Nassau New York Credit Agreement: In-Depth Description of Credit Extension Terms The Nassau New York Credit Agreement is a legally binding document that outlines the terms, conditions, and responsibilities associated with the extension of credit in Nassau County, New York. This agreement serves as a vital tool for lenders and borrowers, ensuring a transparent relationship and safeguarding the interests of both parties involved. Within the realm of credit agreements, there are various types offered in Nassau County, New York, each catering to distinct circumstances and needs. Some prominent Nassau New York Credit Agreement types pertinent to credit extension include: 1. Personal Credit Agreement: This type of credit agreement is entered into between an individual borrower and a lending institution. It details the terms, conditions, and interest rates associated with the extension of personal credit. Personal credit agreements can facilitate funding for personal expenses, education, medical bills, and other individual needs. 2. Business Credit Agreement: This agreement is designed explicitly for businesses in Nassau County, New York, facilitating credit extensions to aid operational requirements, investments, expansions, or other business-related expenditures. Business credit agreements typically outline the credit limit, repayment terms, collateral, and any specific covenants or restrictions. 3. Mortgage Credit Agreement: A mortgage credit agreement focuses on providing credit for real estate purchases or refinancing. This type of credit extension in Nassau County requires the borrower to offer the property being financed as collateral, ensuring the lender's security. It outlines the loan amount, interest rate, repayment period, and any contingencies associated with the property. 4. Line of Credit Agreement: This Nassau County Credit Agreement type establishes a flexible credit option that allows borrowers to access a predetermined credit limit as needed. A line of credit agreement delineates the interest rate, draw period, and repayment terms, granting borrowers the convenience of having funds available when required. Regardless of the specific type, a Nassau New York Credit Agreement will typically include essential components such as: a) Parties Involved: The agreement identifies both the borrower(s) and lender(s) by name and contact details. b) Terms and Conditions: The agreement specifies the credit amount, interest rate, repayment frequency, and duration, along with any penalties or fees associated with late or missed payments. c) Collateral: If applicable, the agreement outlines the collateral that secures the credit extension, ensuring the lender's recourse in case of default. d) Rights and Obligations: The agreement delineates the rights, duties, and responsibilities of both the borrower and the lender, such as reporting requirements, usage restrictions, and confidentiality provisions. e) Dispute Resolution Mechanisms: The agreement may include provisions for resolving disputes, such as arbitration or mediation, to avoid costly legal proceedings. f) Governing Law: The Nassau New York Credit Agreement specifies the jurisdiction and laws applicable to the agreement, providing clarity in case of any legal disputes. In conclusion, the Nassau New York Credit Agreement encompasses various types, tailored to cater to different credit needs in Nassau County, New York. Whether it is personal, business, mortgage-related, or a line of credit, these agreements play a crucial role in defining the terms, obligations, and liabilities associated with credit extension, ensuring a secure and transparent financial relationship between lenders and borrowers.

