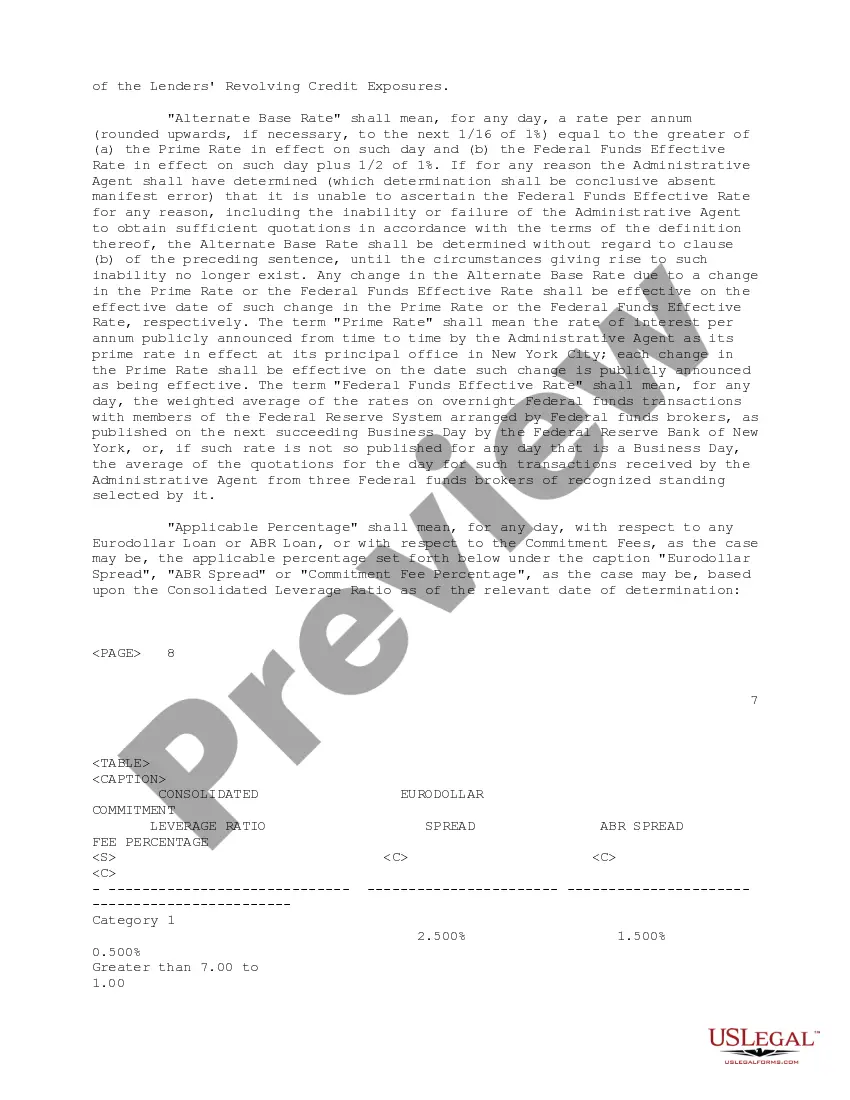

San Diego California Credit Agreement Regarding Extension of Credit: A Comprehensive Overview San Diego, located on the Pacific coast of California, is renowned for its stunning beaches, vibrant economy, and diverse cultural attractions. As a bustling city, it is no surprise that San Diego houses various types of credit agreements regarding the extension of credit. 1. Personal Credit Agreement: This type of credit agreement is commonly used by individuals seeking financial assistance. San Diego residents can approach local financial institutions or credit unions to secure personal loans for various purposes like home renovations, car purchases, or education expenses. The agreement outlines the terms and conditions, including the loan amount, repayment schedule, interest rates, and penalties for defaulting on payments. 2. Commercial Credit Agreement: Businesses in San Diego can enter into commercial credit agreements to obtain funding for expansion, working capital, or investment purposes. These agreements are primarily crafted between the business entity and a financial institution, which lends money based on the company's creditworthiness and growth potential. The terms within the commercial credit agreement may differ from personal agreements due to the varying risk factors associated with commercial ventures. 3. Mortgage Credit Agreement: This type of credit agreement is widely used by homebuyers in San Diego who require financing to purchase residential properties. San Diego's thriving real estate market presents multiple mortgage options, allowing prospective homeowners to secure loans from banks or other lending institutions. The agreement stipulates the loan amount, repayment terms, interest rates, and collateral requirements. It also specifies the consequences of defaulting on mortgage payments, such as potential foreclosure. 4. Credit Card Agreement: Credit cards are extensively utilized in San Diego for various financial transactions. Individuals can obtain credit cards from banks, credit unions, or other financial firms, enabling them to make purchases on credit. The credit card agreement outlines the terms and conditions, including the credit limit, interest rates, repayment terms, and any associated fees. It is important for cardholders to understand the agreement thoroughly to avoid financial pitfalls. 5. Student Loan Agreement: San Diego, being home to numerous esteemed educational institutions, witnesses a significant number of students seeking financial aid in the form of student loans. These loans are designed to fund tuition fees, books, and living expenses during the academic journey. Lending institutions provide student loans within specific credit agreements, which govern the loan amount, interest rates, grace period, and repayment terms, taking into account educational expenses and the borrower's ability to repay. In conclusion, San Diego California offers a range of credit agreements to cater to diverse financial needs. Personal credit agreements, commercial credit agreements, mortgage credit agreements, credit card agreements, and student loan agreements are some common types available. Depending on an individual's or business's specific requirements, selecting the most suitable credit agreement is crucial to ensure a secure and convenient extension of credit.

San Diego California Credit Agreement regarding extension of credit

Description

How to fill out San Diego California Credit Agreement Regarding Extension Of Credit?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the San Diego Credit Agreement regarding extension of credit, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case gathered all in one place. Consequently, if you need the current version of the San Diego Credit Agreement regarding extension of credit, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the San Diego Credit Agreement regarding extension of credit:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your San Diego Credit Agreement regarding extension of credit and save it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!