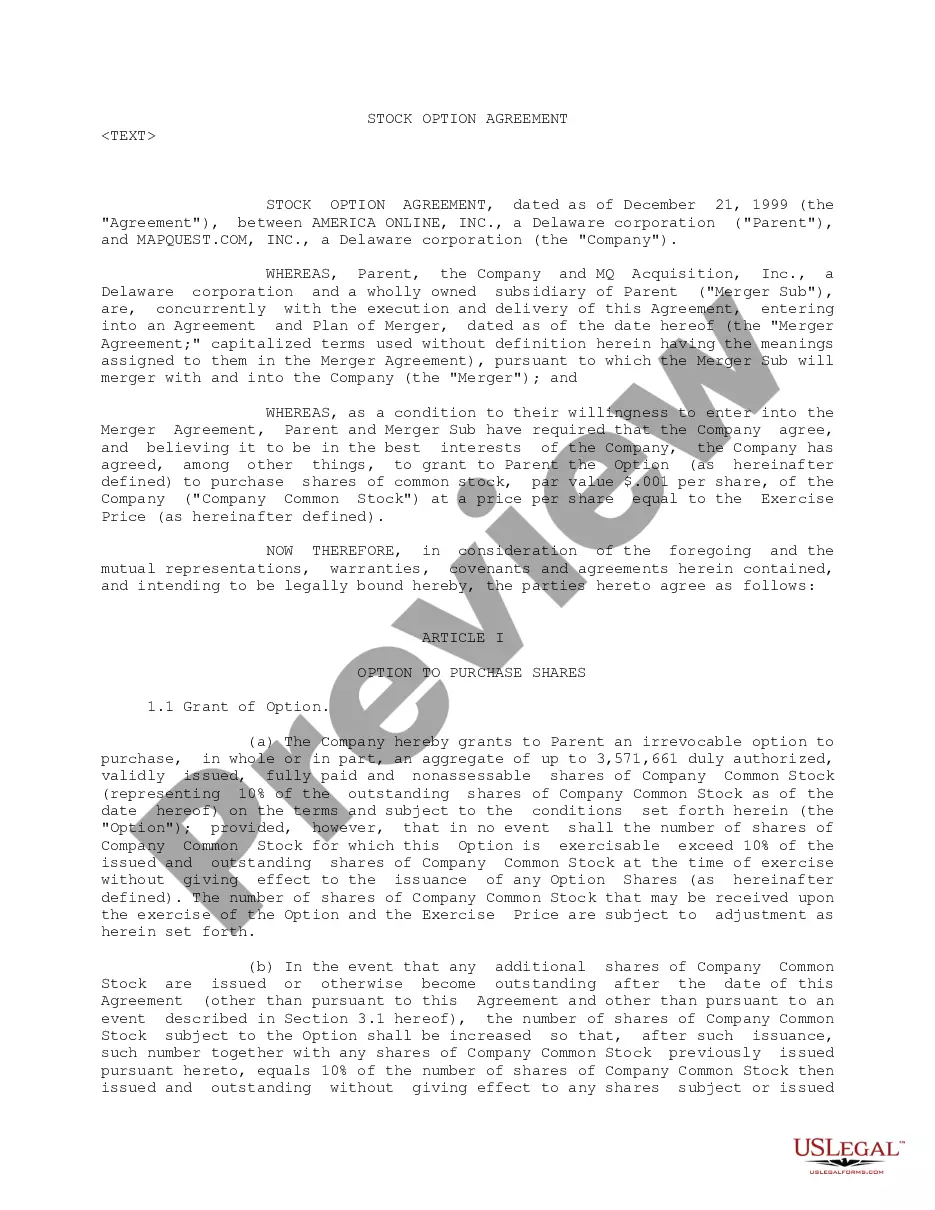

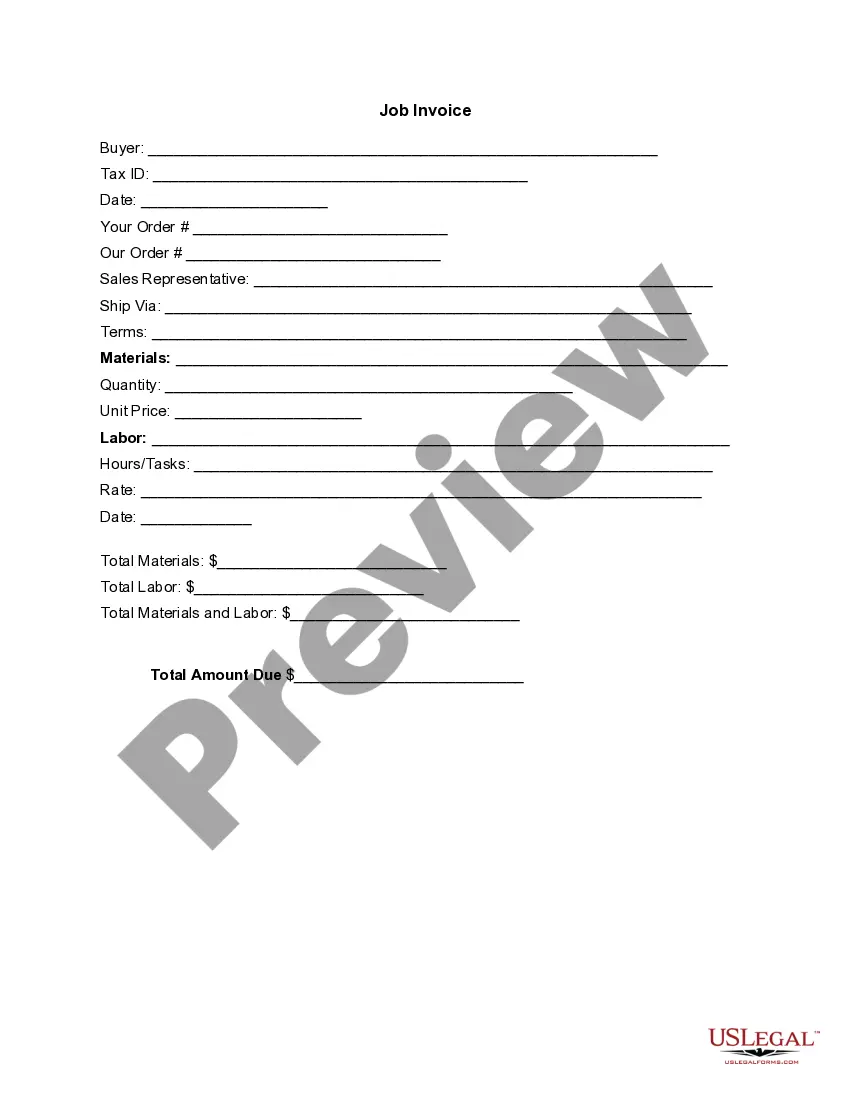

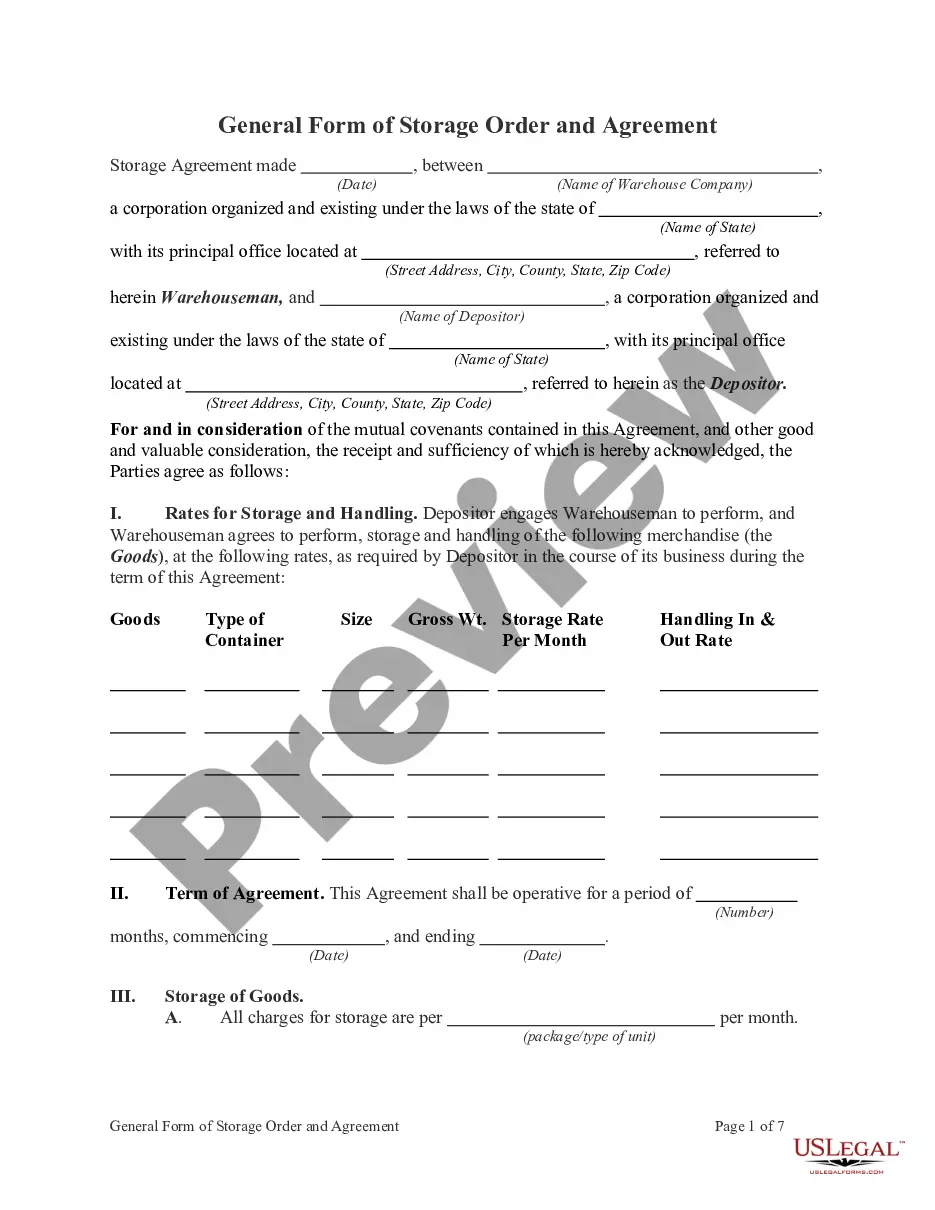

Houston Texas Credit Agreement is a formal contract between a lender and a borrower for the extension of credit. This agreement outlines the terms and conditions associated with the extension of credit, such as interest rates, repayment schedules, and other requirements. The agreement serves as a legal document that protects the rights and obligations of both parties involved. There are several types of Houston Texas Credit Agreements regarding the extension of credit, each catering to different financial needs and circumstances. Some common types include: 1. Personal Credit Agreement: This type of agreement is commonly used by individuals seeking credit for personal expenses, such as home renovations, education, or medical bills. It outlines the borrowing terms and allows the borrower to receive a lump sum amount or access a credit line as needed. 