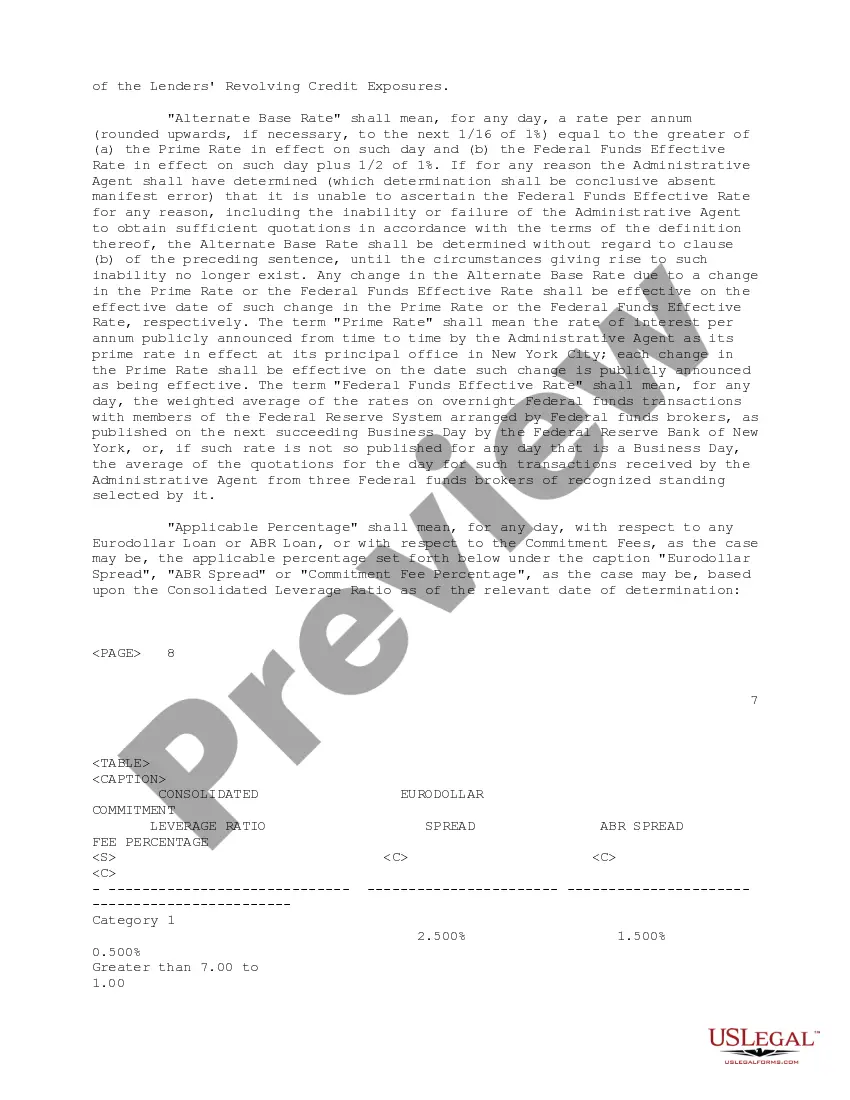

The Mecklenburg North Carolina Credit Agreement regarding extension of credit is a legally binding document that outlines the terms and conditions under which a creditor agrees to extend credit to a borrower in Mecklenburg County, North Carolina. This agreement is designed to protect the rights and interests of both parties involved in the lending process. The Mecklenburg North Carolina Credit Agreement may differ depending on the type of credit being extended. Some common types of credit agreements in Mecklenburg County include: 1. Mortgage Credit Agreement: This type of credit agreement is specifically for real estate transactions. It sets out the terms under which a lender provides funds to a borrower for the purchase or refinancing of a property in Mecklenburg County. The agreement typically includes details regarding loan amount, interest rate, repayment schedule, and any collateral or security required. 2. Personal Loan Credit Agreement: This credit agreement is applicable when a creditor provides a borrower with funds for personal use, such as debt consolidation, home improvement, or education expenses. It outlines the terms and conditions of the loan, including interest rate, repayment period, any fees or charges, and consequences of late payments or default. 3. Business Credit Agreement: This type of credit agreement is tailored for business purposes, where a lender extends funds to a business entity in Mecklenburg County. It typically includes information about the loan amount, purpose of the loan, repayment terms, interest rate, collateral or guarantees required, and any specific conditions or covenants. The Mecklenburg North Carolina Credit Agreement includes several essential elements to ensure clarity and protection for both parties. These may include: — Loan Amount: The total sum being extended as credit by the lender. — Interest Rate: The percentage charged on the loan amount, which determines the cost of borrowing. — Repayment Schedule: The timeline and frequency of payments, specifying the due dates and amount to be paid. — Fees and Charges: Any additional costs associated with the credit agreement, such as origination fees or late payment charges. — Collateral or Security: Any assets or property being offered as collateral to secure the loan. — Prepayment or Early Termination: Terms regarding early repayment of the loan, including any penalties or fees. — Default and Remedies: The actions that can be taken by the lender in the event of non-payment or breach of the credit agreement. It is crucial for both borrowers and lenders in Mecklenburg County to carefully review and understand the terms of the Credit Agreement before signing. Seeking professional advice and ensuring compliance with relevant state and federal laws is highly recommended.

