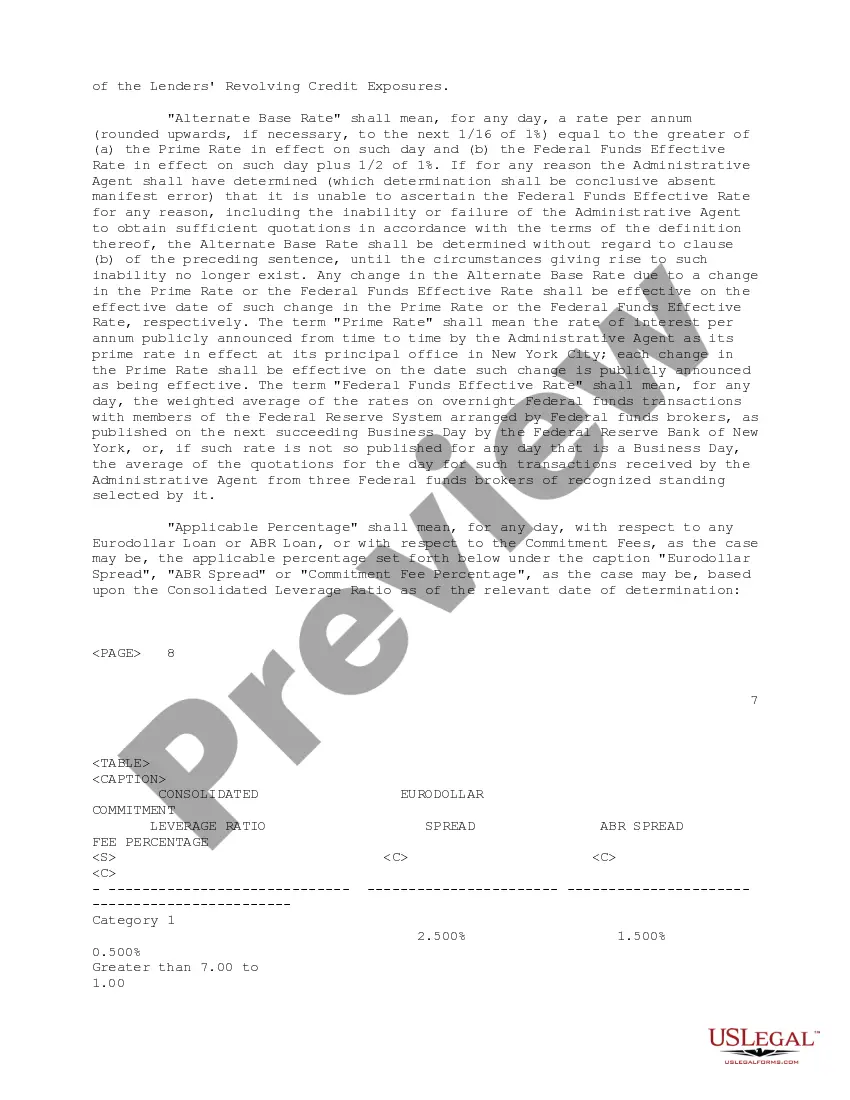

Palm Beach Florida Credit Agreement regarding the extension of credit is a legally binding agreement between a borrower and a lender based in Palm Beach, Florida. This agreement outlines the terms and conditions under which the lender agrees to provide credit to the borrower. The Palm Beach Florida Credit Agreement typically includes various important elements such as, but not limited to, the following: 1. Parties involved: The agreement identifies the borrower, also known as the debtor, and the lender, also known as the creditor. It includes their legal names, addresses, and contact information. 2. Loan details: The agreement specifies the type of credit being extended, whether it is a personal loan, mortgage, business loan, or any other form of credit. Additionally, it outlines the purpose of the credit and the amount being provided. 3. Terms and conditions: This section of the agreement contains crucial information such as the interest rate, repayment schedule, and the duration of the credit extension. It may also include any fees associated with the credit, such as origination fees or late payment penalties. 4. Security interest: Some credit agreements may require the borrower to provide collateral as security for the extended credit. In such cases, the agreement will specify the assets or property being offered as collateral, along with the terms of the security interest. 5. Representations and warranties: Both parties involved may be required to make certain representations and warranties pertaining to their financial status, creditworthiness, and legal capacity to enter into the agreement. 6. Default and remedies: The credit agreement outlines the conditions under which the borrower may default on the credit and the actions that the lender can take in case of default, such as acceleration of the debt or initiating legal proceedings. Types of Palm Beach Florida Credit Agreement regarding the extension of credit may include: 1. Personal Loan Credit Agreement: This type of agreement covers credit extended to an individual for personal use, such as buying a car or funding a vacation. 2. Mortgage Credit Agreement: A mortgage credit agreement pertains to credit extended for the purchase or refinancing of real estate, such as a home or commercial property. 3. Business Loan Credit Agreement: This agreement focuses on credit extended to businesses for various purposes, such as expansion, purchasing inventory, or covering operational expenses. 4. Revolving Credit Agreement: This type of agreement establishes a line of credit where the borrower can make multiple withdrawals up to a set limit, repay, and borrow again within the predetermined time frame. In conclusion, Palm Beach Florida Credit Agreements regarding the extension of credit are comprehensive legal documents that define the terms and conditions of the credit extended between a borrower and a lender. Entrepreneurs, individuals, and prospective homeowners in Palm Beach, Florida, may come across various types of credit agreements tailored to their specific needs.