Nassau New York Credit Agreement regarding extension of credit

Description

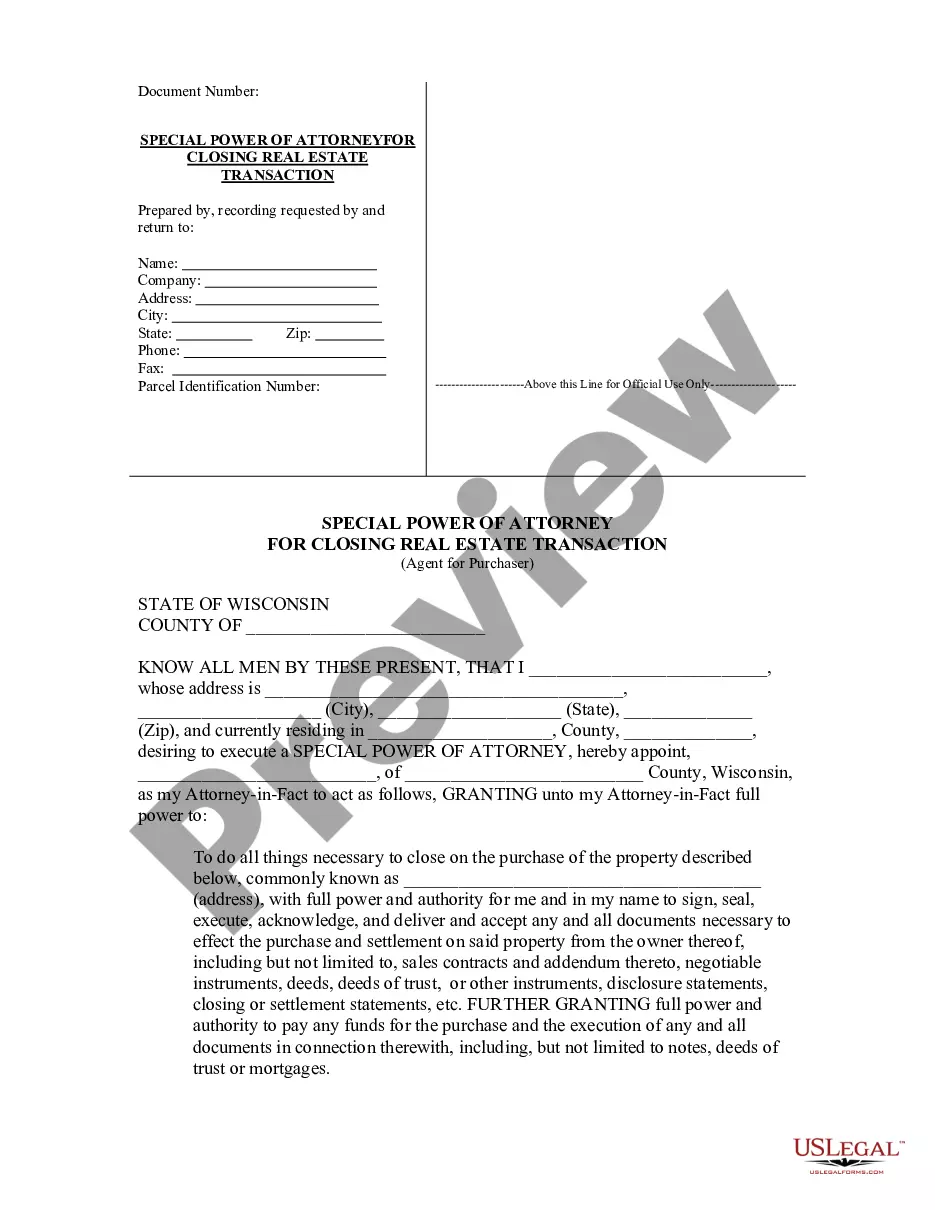