Mecklenburg North Carolina Credit Agreement regarding extension of credit

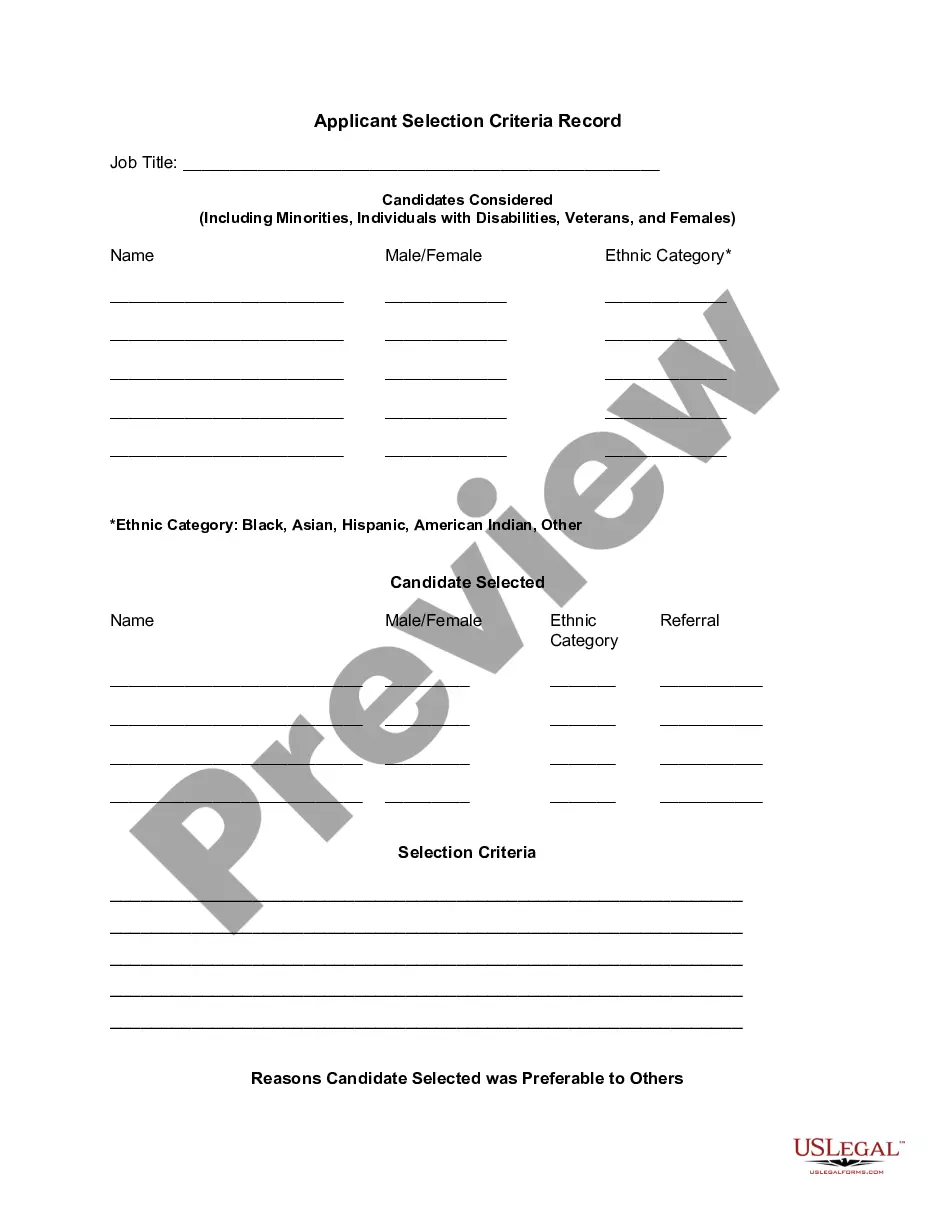

Description

How to fill out Mecklenburg North Carolina Credit Agreement Regarding Extension Of Credit?

Draftwing documents, like Mecklenburg Credit Agreement regarding extension of credit, to manage your legal matters is a difficult and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms created for a variety of cases and life circumstances. We make sure each form is compliant with the laws of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Mecklenburg Credit Agreement regarding extension of credit form. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly easy! Here’s what you need to do before downloading Mecklenburg Credit Agreement regarding extension of credit:

- Make sure that your document is specific to your state/county since the rules for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Mecklenburg Credit Agreement regarding extension of credit isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start utilizing our service and get the form.

- Everything looks good on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s easy to locate and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!