2. Business Credit Agreement: Designed for business entities, this agreement enables companies to secure credit for various purposes, such as working capital, expansion, or purchasing inventory. It typically includes provisions regarding collateral, financial covenants, and repayment terms specific to business needs. 3. Mortgage Credit Agreement: Specifically used for financing real estate properties, a mortgage credit agreement outlines the terms for borrowing funds to purchase a home or property. It includes details about the mortgage loan, repayment terms, interest rates, and potential consequences in case of default. 4. Revolving Credit Agreement: This type of agreement offers a flexible line of credit with a predetermined credit limit. It allows the borrower to access funds as needed, repay them, and borrow again within the agreed limit. Revolving credit agreements are commonly used for short-term financing needs, such as managing cash flow fluctuations in businesses. 5. Installment Credit Agreement: This agreement specifies fixed repayment plans, typically monthly, where borrowers receive a lump sum initially and repay it in regular installments over an agreed-upon period. It is commonly used for personal loans, auto loans, or other large purchases requiring gradual repayment. Houston Texas Credit Agreements are typically governed by state and federal laws, including the Texas Finance Code and the Truth in Lending Act. It is crucial for both the lender and borrower to carefully review and understand the terms of the agreement before signing, ensuring compliance and protection for all parties involved in credit transactions.