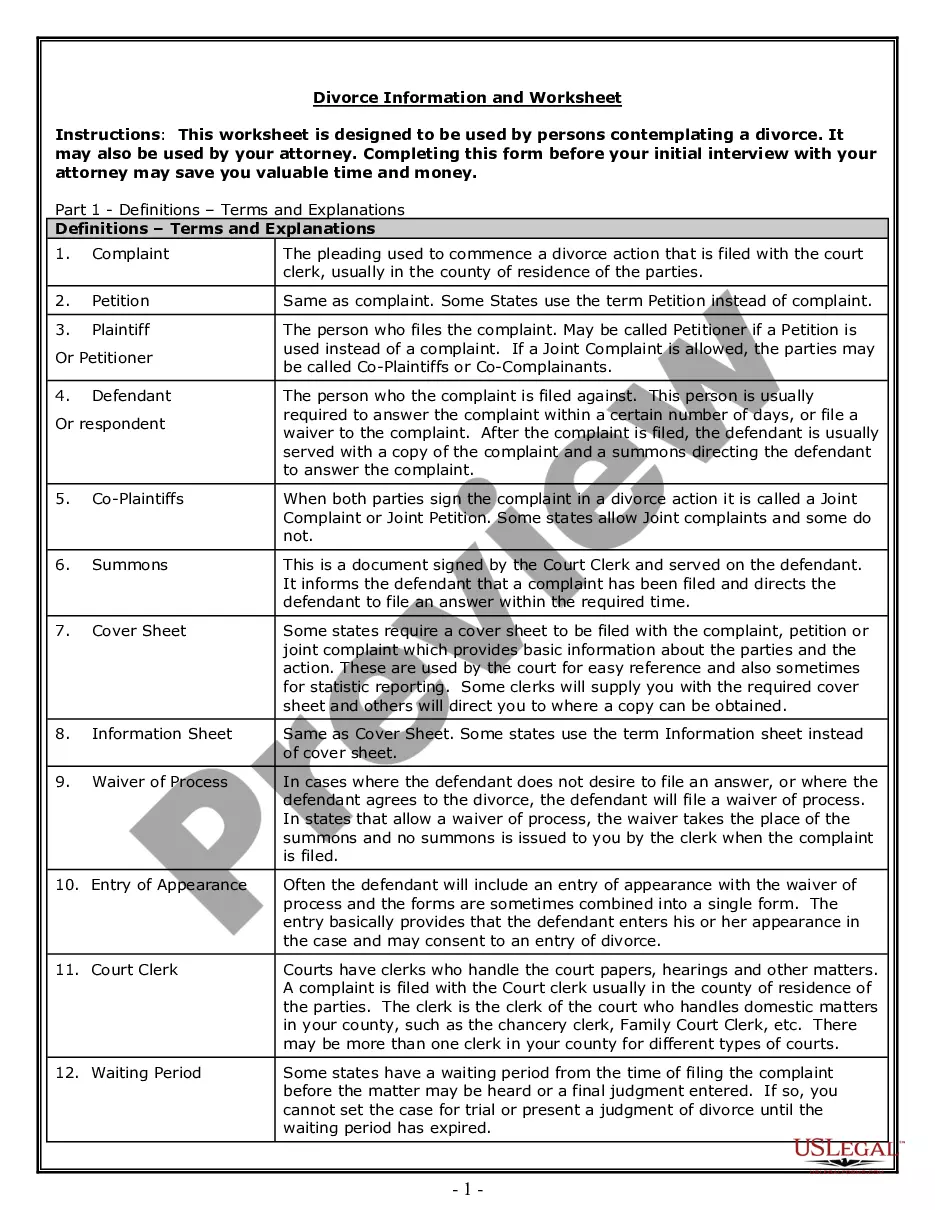

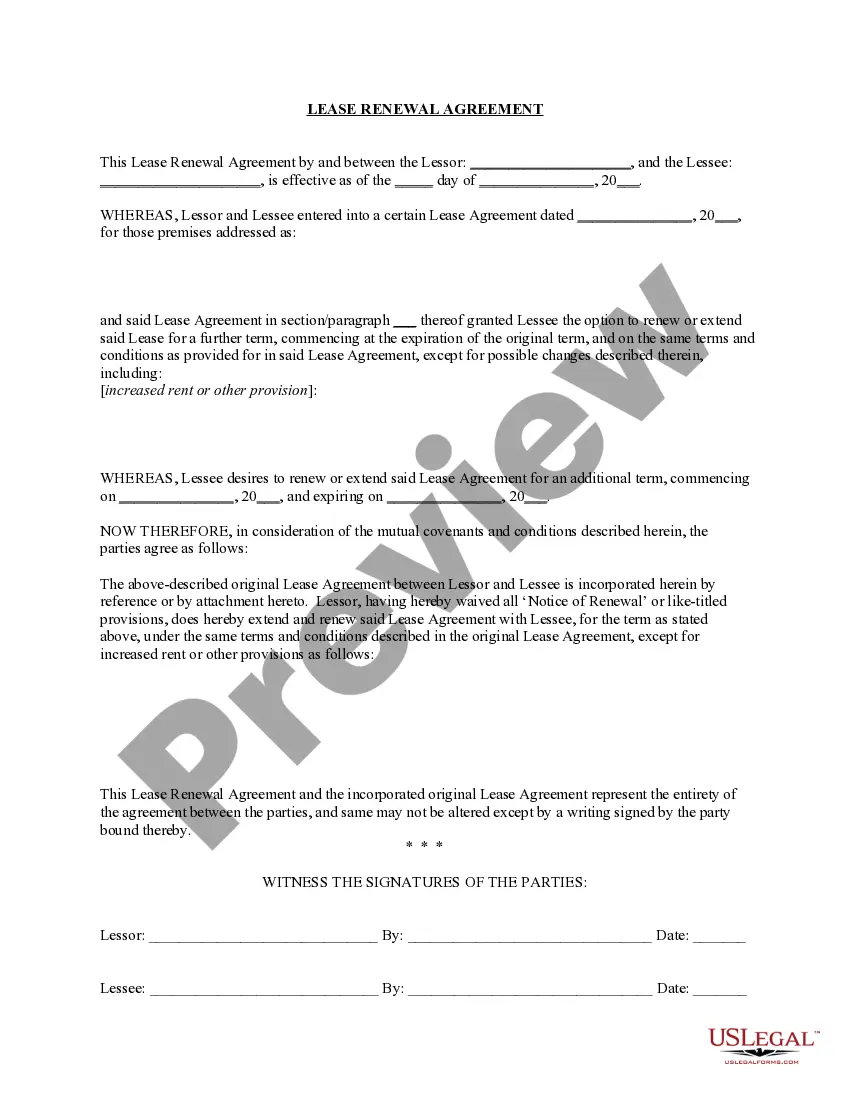