Palm Beach Florida Credit Agreement regarding extension of credit

Description

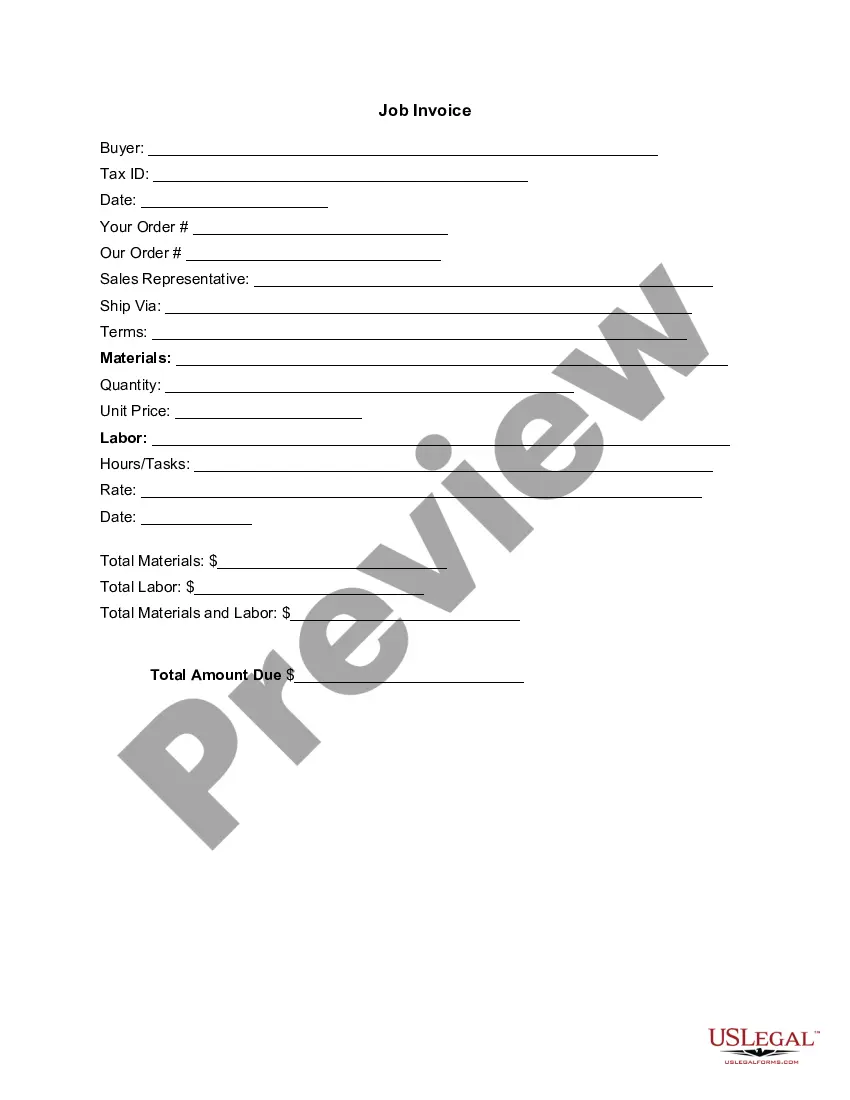

How to fill out Palm Beach Florida Credit Agreement Regarding Extension Of Credit?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Palm Beach Credit Agreement regarding extension of credit, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Therefore, if you need the latest version of the Palm Beach Credit Agreement regarding extension of credit, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Palm Beach Credit Agreement regarding extension of credit:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Palm Beach Credit Agreement regarding extension of credit and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!