Houston Texas Credit Agreement regarding extension of credit

Description

How to fill out Houston Texas Credit Agreement Regarding Extension Of Credit?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from scratch, including Houston Credit Agreement regarding extension of credit, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various types varying from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find detailed resources and tutorials on the website to make any tasks associated with paperwork completion straightforward.

Here's how to purchase and download Houston Credit Agreement regarding extension of credit.

- Take a look at the document's preview and outline (if provided) to get a general information on what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the legality of some documents.

- Check the similar document templates or start the search over to locate the right file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment gateway, and buy Houston Credit Agreement regarding extension of credit.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Houston Credit Agreement regarding extension of credit, log in to your account, and download it. Of course, our website can’t take the place of an attorney completely. If you have to deal with an exceptionally complicated situation, we recommend using the services of an attorney to review your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork with ease!

Form popularity

FAQ

The most common types of lines of credit (LOCs) are personal, business, and home equity (HELOCs). In general, personal LOCs are typically unsecured, while business LOCs can be secured or unsecured.

A credit agreement is a legally-binding contract documenting the terms of a loan agreement; it is made between a person or party borrowing money and a lender.

Initial Ownership Credit Addendum means the addendum filed with the Administrator by each Participating Agency, which sets forth the Initial Ownership Credit Amount applicable to the Participating Agency's Participants in the Initial Ownership Program.

A personal loan contract is a legally binding document regardless of whether the lender is a financial institution or another person. The consequences are the same if you default on the contract. As a borrower, you could be sued by the lender or lose the asset or assets used to secure the loan.

A credit agreement is a legally-binding contract documenting the terms of a loan agreement; it is made between a person or party borrowing money and a lender. The credit agreement outlines all of the terms associated with the loan. Credits agreements are created for both retail and institutional loans.

Once signed, the credit application is legally binding, including all terms and conditions outlined within the agreement.

To extend credit means ?to make or renew any loan, or to enter into any agreement, tacit or express, whereby the repayment or satisfaction of any debt or claim, whether acknowledged or disputed, valid or invalid, and however arising, may or will be deferred.?

A lender is as we have seen is obliged to provide a copy of the credit agreement. The agreement is unenforceable until such time as they provide a copy. Once they do so it will become enforceable. Irredeemably unenforceable agreements are the ones which breach section 60 or section 65 of the Consumer Credit Act.

A line of credit is a credit facility extended by a bank or other financial institution to a government, business or individual customer that enables the customer to draw on the facility when the customer needs funds.

Different types of lines of credit include: Open-end credit or Revolving line of credit. Secured credit. Unsecured credit.

Interesting Questions

More info

Please have the original of this form in your hand before you fill the forms out so that you will be able to keep the necessary documents in your hand during your consultation: ‸ Form 1098 for the Year 2000‸ Form 1098 for the Year 2006‸ Form 1098 for the Year 2010‸ Form 945‸ Form 945 for the Year 2011‸ Form 945 for the Year 2014, and Form 8863‸ Form 945 for the Year 2015 for more detailed information on this form. You don't need to pay this fee if you don't want to. 4. The lender has provided a detailed questionnaire for the Customer in the form of Letter of Credit for the Years 2000 to 2015. Ask the lender to help you fill out the questionnaire. Please have it with you. It will not affect you in any way. Once the lender has verified that you have paid the overdue amount, you can make a small change to the loan information in your application letter, to be added to the loan summary when you send it to the lender.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.