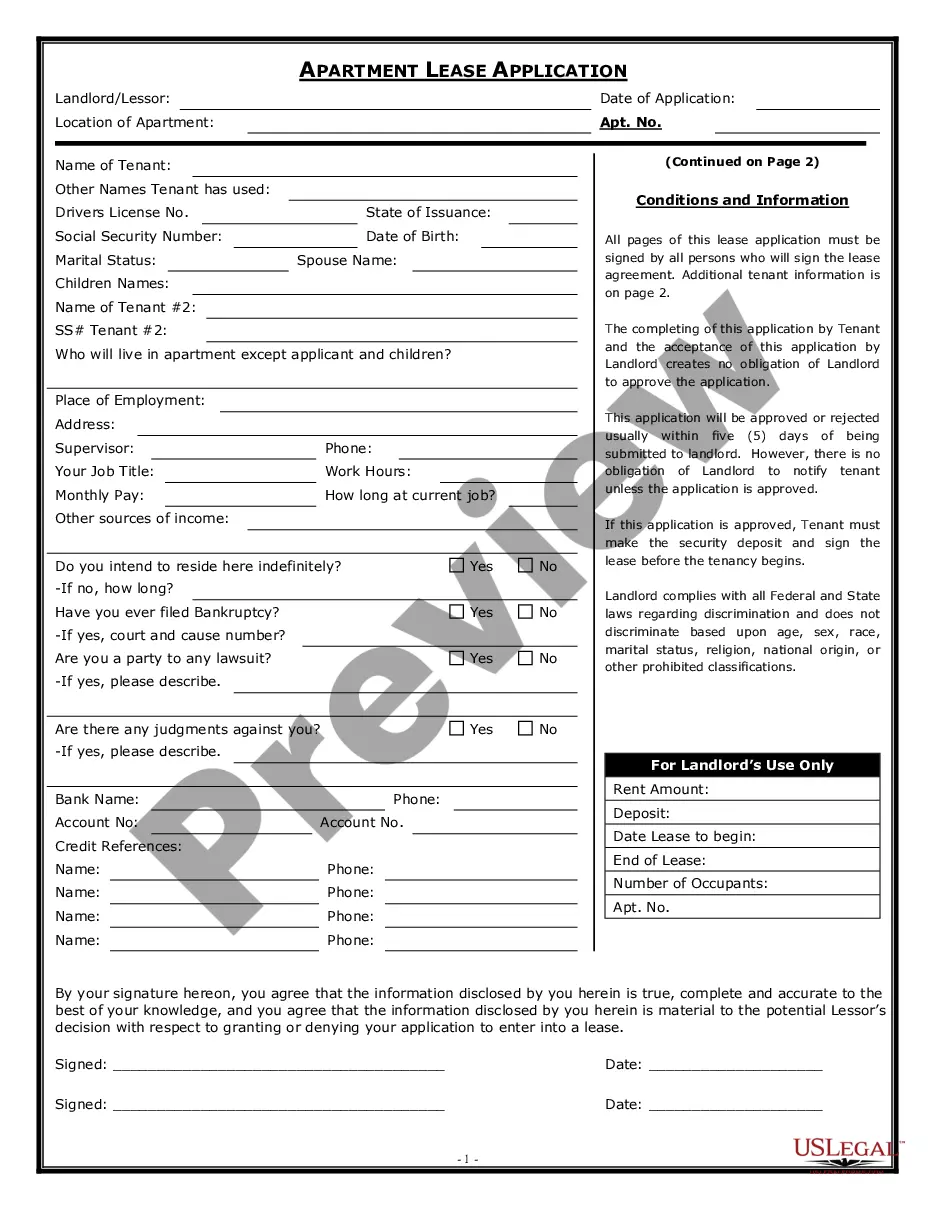

How to fill out Nassau New York Credit Agreement Regarding Extension Of Credit?

Whether you plan to open your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business case. All files are grouped by state and area of use, so picking a copy like Nassau Credit Agreement regarding extension of credit is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to get the Nassau Credit Agreement regarding extension of credit. Follow the instructions below:

- Make sure the sample fulfills your personal needs and state law regulations.

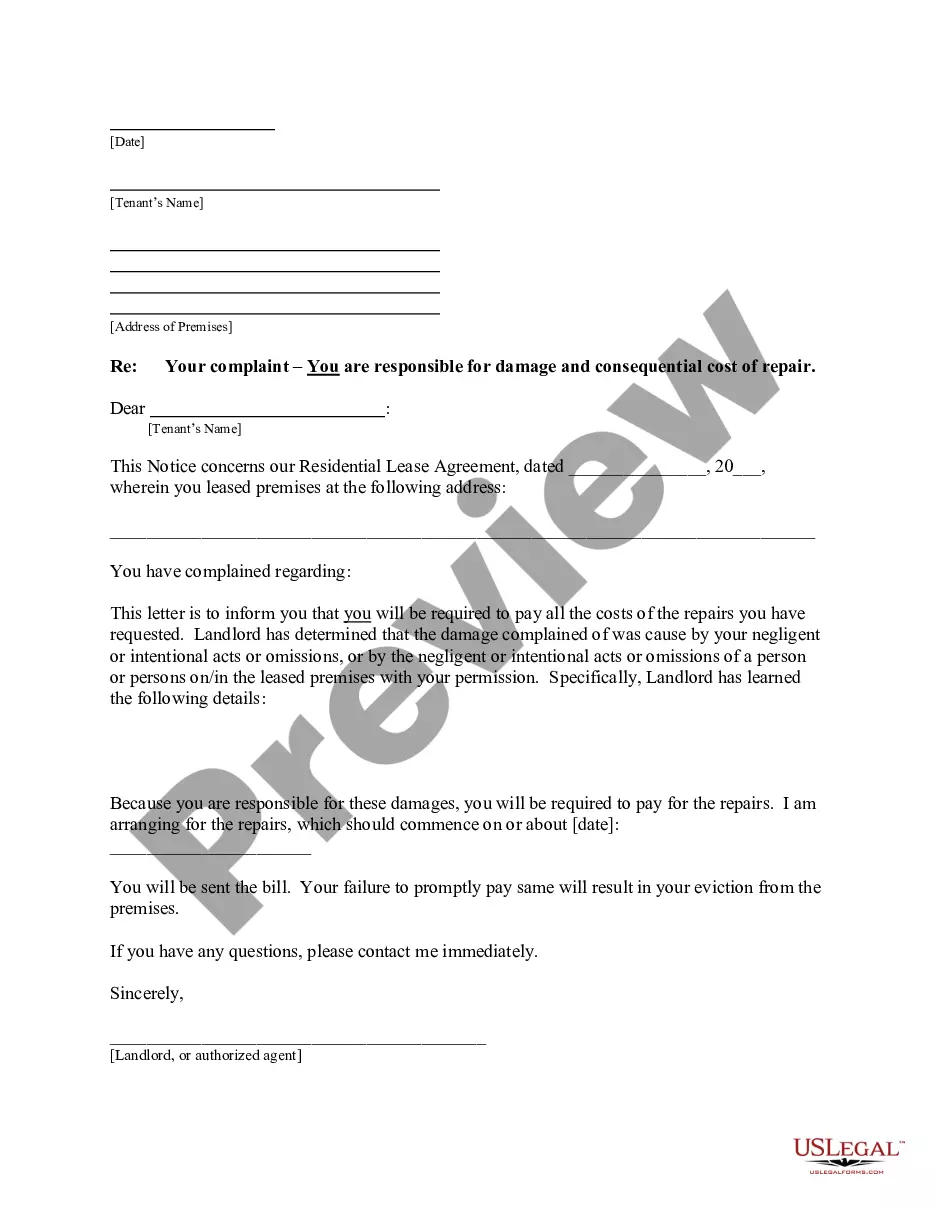

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Credit Agreement regarding extension of credit in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!